1/ Going to quickly outline for everyone why this is extremely concerning if you care (at all) about Bitcoin's ecosystem.

This thread is a must-read.

This thread is a must-read.

https://twitter.com/APompliano/status/1430180379961569298

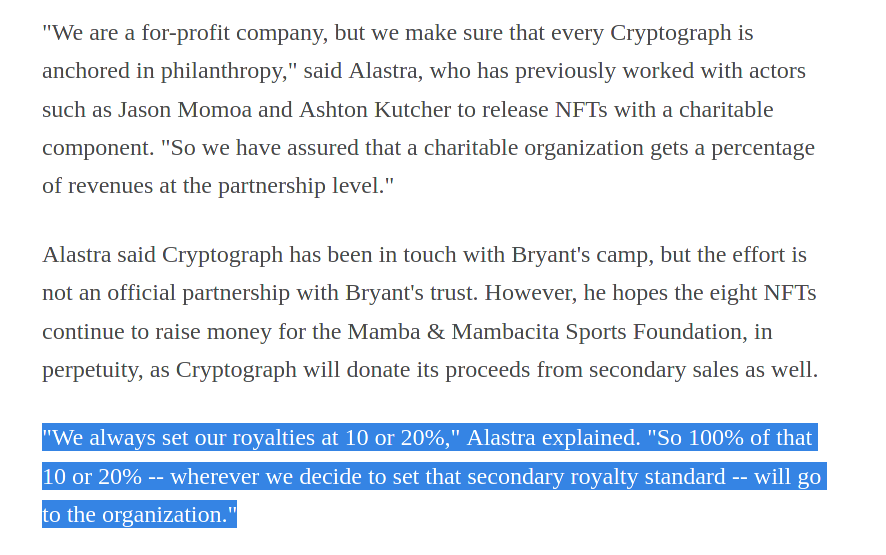

2/ @Blockstream, founded by @adam3us is the primary firm responsible for Bitcoin and LN's development (picture here proves the LN statement; next tweet proves the BTC dev. statement)

veriphi.io/en/blog/a-brie…

veriphi.io/en/blog/a-brie…

3/ Attached to this tweet are screens from Mosaic Ventures' (investor) website

"Out of 200ish committers in total, just a small number...working quasi-independently, are responsibnle for the *vast majority of code commits*."

mosaicventures.com/patterns/our-i… [published 2014]

"Out of 200ish committers in total, just a small number...working quasi-independently, are responsibnle for the *vast majority of code commits*."

mosaicventures.com/patterns/our-i… [published 2014]

4/ Another notable excerpt here where it is admitted by Mosaic that, "A handful of 'core devs' deliberate the merits of various changes to the protocol."

That core group = @Blockstream , so it figures we should be attuned to what it is they're actually doing, right @adam3us?

That core group = @Blockstream , so it figures we should be attuned to what it is they're actually doing, right @adam3us?

5/ What your boy @APompliano forgot to tell you above is that the $210M @Blockstream included funds from both @bitfinex and @Tether_to (via iFinex), and was purposed to help them expand their "mining" activities.

6/ To explain this problem succinctly, let's look at Taproot (BIP370) for Bitcoin.

This was an "upgrade" for Bitcoin based on an idea + code authored mainly by Peter Wiulle

lists.linuxfoundation.org/pipermail/bitc…

This was an "upgrade" for Bitcoin based on an idea + code authored mainly by Peter Wiulle

lists.linuxfoundation.org/pipermail/bitc…

7/ After Wiulle, a *Blockstream* employee at the time (non-disputed), proposed this "upgrade" to the protocol, the idea was accepted fully by other members of Core (i.e., Blockstream.).

Recently, Blockstream put the acceptance of Taproot to a "vote".

Recently, Blockstream put the acceptance of Taproot to a "vote".

8/ Bitcoin changes difficulties every epoch. Each epoch is supposed to take 2 weeks (2016 blocks; 10 mins per block target).

On May 1st, miner "voting" on Taproot started.

In order to pass, >90% of blocks within a given epoch must signal 'yay'

On May 1st, miner "voting" on Taproot started.

In order to pass, >90% of blocks within a given epoch must signal 'yay'

9/ This process is supposedly governed by 'BIP 9', which you can find here - github.com/bitcoin/bips/b…

Guess who authored that BIP? Yes - Blockstream (completely).

So the rules governing the approval of this proposal created by Blockstream were created by Blockstream too. Hmm.

Guess who authored that BIP? Yes - Blockstream (completely).

So the rules governing the approval of this proposal created by Blockstream were created by Blockstream too. Hmm.

10/ This $210M Series B fundraise is not @Blockstream's first foray into mining.

In Sept. 2019, @Blockstream has boasted its "enterprise-class mining facilities, management, and support for the colocation of Bitcoin mining equipment."

They also admit, "we mine ourselves too!"

In Sept. 2019, @Blockstream has boasted its "enterprise-class mining facilities, management, and support for the colocation of Bitcoin mining equipment."

They also admit, "we mine ourselves too!"

11/ To get a better idea of the vast $BTC mining resources @Blockstream held, its worth checking out this Forbes article penned by Kyle Torpey (2019) - forbes.com/sites/ktorpey/…

Torpey himself wrote, "The size of Blockstream's mining facilities cannot be overstated."

Torpey himself wrote, "The size of Blockstream's mining facilities cannot be overstated."

12/ He wasn't lying when he said that.

To get a better sense of this magnitude, let's quantify the MW capacity they boast (300MW). That's approx. 0.3 GW.

Bay City, Texas' power plant has a 400MW capacity

To get a better sense of this magnitude, let's quantify the MW capacity they boast (300MW). That's approx. 0.3 GW.

Bay City, Texas' power plant has a 400MW capacity

13/ Juxtaposing the info above w estimated resource consumption of the Antminer S19j Pro, we know @Blockstream had the capacity to house 98,360 of those units back in 2019 (1MW = 1 million watts); 300mill. / 3050 watts = 98.3k units

14/ Considering the estimated hashrate of 100 TH/s (stock), @Blockstream had/has the ablity to leverage >10 Eh/s (the network total is 128 at this very moment).

15/ Also that article, Torpey himself wrote, "The size of Blockstream's mining facilities cannot be overstated" and that Blockstream CSO, Samson Mow (@Excellion) vouched @Blockstream could leverage >6 EH/s if necessary (as in, they already had that much in tow).

16/ On June 27th, 2021 - the estimated hashrate for the BTC network was 57 Eh/s (source - 'Bitcoin Visuals')

Which means if @Blockstream didn't scale *at all* over the last 2 years, they would've been able to account for >10% of the network's hashrate.

Which means if @Blockstream didn't scale *at all* over the last 2 years, they would've been able to account for >10% of the network's hashrate.

17/ The above is worth mentioning since Taproot didn't gain "confirmation" until a week or two prior

coindesk.com/locked-in-bitc…

coindesk.com/locked-in-bitc…

18/ Another major excerpt from that Torpey piece worth mentioning are the names of @Blockstream's only mining clients at the time.

Those entities were none other than 'Fidelity Center for Applied Technology' and 'Reid Hoffman'; we're going to take a closer look at the latter.

Those entities were none other than 'Fidelity Center for Applied Technology' and 'Reid Hoffman'; we're going to take a closer look at the latter.

19/ Reid Hoffman co-founded LinkedIn back in 2003 and is a partner at VC firm, 'Greylock Partners'.

The reason why this is relevant is because Reid Hoffman is also a key investor in Blockstream and he's on the company Board of Directors.

sec.gov/Archives/edgar…

The reason why this is relevant is because Reid Hoffman is also a key investor in Blockstream and he's on the company Board of Directors.

sec.gov/Archives/edgar…

20/ These facts make it clear that @Blockstream is purposefully mischaracterizing Reid Hoffman as a "customer" of theirs, when - in fact, he's one of @Blockstream's owners (would Bezos ever be considered a customer of Amazon?)

21/ Check out this press release on @Blockstream's site released in January 2021 this year).

They refer to Hoffman as "LinkedIN founder Reid Hoffman"

P.S. - what's this "top secret mining service" about they mention?

blockstream.com/2021/01/27/en-…

They refer to Hoffman as "LinkedIN founder Reid Hoffman"

P.S. - what's this "top secret mining service" about they mention?

blockstream.com/2021/01/27/en-…

22/ This entire thread was created to make readers question how "centralized" and tightly controlled Bitcoin Core development & decision making is.

All that mining info above was to bang home the point that the Taproot voting process was nowhere near objective.

All that mining info above was to bang home the point that the Taproot voting process was nowhere near objective.

23/ Essentially we have a situation where

- Blockstream came up with an idea

- Blockstream put it to a vote using rules created by Blockstream

- Blockstream possesses the resources to account for a major percentage of said vote (which they did participate in)

- Blockstream came up with an idea

- Blockstream put it to a vote using rules created by Blockstream

- Blockstream possesses the resources to account for a major percentage of said vote (which they did participate in)

• • •

Missing some Tweet in this thread? You can try to

force a refresh