Total Sum

In big picture 2 major positives for stocks/risk just happened or about to:

NN in term of Mercury last week, historical bullish edge

Jupiter in term Mars this week, best term for stocks in bull markets by decent margin

What to make of this?

In big picture 2 major positives for stocks/risk just happened or about to:

NN in term of Mercury last week, historical bullish edge

Jupiter in term Mars this week, best term for stocks in bull markets by decent margin

What to make of this?

I've been trying to wrap head around indexes continuing to coast higher with what is my view, significant astro weakness:

Pluto in Cap-Saturn (double Saturn sign & term ruler)

Jupiter in Aquarius-Saturn (same!)

Instead just easy coast up up up

My conclusion has been:

Pluto in Cap-Saturn (double Saturn sign & term ruler)

Jupiter in Aquarius-Saturn (same!)

Instead just easy coast up up up

My conclusion has been:

Bad news = good, because bad = QE continues, and no hikes

And maybe I have been dumb to adopt this so late, but one wonders, how this can continue - fasting doubling of SPX ever? 100%+ off covid low, 18 months.

Recently validated a few times with JPow and EE#

And maybe I have been dumb to adopt this so late, but one wonders, how this can continue - fasting doubling of SPX ever? 100%+ off covid low, 18 months.

Recently validated a few times with JPow and EE#

So this can end either:

Worst astro passes, covid recedes, FOMC starts tapering, then rate hikes; institutions realize gig is up

So worst astro = near market top

Worst astro passes, covid recedes, FOMC starts tapering, then rate hikes; institutions realize gig is up

So worst astro = near market top

OR

FOMC continues to accommodate despite improving data, no hikes, very slow reluctant taper, occasional sound bites about it but jeez...

That would mean big blow-off further strength into 2022 Jupiter Pisces cnj Neptune

Probably the latter is more likely

That's big pic

FOMC continues to accommodate despite improving data, no hikes, very slow reluctant taper, occasional sound bites about it but jeez...

That would mean big blow-off further strength into 2022 Jupiter Pisces cnj Neptune

Probably the latter is more likely

That's big pic

Near term, combo of 3 planets losing term strength soon, plus Sun term change, plus Moon cycle, Mars in term Saturn, there's a lot ahead

Think some trading top immanent, and task is just to watch & adjust crypto/ index ports to avoid damage

Think some trading top immanent, and task is just to watch & adjust crypto/ index ports to avoid damage

No sign of trouble currently, & indexes would have to have some change of pivot status along with VIX to really hold any shorts (not yet!) or go bigger

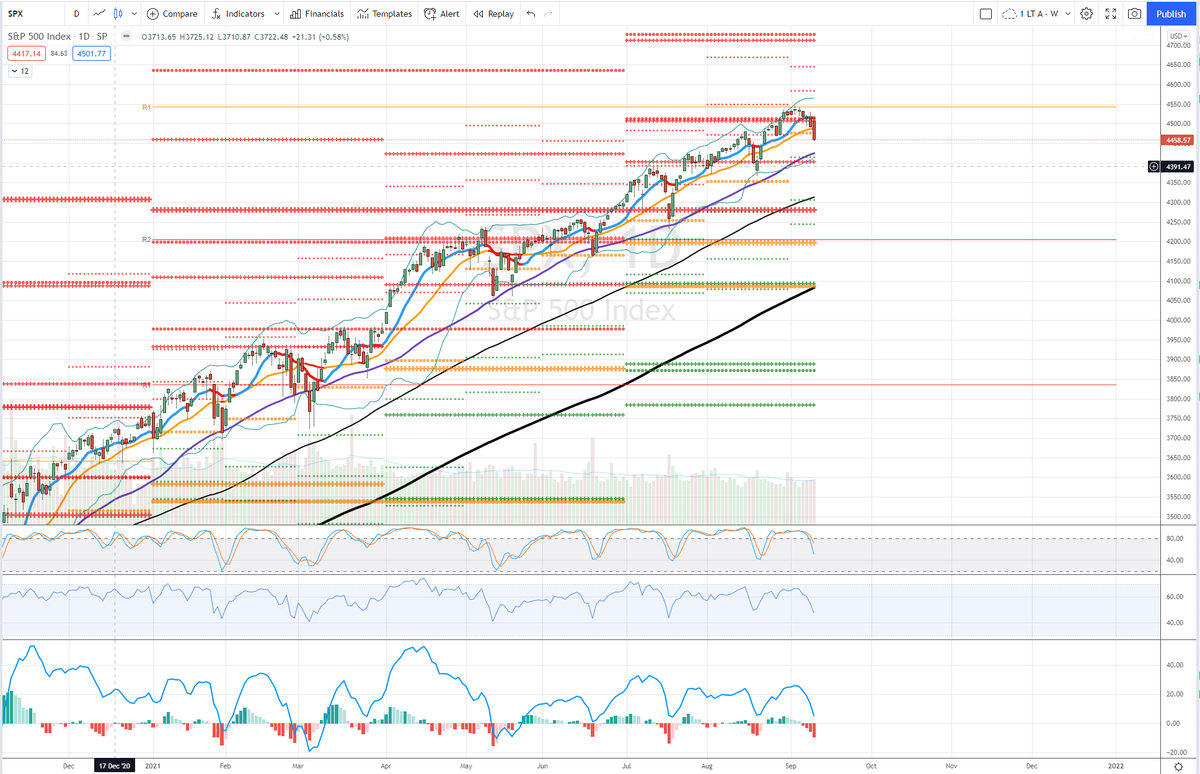

Main call for week both stocks & cyptos is 9/6 high

Turnaround Tues selling

Weds probably recovers

Thurs up? Then more at risk

Main call for week both stocks & cyptos is 9/6 high

Turnaround Tues selling

Weds probably recovers

Thurs up? Then more at risk

Safe havens may not get really in gear to following week

Basic call is 9/6-8 top possible stretch to 9/10 but that is not preferred

Ideally stocks top first with more damage, cryptos less damage

Basic call is 9/6-8 top possible stretch to 9/10 but that is not preferred

Ideally stocks top first with more damage, cryptos less damage

There it is folks thanks for reading

Google sheet link - to show these *timestamped* weekly sums

docs.google.com/spreadsheets/d…

good luck, ciao

~Marsilio~

but I'd like to do just one more data study!

Google sheet link - to show these *timestamped* weekly sums

docs.google.com/spreadsheets/d…

good luck, ciao

~Marsilio~

but I'd like to do just one more data study!

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh