Confidence Petroleum India Ltd

Let us see why we can have a look at this smallcap stock for our portfolio and have exposure to the CNG vertical which company is embarking upon.

Sharing a presentation prepared via thread as option for uploading pdf or ppt is not there in twitter

Let us see why we can have a look at this smallcap stock for our portfolio and have exposure to the CNG vertical which company is embarking upon.

Sharing a presentation prepared via thread as option for uploading pdf or ppt is not there in twitter

3/n

Company's business verticals & key highlights from Chairman's speech in FY21 AR.

We have to track the growth of CNG retailing & marketing division and expansion of cylinder division closely.

Company's business verticals & key highlights from Chairman's speech in FY21 AR.

We have to track the growth of CNG retailing & marketing division and expansion of cylinder division closely.

4/n

Management Discussion & Analysis Report key highlights - 01

Helps us understand what is the company's outlook for FY22 and beyond.

Management Discussion & Analysis Report key highlights - 01

Helps us understand what is the company's outlook for FY22 and beyond.

5/n

Management Discussion & Analysis Report key highlights - 02

Details on Convertible warrants for expansion earmarked.

Management Discussion & Analysis Report key highlights - 02

Details on Convertible warrants for expansion earmarked.

6/n

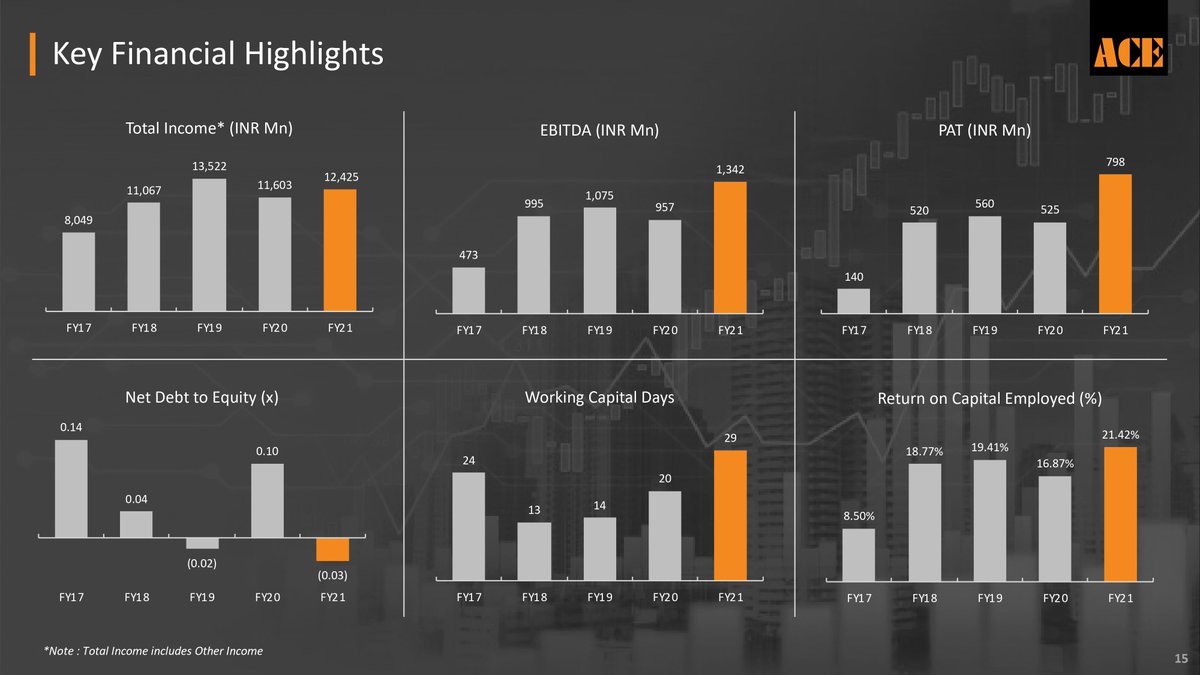

FY21 numbers & Snapshot of Data

Here we have a look at consolidated numbers and product segments

FY21 numbers & Snapshot of Data

Here we have a look at consolidated numbers and product segments

8/n

Points of Contention

Have highlighted key points where further clarity is needed. Can be red flags or areas of concern. Those having idea can share their insights

Points of Contention

Have highlighted key points where further clarity is needed. Can be red flags or areas of concern. Those having idea can share their insights

9/n

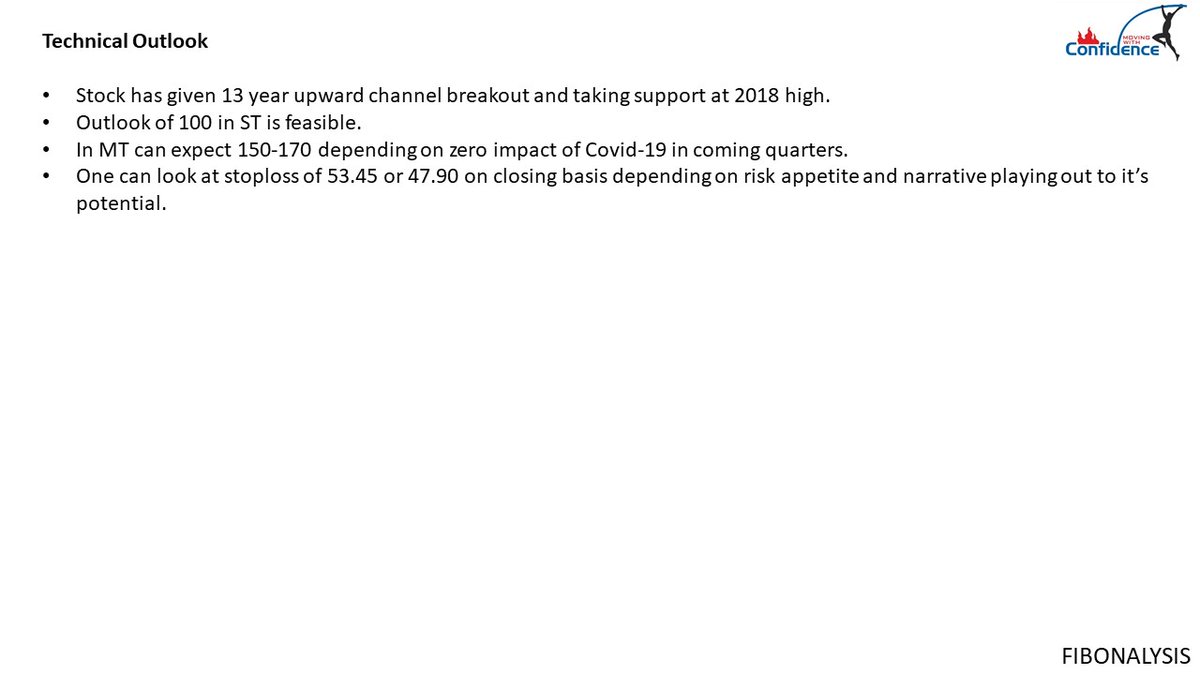

Technical Analysis

Combining Techno Funda analysis has it's advantages.

Attached chart gives stock outlook based on trends & patterns. Request to consult your financial advisor for guidance.

One can have a different approach as per their mode of analysis adapted.

Technical Analysis

Combining Techno Funda analysis has it's advantages.

Attached chart gives stock outlook based on trends & patterns. Request to consult your financial advisor for guidance.

One can have a different approach as per their mode of analysis adapted.

10/n

Conclusion

Now we try to connect the data points and analyze future outlook for the company.

-End

#ConfidencePetro

#finance

#Fibonalysis

#TechnoFunda

#StockMarket

Conclusion

Now we try to connect the data points and analyze future outlook for the company.

-End

#ConfidencePetro

#finance

#Fibonalysis

#TechnoFunda

#StockMarket

• • •

Missing some Tweet in this thread? You can try to

force a refresh