Quick Index TA

Can go on about this too, but only so much time

See #MarsiliosTA for ongoing intro to these methods, plus abbreviations in google sheet (link later)

DJI

Stunning steroid rally continues

DJI bull victory above YR1 (arrow) - not near long term level currently

Can go on about this too, but only so much time

See #MarsiliosTA for ongoing intro to these methods, plus abbreviations in google sheet (link later)

DJI

Stunning steroid rally continues

DJI bull victory above YR1 (arrow) - not near long term level currently

DJI daily

But unlike others no new high last week, and sitting on QR1 (red arrow)

If any trouble this will move below its SepP at 35230 (orange)

hm, DJI more easily bearish but usually the worst short, what to do

But unlike others no new high last week, and sitting on QR1 (red arrow)

If any trouble this will move below its SepP at 35230 (orange)

hm, DJI more easily bearish but usually the worst short, what to do

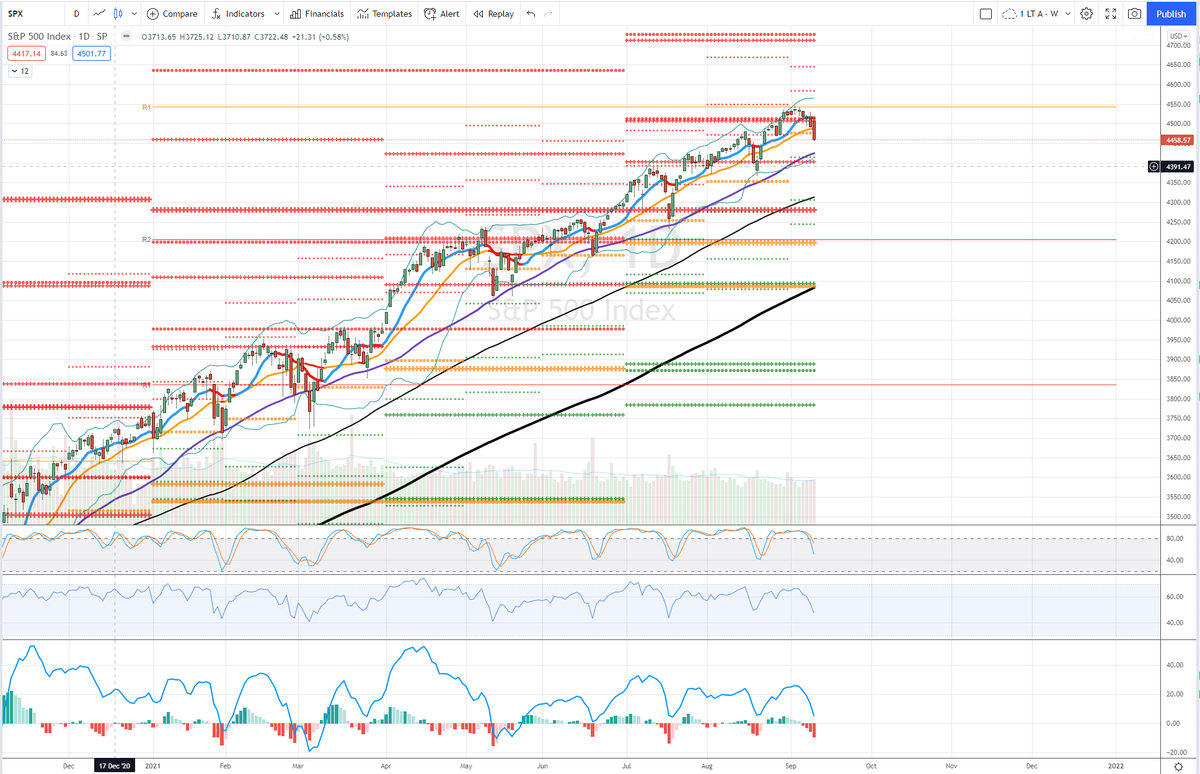

SPX

Floated above YR1, then above HR1 (red crosses & arrows respectively)

Testing DeMark YR1 - jeez I'd like for some real institutional pros to take a whack at this

For now level to watch 4540, showing daily as well - they are nibbling on hedges / shorts

Floated above YR1, then above HR1 (red crosses & arrows respectively)

Testing DeMark YR1 - jeez I'd like for some real institutional pros to take a whack at this

For now level to watch 4540, showing daily as well - they are nibbling on hedges / shorts

NDX

To the Moon? For now on QR2 (arrow) so any higher reduces bear threat

RSI across timesframes 70+

Q RSI 87

M RSI 82 - highest since dotcom has been 85

W RSI 75

D RSI 70

Could keep going though, but momentum should end when Venus loses strength 9/8 last day

To the Moon? For now on QR2 (arrow) so any higher reduces bear threat

RSI across timesframes 70+

Q RSI 87

M RSI 82 - highest since dotcom has been 85

W RSI 75

D RSI 70

Could keep going though, but momentum should end when Venus loses strength 9/8 last day

RUT

Still below high of year

If sellers come in this will get hit

Fib Yearly R2 on recent highs and no follow through to last week's squeeze

Still below high of year

If sellers come in this will get hit

Fib Yearly R2 on recent highs and no follow through to last week's squeeze

ARKK

Big fan of Cathie & ARKK

having a rest year after massive NDX outperform last several years

May pop from D200 but has moved on Mars a lot

Mars strong to 9/11

If D200 fail this week then watch out below

Big fan of Cathie & ARKK

having a rest year after massive NDX outperform last several years

May pop from D200 but has moved on Mars a lot

Mars strong to 9/11

If D200 fail this week then watch out below

VIX

Interesting VIX on DeMark pivot while SPX on DeMark YR1

Things that CFAs never say

Anyway, point is that VIX has to put in a big move to actually indicate trouble - close 20+ really

Until then cannot be too bearish despite what I think is pretty good setup - will explain

Interesting VIX on DeMark pivot while SPX on DeMark YR1

Things that CFAs never say

Anyway, point is that VIX has to put in a big move to actually indicate trouble - close 20+ really

Until then cannot be too bearish despite what I think is pretty good setup - will explain

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh