Let's talk about the non-existent 2021 valuation, that could have been invoked by @USSpensions as a solution to the crisis that the scheme and pre-92 HE sector is heading towards. (This is an overdue thread.) 1/

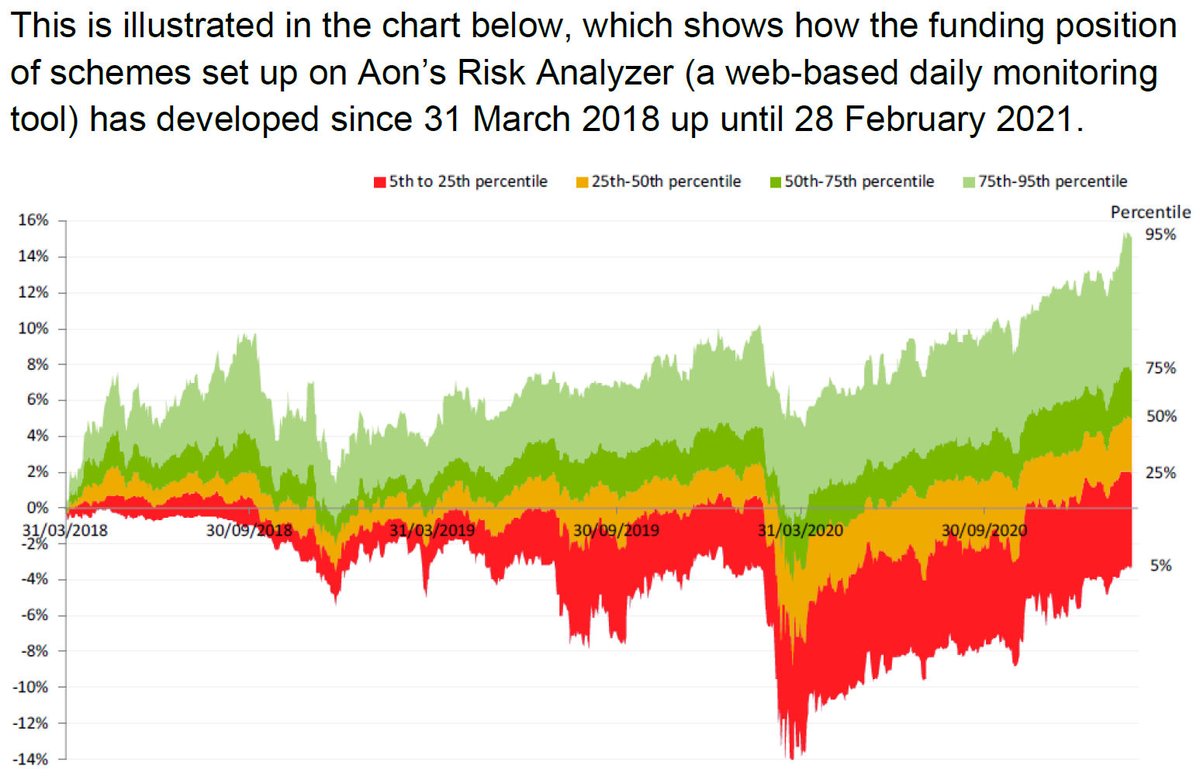

It is widely appreciated by the scheme's members that the 2020 valuation date of 31 March 2020 is right in the middle of a COVID-related dip in the markets (first-wave, locked-down, market chaos), and is one important factor in the huge £14-15bn deficit. 2/

At the valuation date, the scheme's assets had plummeted from around £73bn at the end of December 2019 to £66.5bn. By 31 March 2021 the assets had recovered to £80.6bn, and market conditions were widley seen as more 'normal'. (Most recent figure? £88bn) 3/

Now, you might be thinking that a +£14bn swing in asset values on a scheme with a £14-15bn deficit might mean we've broken even. Alas, no, not in the murky world of pension valuations, and especially not at #USS. 4/

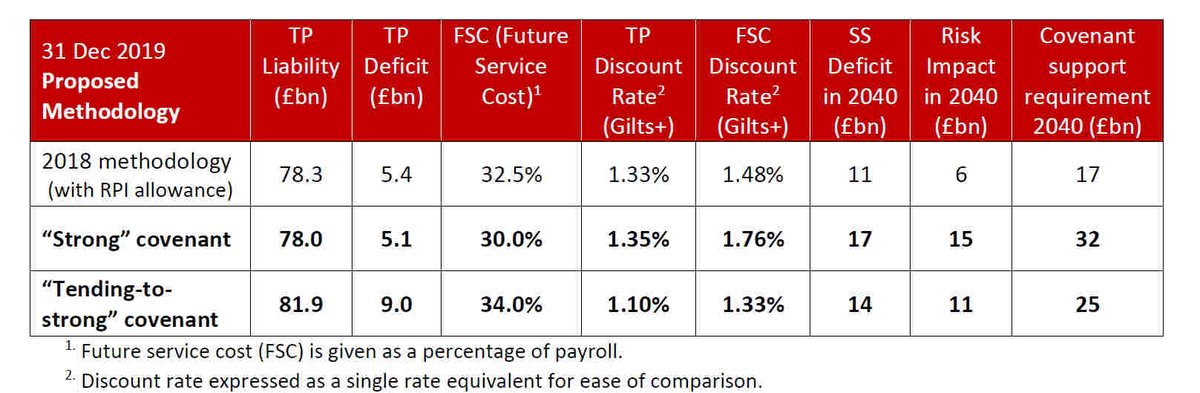

The issue is the valuation of the liabilities, which is based on a complex calculation with many moving parts. @USSpensions' assessment of the March 2021 position is that the deficit has indeed receded significantly, but is still around £5-7bn due to much higher liabilities. 5/

Is this sizeable residual deficit as at March 2021 a fair assessment? That question mainly comes down to the appropriateness (or otherwise) of the so-called 'discount rate', which can be thought of as a prudent estimate of the future investment returns for the scheme. 6/

That word 'prudent' is super-important! On an unbiased estimate of the future investment returns (i.e. one that's equally likely to be too low as too high), the scheme doesn't have a deficit, even as at 31 March 2020, and certainly not a year later. 7/

But pensions regulation requires a prudent assessment, and for good reason: adding in a safety buffer allows for things to turn out worse than expected without knocking things off track. The problems occur when prudence is ramped up too far. 8/

So, how prudent is the discount rate used in the 2021 valuation? The answer is significantly more prudent than the one used in every valuation over the past decade *bar* 2020, where it was ramped up even more. 9/

One way to see this is by looking at where the discount rate sits on the distribution of projected investment returns from #USS's model. In 2014, #USS used the 65th centile. In 2017 and 2018, the 67th. In 2020, it was somewhere around 80-90th centile. 2021? Around the 75th. 10/

Another useful comparison is in a (scrappy) table I threw together, comparing the discount rates for successive valuations in three ways: nominal terms (i.e. % returns), relative to the CPI, and relative to the return on long-dated government bonds (aka 'gilts'). 10/

It is clear from this table that the discount rate assumption is bumping around at its lowest ever level in the 2021 calculations that #USS have released. And I don't think it's possible to over-estimate how much of an effect small tweaks to the discount rate can make! 11/

In other words, the 2021 position (an improved deficit of £5-7bn) is based on the most pessimistic view of long-term investment returns that #USS has used at any point in the last decade of valuations! 12/

So forgive me if I struggle to believe #USS's claims (repeated by @UniversitiesUK) that the 2021 valuation doesn't present an improved position for the scheme. It should, and it would under reasonable valuation assumptions. 13/

This thread's too long, and I haven't mentioned future service costs, which are key to the claims that @USSpensions & @UniversitiesUK are making in ruling out a solution based on a 2021 valuation. Those costs have gone through the roof due to the same ramping up of prudence. 14/

I will try to write this stuff up properly at some point, as it's too central to the brewing dispute to allow #USS to make such claims unchallenged. The document that contains USS's argument and figures is below. Please do scrutinise! 15/15 uss.co.uk/-/media/projec…

PS Why have employers (with a couple of exceptions) not been crying out for a 2021 valuation? Because they were focussed almost exclusively on avoiding the contribution increase from 21.1% to 23.7% due in October; the only way to do that was with a 2020 valuation and benefit cuts

PPS I've just seen that @nm_davies beat me to it on this subject! It's almost as if spending most of the week in in furiating JNC meetings leads you to miss out on Twitter... medium.com/ussbriefs/the-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh