#FOMC: Dive into DOTS

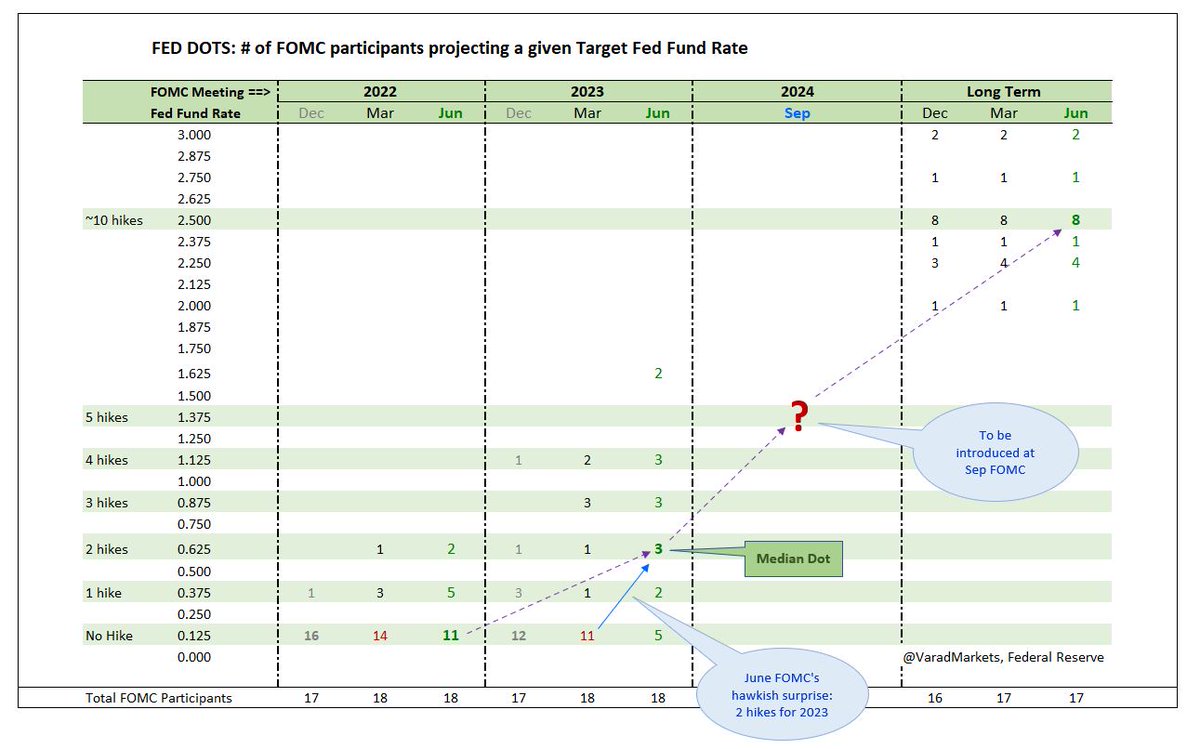

▪️ Besides any tapering ann'ncem't, DOTS or median rate hike projections important at 22 Sep FOMC

▪️ Current DOTS: 2022 (no hike), 2023 (2 hikes), L/T (~10 hikes)

▪️ FOMC to introduce DOTS for 2024 for first time - few calling for 3 rate hikes in 2024

1/9

▪️ Besides any tapering ann'ncem't, DOTS or median rate hike projections important at 22 Sep FOMC

▪️ Current DOTS: 2022 (no hike), 2023 (2 hikes), L/T (~10 hikes)

▪️ FOMC to introduce DOTS for 2024 for first time - few calling for 3 rate hikes in 2024

1/9

▪️ Recall: Fed's surprise projection of 2 rate hikes for 2023 was primarily responsible for Jun FOMC's hawkish pivot => DXY spiked ~2% over 2 trading sessions post June FOMC

So worth paying close attention to Sept DOTS to gauge risk-reward better

2/9

So worth paying close attention to Sept DOTS to gauge risk-reward better

2/9

https://twitter.com/VaradMarkets/status/1433684556859600898?s=20

3 key DOT variables:

1⃣ 2022 to show a rate hike (current none)? Need 3 FOMC members (out of 18) to flip for median to shift to 1 hike

2⃣ 2023 to show addl hike (current 2 hikes)? Need just 2 members to flip to shift median to 3 hikes - easy ask - shouldn't be surprising

3/9

1⃣ 2022 to show a rate hike (current none)? Need 3 FOMC members (out of 18) to flip for median to shift to 1 hike

2⃣ 2023 to show addl hike (current 2 hikes)? Need just 2 members to flip to shift median to 3 hikes - easy ask - shouldn't be surprising

3/9

3⃣ Will 2024 show 3 hikes?

▪️ Significant growth downgrade (Q3-21); but 2024 too far to have good handle on transitory inflation or growth

▪️ For reference, over 2015-2018 hiking cycle, Fed hiked 9 times despite core PCE below 2% (yes Fed's patient AIT didn't exist then)

4/9

▪️ Significant growth downgrade (Q3-21); but 2024 too far to have good handle on transitory inflation or growth

▪️ For reference, over 2015-2018 hiking cycle, Fed hiked 9 times despite core PCE below 2% (yes Fed's patient AIT didn't exist then)

4/9

▪️ With say unchanged DOTS for 2022 & 2023, 3 hikes for 2024 implies 5 hikes by end 2024 v/s 10 hikes in Long Term

So 3 hikes for 2024 seems reasonable for convergence with 9-10 hikes in long term

btw, how do they define 'Long Term' in Fed DOTS = 4y? 5y? 10y?

5/9

So 3 hikes for 2024 seems reasonable for convergence with 9-10 hikes in long term

btw, how do they define 'Long Term' in Fed DOTS = 4y? 5y? 10y?

5/9

1⃣ Super hawkish scenario:

2022 1 new hike

2023 1 addl hike, total 3

2024 4 hikes

Total 8 hikes by end-24

Will be shocker but unlikely => Fed's s/t priority to start tapering, rate hikes come later => prefer to be super dovish while starting to taper not to disrupt mkts

6/9

2022 1 new hike

2023 1 addl hike, total 3

2024 4 hikes

Total 8 hikes by end-24

Will be shocker but unlikely => Fed's s/t priority to start tapering, rate hikes come later => prefer to be super dovish while starting to taper not to disrupt mkts

6/9

3⃣ Super dovish scenario

A view that with further growth slowdown, Fed may actually have to lower DOTS (less hikes)

But that's not for Sep FOMC, may be later

Since last FOMC:

- NFP 644k/m - not that bad

- Core CPI surprised lower but still on 4-handle v/s Fed ~2.25 mandate

7/9

A view that with further growth slowdown, Fed may actually have to lower DOTS (less hikes)

But that's not for Sep FOMC, may be later

Since last FOMC:

- NFP 644k/m - not that bad

- Core CPI surprised lower but still on 4-handle v/s Fed ~2.25 mandate

7/9

Approx mkt pricing

2022 ~1 hike = mkt ahead of DOTS

2023 ~2.5 hikes

2024 ~1.5 hikes = mkt left behind if Fed goes with 3 hikes

End-2026 ~Total 6 hikes=>150bp vs Fed L/T 250bp

Mkt may start preparing for hawkish FOMC in the run up to 22 Sep itself

8/9

2022 ~1 hike = mkt ahead of DOTS

2023 ~2.5 hikes

2024 ~1.5 hikes = mkt left behind if Fed goes with 3 hikes

End-2026 ~Total 6 hikes=>150bp vs Fed L/T 250bp

Mkt may start preparing for hawkish FOMC in the run up to 22 Sep itself

8/9

But if Sep FOMC announces taper start at 'coming meeting' (Nov), it would not want to change DOTS for 2022/23 & add just 1-2 hikes for new 2024 - to sound as dovish as possible, to delink taper from lift off

Remember:

Taper = labor accumulation

Lift off = inflation persistence

Remember:

Taper = labor accumulation

Lift off = inflation persistence

• • •

Missing some Tweet in this thread? You can try to

force a refresh