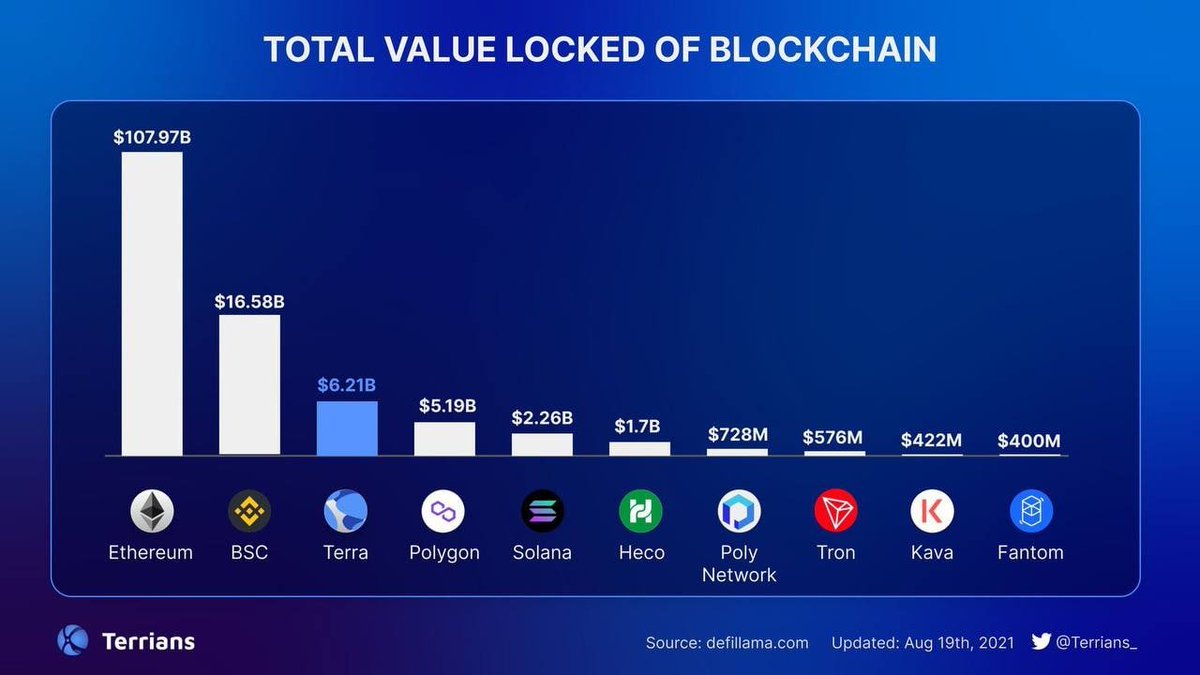

Looking at the valuations of these L1 platforms, I think we are closer to the top than the bottom. With L1's looking more plated out, it's time to front-run the market rush that will come for #ETH L2's.

I'm hyper bullish on $OMG for that reason.

Take a Look!⬇️⬇️⬇️

I'm hyper bullish on $OMG for that reason.

Take a Look!⬇️⬇️⬇️

L2's solve gas wars for NFT's, expensive DeFi transactions, and allow for larger smart contracts.

Crypto is moving in this direction and $OMG positions us with exposure to beat the trend.

Crypto is moving in this direction and $OMG positions us with exposure to beat the trend.

Background...

Every time I bring up $OMG I get the same response

"What's that? Oh, it's OmiseGo???".

It's been in the works since 2017 and actually pumped 20x when Vitalik was seen with the OmiseGo sticker on his laptop. Everyone knows the project, few have kept up with it.

Every time I bring up $OMG I get the same response

"What's that? Oh, it's OmiseGo???".

It's been in the works since 2017 and actually pumped 20x when Vitalik was seen with the OmiseGo sticker on his laptop. Everyone knows the project, few have kept up with it.

Here is an example of @VitalikButerin wiping the floor with $MATIC. Polygon isn't a real layer 2, they have security holes (51%), and it isn't the future of #Etherum scaling.

https://twitter.com/metaflute/status/1404795789143068672?s=20

#EIP1559 was never meant to fix gas issues for #Ethereum, L2's have always been the go-forward solution.

Most L1s currently provide nearly zero value other than cheap/fast transactions. Once L2's are launched most of the value of side chains disappears.

Most L1s currently provide nearly zero value other than cheap/fast transactions. Once L2's are launched most of the value of side chains disappears.

https://twitter.com/VitalikButerin/status/1300707752335962113?s=20

#ETH also has the largest ecosystem and L2's don't require code to be completely rewritten like most chains. Many projects can launch in <1 week depending on the size of their contracts.

Building on L2's has already kicked off and top projects will be ready for launch.

Building on L2's has already kicked off and top projects will be ready for launch.

When researching my thesis I came across this @josephdelong tweet on why @SushiSwap isn't coming to @optimismPBC

There is plenty of drama building on with DEX's and L2 platforms.

There is plenty of drama building on with DEX's and L2 platforms.

https://twitter.com/josephdelong/status/1425451541738237954?s=20

Optimism not having one of the biggest DeFi platforms (SUSHI) is a big deal. In the comments @josephdelong dropped some alpha that instead they are working with the $OMGx team.

I'm a $SUSHI bull and this should mean $OMG will excel in the #DeFi space.

We could run into a dynamic where projects move to specific L2's based on the dex there.

Bad blood also with $OMG and Uniswap as they ghosted @haydenzadams $2M salary request.

We could run into a dynamic where projects move to specific L2's based on the dex there.

Bad blood also with $OMG and Uniswap as they ghosted @haydenzadams $2M salary request.

https://twitter.com/haydenzadams/status/1426398727586078721?s=20

$OMG has been around long enough it is under the radar. L2 narratives have focused on @optimismPBC and @arbitrum as Optimistic Rollup L2 platforms.

$OMG also plays in that market, has $OMGx as a plasma solution, and is the only L2 with a tradeable token 👀

s/o @Coin98Analytics

$OMG also plays in that market, has $OMGx as a plasma solution, and is the only L2 with a tradeable token 👀

s/o @Coin98Analytics

$OMG was actually recently acquired by Genesis Block Ventures (@gbvofficial) in Dec. 2020.

GBV acquisition brought in some talented resources from @enyaai including @alanchiu and @JanLiphardt to assist in the $OMG development.

Acquisition - cointelegraph.com/news/hong-kong…

GBV acquisition brought in some talented resources from @enyaai including @alanchiu and @JanLiphardt to assist in the $OMG development.

Acquisition - cointelegraph.com/news/hong-kong…

Genesis Block Ventures isn't the only big-name investor and partner in $OMG.

1. Toyota invested $80M in $OMG Series C

2. Tether launched on OMG Network

3. Talks of Reddit partnerships but no information lately

Toyota - zycrypto.com/toyota-backed-…

Tether - omg.network/bitfinex-usdt-…

1. Toyota invested $80M in $OMG Series C

2. Tether launched on OMG Network

3. Talks of Reddit partnerships but no information lately

Toyota - zycrypto.com/toyota-backed-…

Tether - omg.network/bitfinex-usdt-…

$OMGx had huge news this week as they rebranded to @bobanetwork and launched their main net beta.

The building has begun and it takes much less effort to stand up than coding in a separate language on a side chain.

The building has begun and it takes much less effort to stand up than coding in a separate language on a side chain.

https://twitter.com/bobanetwork/status/1428373289030717442?s=20

$OMG also sets themselves apart from a feature perspective.

Here are a few differentiators:

1. Fast withdrawals - pull funds off @BobaCommunity in minutes instead of hours/days. If you hate bridges as much as I do, this is a big deal.

Here are a few differentiators:

1. Fast withdrawals - pull funds off @BobaCommunity in minutes instead of hours/days. If you hate bridges as much as I do, this is a big deal.

2. NFT bridging - Mint on L2 and bridge to ETH when gas is cheaper.

Having $SUSHI already gives them a leg up in #DeFi. Pull in the NFT crowd and you cover the two biggest trends on the #Ethereum network. Huge for chain utility.

Having $SUSHI already gives them a leg up in #DeFi. Pull in the NFT crowd and you cover the two biggest trends on the #Ethereum network. Huge for chain utility.

3. Hybrid Computing - connecting smart contracts with trading algorithms leveraging AWS.

This is important for DeFi risk modeling. This gives you the ability to use sophisticated algorithms that trigger your smart contracts. I'm hoping to see decentralized computing (AKT?).

This is important for DeFi risk modeling. This gives you the ability to use sophisticated algorithms that trigger your smart contracts. I'm hoping to see decentralized computing (AKT?).

4. DAO - Other L2's don't have much information around community operation but OMG/BOBA will be creating a DAO.

OMG will be the governance token and the community will be a huge piece of network improvement moving forward.

OMG will be the governance token and the community will be a huge piece of network improvement moving forward.

First mover advantage is important in this space and the race to L2 has already begun.

$OMG is the only one you can invest in now and catch the trend early. It shows if you take a look at the chart.

s/o @Pool2Paulie charting

$OMG is the only one you can invest in now and catch the trend early. It shows if you take a look at the chart.

s/o @Pool2Paulie charting

$OMG is insanely undervalued at $850M MC compared to other chains. $SOL - $22B, $ADA - $78B, and $MATIC - $9.8B

$OMG is also fully diluted at $140M coins! 👀

$OMG is:

$70 at MATIC MC

$152 at SOL MC

$546 at ADA MC

$OMG is also fully diluted at $140M coins! 👀

$OMG is:

$70 at MATIC MC

$152 at SOL MC

$546 at ADA MC

Compared to #ETH at $391B MC and $22B daily trade volume, $OMG is extremely undervalued.

If it captures even 4$ of #ETH traffic, the daily trade volume would be $940M which is larger than its current MC.

L2's should also pull money back to ETH, so I'd expect larger numbers.

If it captures even 4$ of #ETH traffic, the daily trade volume would be $940M which is larger than its current MC.

L2's should also pull money back to ETH, so I'd expect larger numbers.

$OMG staking is coming although not many details have been released.

When L2 transactions happen, the L2 collects the fees and then pays L1. The difference is pocketed and in some form could be distributed to $OMG stakers.

Think of this as owning a piece of the network.

When L2 transactions happen, the L2 collects the fees and then pays L1. The difference is pocketed and in some form could be distributed to $OMG stakers.

Think of this as owning a piece of the network.

Once again, not many details have been released so big speculation on my part...

They've worked closely with the $SUSHI team so there is a good chance they use the Sushi staking model (xOMG). The fees from USDT alone should be massive...

They've worked closely with the $SUSHI team so there is a good chance they use the Sushi staking model (xOMG). The fees from USDT alone should be massive...

I'm not the only one asking for L2's or that sees the trend coming...

Eric.ETH (@econoar) -

@CryptoMessiah on ETH DeFI being too expensive. ETH L2's should solve this..

Eric.ETH (@econoar) -

https://twitter.com/econoar/status/1427462851761823744?s=20

@CryptoMessiah on ETH DeFI being too expensive. ETH L2's should solve this..

https://twitter.com/cryptomessiah/status/1429198046735261697?s=21

Play -

Accumulate as much $OMG as possible and hold.

@arbitrum announced an August launch and @optimism has launched its alpha layer w/ transaction limits.

I expect the narrative to gain traction over the next few weeks w/ loads of announcements around each.

DYOR+NFA!

Accumulate as much $OMG as possible and hold.

@arbitrum announced an August launch and @optimism has launched its alpha layer w/ transaction limits.

I expect the narrative to gain traction over the next few weeks w/ loads of announcements around each.

DYOR+NFA!

• • •

Missing some Tweet in this thread? You can try to

force a refresh