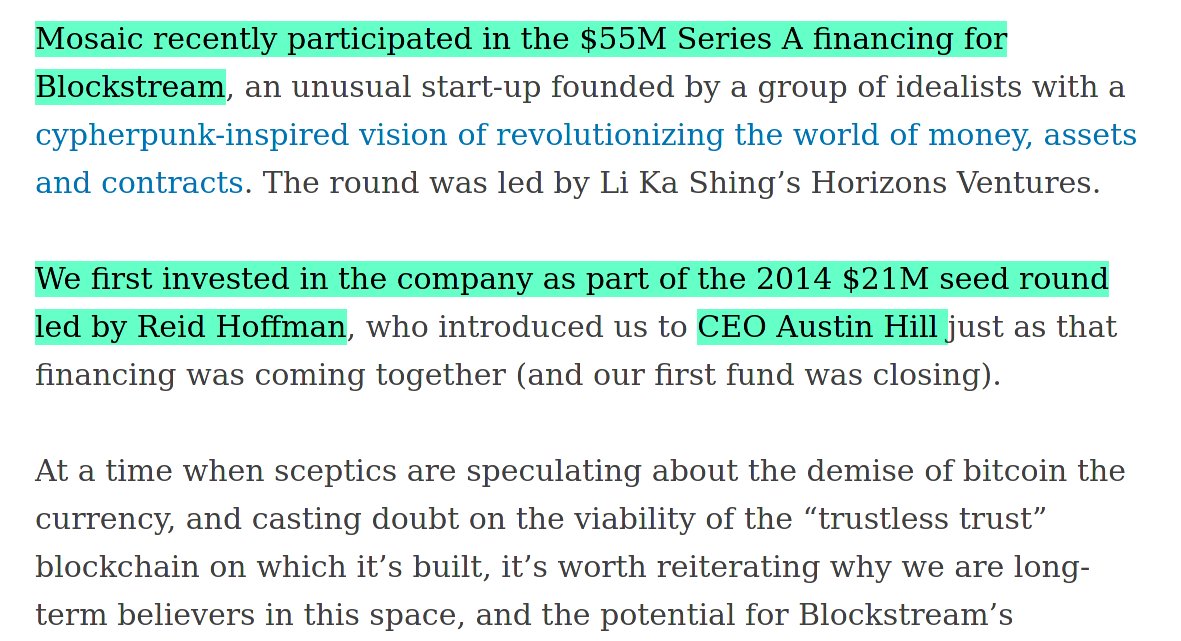

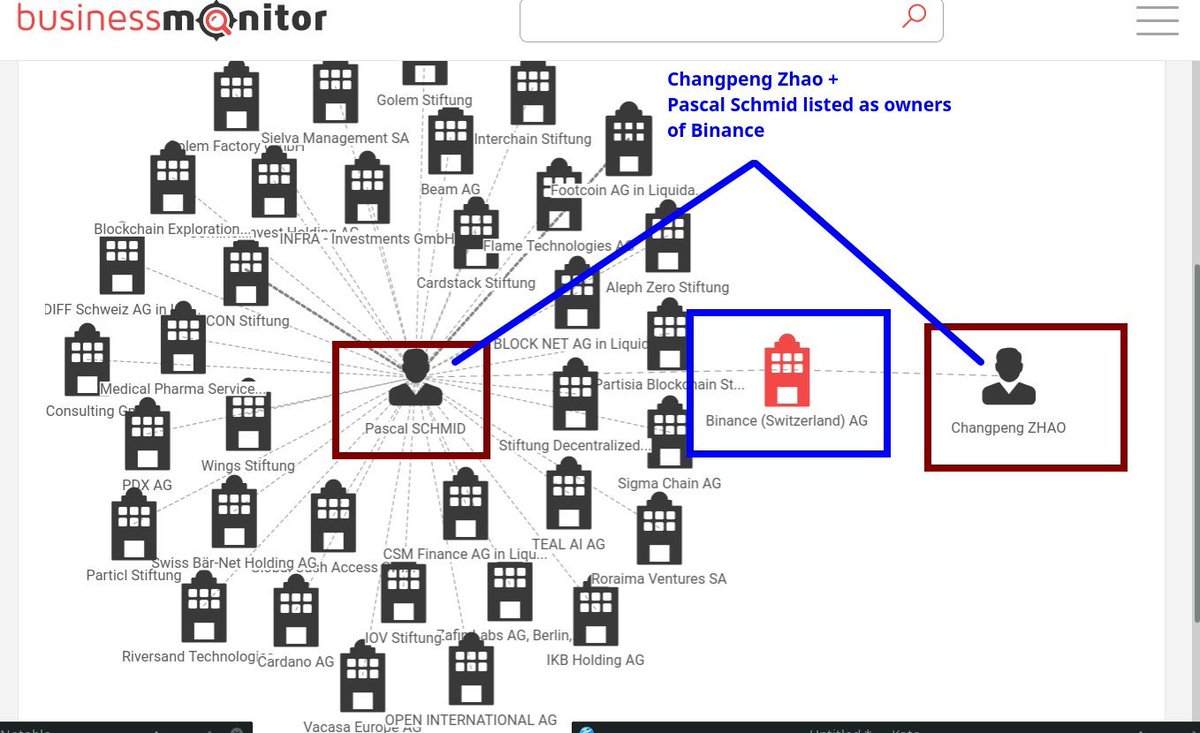

1/ Recently, Pascal Schmid de-registered himself from all of these companies (spontaneously) amid all the scrutiny @binance was receiving mid-June '21 (i.e., being banned out of virtually every jurisdiction on planet earth).

https://twitter.com/librehash/status/1182135415224066051

2/ The change was very quiet (and subtle), but within the last couple of months, Pascal Schmid removed himself (entirely) from almost all registries / companies he was previously associated w

Most relevant one here is @binance; he was replaced w a fellow named 'Markus Felix'

Most relevant one here is @binance; he was replaced w a fellow named 'Markus Felix'

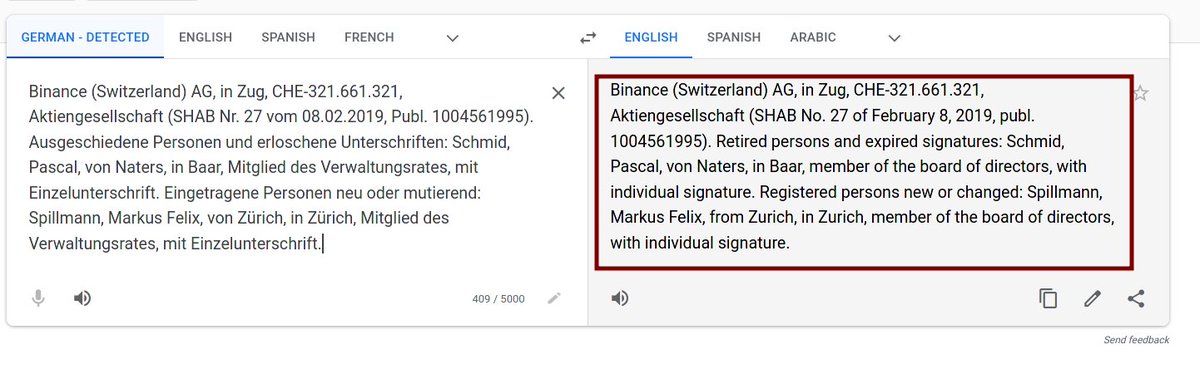

3/ @binance is not the only company where Pascal Schmid was listed as owner. Attached to this tweet is a screenshot showing the various other entities Pascal has been attached to.

Second picture honestly speaks *volumes*. What the hell is really going on here?

Second picture honestly speaks *volumes*. What the hell is really going on here?

4/ Woops, forgot to mention that the first picture int he previous tweet just showed all of the companies where Pascal is still on the register as owner *actively*.

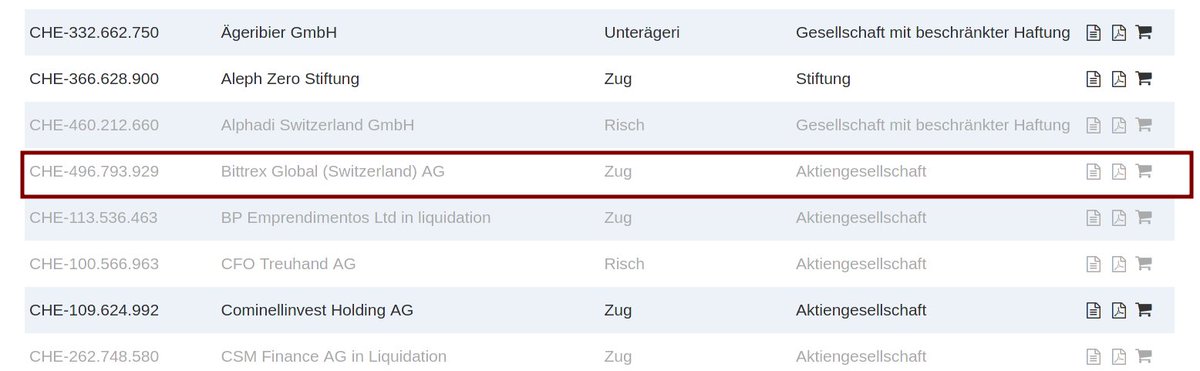

If we dig into his inactive list, we'll see he was listed as owner of @BittrexExchange too, once.

If we dig into his inactive list, we'll see he was listed as owner of @BittrexExchange too, once.

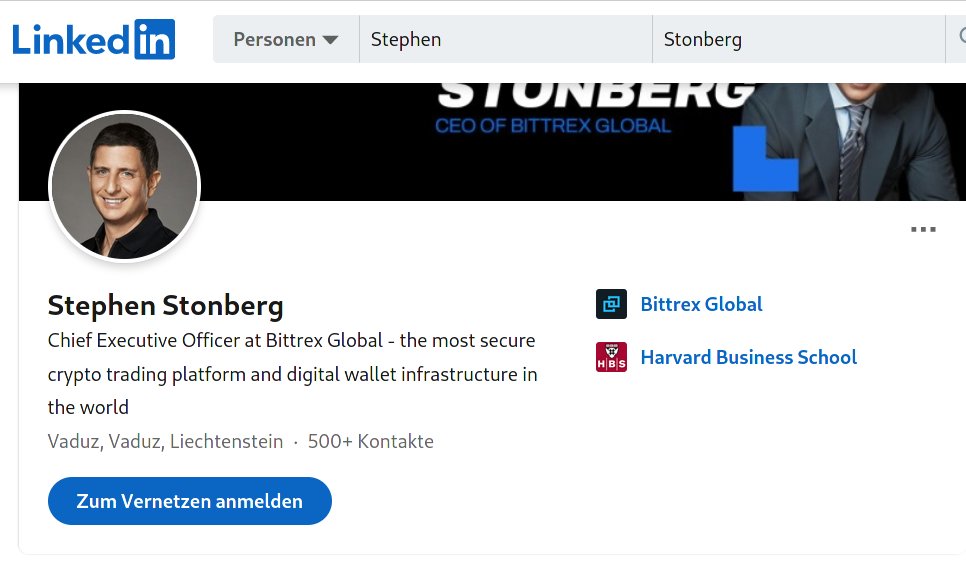

5/ Wondering who those other two guys are that are listed with Pascal on this (now-deleted) registry for Bittrex in Switzerland? That would be 'Stephen Stonberg' & 'Thomas Albright'.

Both publicly listed execs of Bittrex (Thomas resigned mid-May '21; check the prices that day)

Both publicly listed execs of Bittrex (Thomas resigned mid-May '21; check the prices that day)

6/ We're not done here though. Let's circle back over to Pascal Schmid - because I'd be remiss if we didn't speak about his ties to @IOHK_Charles and the @CardanoStiftung (Cardano Foundation / @Cardano ), directly.

The saga gets a bit more interesting.

The saga gets a bit more interesting.

7/ Way back in 2018, @IOHK_Charles led a crusade (manifested by himself) against Michael Parsons, whom was then the head of the Cardano Foundation (@CardanoStiftung) at the time.

It began with his 'open letter' to @Cardano -

It began with his 'open letter' to @Cardano -

https://twitter.com/IOHK_Charles/status/1050825892891688961

8/ Following that, was another open letter published by @IOHK_Charles ; this time it was allegedly authored by the "Guardians of Cardano" and addressed to Michael Parsons directly (circa Oct. 2018)

https://twitter.com/IOHK_Charles/status/1050825892891688961

9/ As if all of that wasn't enough, @IOHK_Charles then published a *video* on YouTube addressing what he felt were gross inadequacies + lack of transparency by the Cardano Foundation at the time.

11/ Doing my best impression of a researcher, I decided to dig into @IOHK_Charles' claims at the time.

That led me to this forum entry here - forum.cardano.org/t/cardano-foun… ; from here, I was able to deduce where most of Cardano's funds were at (w little effort, honestly).

That led me to this forum entry here - forum.cardano.org/t/cardano-foun… ; from here, I was able to deduce where most of Cardano's funds were at (w little effort, honestly).

11a/ Moving forward, here was the Cardano Foundation's response to everything - forum.cardano.org/t/14-09-18-sta…

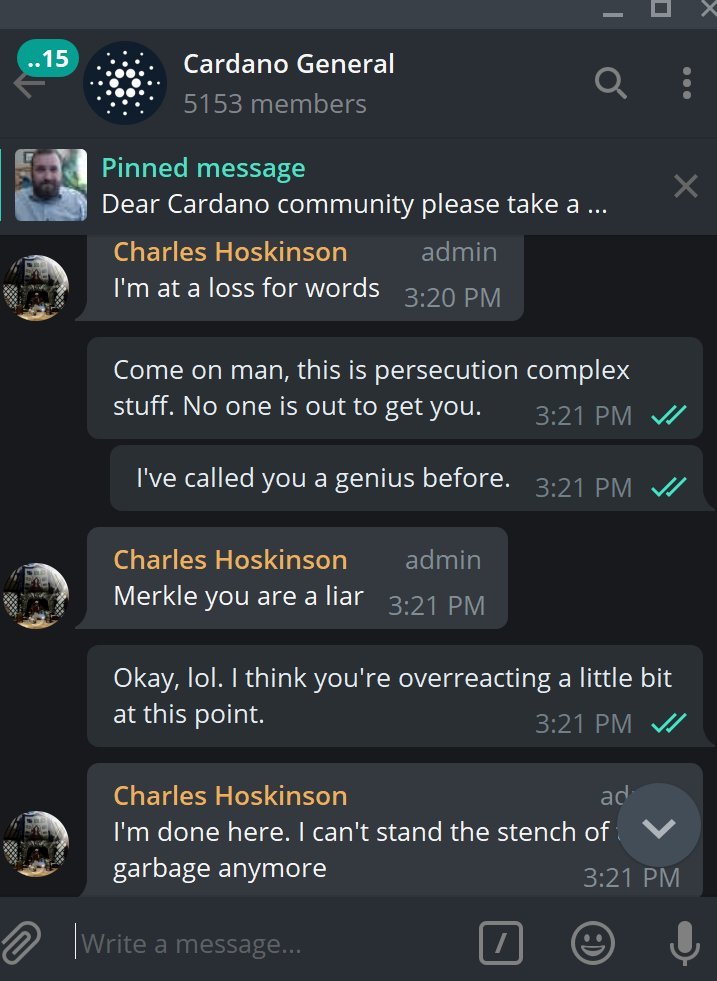

12/ Curiously, I found myself inserted in the mix (directly), after publishing an article covering the matter. Apparently @IOHK_Charles read it and was *enraged* at what I wrote (for w/e reason).

Attached to this tweet is my direct dialogue w Charles

Attached to this tweet is my direct dialogue w Charles

13/ Getting to the point here, @IOHK_Charles' efforts at manufacturing negative sentiment toward Parsons and the Cardano Foundation (overall) were ultimately successful since they resulted in Parsons' resignation - hackernoon.com/cardano-founda…

14/ This is when Pascal Schmid was made *head* of the Cardano Foundation.

Here is the tweet where the Cardano Foundation announced this publicly -

Here is the tweet where the Cardano Foundation announced this publicly -

https://twitter.com/CardanoStiftung/status/1062384674390073345?s=20

15/ Curiously, this used to exist on the Cardano Foundation website here - cardanofoundation.org/en/news/cardan…

But it has since been removed.

Fortunately the archive machine has it - web.archive.org/web/2020052410…

But it has since been removed.

Fortunately the archive machine has it - web.archive.org/web/2020052410…

15a/ As a sidenote, if you look closer at the screenshot of the archived link I posted up, you'll see that the webpage was up as recently as May 2020. This announcement about Parsons resignation + Pascal Schmid being nominated interim head was made Nov. 2018.

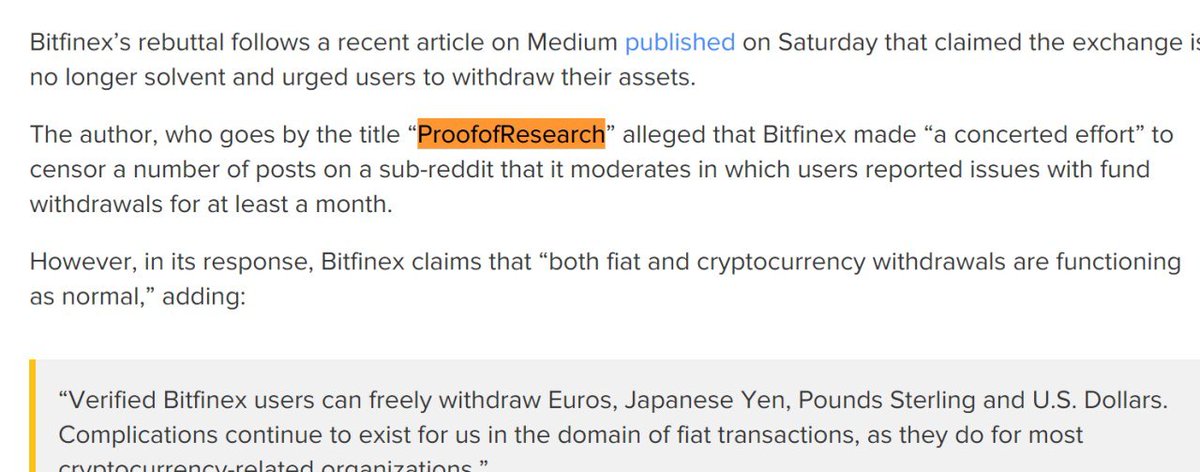

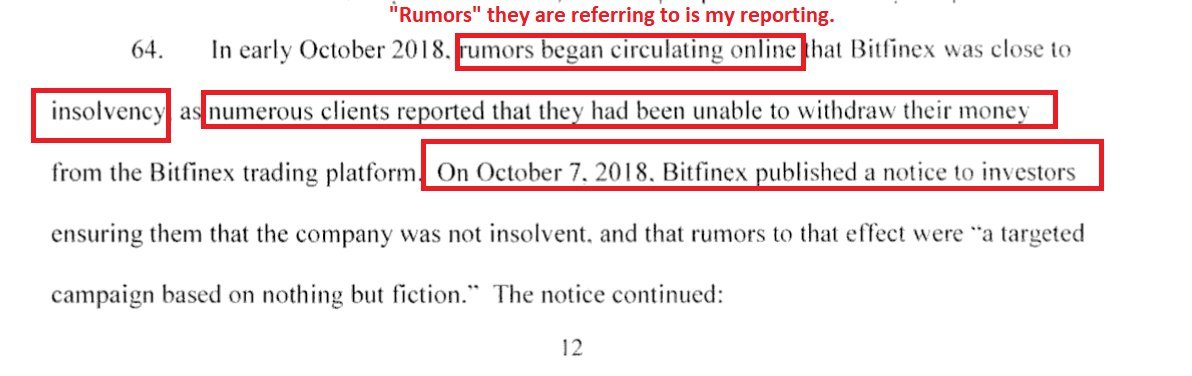

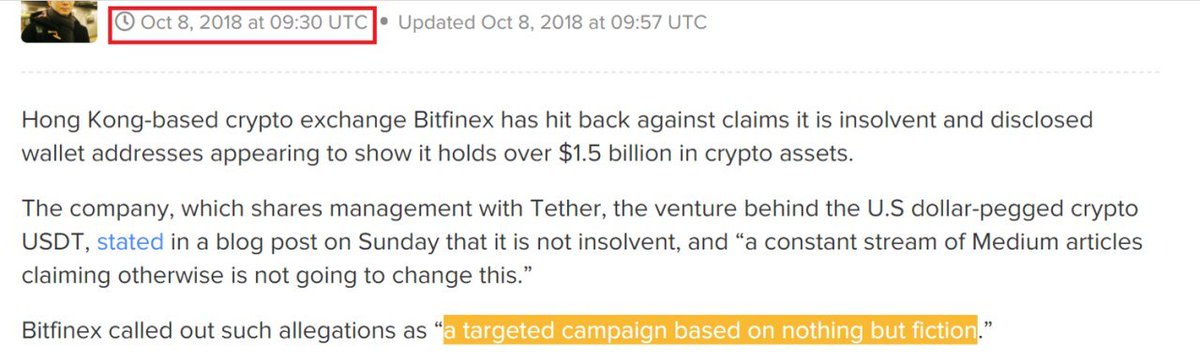

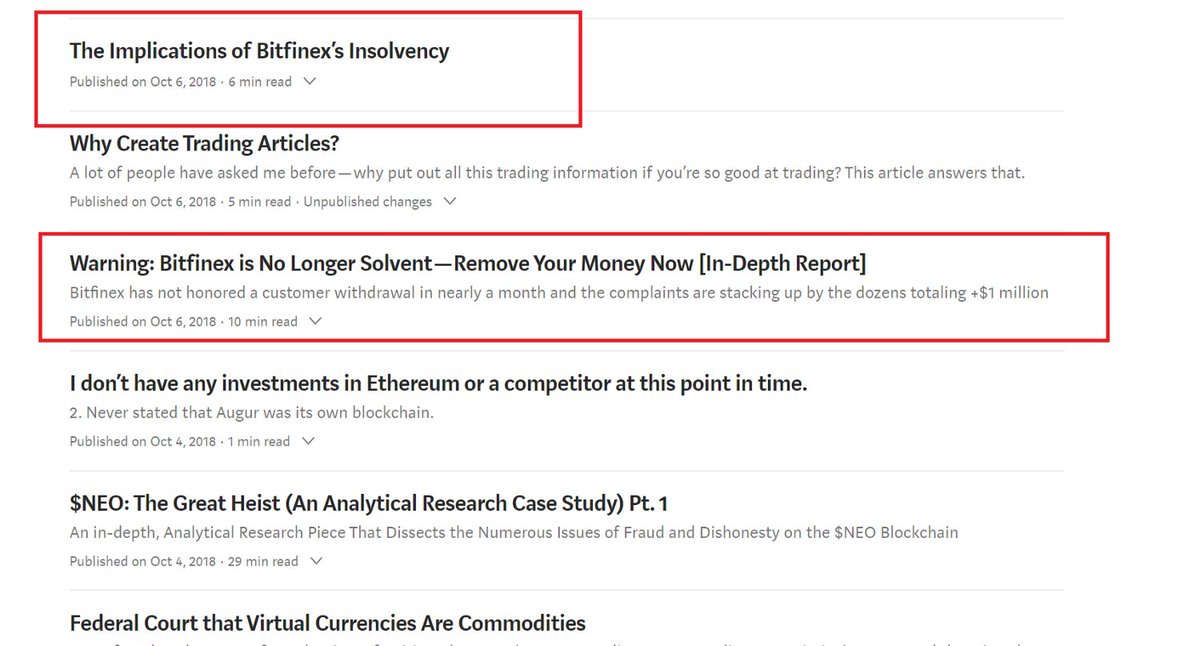

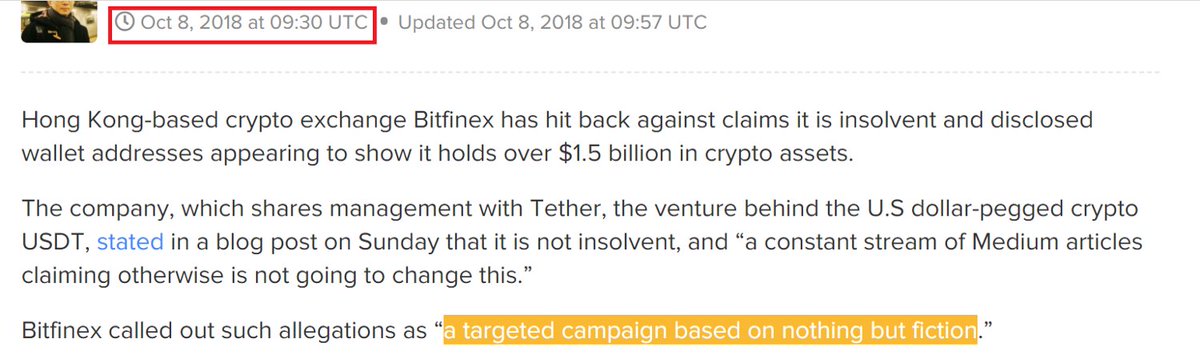

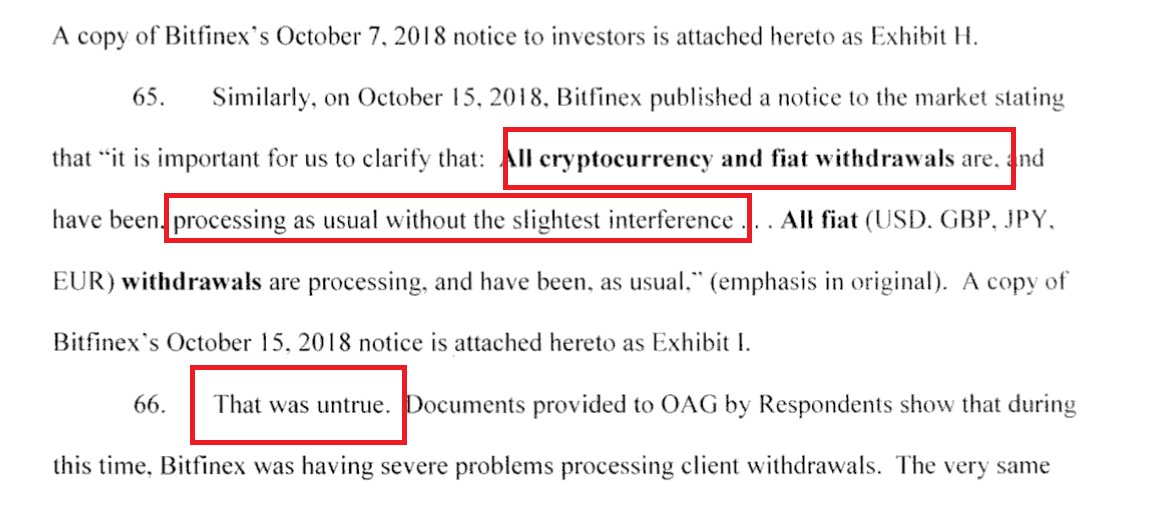

16/ This may or may not be related, but (@Tether_to + @bitfinex), were going through *tough times* back in Oct. + Nov. 2018 ; that was when I exposed the fact they were insolvent (backed up by the New York AG), leading to the peg nearly breaking.

16a/ Sidebar, NYAG confirmed that my posts exposing @bitfinex as functionally insolvent at the time were correct. Full stop.

October 15th the Tether peg broke below 90 cents as well.

Of course, Fowler was speaking w Feds around then too.

October 15th the Tether peg broke below 90 cents as well.

Of course, Fowler was speaking w Feds around then too.

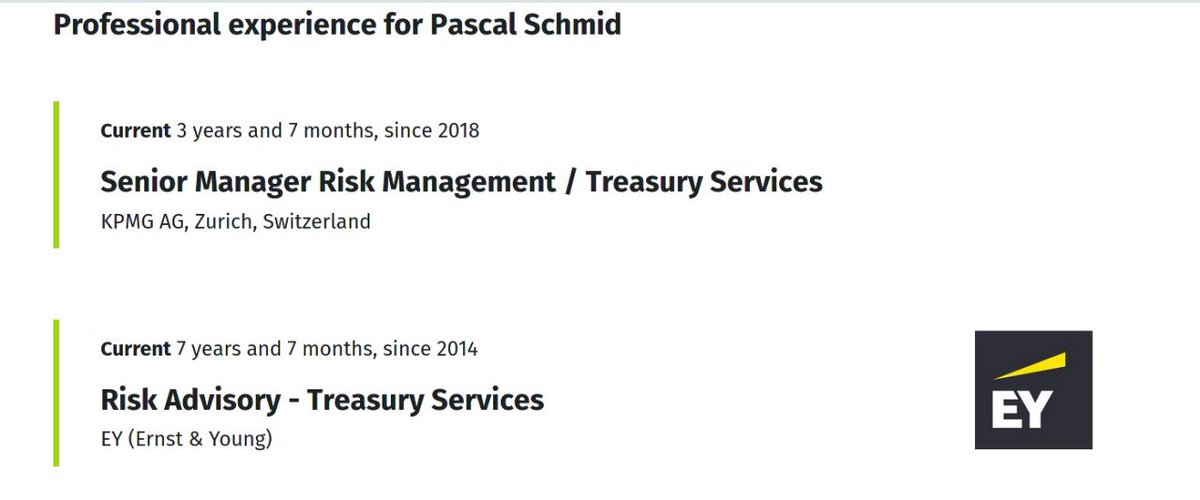

17/ Rounding things off, as I dug deeper into Pascal Schmid's background, the info I found appears to corroborate the idea that he is *currently* an employee of E&Y (Ernst & Young); I reached out to the firm for comment, got no response.

• • •

Missing some Tweet in this thread? You can try to

force a refresh