#MarsiliosTA

Follow up on S & R levels to show a couple short term examples

Weekly & daily pivots important for trend, and pullbacks to the WP or DP often great buys in uptrend.

But also because entire structure is more clustered, S & R levels a lot more likely to trade.

Follow up on S & R levels to show a couple short term examples

Weekly & daily pivots important for trend, and pullbacks to the WP or DP often great buys in uptrend.

But also because entire structure is more clustered, S & R levels a lot more likely to trade.

BTC 1H chart with

All levels plus weeklies

Fibonacci weeklies in red

DeMark weeklies in orange

No daily levels for clarity

This week near tag of yearly level (YR2 as support), but no other half-year, quarterly or monthly levels in play at all

Action all on weeklies

All levels plus weeklies

Fibonacci weeklies in red

DeMark weeklies in orange

No daily levels for clarity

This week near tag of yearly level (YR2 as support), but no other half-year, quarterly or monthly levels in play at all

Action all on weeklies

Arrows are just showing turns - sometimes chop, it happens

1st brown = fail at WP then down

1st red = Fib S1 low

green = WS1 low of week

2nd brown = WP chop a bit

2nd red = Fib R1 resistance

3rd brown = WP pullback hold

Crypto traders if you are not interested this...

1st brown = fail at WP then down

1st red = Fib S1 low

green = WS1 low of week

2nd brown = WP chop a bit

2nd red = Fib R1 resistance

3rd brown = WP pullback hold

Crypto traders if you are not interested this...

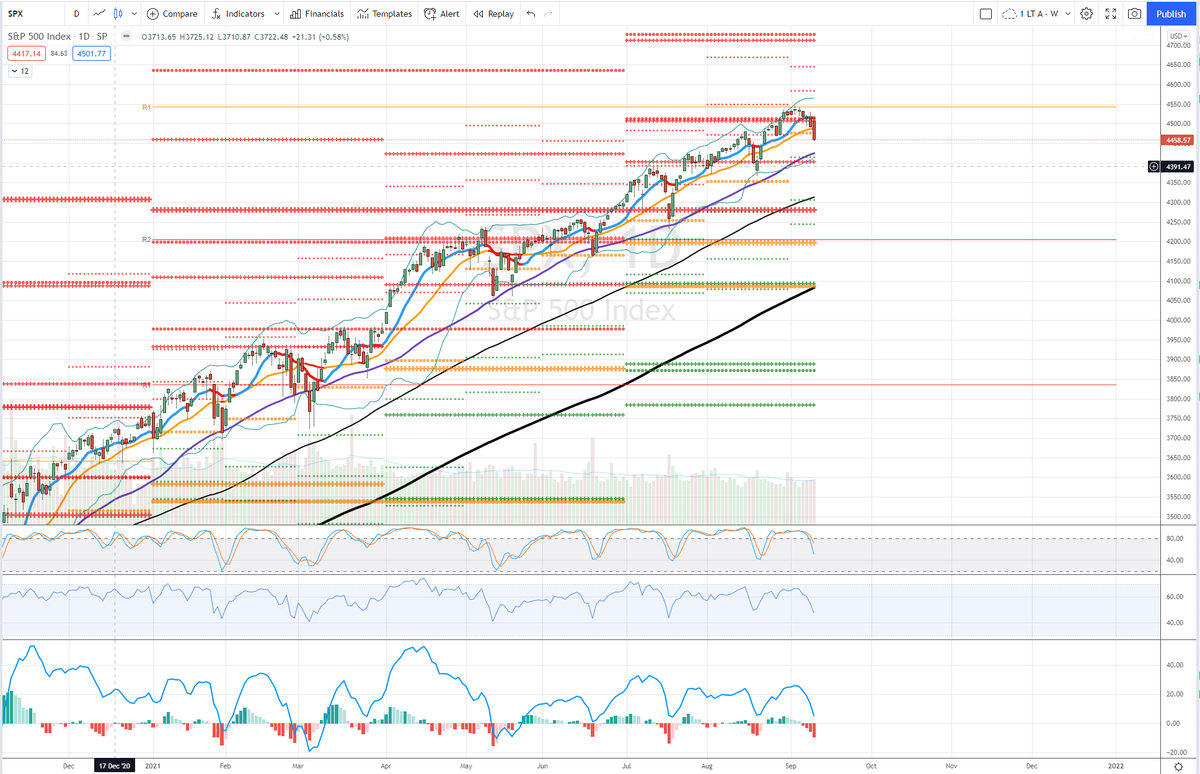

ES

Quiet holiday week, tight range

Same setup

As it so happened, one top very near a monthly R1 (how do I know? because dots extend more than 1 week) and a quarterly level acting as support (same idea)

Highs near DeMark WR1 with poke above but not close above today in orange

Quiet holiday week, tight range

Same setup

As it so happened, one top very near a monthly R1 (how do I know? because dots extend more than 1 week) and a quarterly level acting as support (same idea)

Highs near DeMark WR1 with poke above but not close above today in orange

So, this stuff does work but there are a lot of levels and once we add dailies then there will be levels everywhere, so how to judge?

Some traders use pivots alone

I prefer to combine other tools into system

And for that... come back next installment

unroll @threadreaderapp

Some traders use pivots alone

I prefer to combine other tools into system

And for that... come back next installment

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh