Want a whistle-stop summary of how we ended up hurtling towards industrial action over #USS? Here's a brief summary. 1/

https://twitter.com/ucu/status/1432747530505310211

1. The valuation date

@USSpensions ploughed ahead with a valuation using market data from the peak of market turmoil in the first wave of COVID (31 March 2020), wiping billions off the value of the scheme's assets.

@USSpensions ploughed ahead with a valuation using market data from the peak of market turmoil in the first wave of COVID (31 March 2020), wiping billions off the value of the scheme's assets.

2. Extreme prudence and misguided risk-management

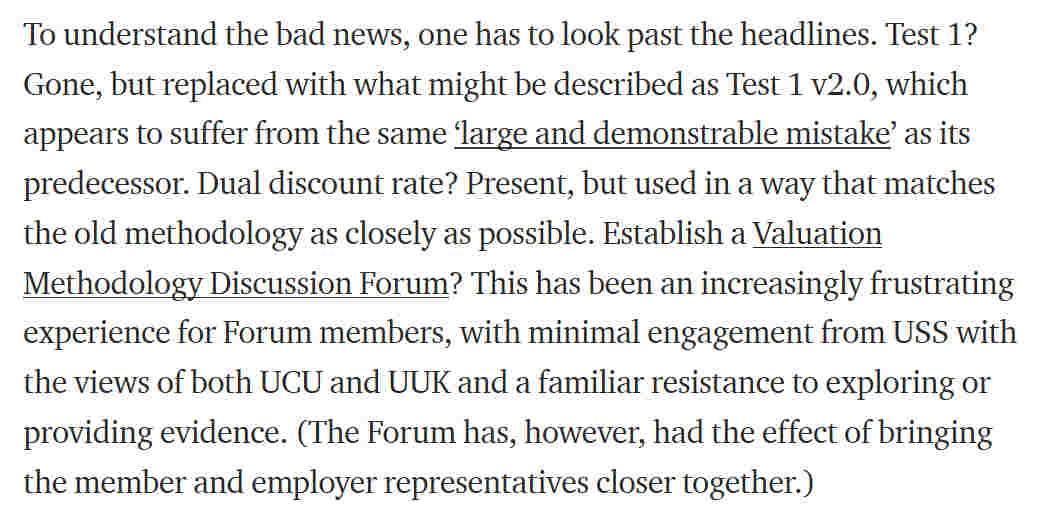

Not content with a COVID-affected valuation date, #USS reworked their discredited Test 1 and ramped up prudence much further than in previous valuations. medium.com/ussbriefs/how-…

Not content with a COVID-affected valuation date, #USS reworked their discredited Test 1 and ramped up prudence much further than in previous valuations. medium.com/ussbriefs/how-…

3. Contribution rates

With a COVID-affected valuation and ramped up prudence, the rates @USSpensions say are required to keep benefits unchanged lose touch with reality, somewhere between 42% and 57% of salary (cf 26% before the 2018 dispute). This is a rip off, pure and simple.

With a COVID-affected valuation and ramped up prudence, the rates @USSpensions say are required to keep benefits unchanged lose touch with reality, somewhere between 42% and 57% of salary (cf 26% before the 2018 dispute). This is a rip off, pure and simple.

4. @TPRgovuk are not on your side

Think the regulator might step in to prevent overcharging? I'm afraid not. They are happy to see DB priced out of reach if it leads to less benefit accrual and lower risk to the PPF, and seem happy to ignore one of their statutory objectives.

Think the regulator might step in to prevent overcharging? I'm afraid not. They are happy to see DB priced out of reach if it leads to less benefit accrual and lower risk to the PPF, and seem happy to ignore one of their statutory objectives.

5. The employers briefly challenged #USS...

Early on, @UniversitiesUK did call out @USSpensions decision-making as "odd" and the valuation as "unjustified", and asked for a review. pensionsage.com/pa/USS-Employe…

Early on, @UniversitiesUK did call out @USSpensions decision-making as "odd" and the valuation as "unjustified", and asked for a review. pensionsage.com/pa/USS-Employe…

6. ... then decided it was easiest to cut your pension

When @USSpensions confirmed that they weren't minded to review their valuation, employers swiftly pivoted to benefit cuts, with proposals equivalent to a 21% hit to benefits and "no detriment" to employers.

When @USSpensions confirmed that they weren't minded to review their valuation, employers swiftly pivoted to benefit cuts, with proposals equivalent to a 21% hit to benefits and "no detriment" to employers.

7. A 2021 could solve the problem...

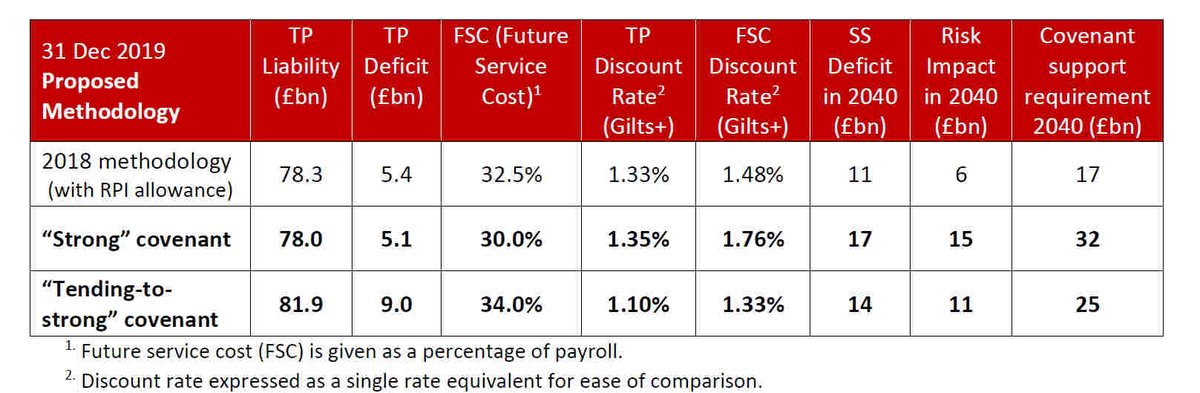

The 2020 valuation has occurred a year before a triennial valuation was necessary (the last one was in 2018). A 2021 valuation would show a huge recovery in assets (a +£14bn swing!), and should show a greatly improved position.

The 2020 valuation has occurred a year before a triennial valuation was necessary (the last one was in 2018). A 2021 valuation would show a huge recovery in assets (a +£14bn swing!), and should show a greatly improved position.

8. ... but employers aren't interested

@UniversitiesUK have not shown any interest in switching the valuation date, as preferring to cut benefits now rather than pay a step-up in contributions (21.1% to 23.7%) scheduled for this October as part of the 2018 valuation.

@UniversitiesUK have not shown any interest in switching the valuation date, as preferring to cut benefits now rather than pay a step-up in contributions (21.1% to 23.7%) scheduled for this October as part of the 2018 valuation.

9. ... and @USSpensions have the gall to claim it wouldn't make a difference

#USS's assessment of the 2021 position is that while the deficit is vastly improved, the overall cost of maintaining the benefits would be similar to the 2020 costs. Their claims do not stand scrutiny.

#USS's assessment of the 2021 position is that while the deficit is vastly improved, the overall cost of maintaining the benefits would be similar to the 2020 costs. Their claims do not stand scrutiny.

10. @UCU tried to find a compromise position that members might tolerate for the short-term..

@UCU looked for a way to deal with the 2020 valuation at the JNC, drawing up proposals that prioritised the lower paid and would have seen employers pay more & members less.

@UCU looked for a way to deal with the 2020 valuation at the JNC, drawing up proposals that prioritised the lower paid and would have seen employers pay more & members less.

11. ... but UUK pulled the rug from under UCU by withdrawing covenant support

@UniversitiesUK ensured that @UCU's proposals could not be put to the vote by saying they would withdraw commitments to the scheme that #USS claimed were necessary to bring the costs down.

@UniversitiesUK ensured that @UCU's proposals could not be put to the vote by saying they would withdraw commitments to the scheme that #USS claimed were necessary to bring the costs down.

12. The JNC chair broke the deadlock, voting with employers

With only @UniversitiesUK's proposals left on the table, the JNC chair had to choose between backing the employers and resorting to the cost-sharing default, which could have sent rates up to 57%. She chose the former.

With only @UniversitiesUK's proposals left on the table, the JNC chair had to choose between backing the employers and resorting to the cost-sharing default, which could have sent rates up to 57%. She chose the former.

13. Industrial action is a near certainty

Unless employers swiftly recognise the mistakes that @UniversitiesUK have made on their behalf and ask for the JNC decision to be revoked, you can bet your bottom dollar that @USSpensions members will stike to defend their pensions. END

Unless employers swiftly recognise the mistakes that @UniversitiesUK have made on their behalf and ask for the JNC decision to be revoked, you can bet your bottom dollar that @USSpensions members will stike to defend their pensions. END

• • •

Missing some Tweet in this thread? You can try to

force a refresh