#MarsiliosTA

People asking how to turn on pivots - just use tradingview's built in indicator where you can select yearly. half-year, quarter, etc what you want to check

You can turn it on more than once for different timeframes or use different tabs, then customize the lines

People asking how to turn on pivots - just use tradingview's built in indicator where you can select yearly. half-year, quarter, etc what you want to check

You can turn it on more than once for different timeframes or use different tabs, then customize the lines

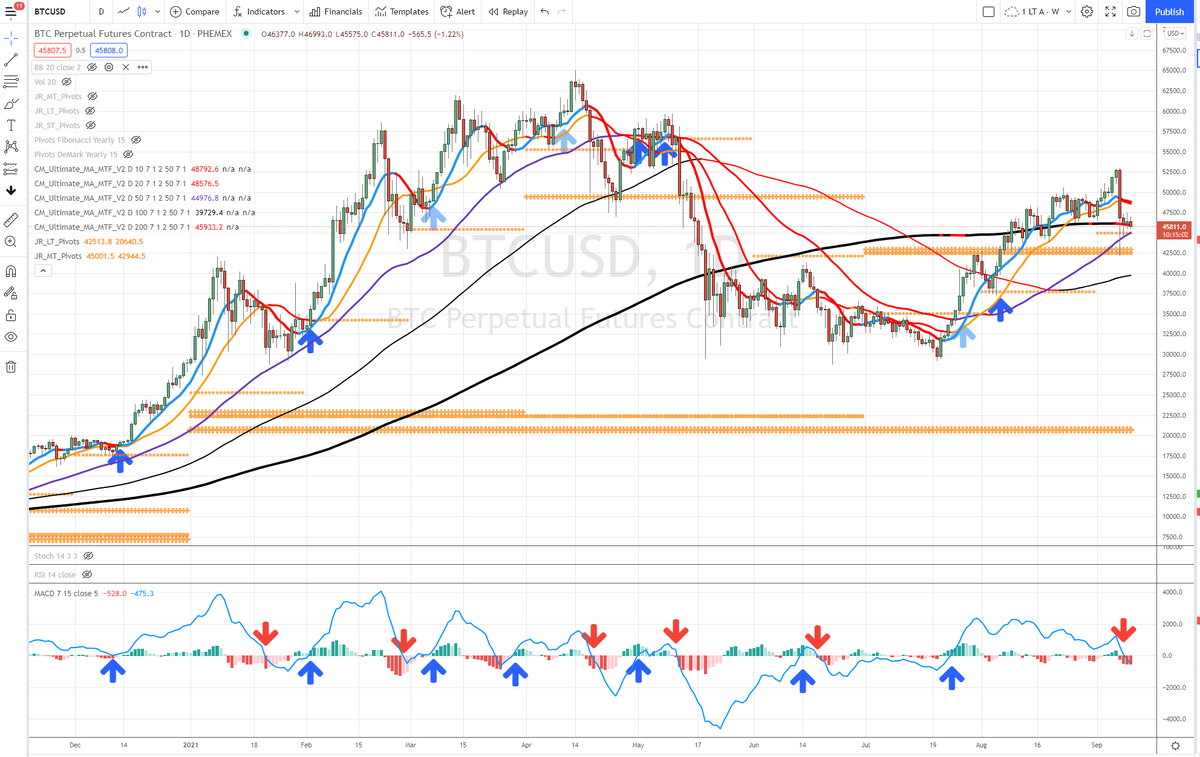

MACD

not based on quant study

& did not do very rigorous experiment

played around until found settings that seemed to line up with pivot & MA signals a lot of the time

regular is 12 26 9

mine much faster - 7 15 5

more signals - if too many zoom out, or be rigorous on filter

not based on quant study

& did not do very rigorous experiment

played around until found settings that seemed to line up with pivot & MA signals a lot of the time

regular is 12 26 9

mine much faster - 7 15 5

more signals - if too many zoom out, or be rigorous on filter

So a lot of arrows in the MACD here, change of signal line

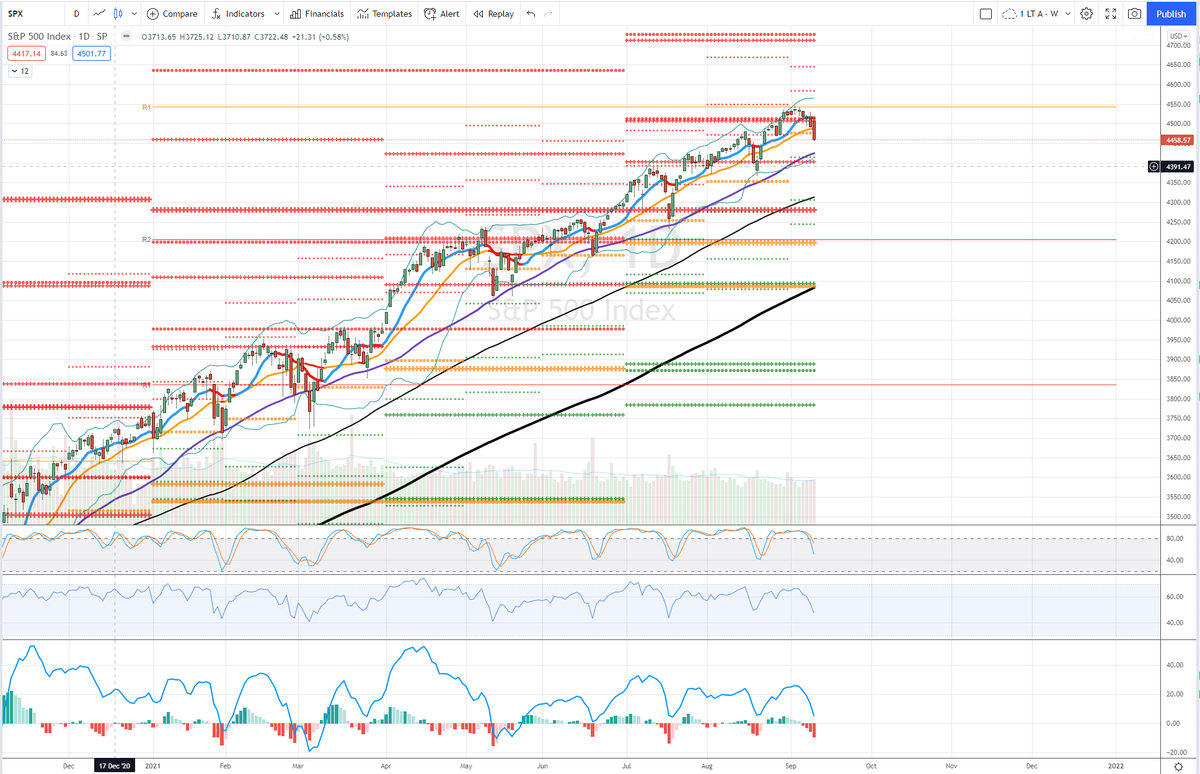

But on the way up above rising MAs & pivots longs profit, shorts easy to filter out - you don't short above a 50MA that is screaming higher or on top of monthly pivot

Just think about the 3 together & see when line up

But on the way up above rising MAs & pivots longs profit, shorts easy to filter out - you don't short above a 50MA that is screaming higher or on top of monthly pivot

Just think about the 3 together & see when line up

Based on this idea, on strictly technical basis, BTC is not a "good" daily short here

above rising D50

no pivot status change at all yet

June was way better & also high confidence

(same chart)

above rising D50

no pivot status change at all yet

June was way better & also high confidence

(same chart)

This is not a contradiction

I could be swing short based on lower TF (timeframe)

but on daily chart basis, don't want to be fully long when daily macd is down and below 10 & 20 MAs both with negative slope

Today watching reaction from this D200

could play around with us

end

I could be swing short based on lower TF (timeframe)

but on daily chart basis, don't want to be fully long when daily macd is down and below 10 & 20 MAs both with negative slope

Today watching reaction from this D200

could play around with us

end

• • •

Missing some Tweet in this thread? You can try to

force a refresh