#MarsiliosTA

The pivot is the basic bull/bear dividing line, so trend indicator

Most pivot systems include support & resistance levels, so these are potential turn indicators

There are various formulas:

R1 = P*2 - L(ow)

S1 = P*2 - H(igh)

R2 = P + (R1 - S1)

S2 = P - (R1 - S1)

The pivot is the basic bull/bear dividing line, so trend indicator

Most pivot systems include support & resistance levels, so these are potential turn indicators

There are various formulas:

R1 = P*2 - L(ow)

S1 = P*2 - H(igh)

R2 = P + (R1 - S1)

S2 = P - (R1 - S1)

But don't worry about the math because all we need to do is turn them on in tradingview or whatever you are using

So here is DJI with yearly levels only, P & S & R

2020 panic covid low, smart $ bought YS3

Recently YR1 saw minor selling a few times, then turned into support

So here is DJI with yearly levels only, P & S & R

2020 panic covid low, smart $ bought YS3

Recently YR1 saw minor selling a few times, then turned into support

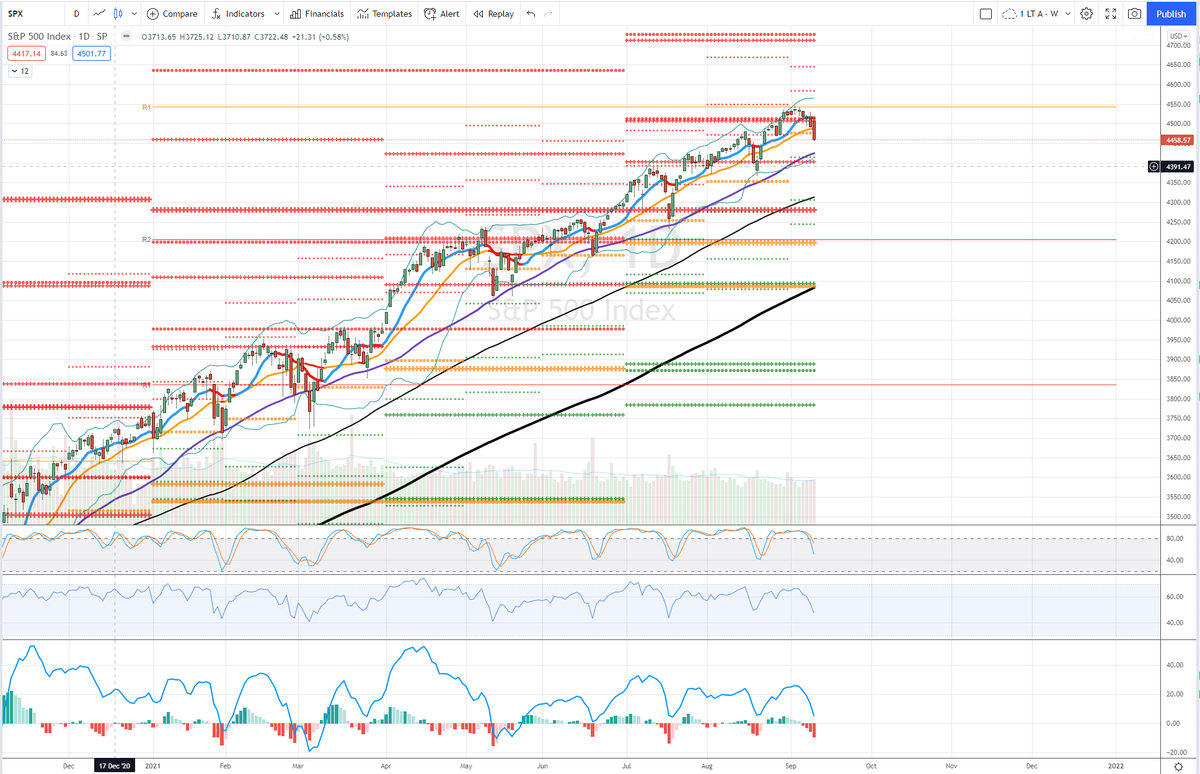

SPX

2020 covid low on YS2

Similar "resistance into support" idea on YR1 later in 2020 and again this year

2020 covid low on YS2

Similar "resistance into support" idea on YR1 later in 2020 and again this year

Wait - you are saying "the low" was DJI YS3, SPX YS2 and NDX YS1 all on the same day and after those held the low was in?

Yes

And not the first time that markets have made a major turn with multiple main indexes on major levels

Yes

And not the first time that markets have made a major turn with multiple main indexes on major levels

Does this work on cryptos?

Yes, in a modified way.

BTC high of 2021 is YR3.

But the % moves are often so large, that the market will trade through levels much more quickly than stocks or other assets. So this needs to be factored in.

Yes, in a modified way.

BTC high of 2021 is YR3.

But the % moves are often so large, that the market will trade through levels much more quickly than stocks or other assets. So this needs to be factored in.

BTC again with addition of half-year pivots

Jan - Jun

Jul - Dec

yearlies in thick crosses on my charts, half-year in dots

So now "the 2020 low" on HS1 stands out.

but a lot of levels pretty quick

Jan - Jun

Jul - Dec

yearlies in thick crosses on my charts, half-year in dots

So now "the 2020 low" on HS1 stands out.

but a lot of levels pretty quick

I can go on, suffice to say I've seen these work on indexes, cryptos, VIX, sector, bond, commodity ETFs, & forex

But the pivot is still the most important because that is the trend

Resistance is potential turn, so that is judgment what to do? Let play, hedge, exit?

But the pivot is still the most important because that is the trend

Resistance is potential turn, so that is judgment what to do? Let play, hedge, exit?

Support is potential turn, so what to do? Cover if short, buy?

But main money is NOT made by selling resistance and buying support, because these are actually counter-trend

Although buying a monthly S1 in context of above YP HP QP often works

Main $ made with trend

But main money is NOT made by selling resistance and buying support, because these are actually counter-trend

Although buying a monthly S1 in context of above YP HP QP often works

Main $ made with trend

That said, the more indexes at major R or S levels, more likely a turn is important

And if it doesn't turn and market continues like we saw on indexes rallying above YR1s, that's important too

PS: for swing trading on short term charts, monthly & weekly R & S work great

end

And if it doesn't turn and market continues like we saw on indexes rallying above YR1s, that's important too

PS: for swing trading on short term charts, monthly & weekly R & S work great

end

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh