Mini Case Study Thread

Building Your Trading Idea:

So we talk about finding confluence with moves and trying to build a bit of narrative for where price is likely to reach up or down to

I'll take a look here at how a possible $UNI trade could be developed:

Building Your Trading Idea:

So we talk about finding confluence with moves and trying to build a bit of narrative for where price is likely to reach up or down to

I'll take a look here at how a possible $UNI trade could be developed:

Start with HTF key closes ie Monthly, Weekly, and Daily.

I've gone ahead and marked these up, but consolidated on the Daily Chart

I've gone ahead and marked these up, but consolidated on the Daily Chart

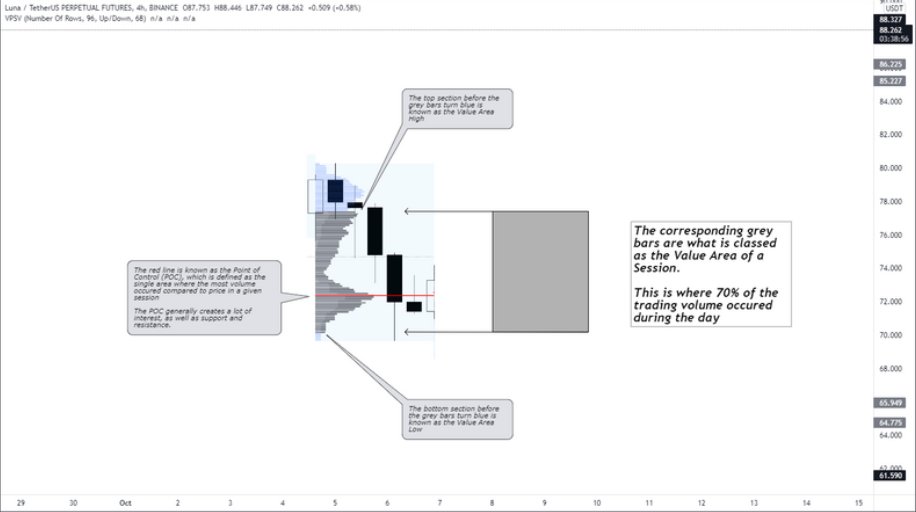

Using the VPVR tool from Tradingview, we can see where the most volume has taken place within the area that we are looking at on the chart.

Notice that we are just trading above the Point of Control for this area (and also just below the recent monthly close)

Notice that we are just trading above the Point of Control for this area (and also just below the recent monthly close)

So are we bearish or bullish? In this case, let's explore with fibs and PA

We're looking like we've had two higher lows, followed by a rally up past recent market structure (shaded rectangle) and formed a swing high.

(HTF levels turned off for clarity)

We're looking like we've had two higher lows, followed by a rally up past recent market structure (shaded rectangle) and formed a swing high.

(HTF levels turned off for clarity)

We'd expect price to fall back to the 0.618 - 0.705 levels, but with instances of sharp moves like this (think flags etc), you'll find that price respects the 0.382 and 0.5 levels more than our usual targets.

And, we have seen a bit of a spike at the 0.5 level per the chart.

And, we have seen a bit of a spike at the 0.5 level per the chart.

On the 1H chart, we also see a rounded bottom / reversal move play out, which supports our hypothesis.

In this case, I would be bullish.

In this case, I would be bullish.

Taking it the next level down to the 15M TF, we turn our HTF levels back on, and then also include our favourite suite of entry / exit / target fibs

If pull your fibs in anticipation of where a bullish trade could run into trouble, you find confluence with:

- A weekly level

- The 0.618 to 0.79 levels of the fibs

- Not only that, but you'd also find that there was a previous POC in between the 0.618 and 0.705 levels

- A weekly level

- The 0.618 to 0.79 levels of the fibs

- Not only that, but you'd also find that there was a previous POC in between the 0.618 and 0.705 levels

And entry and targets?

See below for an example of a trade based on retracement to realistic market structure, and then an end goal of the Daily swing high, with profits taken at the Weekly level / POC interface explored above / reverse fib zones.

See below for an example of a trade based on retracement to realistic market structure, and then an end goal of the Daily swing high, with profits taken at the Weekly level / POC interface explored above / reverse fib zones.

Stop Loss *could* be placed below the HTF recent lows, or if aggresive, then at more local swing lows

This example is a 3.45R trade

This example is a 3.45R trade

And what if price flips and is bearish I hear you ask?

Well, you've now got the tools to at least formulate a plan...we aren't always right, but as long as we've got a plan, this is half the battle hey?

Hope this helped you on your journey, and happy trading

- Mindset

Well, you've now got the tools to at least formulate a plan...we aren't always right, but as long as we've got a plan, this is half the battle hey?

Hope this helped you on your journey, and happy trading

- Mindset

• • •

Missing some Tweet in this thread? You can try to

force a refresh