1/25

Some books within minutes , force you to ditch the e-version of kindle & buy the hard copy instead !🙂

The Joys of Compounding is one such 💎

Content ( Curation + Creation ) at its finest !

Compressed JUST A FEW takeaways in this 🧵

#BookTwitter

#BookRecommendation

Some books within minutes , force you to ditch the e-version of kindle & buy the hard copy instead !🙂

The Joys of Compounding is one such 💎

Content ( Curation + Creation ) at its finest !

Compressed JUST A FEW takeaways in this 🧵

#BookTwitter

#BookRecommendation

2/25

Invest in yourself. Read.

Self educate. Think in isolation !

Everything in life can teach you when you possess the right mindset.

Read across a wide spectrum,for the scenes change but the behaviours & outcomes don't.

How to go about #READING & #THINKING effectively.

👇

Invest in yourself. Read.

Self educate. Think in isolation !

Everything in life can teach you when you possess the right mindset.

Read across a wide spectrum,for the scenes change but the behaviours & outcomes don't.

How to go about #READING & #THINKING effectively.

👇

3/25

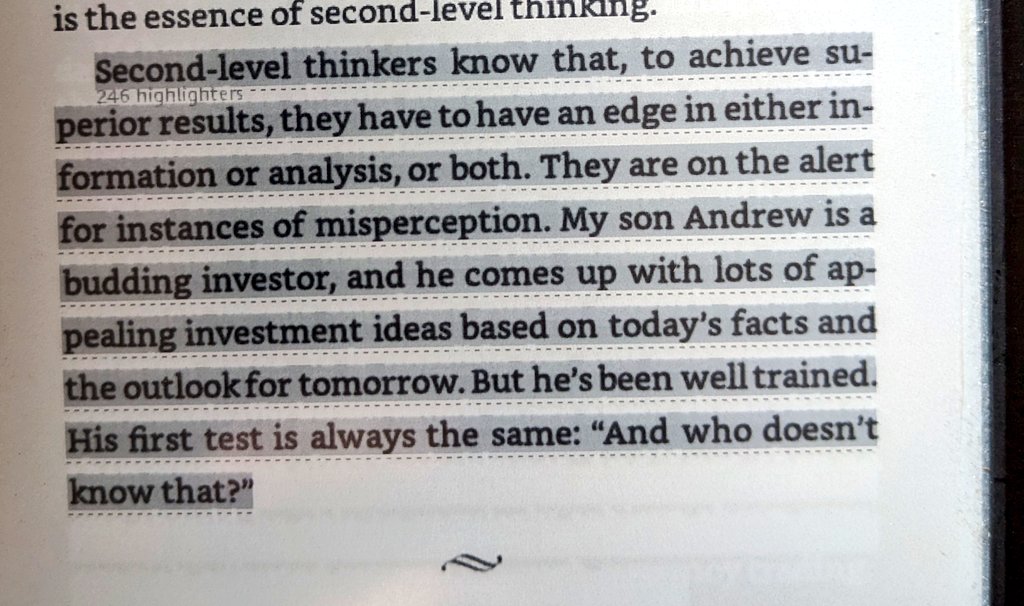

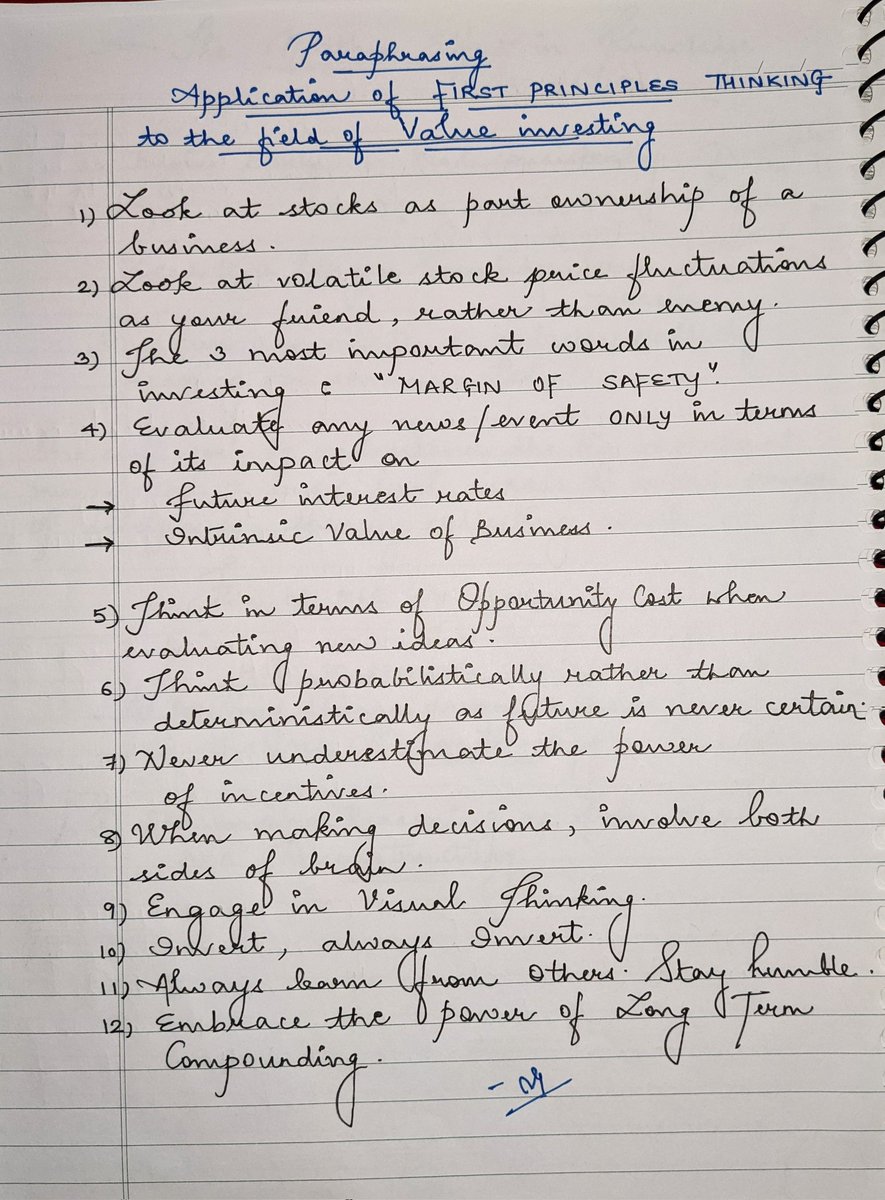

First Principles Thinking requires us to delve deeper & question everything until one is left with the fundamental truth in essence.

Deconstruct to effectively

Reconstruct ! ( Both in times of Greed & Gloom )

How to apply it to the field of #ValueInvesting

👇

First Principles Thinking requires us to delve deeper & question everything until one is left with the fundamental truth in essence.

Deconstruct to effectively

Reconstruct ! ( Both in times of Greed & Gloom )

How to apply it to the field of #ValueInvesting

👇

4/25

Know the difference between Being Rich & Staying Rich.

Quite a few become rich , FEW maintain it - For it requires humility , gratitude & a constant learning mindset.

Think probabilistically.

Consume content wisely.

Apply #LindyEffect to learning.

Some pointers

👇

Know the difference between Being Rich & Staying Rich.

Quite a few become rich , FEW maintain it - For it requires humility , gratitude & a constant learning mindset.

Think probabilistically.

Consume content wisely.

Apply #LindyEffect to learning.

Some pointers

👇

5/25

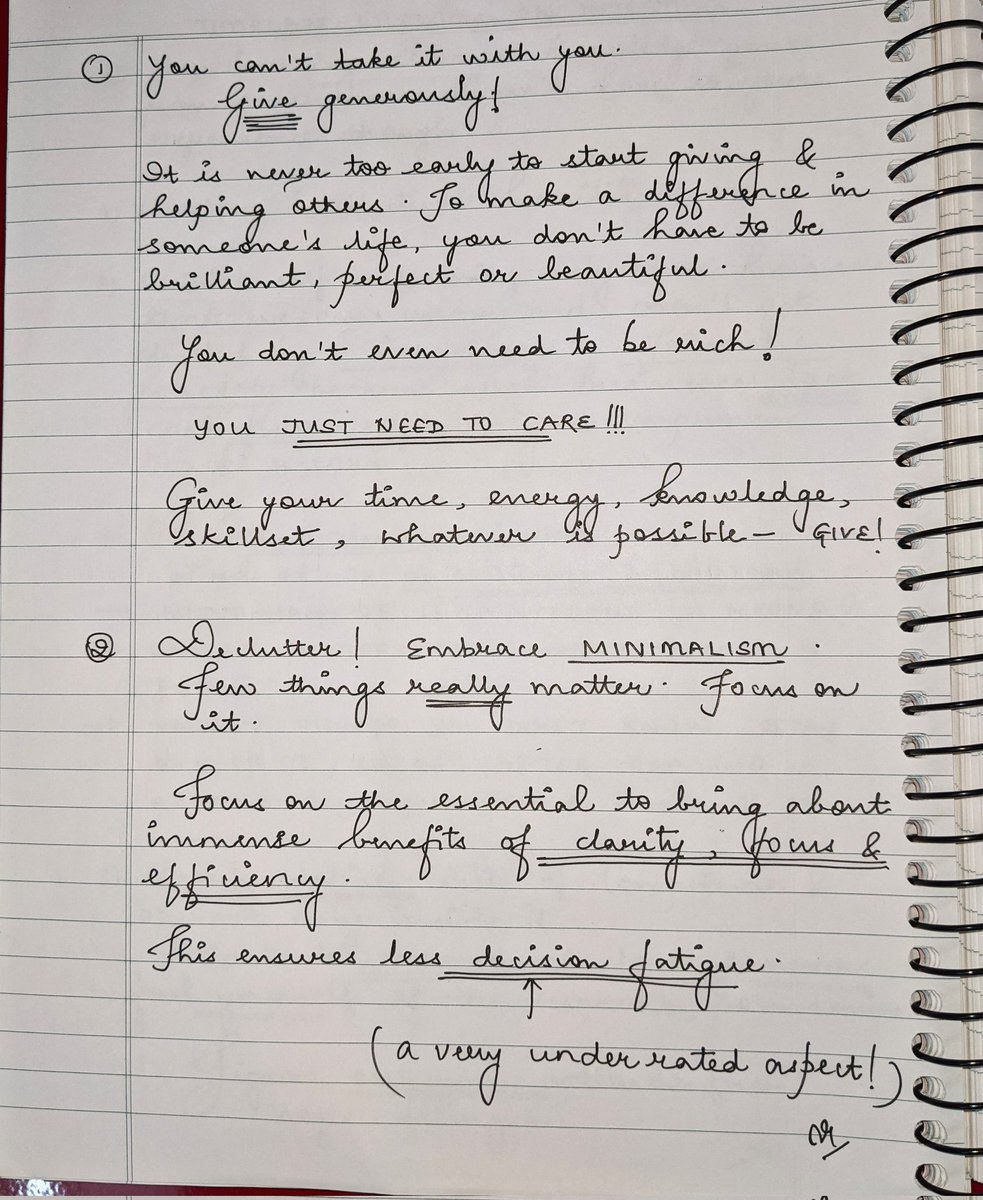

Some #TimelessWisdom

Don't sulk on missing out on trophies or fame.

Enjoy life's tiny delights .There are plenty for all of us !

For one day when we look back we shall realise that it was the little things that mattered the most ! 🙂

👇

Some #TimelessWisdom

Don't sulk on missing out on trophies or fame.

Enjoy life's tiny delights .There are plenty for all of us !

For one day when we look back we shall realise that it was the little things that mattered the most ! 🙂

👇

6/25

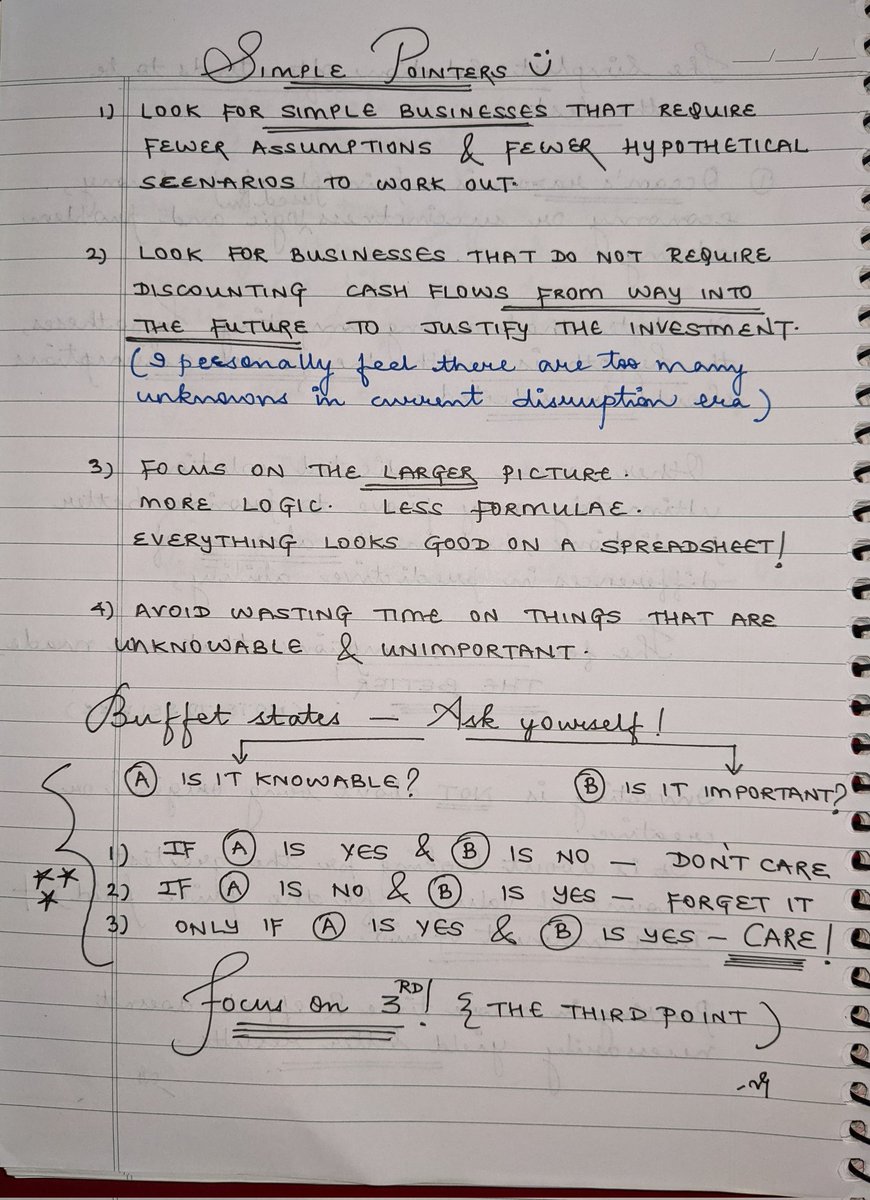

My fav !!

This one is on #Simplicity & Occam's Razor concept.

▫️Remember Warren Buffett's Golden Rule for successful Investing.

Rule 1- Never lose Money.

Rule 2- Never forget Rule 1.

▫️As Munger says ,

"Take a simple idea & take it seriously."

Some v.imp pointers

👇

My fav !!

This one is on #Simplicity & Occam's Razor concept.

▫️Remember Warren Buffett's Golden Rule for successful Investing.

Rule 1- Never lose Money.

Rule 2- Never forget Rule 1.

▫️As Munger says ,

"Take a simple idea & take it seriously."

Some v.imp pointers

👇

7/25

Achieving Financial Independence opens up a plethora of choices.

The ABILITY to choose the way to spend one's TIME being THE most important one.

How to go about achieving #FI ?

It's simple ( but not easy ) & straight forward since time immemorial 🤷🏻♀️

👇

Achieving Financial Independence opens up a plethora of choices.

The ABILITY to choose the way to spend one's TIME being THE most important one.

How to go about achieving #FI ?

It's simple ( but not easy ) & straight forward since time immemorial 🤷🏻♀️

👇

8/25

Moving onto Living Life😇

Inner scorecard > Outer

Something endorsed by Warren Buffett also.

Let your life be guided by internal principles, not external validation.

Strive to be the best version of YOURSELF ! In living a fulfilling life.

Applies to Fund Managers also!

Moving onto Living Life😇

Inner scorecard > Outer

Something endorsed by Warren Buffett also.

Let your life be guided by internal principles, not external validation.

Strive to be the best version of YOURSELF ! In living a fulfilling life.

Applies to Fund Managers also!

9/25

Short Term Pain for Long Term Gain.

Organic revenue growth is the most important driver of shareholder returns for companies with high returns on capital.

But most managers aren't willing to suffer for S.T, consequentially hurting their chances of L.T success.

Details👇

Short Term Pain for Long Term Gain.

Organic revenue growth is the most important driver of shareholder returns for companies with high returns on capital.

But most managers aren't willing to suffer for S.T, consequentially hurting their chances of L.T success.

Details👇

10/25

Look for CEO's who :

▫️Are good Capital Allocators + Discuss it rationally + Walk the talk + Are consistent .

▫️Focus on recurring Cash Flows

▫️Publish meaningful Financial + Operating goals + Clean B/S

▫️Are candid in communication with shareholders + Simplistic

Look for CEO's who :

▫️Are good Capital Allocators + Discuss it rationally + Walk the talk + Are consistent .

▫️Focus on recurring Cash Flows

▫️Publish meaningful Financial + Operating goals + Clean B/S

▫️Are candid in communication with shareholders + Simplistic

11/25

#Checklists remind us that we aren't infallible & must exercise caution.

Follow process of elimination & stick to checklist.

Helps immensely in Due Diligence.

The book shares some excellent checklists including Munger's psychological one. ( Read the book to know more ! 😀)

#Checklists remind us that we aren't infallible & must exercise caution.

Follow process of elimination & stick to checklist.

Helps immensely in Due Diligence.

The book shares some excellent checklists including Munger's psychological one. ( Read the book to know more ! 😀)

12/25

( Something I can vouch for !!)

#Journal to remain true to yourself & avoid hindsight bias.

*Track all important decisions

*Write down your thesis & anti thesis

*When in doubt , read it to avoid being wavered

*Write,make better decisions,be happier ! True for Life also!

( Something I can vouch for !!)

#Journal to remain true to yourself & avoid hindsight bias.

*Track all important decisions

*Write down your thesis & anti thesis

*When in doubt , read it to avoid being wavered

*Write,make better decisions,be happier ! True for Life also!

13/25

Charlie Munger on Skin in the Game.

An example of a really responsible system is the system Romans used when they built an arch.

The guy who created the arch stood under it as the scaffolding was removed.

It's like packing your own parachute.

Some pointers & examples

👇

Charlie Munger on Skin in the Game.

An example of a really responsible system is the system Romans used when they built an arch.

The guy who created the arch stood under it as the scaffolding was removed.

It's like packing your own parachute.

Some pointers & examples

👇

14/25

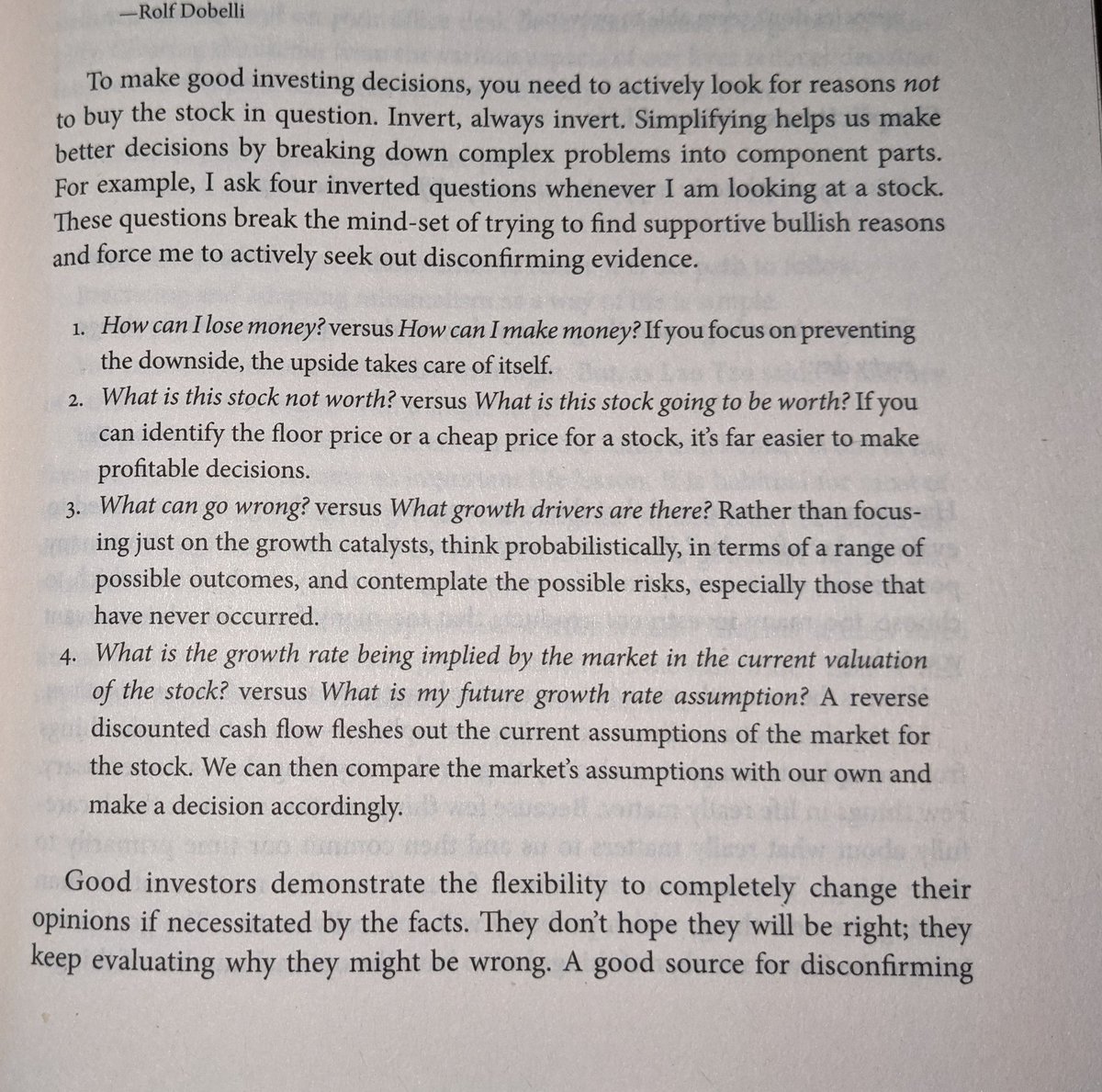

As investors we don't need perfection.Being fairly right with a good MOS suffices.

Focus on finding MOS & not why estimates were missed in a quarter.

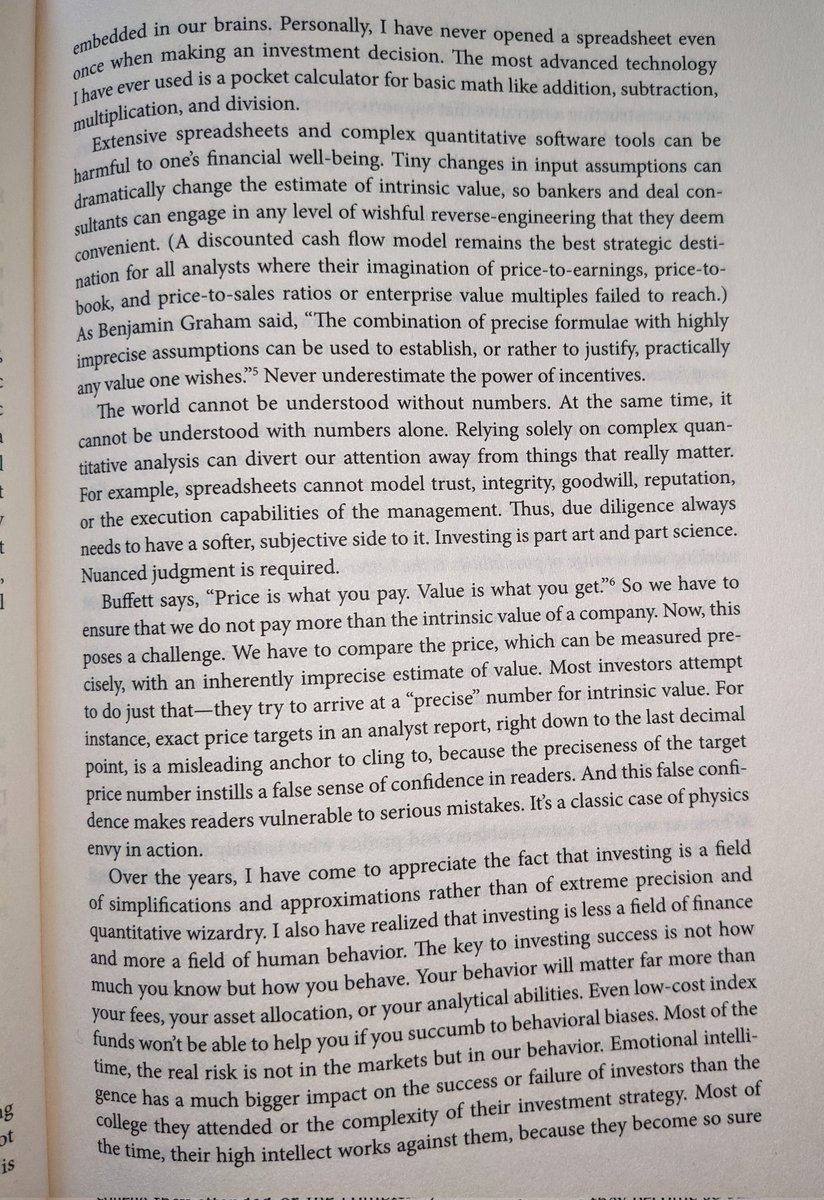

Refrain from overuse of Excel spreadsheets. Not everything can be quantified correctly !

Nuanced judgement is needed.

As investors we don't need perfection.Being fairly right with a good MOS suffices.

Focus on finding MOS & not why estimates were missed in a quarter.

Refrain from overuse of Excel spreadsheets. Not everything can be quantified correctly !

Nuanced judgement is needed.

15/25

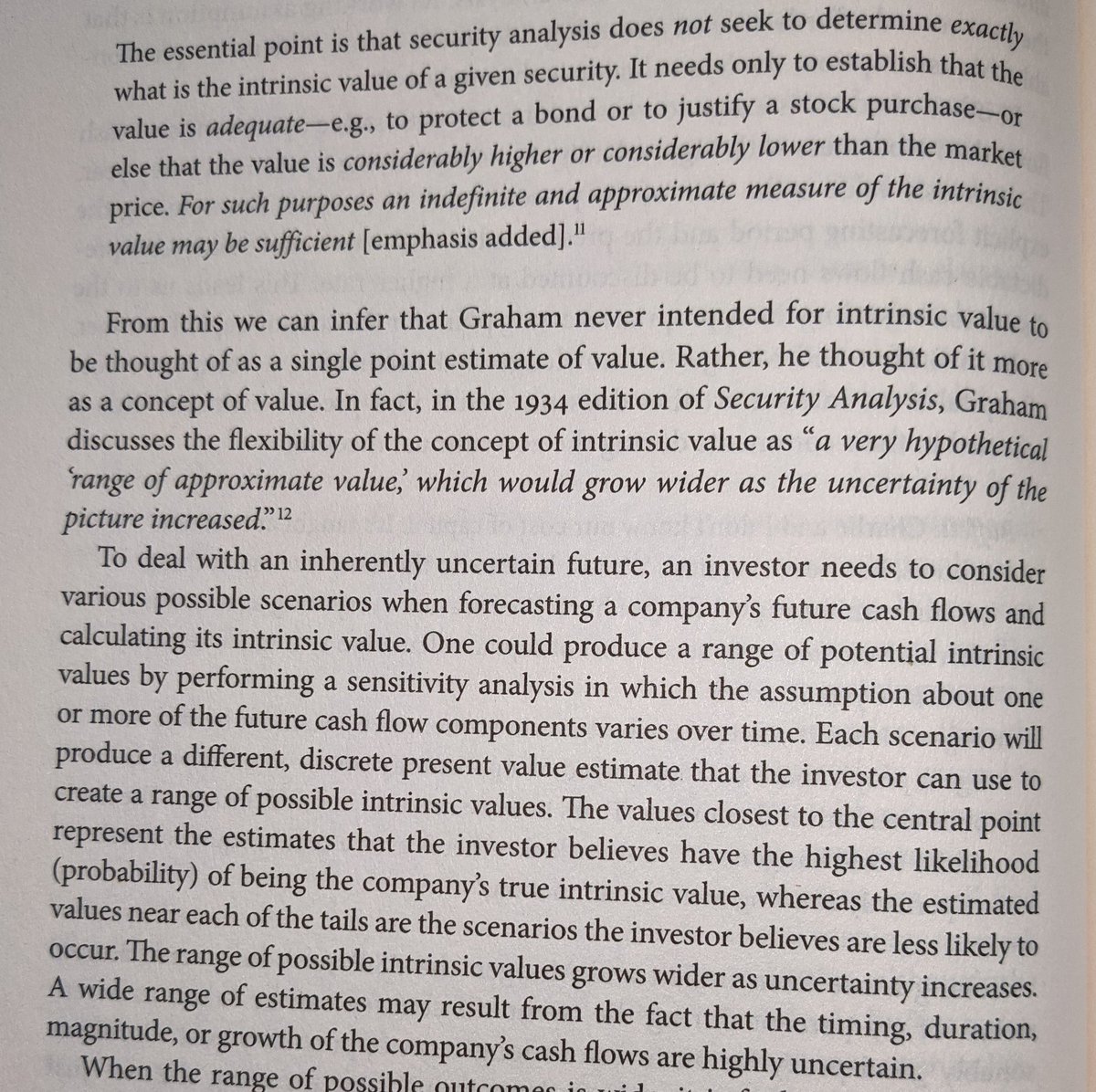

Determining the Intrinsic Value is an art.

It is the sum of cash flows expected to be received from that asset, over the remaining useful life, discounted for the Time Value of money & uncertainty involved.

THIS ENTIRE CHAPTER IS A GOLDMINE.

Read it to appreciate it !

Determining the Intrinsic Value is an art.

It is the sum of cash flows expected to be received from that asset, over the remaining useful life, discounted for the Time Value of money & uncertainty involved.

THIS ENTIRE CHAPTER IS A GOLDMINE.

Read it to appreciate it !

16/25

MOS matters.

When you pay a lot entry price, you don't need too many good things to happen to get good returns.Even bad news impact is restricted.

As Buffett states,

Rule no 1 : NEVER LOSE MONEY

Rule no 2 : NEVER FORGET RULE 1

Each line in this chapter is 👌

MOS matters.

When you pay a lot entry price, you don't need too many good things to happen to get good returns.Even bad news impact is restricted.

As Buffett states,

Rule no 1 : NEVER LOSE MONEY

Rule no 2 : NEVER FORGET RULE 1

Each line in this chapter is 👌

17/25

If a particular stock displays a price volume B/O to 52 week/multiyear/ATH with LARGE volumes, start reading about it.

Time frame is important.

Find out why someone is willing to pay a high price for it now ?

What has changed in its fundamentals ?

Much more in the 📗

If a particular stock displays a price volume B/O to 52 week/multiyear/ATH with LARGE volumes, start reading about it.

Time frame is important.

Find out why someone is willing to pay a high price for it now ?

What has changed in its fundamentals ?

Much more in the 📗

18/25

What is competitive advantage?

It's a company's ability to generate excess returns ( ROIC - Cost of Cap) - this done continually enables Competitive Advantage Period.

Great businesses produce high returns on incremental invested capital + have pricing power.

Find them!

What is competitive advantage?

It's a company's ability to generate excess returns ( ROIC - Cost of Cap) - this done continually enables Competitive Advantage Period.

Great businesses produce high returns on incremental invested capital + have pricing power.

Find them!

19/25

Temperament matters !

Your lifetime track record as an investor will be determined primarily by HOW you conduct yourself during occasional periods of extreme market behaviour .

Be fearful when others are greedy.

Be greedy when others are fearful.

( Rings any bells ? 😬 )

Temperament matters !

Your lifetime track record as an investor will be determined primarily by HOW you conduct yourself during occasional periods of extreme market behaviour .

Be fearful when others are greedy.

Be greedy when others are fearful.

( Rings any bells ? 😬 )

20/25

Don't aim for exceptional returns. They won't last long!

Rather settle for Consistent Returns over a long time.

A Bull Market hides many mistakes which become visible in a Bear Market.

Develop a sound philosophy & stick to it.

Don't aim for exceptional returns. They won't last long!

Rather settle for Consistent Returns over a long time.

A Bull Market hides many mistakes which become visible in a Bear Market.

Develop a sound philosophy & stick to it.

21/25

To Finish First , You Must First Finish !

* Keep separate Emergency Funds

* Say NO to Leverage

* Have TIME as your friend.

* Accept being wrong

* Discipline > Smartness ( in LT)

* Diversify wisely in unrelated sectors

* Embrace Volatility

* Quality only

To Finish First , You Must First Finish !

* Keep separate Emergency Funds

* Say NO to Leverage

* Have TIME as your friend.

* Accept being wrong

* Discipline > Smartness ( in LT)

* Diversify wisely in unrelated sectors

* Embrace Volatility

* Quality only

22/25

We have two classes of forecasters .

Those who don't know & those who don't know that they don't know .

They shall fill your EARS , NEVER your POCKETS.

Stop wanting to make sense of everything & TIMING markets.

Focus on what can be controlled.

We have two classes of forecasters .

Those who don't know & those who don't know that they don't know .

They shall fill your EARS , NEVER your POCKETS.

Stop wanting to make sense of everything & TIMING markets.

Focus on what can be controlled.

23/25

Embrace change ! Don't be rigid.

Flexible thinking is of paramount importance in today's disruptive times.

It helps in accepting a thesis hasn't played out .

As investors we shall be wrong many a number of times .

Listen to opposing viewpoints to Learn something new !

Embrace change ! Don't be rigid.

Flexible thinking is of paramount importance in today's disruptive times.

It helps in accepting a thesis hasn't played out .

As investors we shall be wrong many a number of times .

Listen to opposing viewpoints to Learn something new !

24/25

We remember the explicit cost. But it's the Opportunity Cost that matters!

Don't be penny wise,pound foolish.

Mistakes of Commission are capped to 100% but Mistakes of Omission have no ceiling !

Opp cost + Circle of Competence would in conjunction.

We remember the explicit cost. But it's the Opportunity Cost that matters!

Don't be penny wise,pound foolish.

Mistakes of Commission are capped to 100% but Mistakes of Omission have no ceiling !

Opp cost + Circle of Competence would in conjunction.

25/25

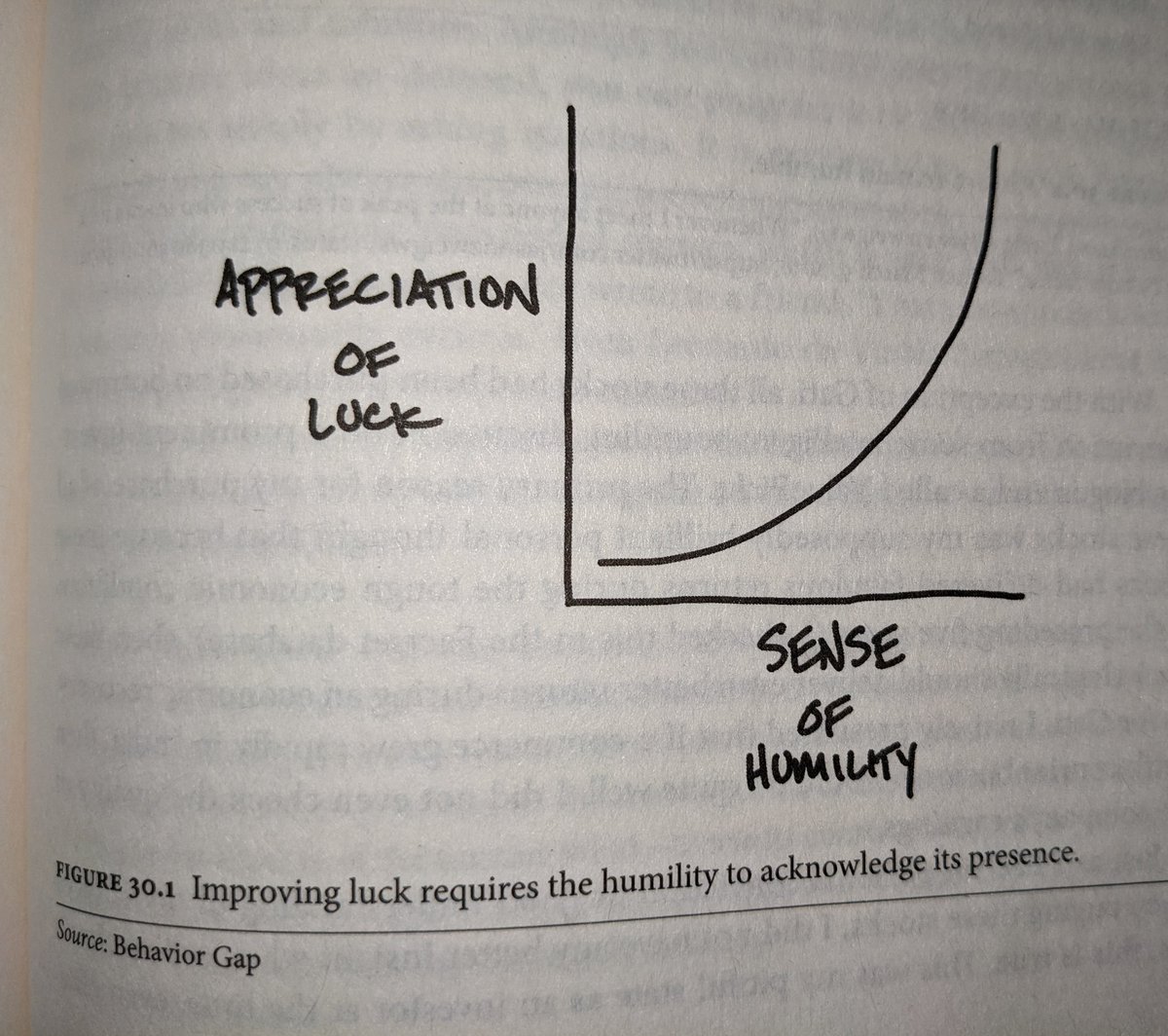

Lastly, LUCK plays a major role.

It's often hidden because outstanding success is spotlighted, whilst failures are all around but unseen.

Stay humble always , for there is no self made man !

Keep learning & truly enjoy the Joys of Compounding in all aspects of life!

Lastly, LUCK plays a major role.

It's often hidden because outstanding success is spotlighted, whilst failures are all around but unseen.

Stay humble always , for there is no self made man !

Keep learning & truly enjoy the Joys of Compounding in all aspects of life!

I would like to thank you @Gautam__Baid from the bottom of my heart for this beauty.

It's treasure worthy & I truly enjoyed even the APPENDIX !!

Rarely have I come across such great Content Curation & Creation in such a simplistic manner.

विद्याधनं सर्व धनं प्रधानम् । 😇🙏

It's treasure worthy & I truly enjoyed even the APPENDIX !!

Rarely have I come across such great Content Curation & Creation in such a simplistic manner.

विद्याधनं सर्व धनं प्रधानम् । 😇🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh