We will come to the next chapter soon enough but here's a recap to catch you up. 2014-19 was an exploratory period where I developed my investment style; tried to launch a fund, 2x, and didn't get it going; and had overall success punctuated by extreme volatility at times...

https://twitter.com/puppyeh1/status/1434773353076641792

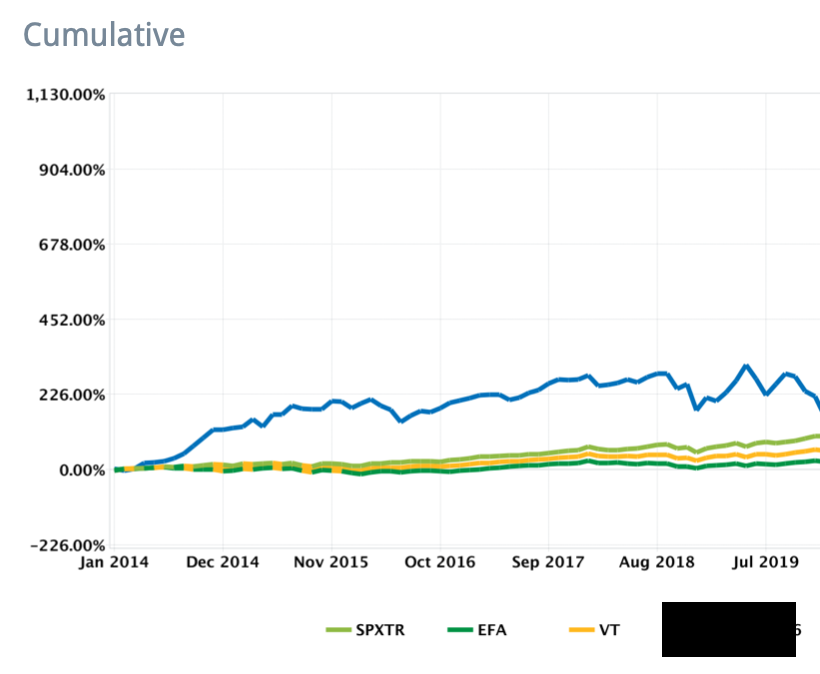

I grossed 220% over six yrs (vs SPX ~100%), whilst running ~30% average net exposure (ie beta-adjusted neutral), but punctuated by bouts of extreme volatility and underperformance.

Indeed most all the outperformance was generated in the early years when credit analysis 'worked'

Indeed most all the outperformance was generated in the early years when credit analysis 'worked'

To recap:

2014: +119% vs SPX +12%

2015: +39% vs SPX -1%

2016: +1% vs SPX +10%

2017: +21% vs SPX +19%

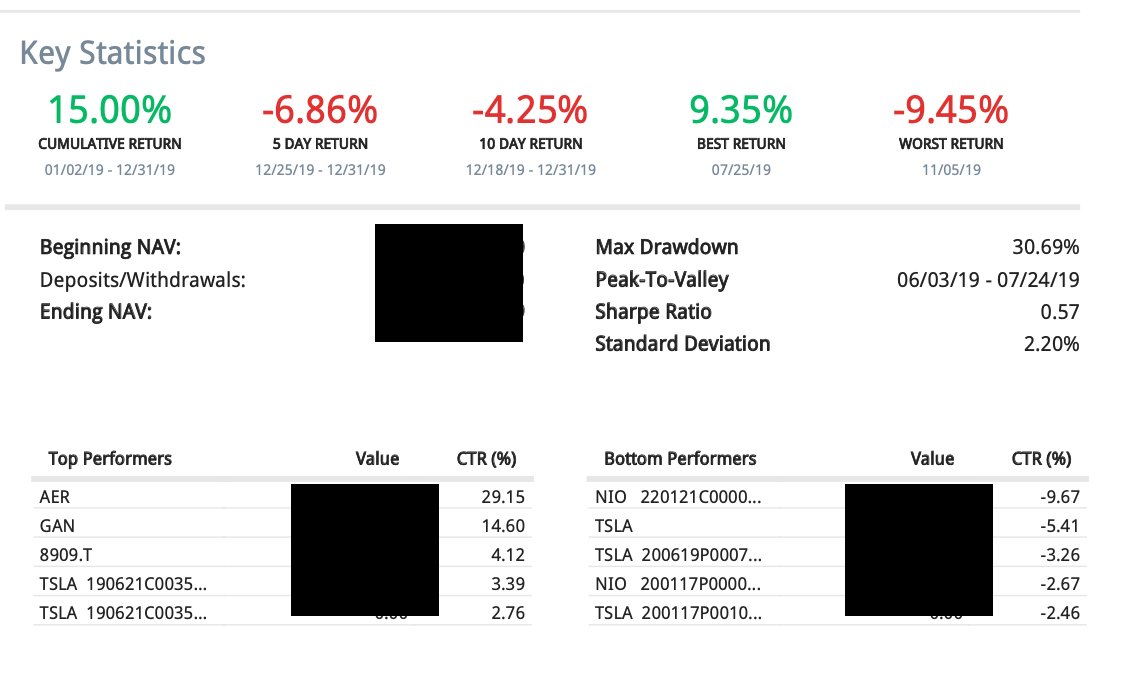

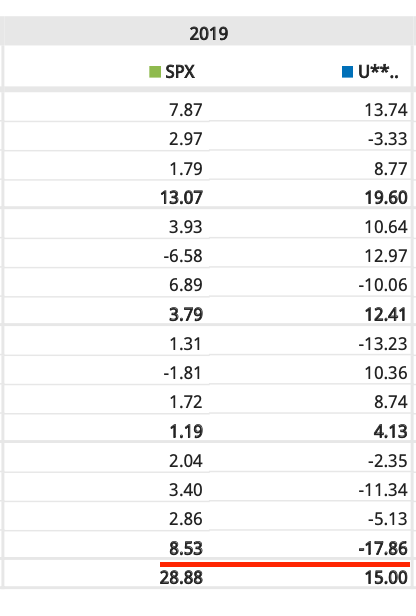

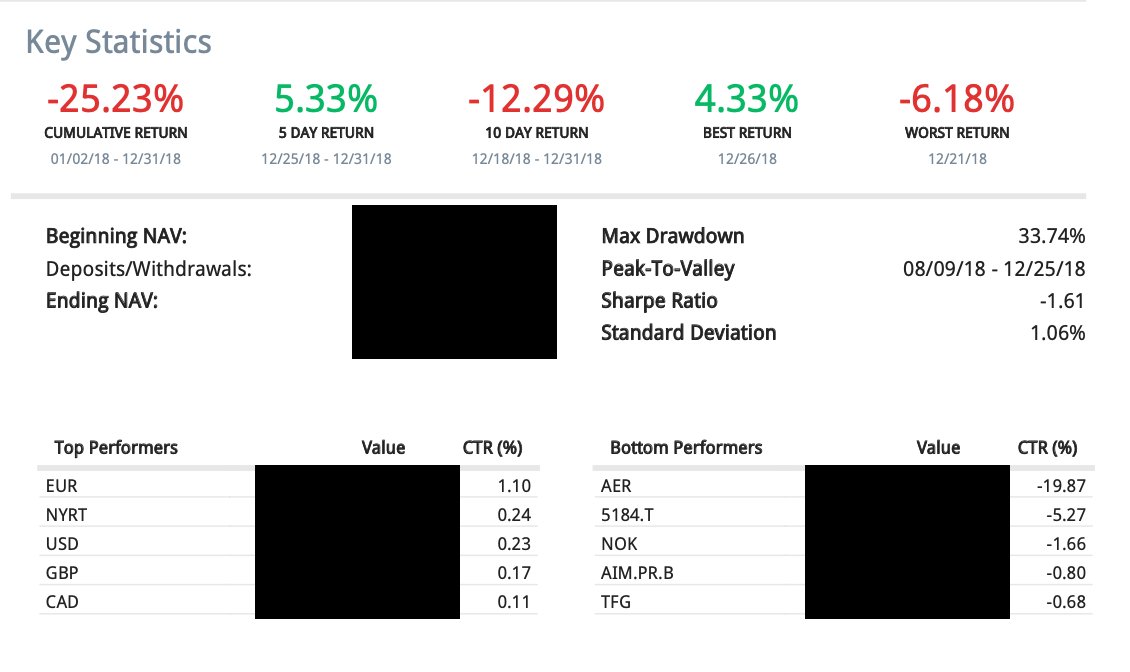

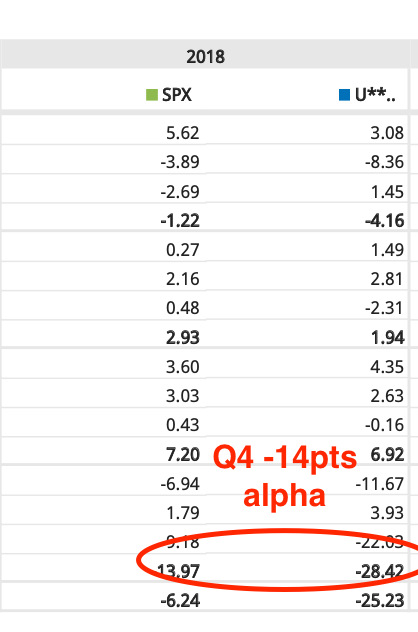

2018: -25% vs SPX -6%

2019: +15% vs SPX +29%

Cumulative performance: +220% (21.5% CAGR) vs SPX +100% (12.2% CAGR)

2014: +119% vs SPX +12%

2015: +39% vs SPX -1%

2016: +1% vs SPX +10%

2017: +21% vs SPX +19%

2018: -25% vs SPX -6%

2019: +15% vs SPX +29%

Cumulative performance: +220% (21.5% CAGR) vs SPX +100% (12.2% CAGR)

Basically by early 2020 I had semi-decided that shorting - at least the way I was practising it - had become fiendishly difficult as to be almost impossible. Certainly, impossible for me to do in a sane, effective, money-generating manner...yes it took a long time to get here!

Meaning as I entered 2020 I made a conscious effort to reduce the short book materially; reduce overall gross; and reduce sizing of individual shorts as well.

Long-time followers no doubt have noticed I spend far, far less time on individual shorts now...

Long-time followers no doubt have noticed I spend far, far less time on individual shorts now...

...because the 'return on brain pain' simply is too tough in most cases. In fact I seem to do better (on shorts specifically) the less I talk about them (it's been that kind of environment).

I thus transitioned the book from a high gross, low net strategy to a low(ish) gross...

I thus transitioned the book from a high gross, low net strategy to a low(ish) gross...

medium net strategy (call it 70-80% invested, 50-60% net long vs 150-200% gross, 30% net long previously).

Obviously, this was about to really hurt in early 2020...but I made the decision in good faith based on my past learnings.

Obviously, this was about to really hurt in early 2020...but I made the decision in good faith based on my past learnings.

The other main change (from early 2020) was i decided to dedicate more effort to my blog, ultimately putting up a paywall during the early COVID onset. Given the failure to attract (enough) outside capital, this became (and remains) my 'base salary.'

On a personal level, 2019 saw the arrival of my first child (yay 💕💕) and a decision to move back to Asia (Tokyo) after 4 years in the UK. This ultimately only happened late in 2020 (thanks, COVID), meaning most of the initial COVID response happened whilst still in the UK...

Stay tuned for next time, when we break down Raper Capital's 2020 roller-coaster and what I learnt along the way 👊👊

• • •

Missing some Tweet in this thread? You can try to

force a refresh