Here's an interesting example for the commodity shitco degenerates in my feed: Stanmore Resources, $SMR.AX.

Note this is extremely illiquid, as a result I have a tiny position, I think its more of a speculation than an 'all in' type call. But it is certainly intriguing...

👇👇

Note this is extremely illiquid, as a result I have a tiny position, I think its more of a speculation than an 'all in' type call. But it is certainly intriguing...

👇👇

https://twitter.com/puppyeh1/status/1437639205883056132

As always here at Raper Capital there is an event angle. $SMR.AX is 74% owned by a Singapore holdco, Golden Energy $AUE.SI, also v cheap but a different beast.

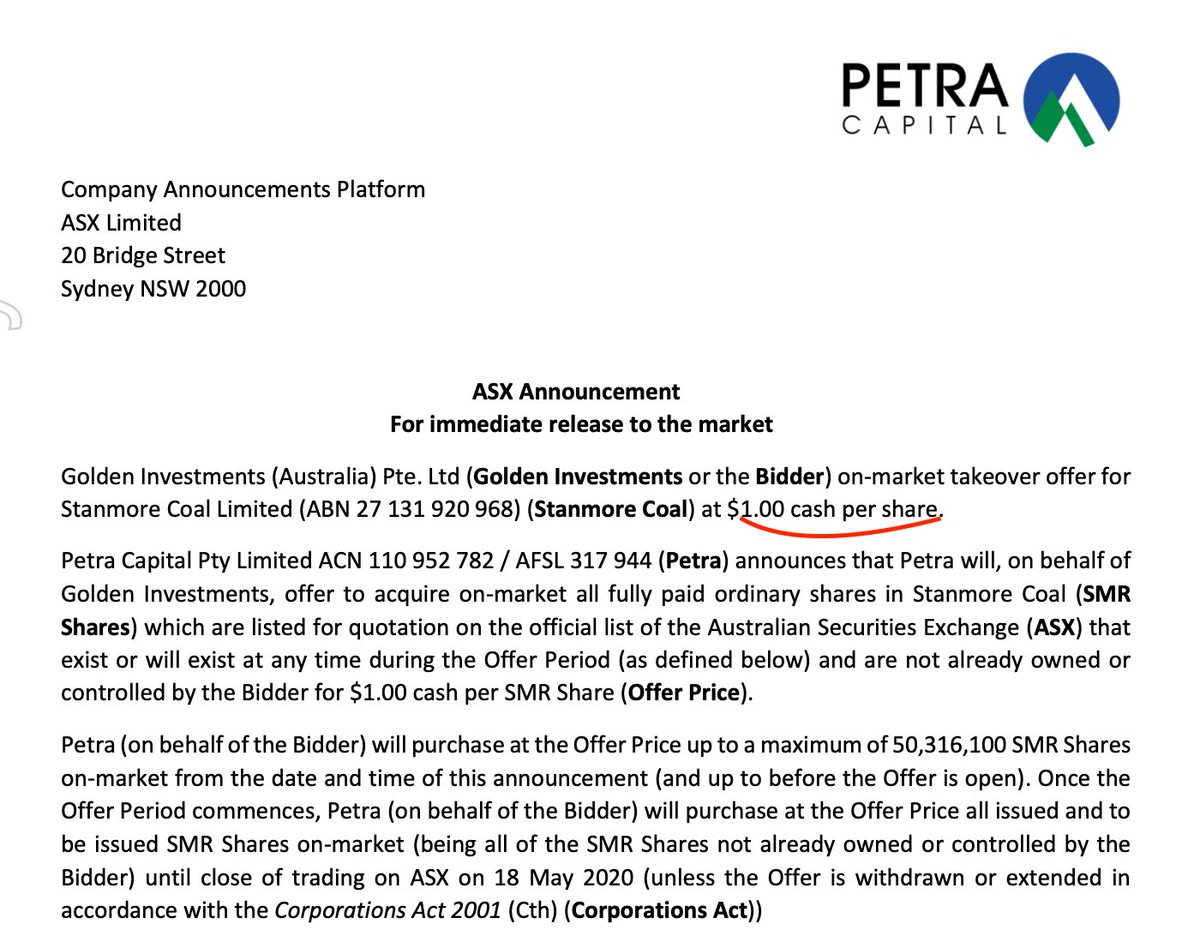

Note that Golden bid for the whole co at $1 last April...

Note that Golden bid for the whole co at $1 last April...

Stock was in the low 80s at the time - despite coal prices being in the toilet (post COVID) and a few operational issues.

Unclear why they couldn't mop up the entire thing, I guess there were a few holdouts, they went from 31% to 75% but couldn't get it done.

Unclear why they couldn't mop up the entire thing, I guess there were a few holdouts, they went from 31% to 75% but couldn't get it done.

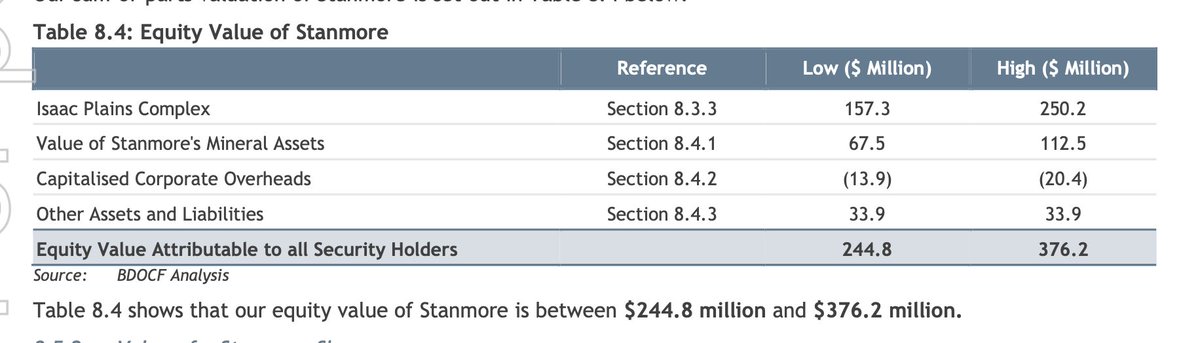

In situations like this I always like to look back at the independent expert report bec they generally give a pretty balanced view of the co and a no of diff ways to cut the cake.

At the time they said the $1 bid was fair, in a 90c-$1.4 range, and shareholders should take it.

At the time they said the $1 bid was fair, in a 90c-$1.4 range, and shareholders should take it.

As you can see in the breakdown, about 2/3 the value comes from an NPV of the operating mine, and 1/3 from mineral tenements/rights to land w (unmined) coal resources:

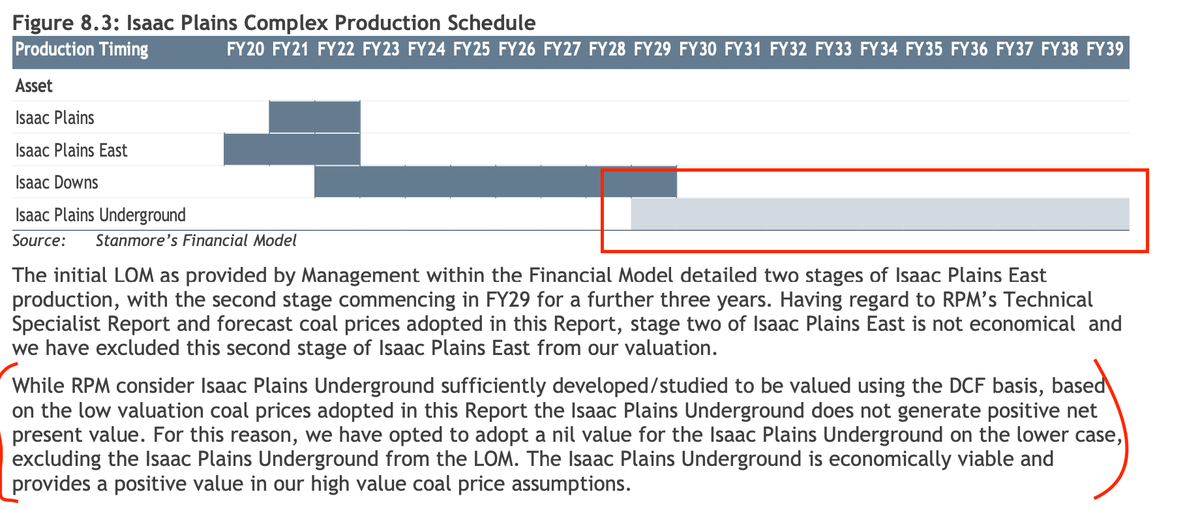

Here's where it gets interesting. The DCF valuation of the mine (the bulk of the value) ignores any value to the underground expansion beyond FY29, bec of low coal prices at the time. Here's the key portion:

Essentially then the higher coal price helps in a no of ways. There's the straight NPV increase from higher coal pxes -> higher cash flows near term. But the higher prices also give more value to the marginal reserves in the out-years; and also the mineral tenements (1/3 the NPV)

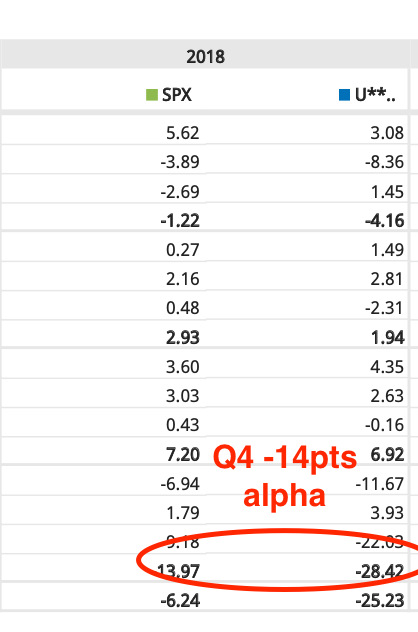

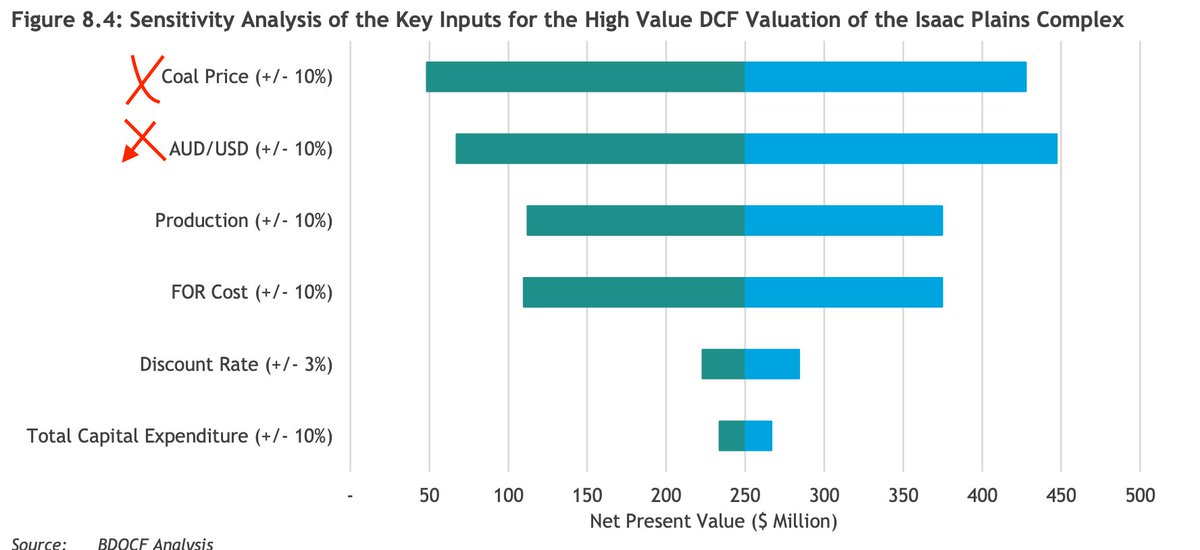

It's a bit hard to strip out what the baseline starting coal price assumption is (given grade differences, etc) but the sensitivity to higher coal (and lower AUD) is massive:

The AUD is obvi 10% or so stronger but the coal price - in aggregate - is obvi much higher. You can't price in current spot but maybe you could pencil in 20-30% uplift?

Even accounting for FX a 20% spot incr gets you a ~$450mm NPV looking at the above - or $1.7 a share.

Even accounting for FX a 20% spot incr gets you a ~$450mm NPV looking at the above - or $1.7 a share.

Today the stock is 93c...so even on the basis of a REALLY discounted offer to the new 'fair value' range...hard to lose $$

What about on run-rate earnings?

What about on run-rate earnings?

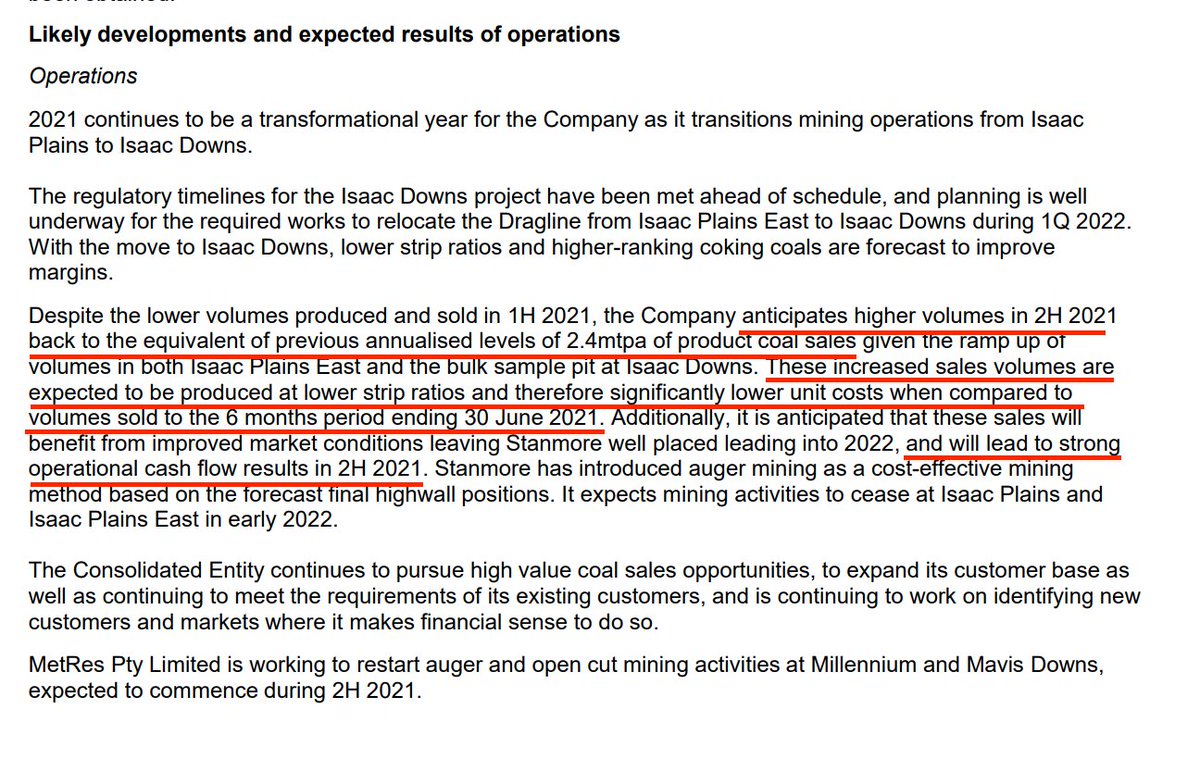

The stock is so illiquid I doubt many/any are paying attention (it only started moving last few days) but here's what they had to say in the last report:

In 2019 they did $69/t margin (pre corp overheads) on a $115/t all in cost base. Given the above commentary, I wouldn't be shocked to see a similar unit cost but higher margins (as 2H prices are clearly higher than 2019 levels).

Not saying this lasts but...

Not saying this lasts but...

1H of production at say ~$70/t of EBITDA is ~$85mm of FCF...on an EV of $270mm today. They would thus end the year solidly net cash (~$40mm net debt today imo)...

But wait...there's a BIT more sizzle 😉

But wait...there's a BIT more sizzle 😉

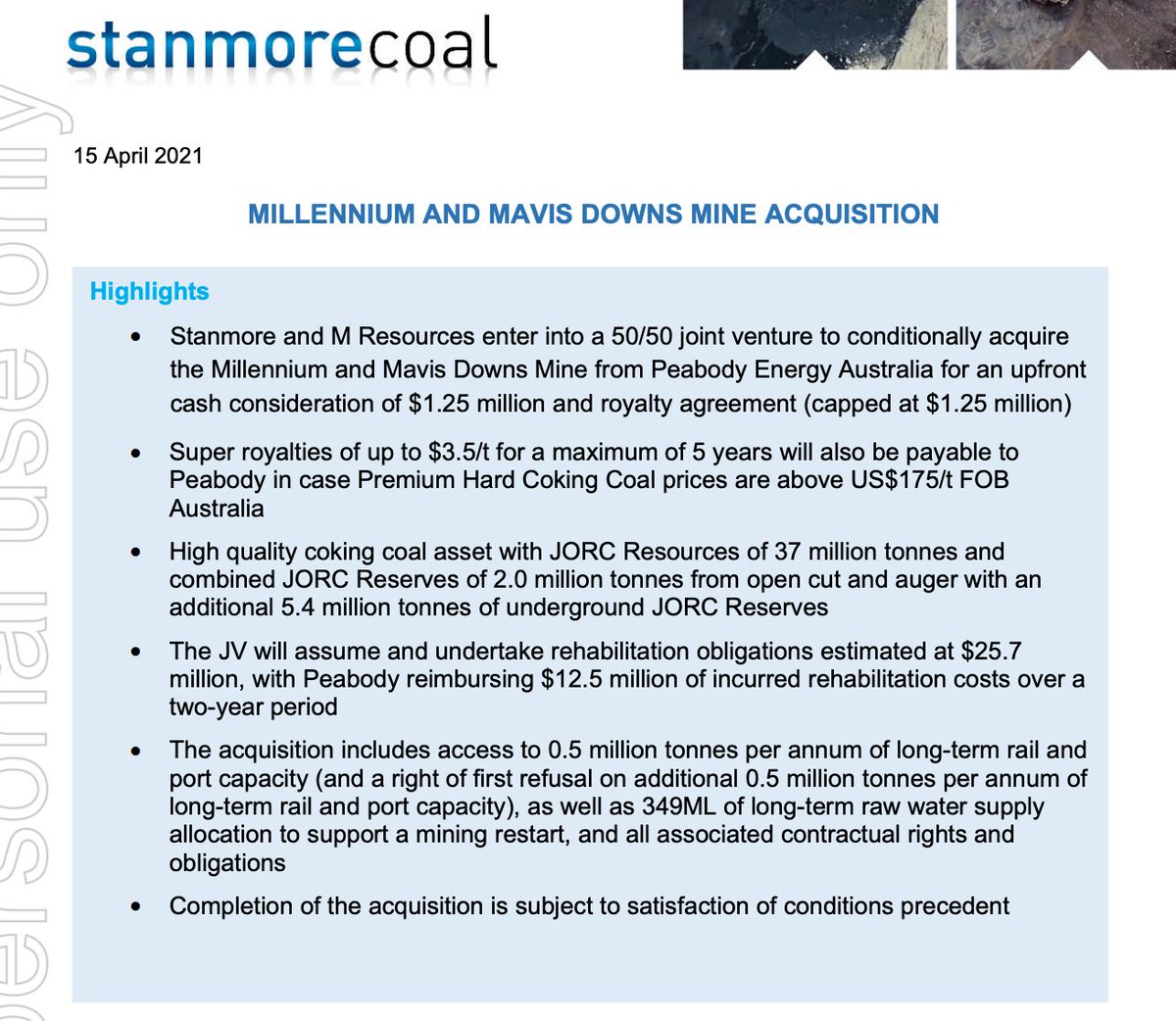

$SMR.AX acquired 50% of some legacy $BTU assets (Mavis and Millenium) in what looks like an incredibly accretive, but tiny, bolt-on earlier this year.

They paid very little ($1.25mm plus assumption of $13mm in clean-up liability, split 50/50 w their partner):

They paid very little ($1.25mm plus assumption of $13mm in clean-up liability, split 50/50 w their partner):

It sounds like $SMR.AX invested another $15mm in W/C (equipment, etc) but they get a completely adjacent, infrastructure-ready 1mtpa mini operation which is already starting mining...and has at least 3-4yrs (based on reserves) w/ upside optionality from resources...

The product (PCI, thermal) is lower grade but it should be highly synergistic. it is literally right next door to Isaac Downs and they can get blending synergies, apparently.

In any case even at much lower marginal profitability ($30/t? $40/t?) this could be a real needle mover.

In any case even at much lower marginal profitability ($30/t? $40/t?) this could be a real needle mover.

$30-40mm of incremental EBITDA at 50% ownership is probably another $20mm+ of FCF. With upside from synergies and tapping the (large) attached resources...

End of day I don't think its unrealistic to see $80mm++ in EBITDA in 2H this year.

End of day I don't think its unrealistic to see $80mm++ in EBITDA in 2H this year.

If coal stays hot for a few more months 1H will be 🔥too as pricing is generally on a lag. This thing could really be <$100mm EV by mid-year next year...

...which is another reason why I think minority takeout here is a matter of time.

...which is another reason why I think minority takeout here is a matter of time.

Simply put either way I think it's quite hard to lose from current levels. Either cash flow takes care of us or the Singaporeans take us out.

As always - DYODD. This is illiquid. I have a (small) long position.

As always - DYODD. This is illiquid. I have a (small) long position.

• • •

Missing some Tweet in this thread? You can try to

force a refresh