Time for another chapter in the Raper Capital origin story. Part 6: 2019.

This was a most eventful year and the most difficult since I began my full-time money management adventure. I got carried out of numerous shorts at huge losses and my entire approach was questioned...

👇

This was a most eventful year and the most difficult since I began my full-time money management adventure. I got carried out of numerous shorts at huge losses and my entire approach was questioned...

👇

https://twitter.com/puppyeh1/status/1429617459049373700

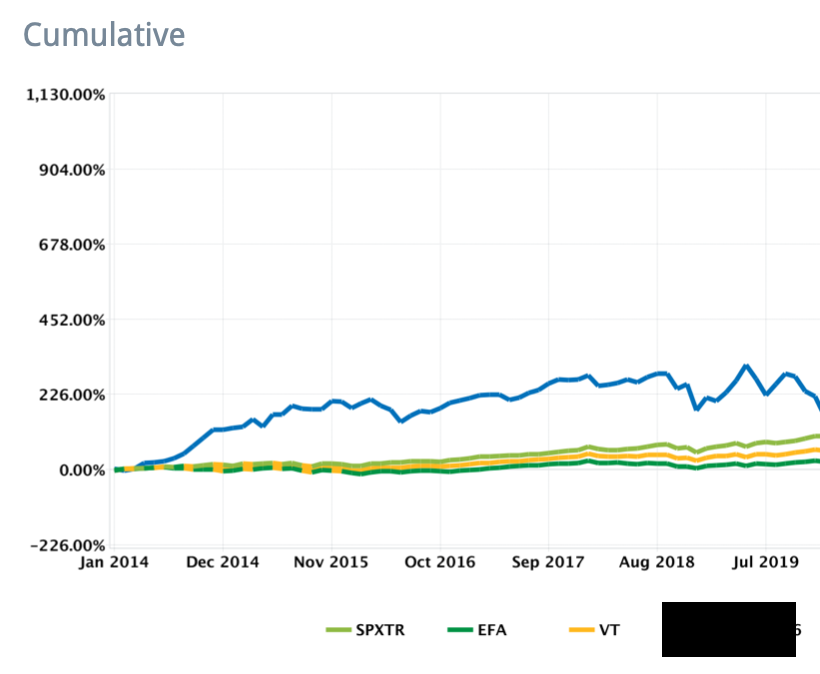

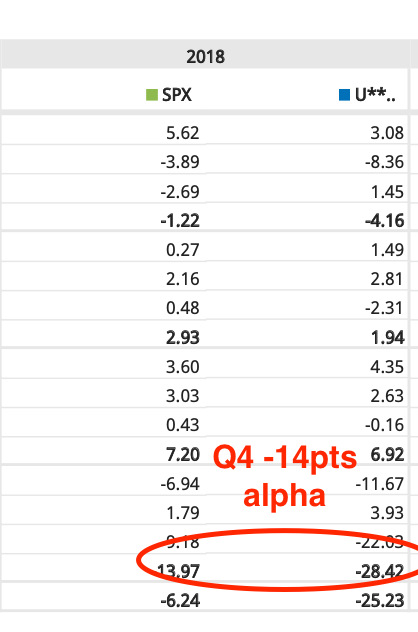

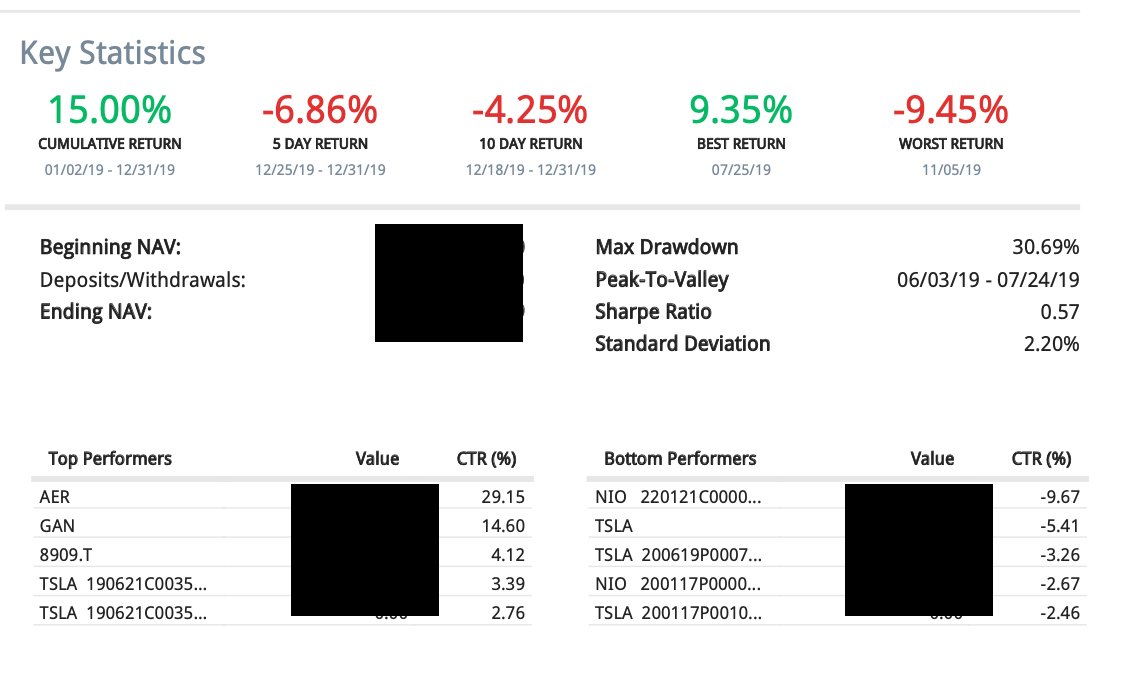

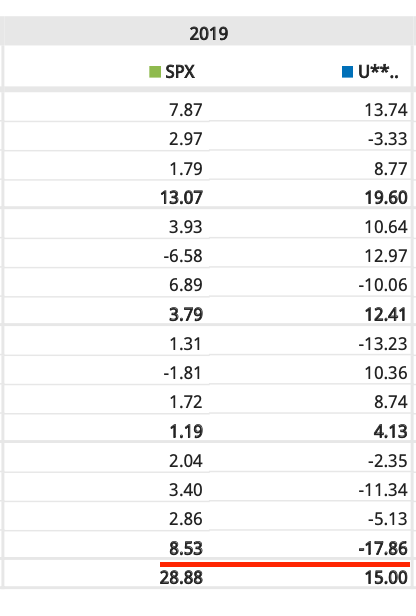

First, the headline numbers. +15% on the yr vs the SPX +29%. In general I'll always take an absolute performance like that, but this felt like a total loss if you look at how I was doing through 1-3Q:

As you can see, I was on track for a smashing year (mid-30s%+) before 4Q happened and brought everything crashing down...

Looking at the top detractors ($NIO short calls, short $TSLA, etc) its pretty clear what happened...

Looking at the top detractors ($NIO short calls, short $TSLA, etc) its pretty clear what happened...

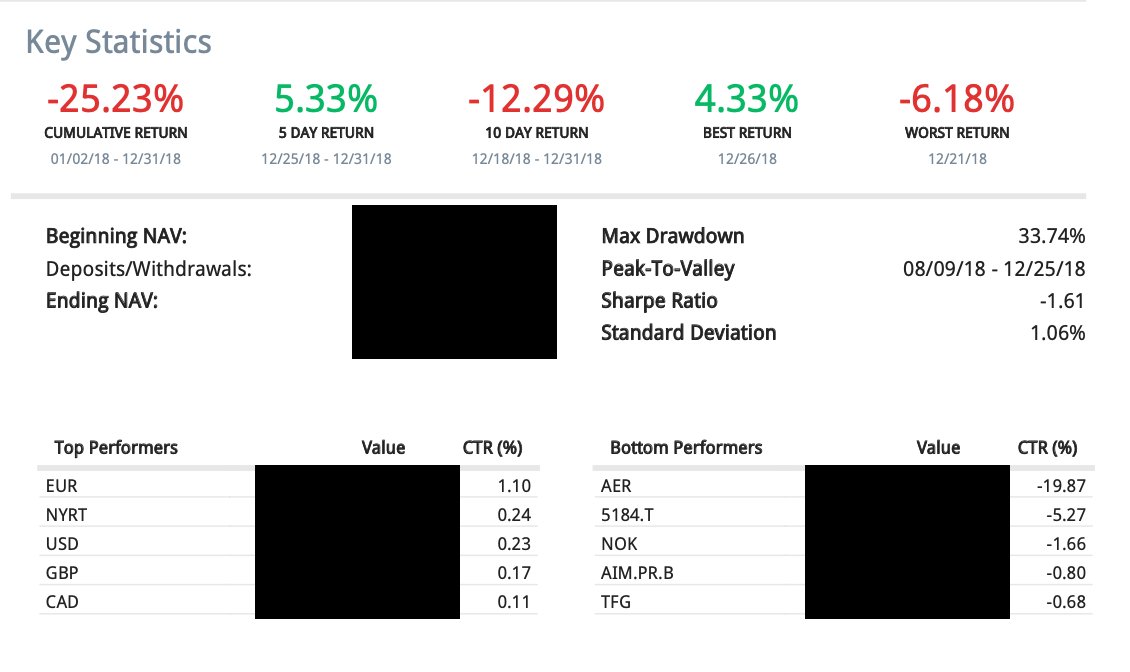

Let's talk about the winners first. $AER bounced back from the 2018 obliteration, largely with the market. No rocket science there.

But $GAN was a huge winner, largely off the back of a tried and tested playbook: business inflection + better capital market (US relisting)...

But $GAN was a huge winner, largely off the back of a tried and tested playbook: business inflection + better capital market (US relisting)...

...leading to significant rerating. You can read my original $GAN musings here:

rapercapital.com/2020/01/03/gan…

its funny to look back on it now and see how much the story has changed from what I thought it was; and also how much more the market is willing to pay for this biz...

rapercapital.com/2020/01/03/gan…

its funny to look back on it now and see how much the story has changed from what I thought it was; and also how much more the market is willing to pay for this biz...

...and is a continual reminder to me of how little we really know, both about the biz and the mkt's perception of it.

Also it doesn't show up on the top winners, but through 1-3Q I had variouse HUGE paper gains on my core shorts in $TSLA and $NIO.

These all reversed massively..

Also it doesn't show up on the top winners, but through 1-3Q I had variouse HUGE paper gains on my core shorts in $TSLA and $NIO.

These all reversed massively..

Let's talk a bit about what went wrong. First $TSLA as its easier.

$TSLA was always for me a credit-based short as I thought they had a balance sheet issue; a capital markets access issue; and, ultimately, a liquidity issue, in early 2019.

$TSLA was always for me a credit-based short as I thought they had a balance sheet issue; a capital markets access issue; and, ultimately, a liquidity issue, in early 2019.

This was the principal reason why the stock was so weak in 1H 2019. But what was interesting - and fooled me - was the stock KEPT falling after doing an equity deal in April (?) that removed 1) trigger risk and 2) access to capital risk. The fact stock kept falling meant...

...I, and a lot of other credit shorts, thought we were right. But we were not. They had removed solvency risk and generally in balance sheet situations, if the 'trigger' is gone, whether you think its a fraud or not, you have to cover and move on.

It took me until the 3Q print.

It took me until the 3Q print.

Still, I'm obvi glad I covered when I did 🥴🥴

$NIO was something else entirely. I made a number of positioning/structuring mistakes, but the main problem was I nailed the fundamentals. See here for my original writeup:

valueinvestorsclub.com/idea/NIO_INC_-…

$NIO was something else entirely. I made a number of positioning/structuring mistakes, but the main problem was I nailed the fundamentals. See here for my original writeup:

valueinvestorsclub.com/idea/NIO_INC_-…

When you nail the fundamentals on a levered shitco fraud and it goes 80% in your favor, it is EXTREMELY DIFFICULT to check out of the story on time.

When $NIO lost its CFO, and resorted to selective disclosure to get by, I thought it was a bagel and piled on.

When $NIO lost its CFO, and resorted to selective disclosure to get by, I thought it was a bagel and piled on.

We all know how that ended. 🤮🤮

Most of the pain came through, again, sizing mistakes, and using derivatives (even 'pros' make huge errors).

Basically though the main learning/takeaway was to question entirely my shorting philosophy...

Most of the pain came through, again, sizing mistakes, and using derivatives (even 'pros' make huge errors).

Basically though the main learning/takeaway was to question entirely my shorting philosophy...

...because if a co like $NIO wasn't a zero given all the facts on the ground, and if capital would be endlessly extended, what good was/is credit analysis?

After this i really reined in my shorts and essentially stopped shorting in the US market...

After this i really reined in my shorts and essentially stopped shorting in the US market...

...which caused me a ton of pain in early 2020, but saved me from trying to take the other side of obvious frauds/fads like $KODK, $GME, $AMC, etc, and thus, added to my performance the next two years.

In other words $NIO was a massively painful lesson and extracted probably 15pts of PnL from me in 2019, but nevertheless I learnt something from it that I continue to use, today.

As a wider point - I had now underperformed the mkt 3 out of the last 4 yrs...

As a wider point - I had now underperformed the mkt 3 out of the last 4 yrs...

...and had failed at raising $$ for a second time. So was feeling somewhat dejected on the work front heading into 2020. Nevertheless I took some comfort from being able to turn a decent year even in the face of massive blow ups in a very short time period.

Still, if I thought 2019 was challenging, 2020 was about to throw something else at me....

• • •

Missing some Tweet in this thread? You can try to

force a refresh