Paras Defence IPO Review -

Let's understand everything about the business and its IPO!

Retweet for a wider reach and help us educate more investors!

#IPOwithJST #Defence

Let's understand everything about the business and its IPO!

Retweet for a wider reach and help us educate more investors!

#IPOwithJST #Defence

1/

Issue Details

Dates - Sept 21 to 23

Price Band - Rs 165 - 175

Size - 171 Cr (30 cr ofs + 141 cr +34 cr Pre ipo already done)

Quotas – QIB 50% | NII 15% | RII 35%

MCap post listing – 683 Cr

(3.1 Cr existing shares + 80L new shares from fresh issue)

Issue Details

Dates - Sept 21 to 23

Price Band - Rs 165 - 175

Size - 171 Cr (30 cr ofs + 141 cr +34 cr Pre ipo already done)

Quotas – QIB 50% | NII 15% | RII 35%

MCap post listing – 683 Cr

(3.1 Cr existing shares + 80L new shares from fresh issue)

2/

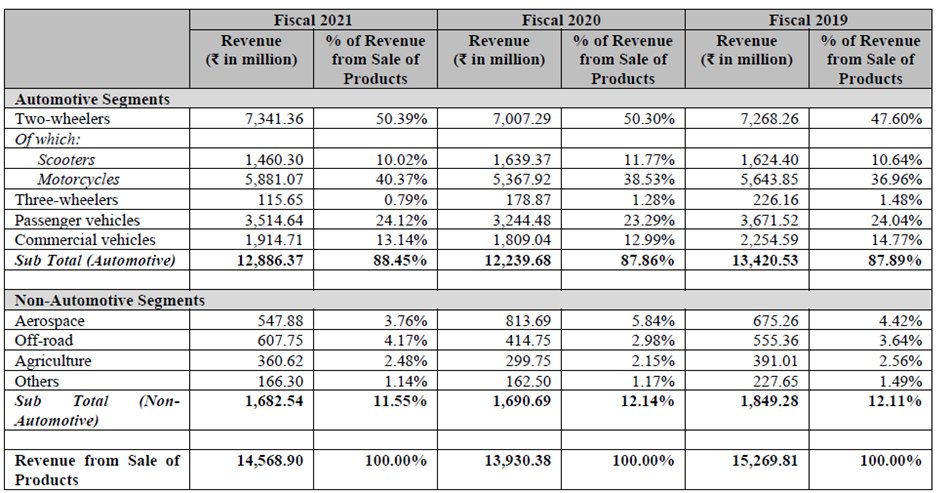

Pre IPO Information - (Img 1)

Objects of Issue - (Details in Img 2)

- Purchase of machinery and equipment

- Funding incremental working capital

- Repayment or prepayment of all or a portion of certain borrowings/outstanding loan facilities

- General corporate purposes

Pre IPO Information - (Img 1)

Objects of Issue - (Details in Img 2)

- Purchase of machinery and equipment

- Funding incremental working capital

- Repayment or prepayment of all or a portion of certain borrowings/outstanding loan facilities

- General corporate purposes

3/

About the Company -

- Designing, developing, manufacturing and testing a wide range of defence and space engineering products and solutions. 5 categories: defence and space optics, defence electronics, EMP protection, heavy engineering for defence and niche technologies

About the Company -

- Designing, developing, manufacturing and testing a wide range of defence and space engineering products and solutions. 5 categories: defence and space optics, defence electronics, EMP protection, heavy engineering for defence and niche technologies

4/

- As of Q1FY22 - 34 categories of products/solutions, with multiple variations in each category

- Main vertical is optics – services military and Space. Management says “Company has a great capability here, and when it comes to optics everyone thinks about us first"

- As of Q1FY22 - 34 categories of products/solutions, with multiple variations in each category

- Main vertical is optics – services military and Space. Management says “Company has a great capability here, and when it comes to optics everyone thinks about us first"

5/

- In the future, they may think of venturing out into other sectors too

- Commercial optical started with 3 types of drones - agricultural, day and night surveillance, and day surveillance. Focussing on drone-based cameras as this is an open field with no competitors

- In the future, they may think of venturing out into other sectors too

- Commercial optical started with 3 types of drones - agricultural, day and night surveillance, and day surveillance. Focussing on drone-based cameras as this is an open field with no competitors

6/

- Currently working on a complete camera system for the defense sector that is going to be launched in orbit

- Working on niche areas where they will have no clash with their customers

- Currently working on a complete camera system for the defense sector that is going to be launched in orbit

- Working on niche areas where they will have no clash with their customers

7/

Manufacturing -

- 2 manufacturing facilities in Maharashtra - Ambernath in Thane (heavy engineering products) & Nerul in Navi Mumbai (optics, manufacturing and integration of electronics and EMP protection products/solutions)

Manufacturing -

- 2 manufacturing facilities in Maharashtra - Ambernath in Thane (heavy engineering products) & Nerul in Navi Mumbai (optics, manufacturing and integration of electronics and EMP protection products/solutions)

8/

R&D -

- R&D Centres at Nerul in Navi Mumbai and Bengaluru, Karnataka

Note - Company enters into contracts with third parties in India and outside India for partnering in relation to the development of certain products or sourcing components

R&D -

- R&D Centres at Nerul in Navi Mumbai and Bengaluru, Karnataka

Note - Company enters into contracts with third parties in India and outside India for partnering in relation to the development of certain products or sourcing components

9/

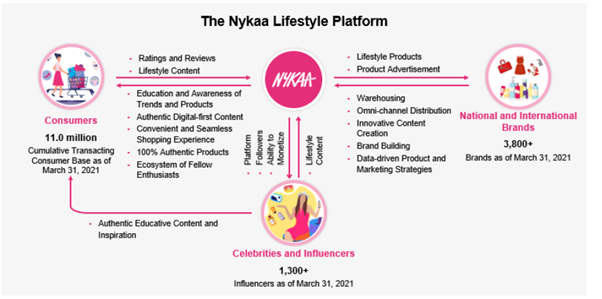

Order Book -

- Rs 305 Cr

- Mgmt said this will come in revenue in 12-18 months. FY22 mostly and FY23 start

- Very strong funnel of the order book, expecting good orders (Optical + EM)

- EMP solutions – new vertical has a good funnel for the local market, export as well

Order Book -

- Rs 305 Cr

- Mgmt said this will come in revenue in 12-18 months. FY22 mostly and FY23 start

- Very strong funnel of the order book, expecting good orders (Optical + EM)

- EMP solutions – new vertical has a good funnel for the local market, export as well

10/

Customers -

- Work with almost all government defense and space organizations and most private defense firms too

Customers -

- Work with almost all government defense and space organizations and most private defense firms too

11/

Risks -

- Dependent on Govt. contracts – FY21, FY20, and FY19 had 50.84%, 28.75%, and 35.62% of total sales from GoI. They expect this to continue

- Revenue from Top 5 customers constituted 59.63%, 72.27%, and 58.65% of total sales in FY21, FY20, and FY19 respectively

Risks -

- Dependent on Govt. contracts – FY21, FY20, and FY19 had 50.84%, 28.75%, and 35.62% of total sales from GoI. They expect this to continue

- Revenue from Top 5 customers constituted 59.63%, 72.27%, and 58.65% of total sales in FY21, FY20, and FY19 respectively

12/

Management Experience -

- Sharad Virji Shah, Chairman, and Munjal Sharad Shah, MD, have 41 years and 23 years of experience, respectively, in engineering products and solutions for defence application

Management Experience -

- Sharad Virji Shah, Chairman, and Munjal Sharad Shah, MD, have 41 years and 23 years of experience, respectively, in engineering products and solutions for defence application

13/

Strategies Ahead -

- Expansion of production capacity

- Strengthen foothold in India’s expanding market

- Continue to focus on R&D

- Diversify products/solutions range, with focus on growth by expansion into opportunistic areas

- Increasing reach in international markets

Strategies Ahead -

- Expansion of production capacity

- Strengthen foothold in India’s expanding market

- Continue to focus on R&D

- Diversify products/solutions range, with focus on growth by expansion into opportunistic areas

- Increasing reach in international markets

14/

Financials -

- P&L - No growth | EBITDA grew because of lower cost of materials this year (Img #2)

- Mgmt. guided for better cash flows and return ratios ahead and also said they were Earlier assembling company, now full-fledged product company that will help the financials

Financials -

- P&L - No growth | EBITDA grew because of lower cost of materials this year (Img #2)

- Mgmt. guided for better cash flows and return ratios ahead and also said they were Earlier assembling company, now full-fledged product company that will help the financials

15/

- Working capital – it was very high last year, going forward they are going to sell complete products, off the shelf, kind of more faster-moving, so here the turnaround time will be faster

- Working capital – it was very high last year, going forward they are going to sell complete products, off the shelf, kind of more faster-moving, so here the turnaround time will be faster

16/

Valuation & Conclusion -

FY21 EPS – 5.55

FY21 Book Value – 55.23

P/E – 31.5x

P/BV – 3.2x

P/S – 4.8x

Valuations seem expensive

Key monitorable - Execution and growth as they say that their financials will improve due to the pivot to a complete products company

Valuation & Conclusion -

FY21 EPS – 5.55

FY21 Book Value – 55.23

P/E – 31.5x

P/BV – 3.2x

P/S – 4.8x

Valuations seem expensive

Key monitorable - Execution and growth as they say that their financials will improve due to the pivot to a complete products company

• • •

Missing some Tweet in this thread? You can try to

force a refresh