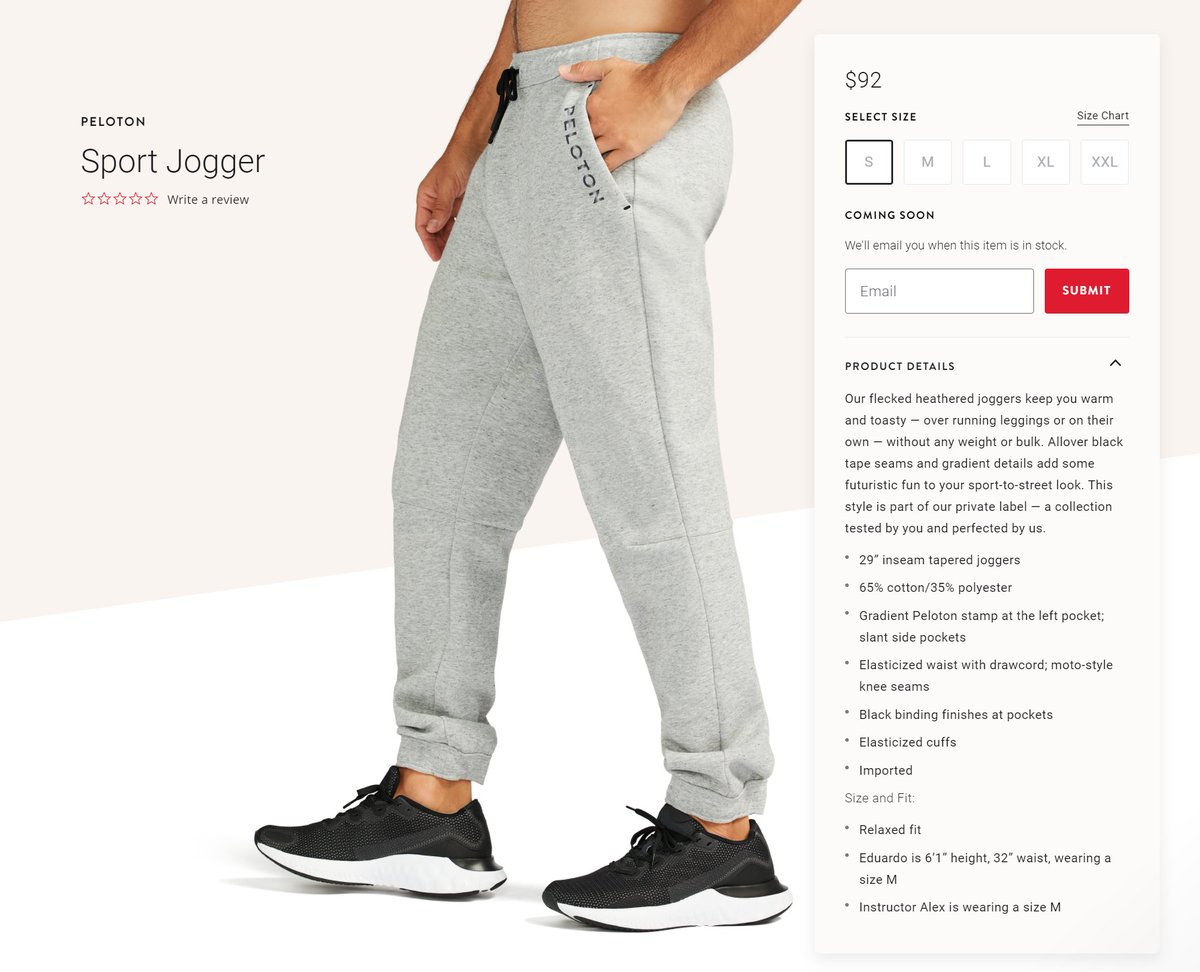

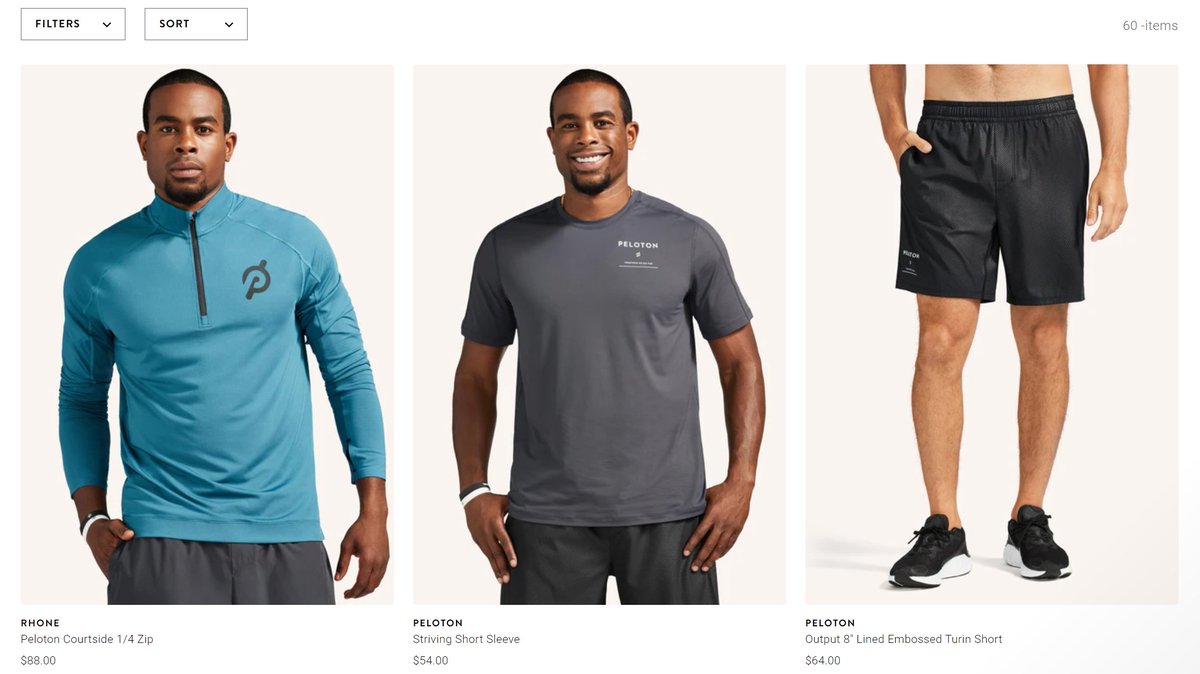

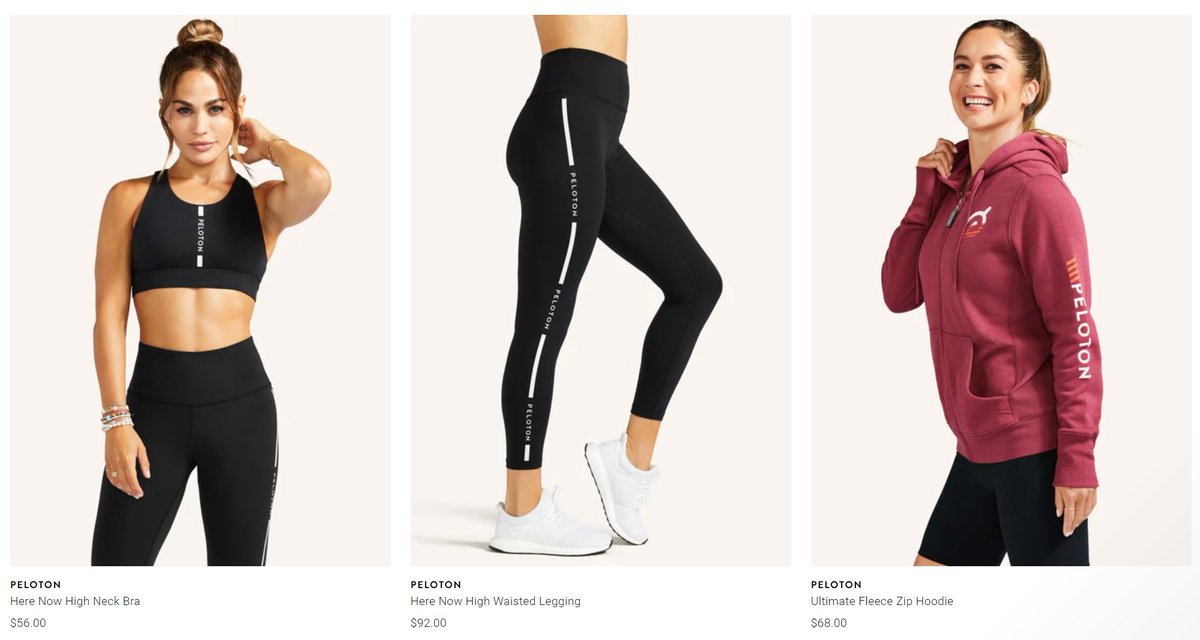

Peloton Apparel... I think this could be huge if well executed. Maybe I'm anchoring too much on Lululemon (which is fantastic) but I don't think in 2021 many people want to wear a large logo? $PTON

I hope this succeeds, they learn and iterate fast, and keep at it, because it just feels like a very natural extension of the business. Huge community and fanatical customer base ready to promote your brand--just make it great.

• • •

Missing some Tweet in this thread? You can try to

force a refresh