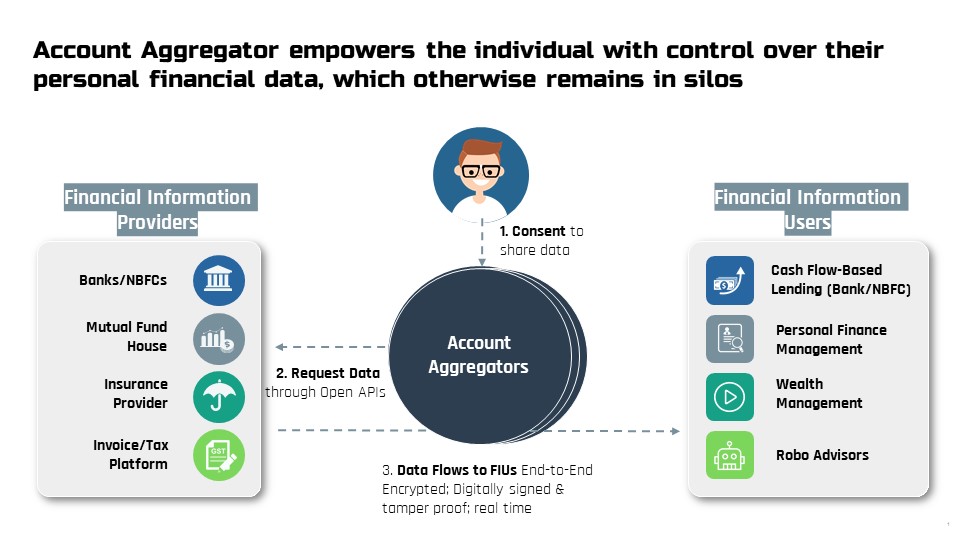

Last week India unveiled the #AccountAggregator network, a financial data-sharing system. Account Aggregator empowers the individual with control over their personal financial data, which otherwise remains in silos.

Read more➡️ pib.gov.in/PressReleaseIf…

Read more➡️ pib.gov.in/PressReleaseIf…

पिछले सप्ताह, भारत ने वित्तीय डेटा-साझा प्रणाली - अकाउंट एग्रीगेटर (एए) नेटवर्क का अनावरण किया।अकाउंट एग्रीगेटर व्यक्ति को अपने व्यक्तिगत वित्तीय डेटा पर नियंत्रण के साथ सशक्त बनाता है, जो डेटा सामान्यतया अलग-थलग और आसान पहुँच से बाहर रहते हैं।

विवरण➡️pib.gov.in/PressReleasePa…

विवरण➡️pib.gov.in/PressReleasePa…

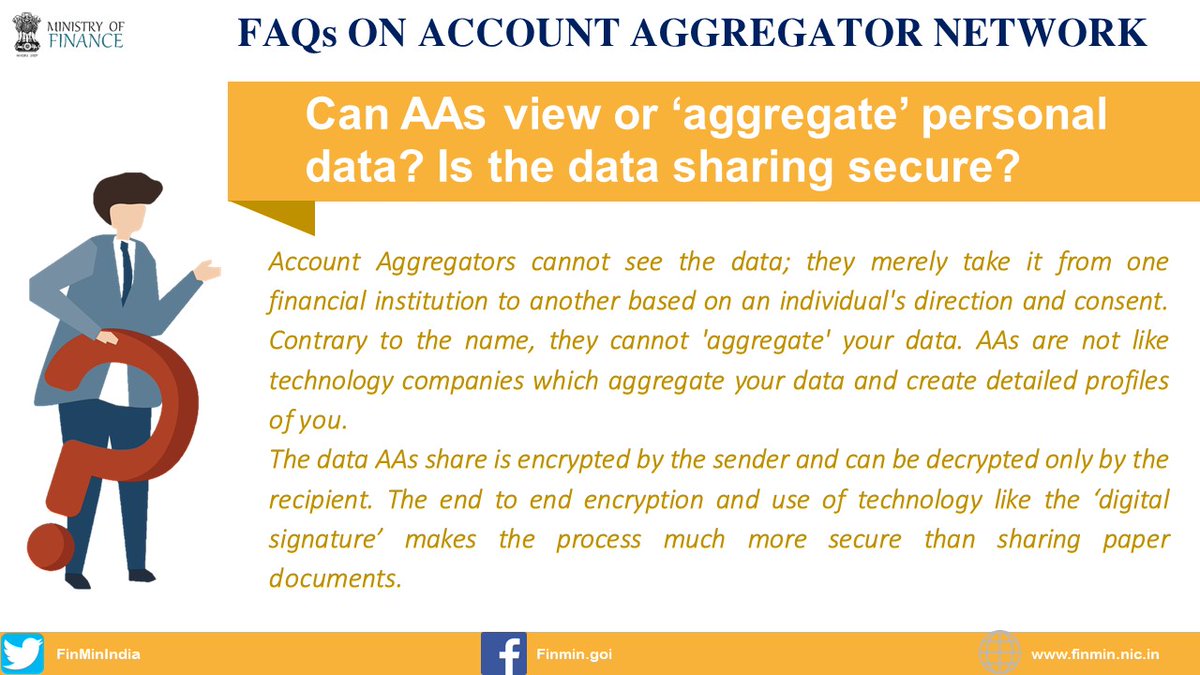

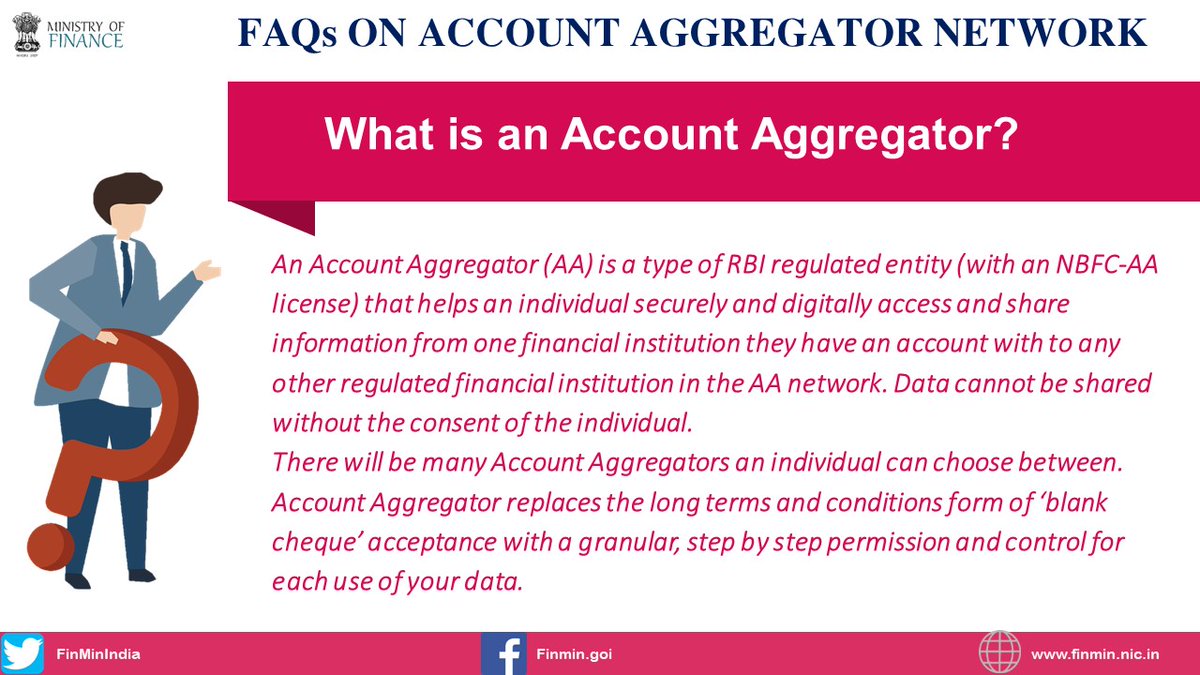

What is an #AccountAggregator? 👇

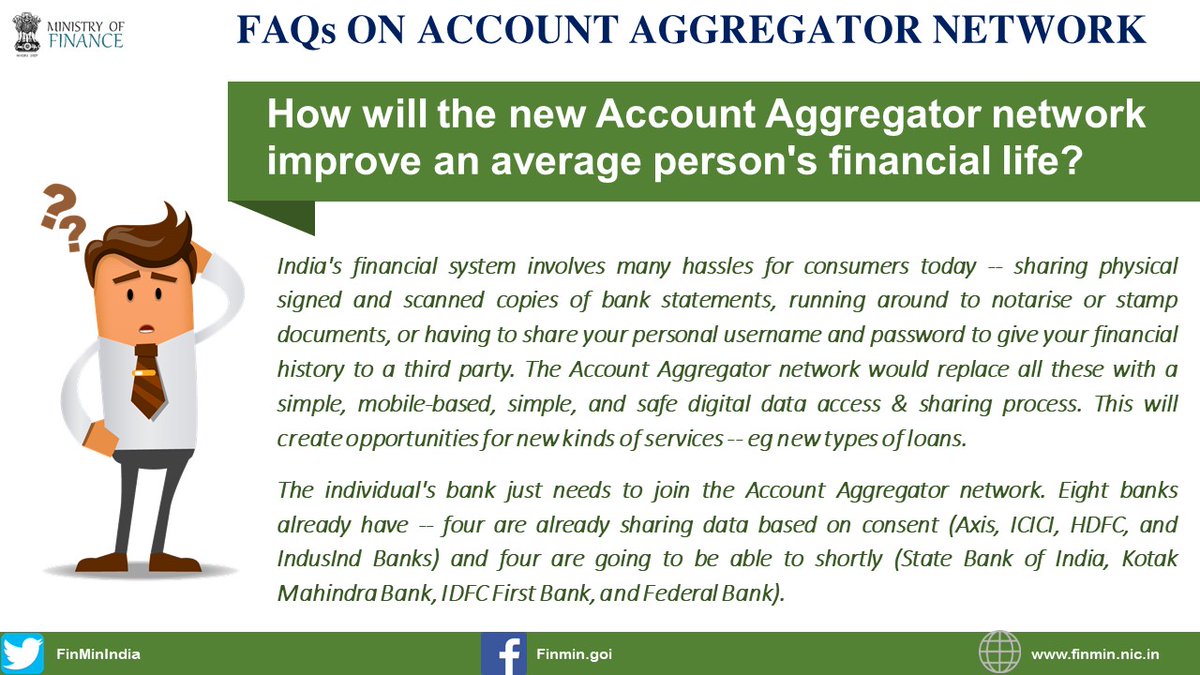

How will the new #AccountAggregator network improve an average person's financial life? 👇

How is #AccountAggregator different to Aadhaar eKYC data sharing, credit bureau data sharing, and platforms like CKYC? 👇

If a consumer has shared my data once with an institution, for how long can they use it?👇

#AccountAggregator

#AccountAggregator

What new services can a customer access if their bank has joined the AA network of data sharing?👇

#AccountAggregator

#AccountAggregator

• • •

Missing some Tweet in this thread? You can try to

force a refresh