Manchester United’s 2020/21 accounts cover a season when they finished 2nd in the Premier League and reached the final of the Europa League, having been eliminated at group stage of the Champions League. Financials significantly impacted by COVID-19. Some thoughts follow #MUFC

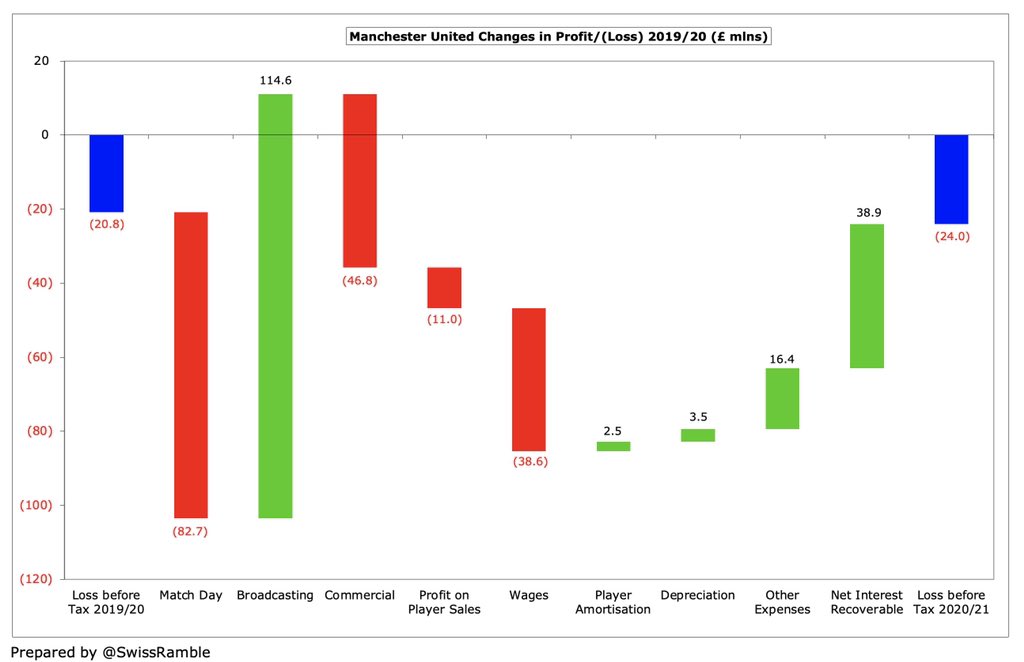

#MUFC pre-tax loss up from £21m to £24m, as revenue dropped £15m (3%) from £509m to £494m and profit on player sales fell £11m to £7m, while expenses rose £16m (3%). Operational decline offset by interest swinging £39m from £26m payable to £13m recoverable thanks to forex gains.

Net loss after tax rose £69m from 23m to £92m, due to April 2023 increase in corporation tax from 19% to 25%, which meant that #MUFC wrote down the value of a US deferred tax asset, as it is no longer expected to give rise to a future economic benefit. This is a non-cash impact.

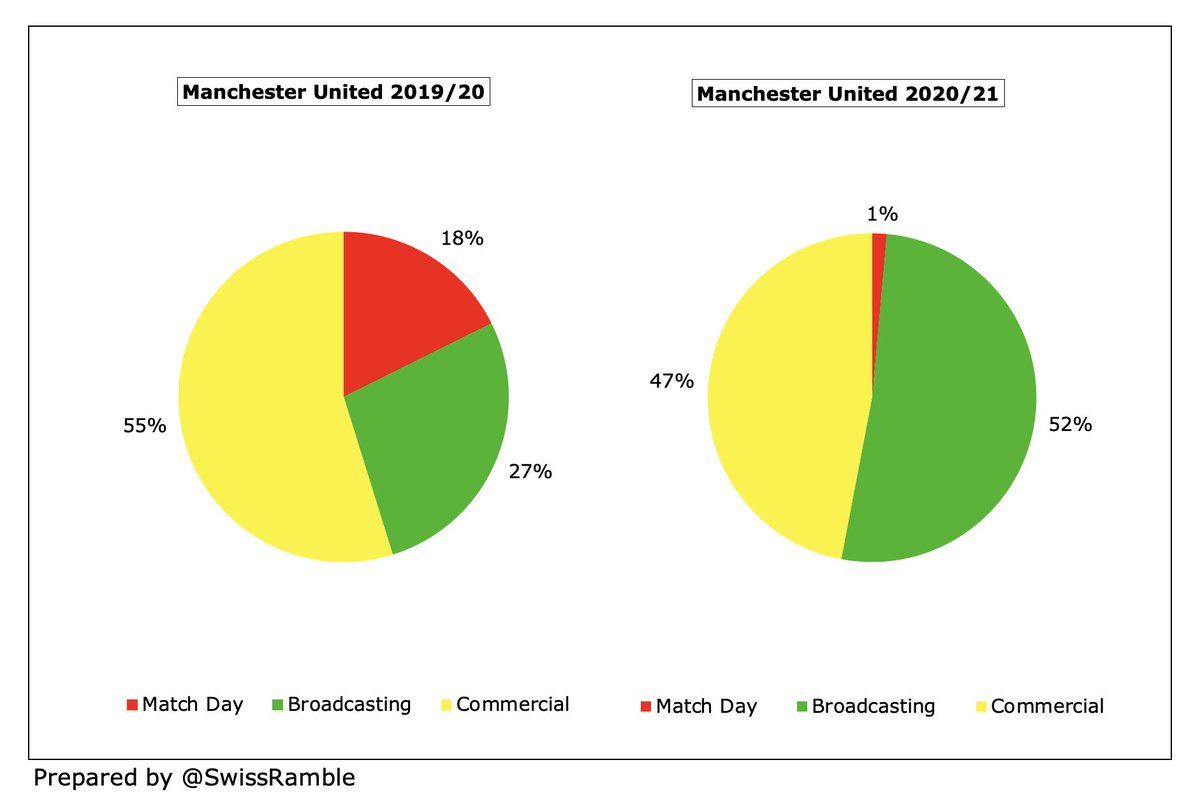

The main reason that #MUFC revenue only fell 3% was £115m (82%) increase in broadcasting to £255m, mainly due to return to Champions League, which compensated for COVID driven reductions in match day, down £83m (92%) to £7m, and commercial, down £47m (17%) to £232m.

Despite the revenue decrease, #MUFC wages rose £39m (14%) from £284m to £323m, due to Champions League bonuses, though player amortisation fell £2m (2%) to £122m. Reduced business activity, due to COVID closures, meant £16m (18%) reduction in other expenses to £76m.

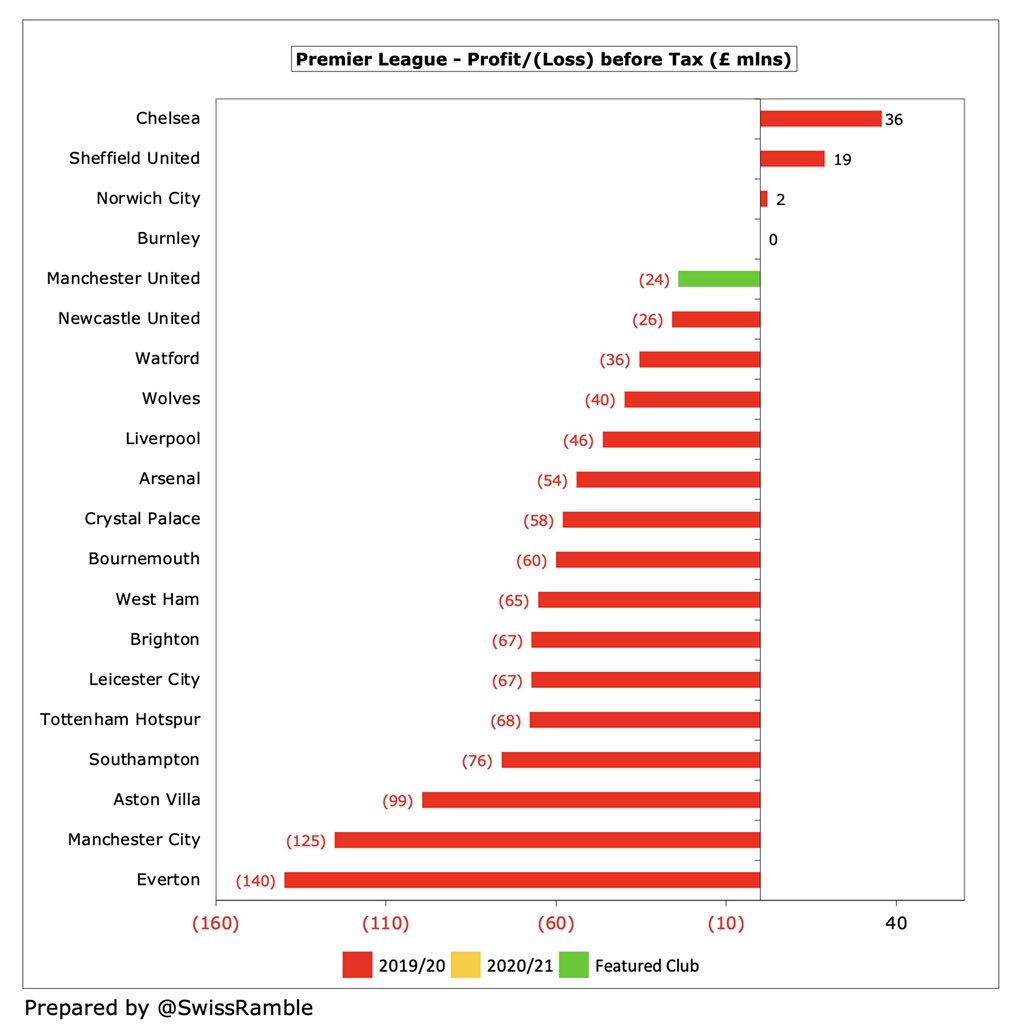

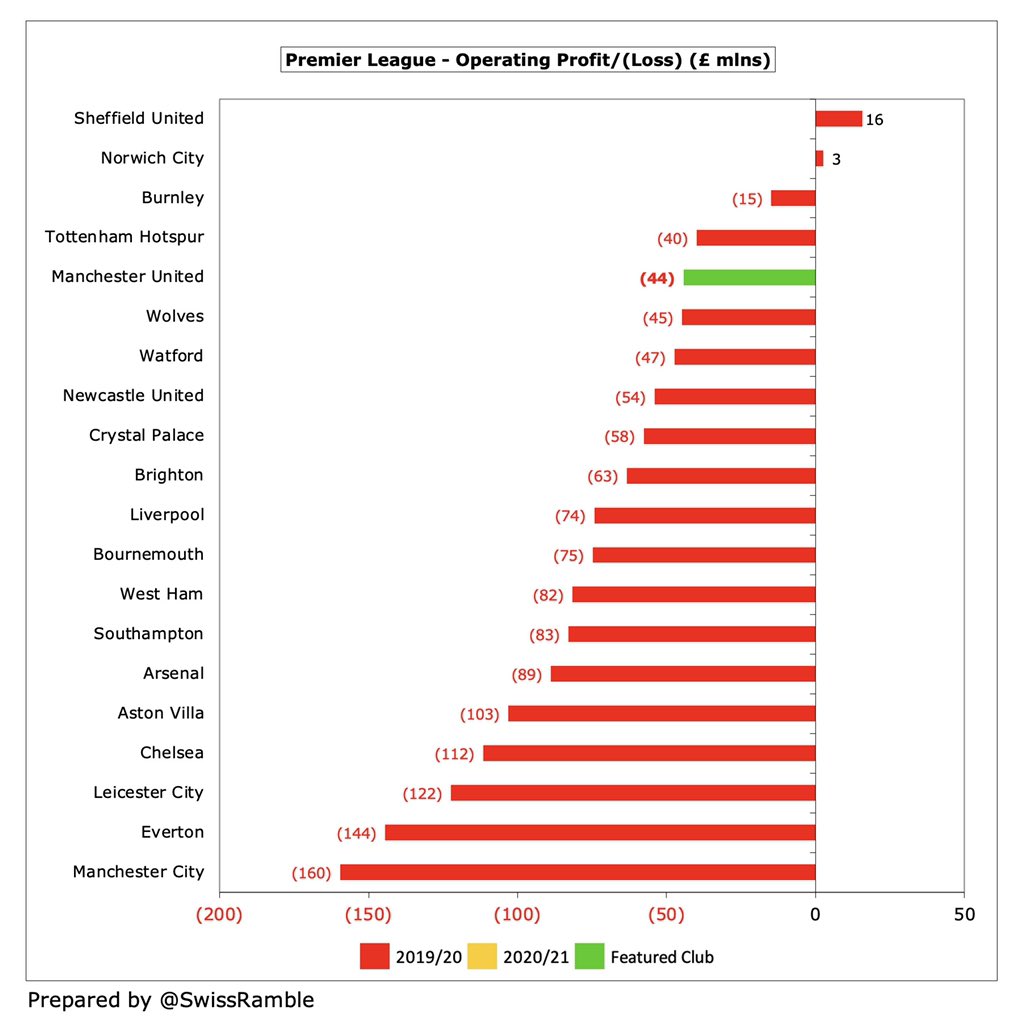

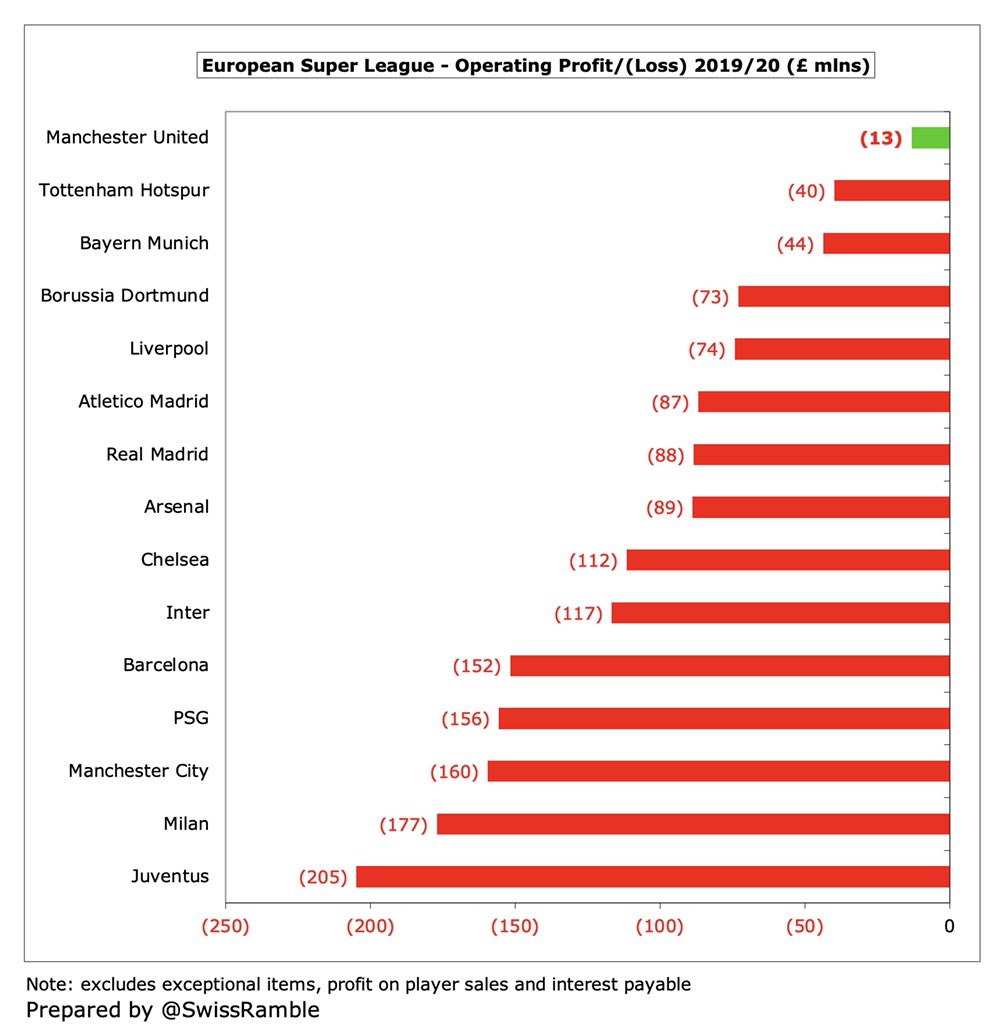

As a sign of #MUFC resilience, their £24m pre-tax loss is better than most Premier League clubs in 2019/20, even though their figures are the only ones to include a full year of the pandemic. For 2020/21, Barcelona and Juventus have announced massive losses of €481m and €210m.

Of course, #MUFC revenue was significantly impacted by COVID. I have estimated the revenue loss as £170m in 2020/21 (match day £113m, commercial £47m & broadcasting £10m). Added to 2019/20 £31m loss, that gives a total of £201m. Around £24m TV revenue deferred from 2020 to 2021.

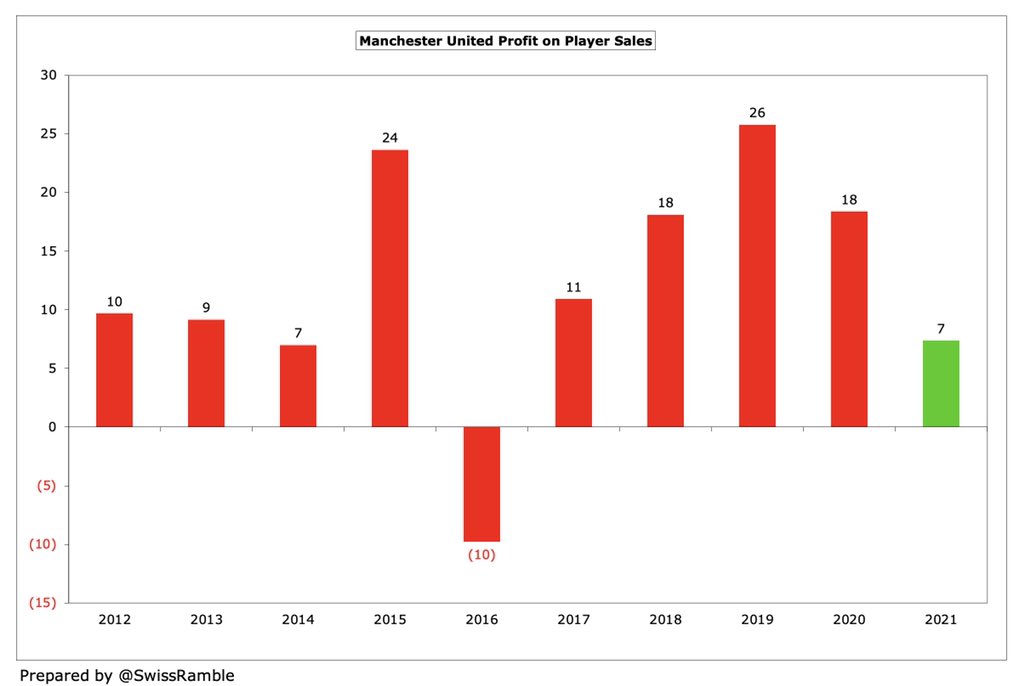

The #MUFC strategy has not been overly reliant on player sales, so their £7m profit from this activity is one of the lowest in the Premier League, down £11m from previous season. Miles below the likes of #CFC £143m, #LCFC £63m and #AFC £60m (all 2019/20 figures).

This is the second year in a row that #MUFC have posted a loss (due to COVID), but they have managed to limit these to £21m in 2020 and £24m in 2020. Before then they had accumulated an impressive £159m profit in the preceding four years, averaging £40m annually in that period.

#MUFC results have rarely been boosted by player sales, only averaging £12m a year over last decade. In the 5 years up to 2020, United’s £63m profit from this activity was significantly lower than rest of the Big 6: #CFC £434m, #LFC £276m, #AFC £201m, #MCFC £173m & #THFC £166m.

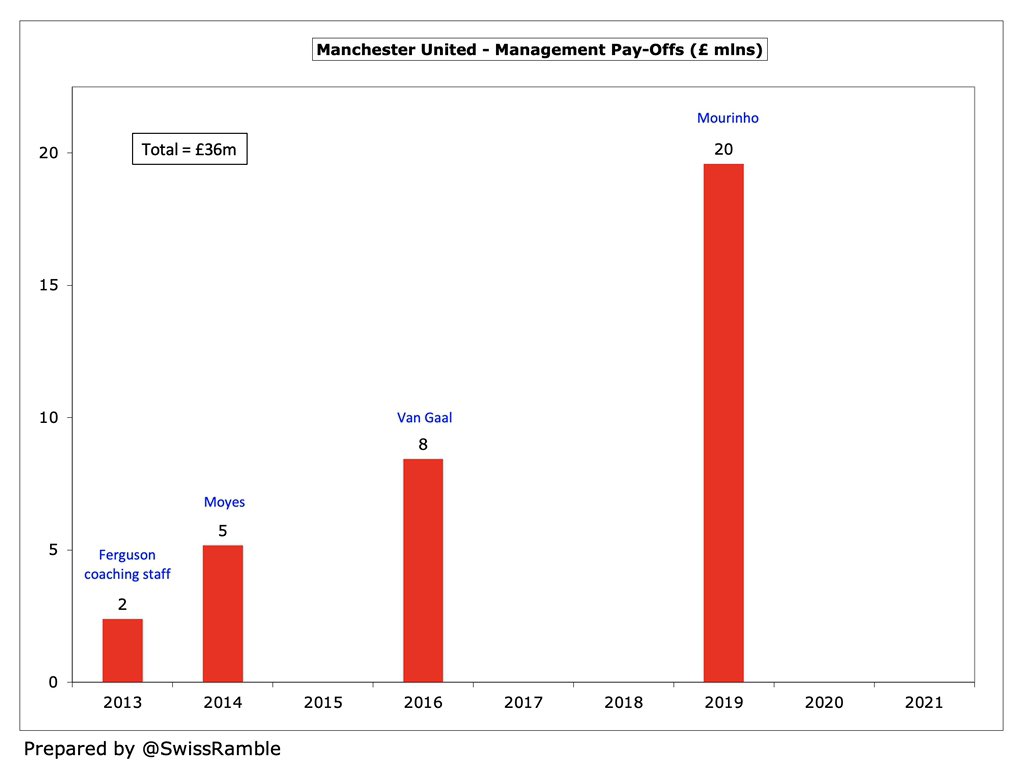

#MUFC 2020/21 results were not impacted by exceptional items., whereas previous year have been hit by manager pay-offs, amounting to £36m since Sir Alex Ferguson retired, most recently £20m in 2019 with Jose Mourinho picking up £15m and the rest going to his coaching team.

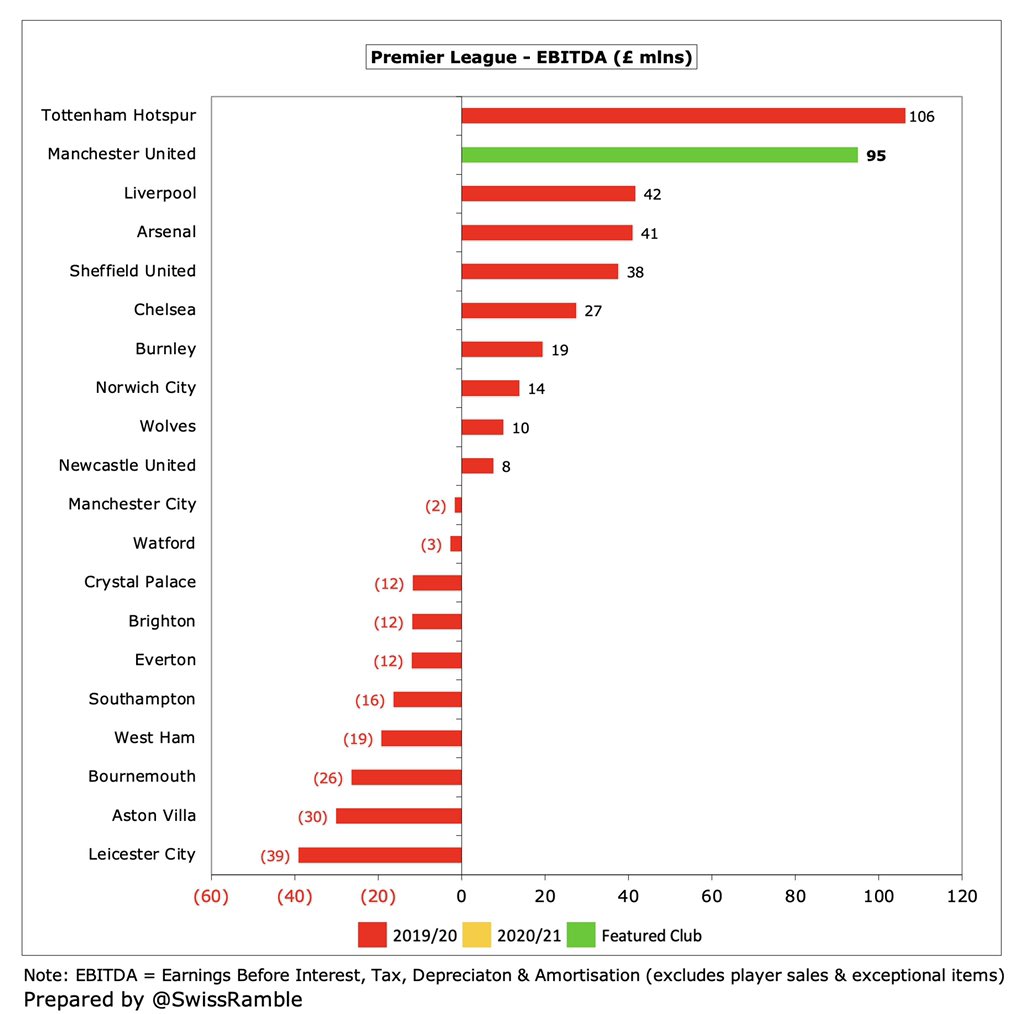

#MUFC EBITDA (Earnings Before Interest, Depreciation and Amortisation), which strips out player sales and non-cash items to give underlying profitability, dropped from £132m to £95m. Down from amazing £200m in 2017, though still one of the best in the top flight.

In 2020 #MUFC reported an operating loss for the first time in ages. In 2021 this further widened from £13m to £44m, though this is still pretty good compared to other clubs. In fact, United had by far the smallest operating loss of major European clubs in 2020.

#MUFC revenue has fallen by £133m (21%) in the past two years from the £627m peak to £494m, which is around 2015 level of £515m. Most of the reduction (£104m) is in match day, down to £7m as games played behind closed doors, so just 1% of total revenue.

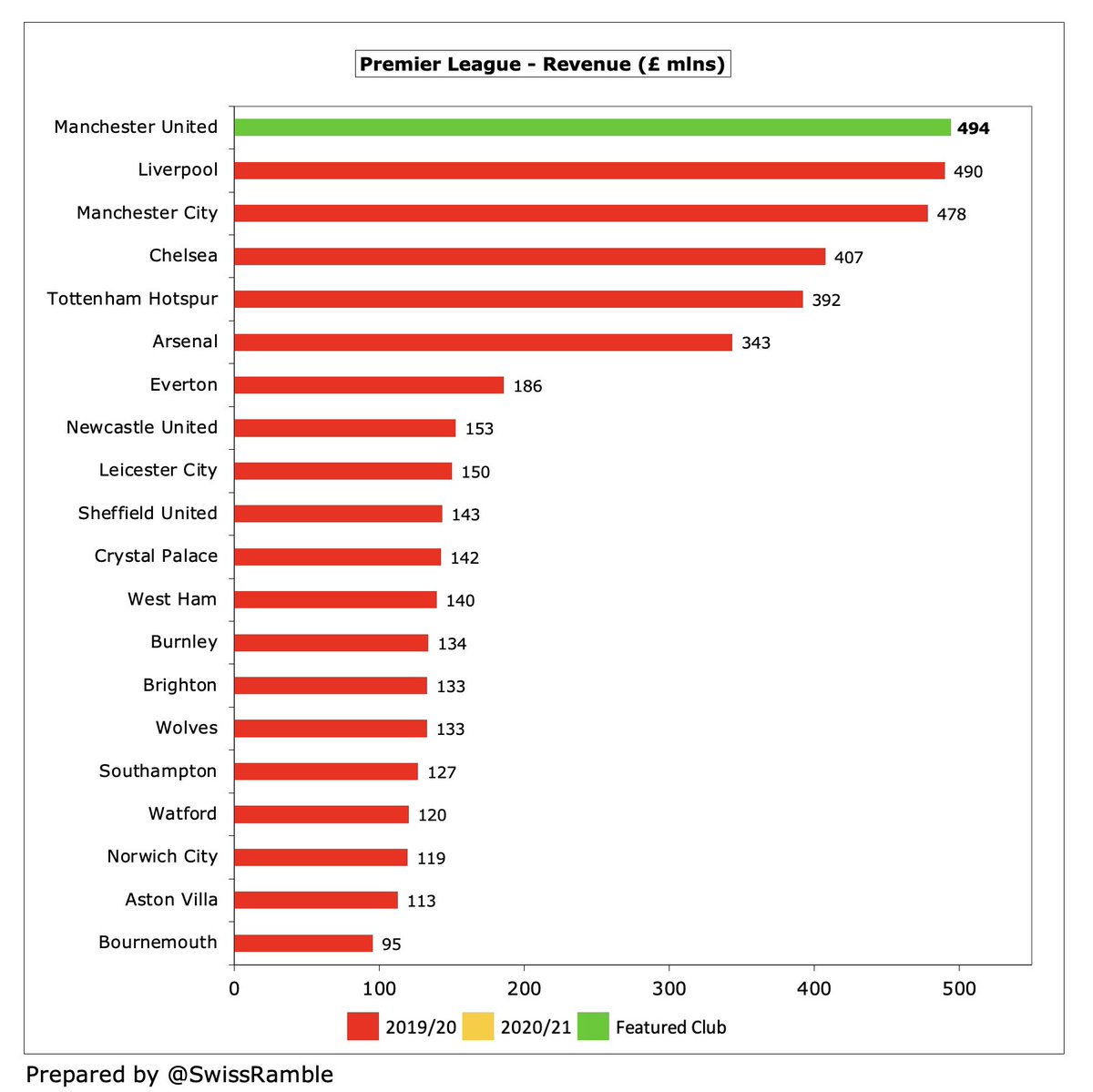

Despite reflecting a full season of COVID, #MUFC £494m revenue is still currently the highest in England, just ahead of #LFC £490m and #MCFC £478m (2019/20 figures), though these clubs had been significantly closing the gap with United pre-COVID.

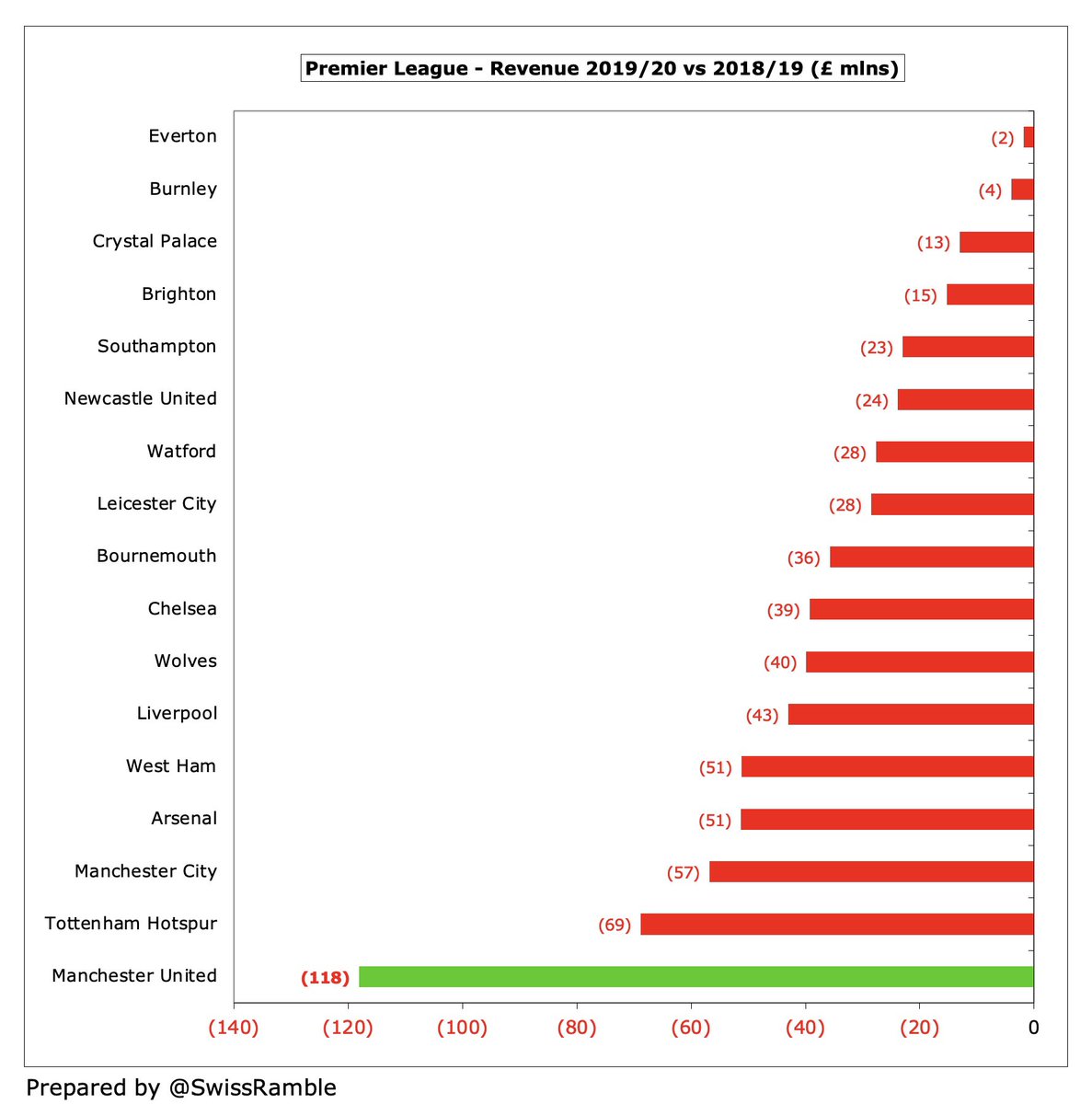

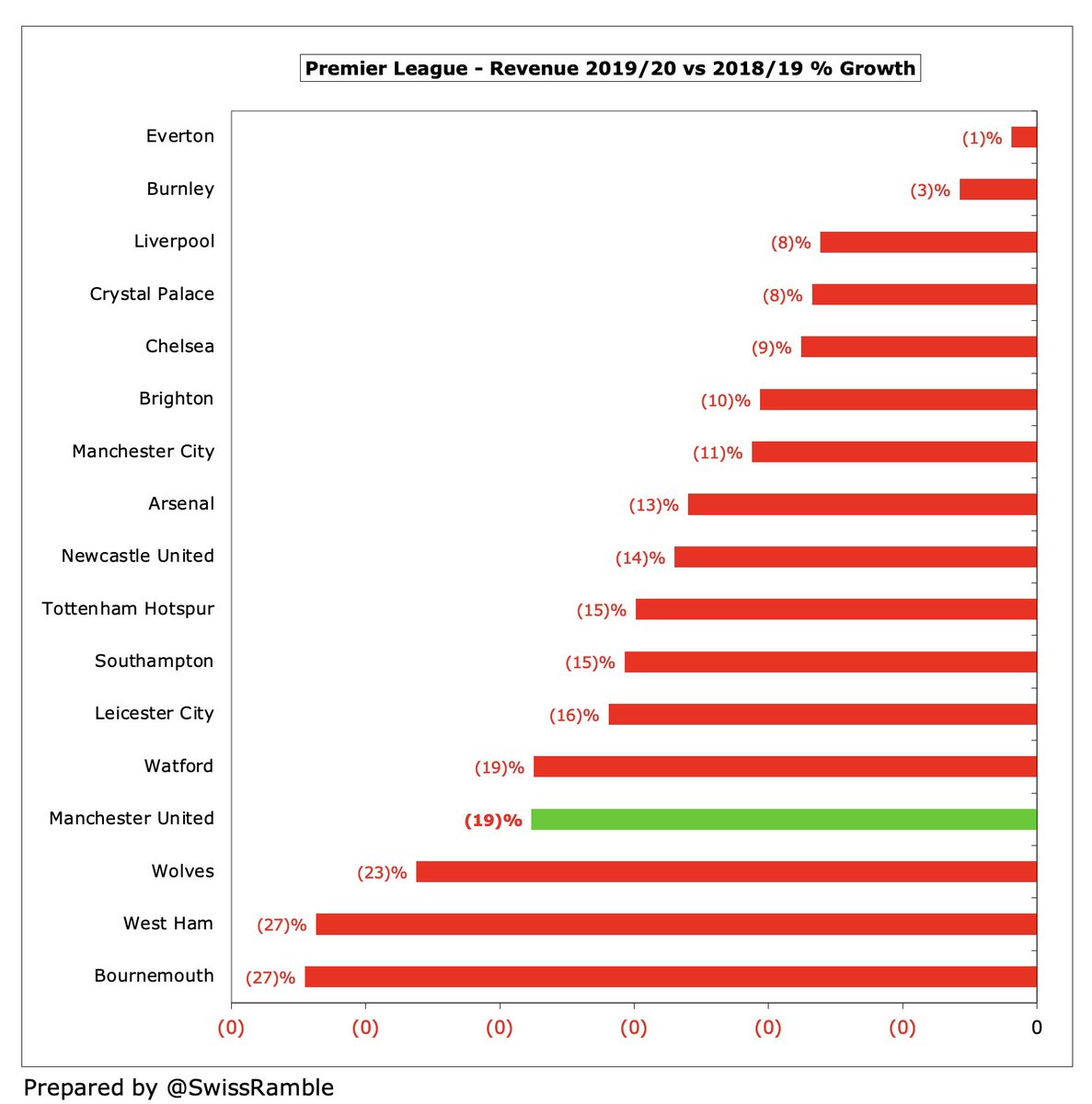

Indeed, #MUFC revenue fall in 2019/20 compared to the previous season was the highest in the Premier League in absolute terms (£118m) and one of the highest in percentage terms (19%), highlighting the importance of qualifying for the Champions League.

Based on 2019/20 figures, #MUFC £509m revenue was the fourth highest in the world, based on the Deloitte Money League, down one place from the prior year, only below Barcelona and Real Madrid (both £627m) and Bayern Munich £556m.

#MUFC commercial income fell £47m (17%) from £279m to £232m, mainly due to no pre-season tour, COVID sponsorship “variations” and closure of Megastore. United’s commercial engine has essentially stalled (revenue flat for 5 years before 2021 decrease), while big growth at rivals.

That said, #MUFC £232m commercial income is higher than all other PL clubs except #MCFC £246m. The fact that so much of United’s revenue is from commercial (55% in 2019/20) gives them a degree of protection from the impact of the pandemic that others don’t enjoy.

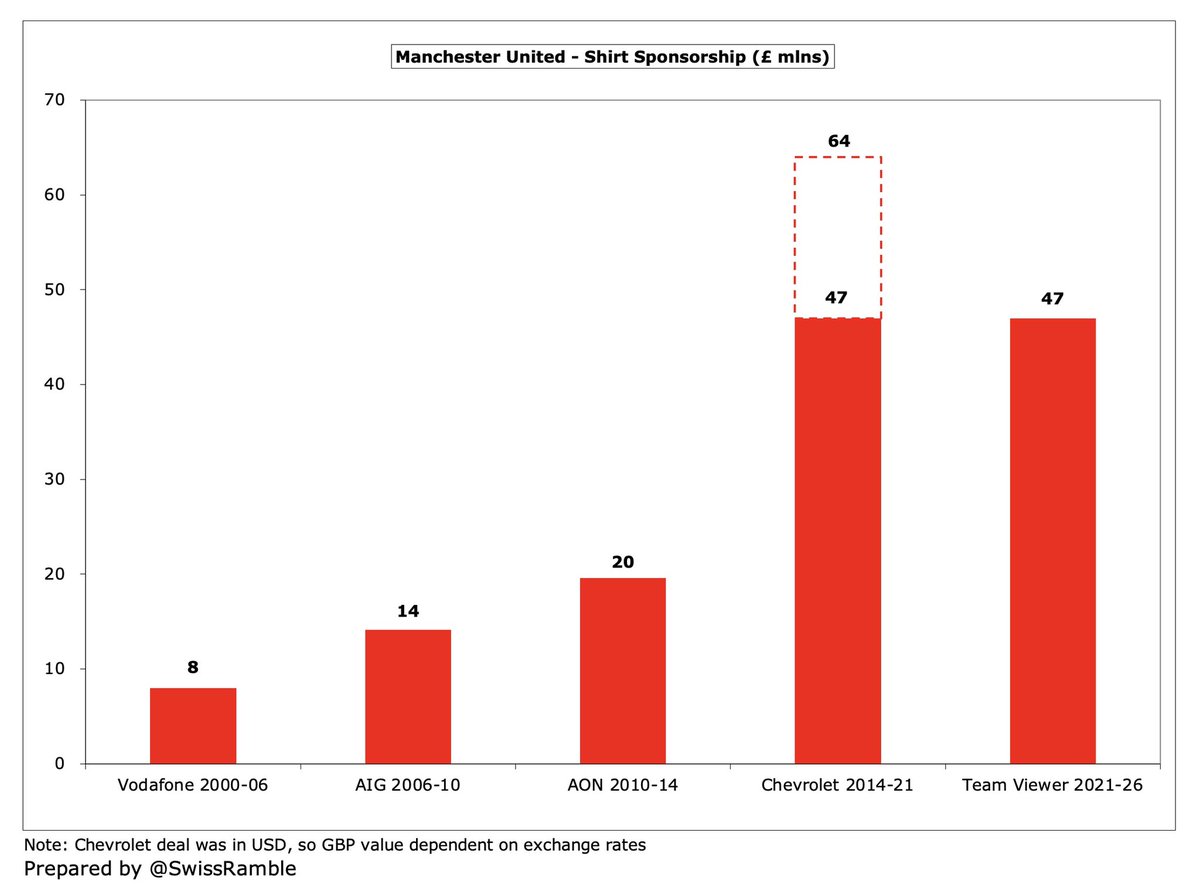

Furthermore #MUFC lucrative commercial deals are trending down: the new £47m TeamViewer shirt sponsorship is much lower than Chevrolet £64m, while no replacement announced for Aon training ground £15m deal that ended this summer. However, the £75m Adidas kit deal runs to 2025.

#MUFC broadcasting revenue shot up £115m (82%) from £106m to £255m, mainly due to participation in the Champions League and run to Europa League final, though also benefited from revenue deferred from 2019/20 for games played after end-June accounting close (estimated as £24m).

#MUFC broadcasting revenue of £255m is the second highest ever reported by an English club from this revenue stream, only below #LFC £264m in 2019, partly due to the money deferred from the 2020 accounts. In fact, it’s the third highest anywhere, as Barcelona had £263m in 2019.

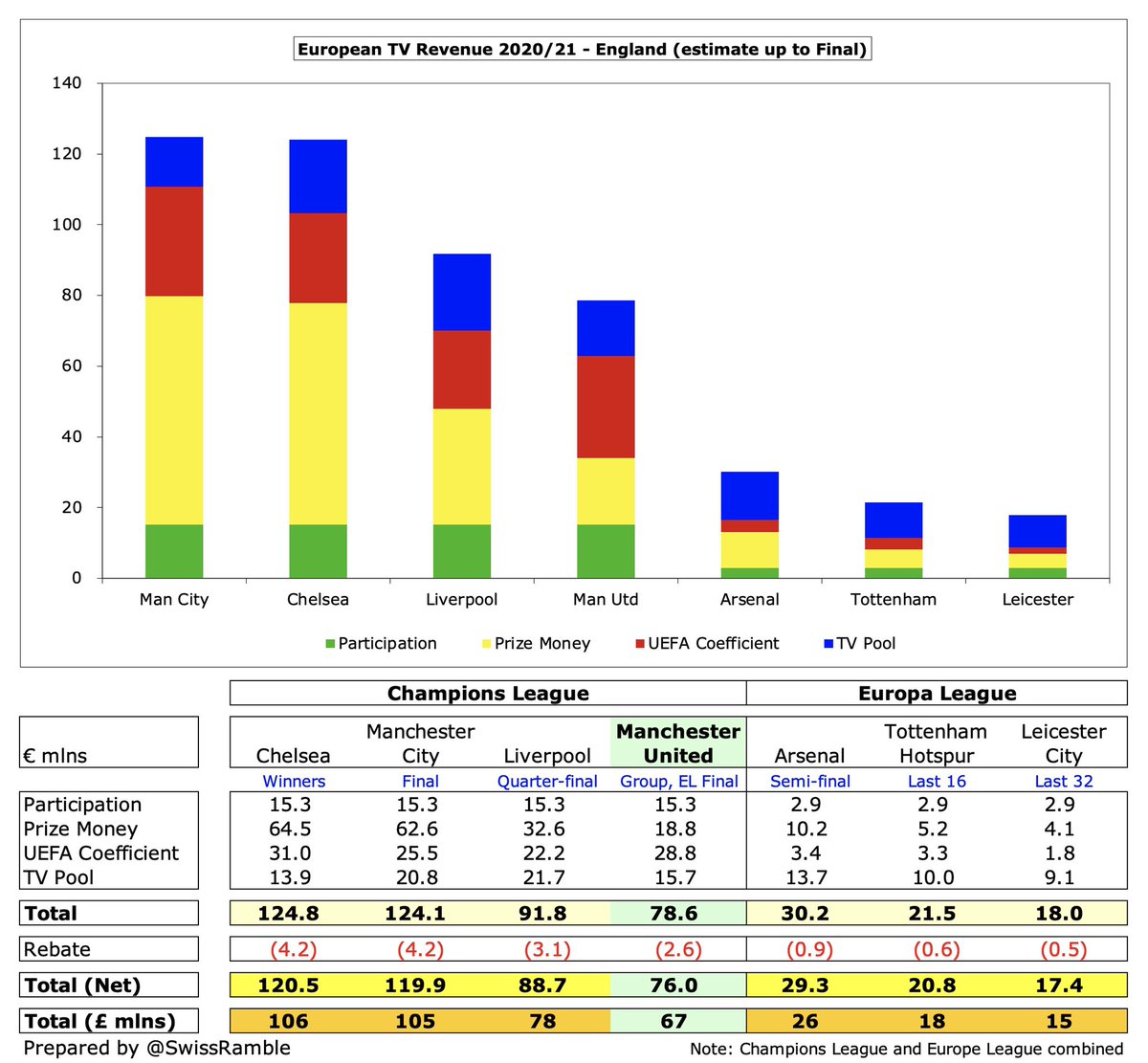

I estimate that #MUFC earned €76m from Europe in 2020/21, split Champions League (group) €62m and Europa League (final) €14m. That’s pretty good, but a lot lower than Champions League finalists, #CFC €121m and #MCFC €120m. Net amounts after COVID rebate.

#MUFC relatively poor performance in Europe, including not even qualifying in 2015, means that they have earned “only” €284m in the last 5 years. That’s not too shabby, but it is a hefty €138m less than #MCFC €422m. Also below #LFC €361m, #CFC €311m and #THFC €293m.

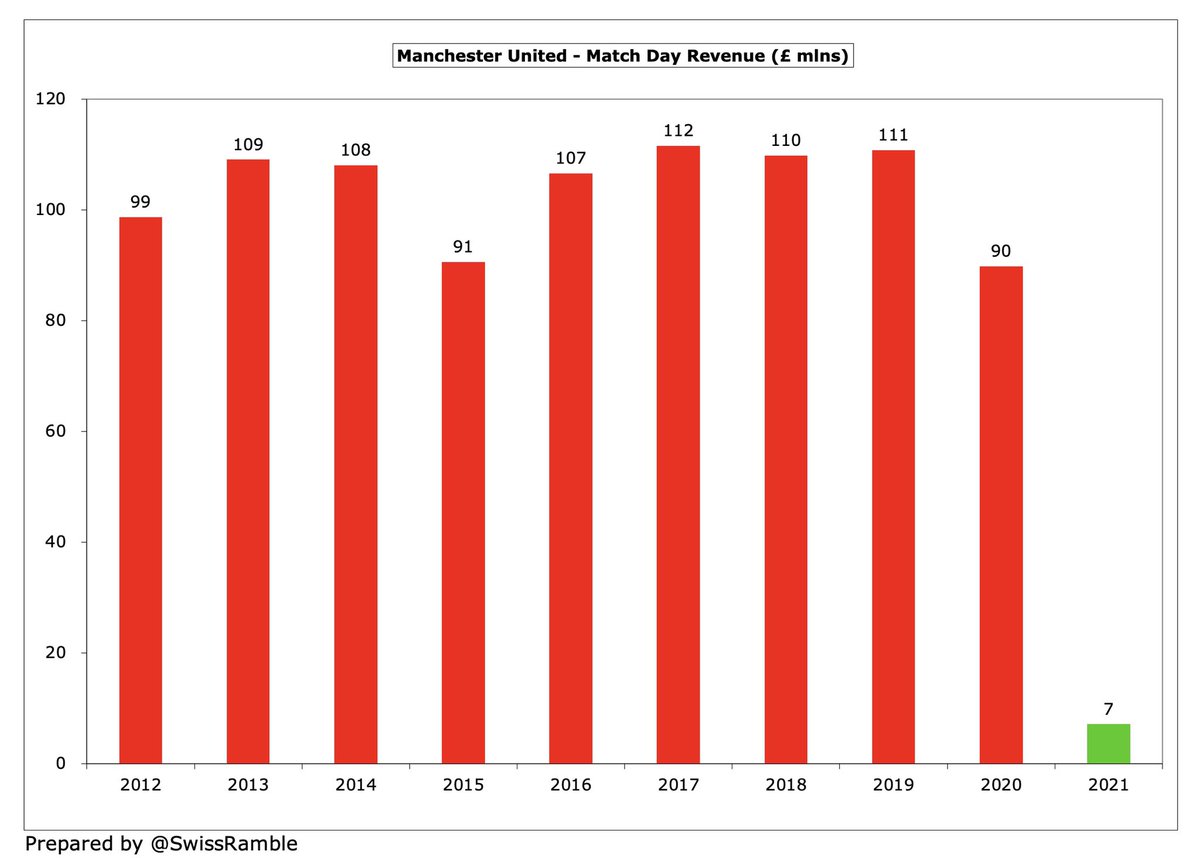

#MUFC match day income slumped £83m (92%) from £90m to just £7m, as all home games except the final Premier League match were played behind closed doors. The only club to buck the trend in 2019/20 was #THFC, thanks to the move to the new stadium.

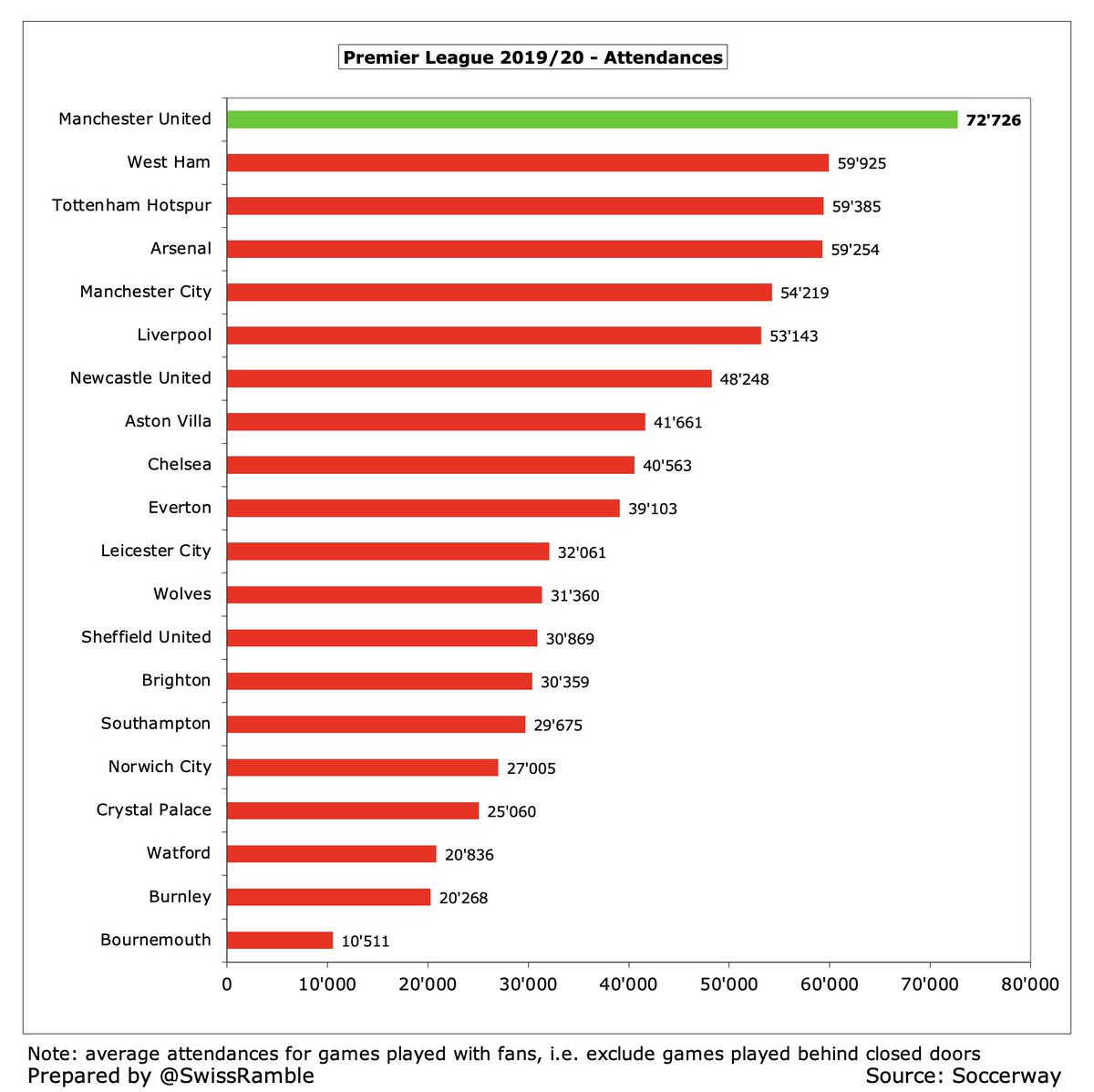

Due to their high match day income, #MUFC revenue was more impacted by COVID than any other English club, so they will be delighted that Old Trafford returned to full capacity at the start of the 2021/22 season, when they will once again benefit from the largest crowds in the PL.

#MUFC wage bill rose £39m (14%) from £284m to £323m, mainly due to higher bonuses for playing in the Champions League, almost back to £332m club high in 2019. After many years with the highest wages, United still only third highest in England, below #MCFC £351m and #LFC £326m.

However, #MUFC estimate that their wage bill will rise by “around 20%” this season, as a result of signing Cristiano Ronaldo, Raphael Varane and Jadon Sancho. That would mean £65m increase to £387m in 2022, the highest ever in England, around the same level as Barcelona in 2020.

#MUFC wages to turnover ratio increased from 56% to 65%. This is United’s highest ever (it was only 45% in 2017), but it is still one of the lowest (best) in the Premier League. Last year it was also one of the best in Europe, sandwiched between Bayern Munich & Borussia Dortmund.

We will have to wait for another #MUFC company to publish its accounts before we know Ed Woodward’s 2020/21 salary, but United fans will be delighted to see that he trousered £3.1m in 2019/20, the highest in England. He has received a tidy £21m in the last 7 years.

#MUFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, fell £2m (2%) to £122m, down £17m from the £137m peak three years ago. United have been overtaken by both #MCFC £146m and #CFC £127m.

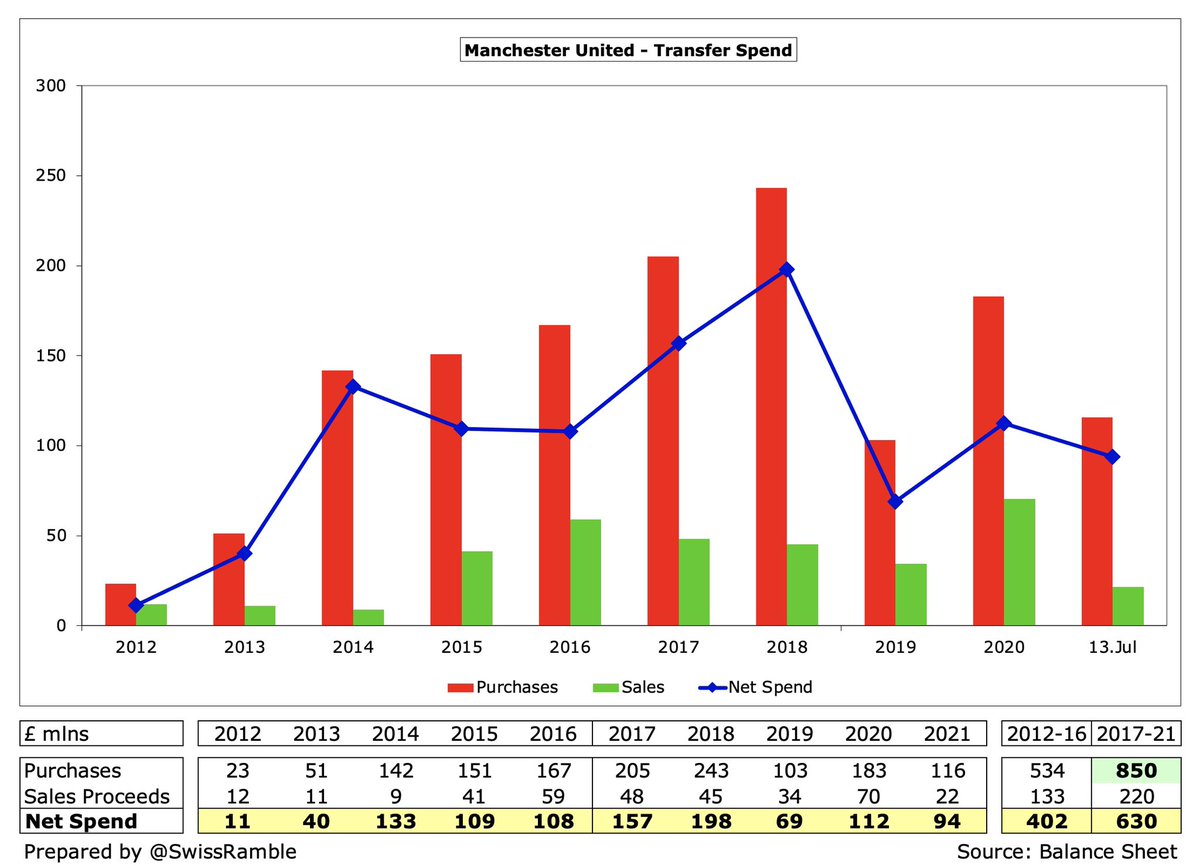

#MUFC player purchases in 2020/21 of £116m were £67m lower than the prior season. Significantly outpaced in 2019/20 by their neighbours #MCFC £180m, but more surprisingly also by #AFC £182m, #AVFC £156m, #THFC £136m and #WWFC £118m.

That said, #MUFC have splashed out £850m in the last 5 years, compared to £534m in the preceding 5-year period. In the same time, net spend has increased from £402m to £630m. Since these accounts closed, spent £141m, mainly on Sancho, Varane and Ronaldo.

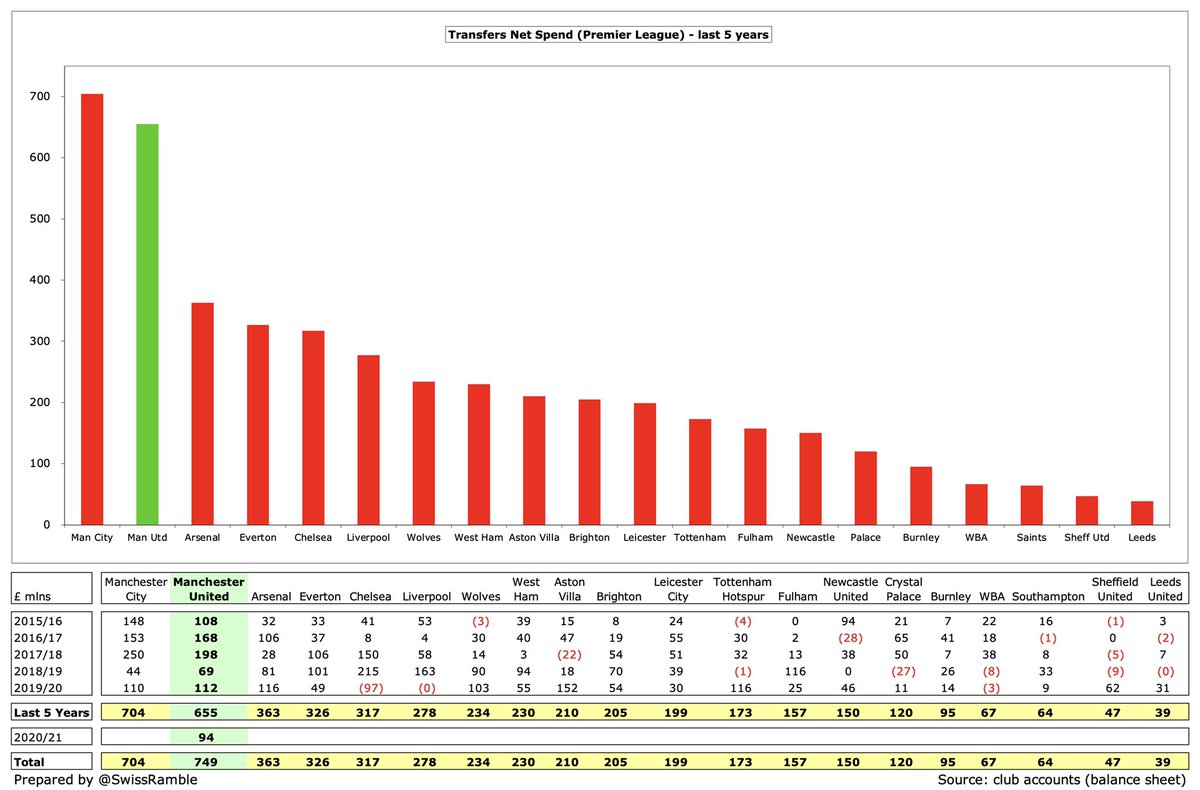

#MUFC £655m net transfer spend in the preceding 5 years (up to 2019/20) was the second highest in England, only surpassed by #MCFC £704m, but around £300m more than #AFC £363m. Similar story with gross spend (£902m vs #MCFC £974m), though #CFC £890m close.

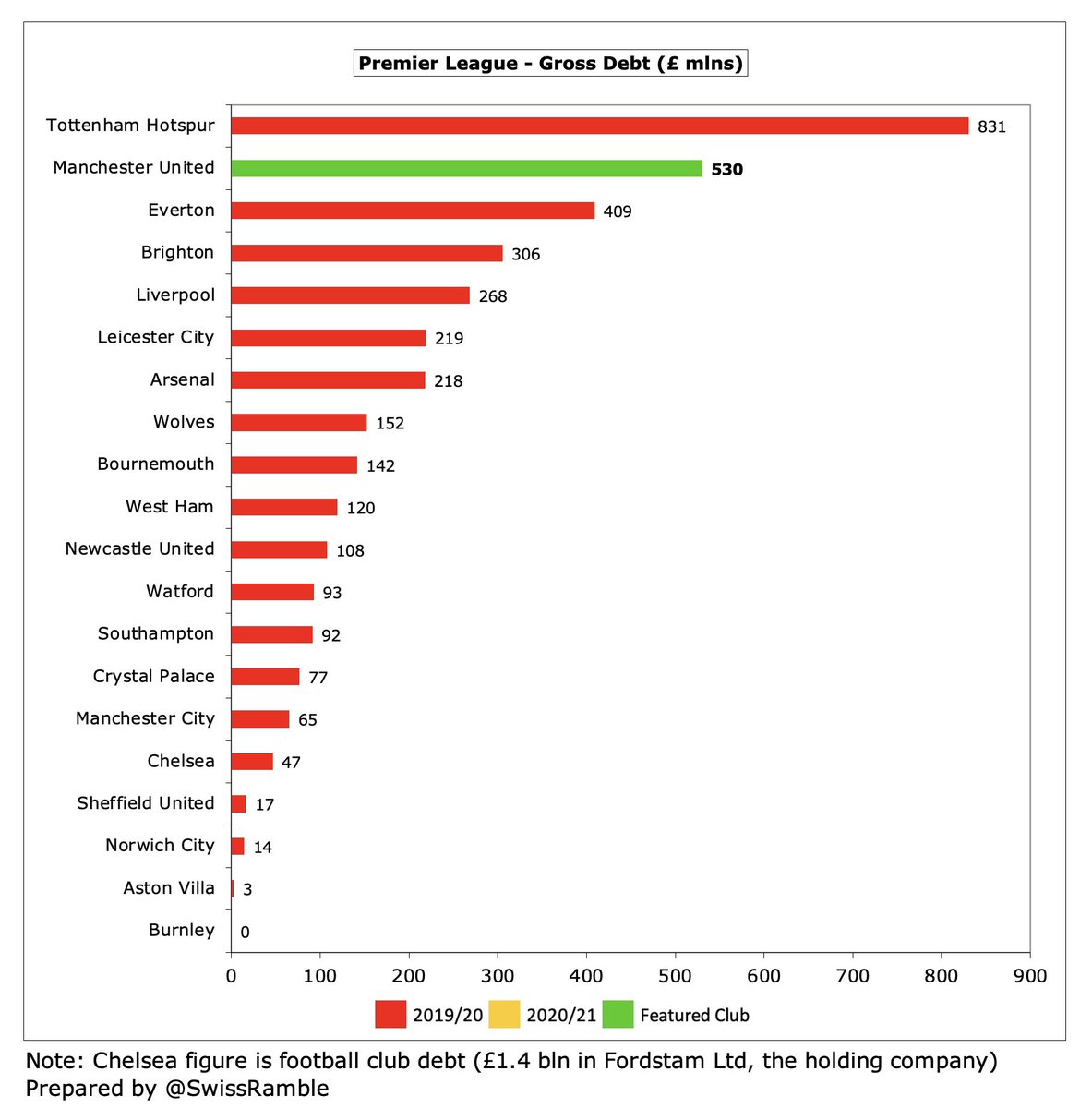

#MUFC net debt fell £54m from £474m to £420m, mainly due to £59m increase in cash from £52m to £111m. Gross debt only up £4m from £526m to £530m, despite a £60m drawdown from credit facility, as offset by fall in USD denominated debt in GBP terms, due to forex gains.

Even after all the Glazers’ refinancings, #MUFC still owe more than half a billion pounds, only behind #THFC £831m (new stadium), though #CFC have £1.4 bln holding company debt. United also 2nd highest financial debt in Europe, above Barcelona £421m, Inter £361m & Juventus £347m.

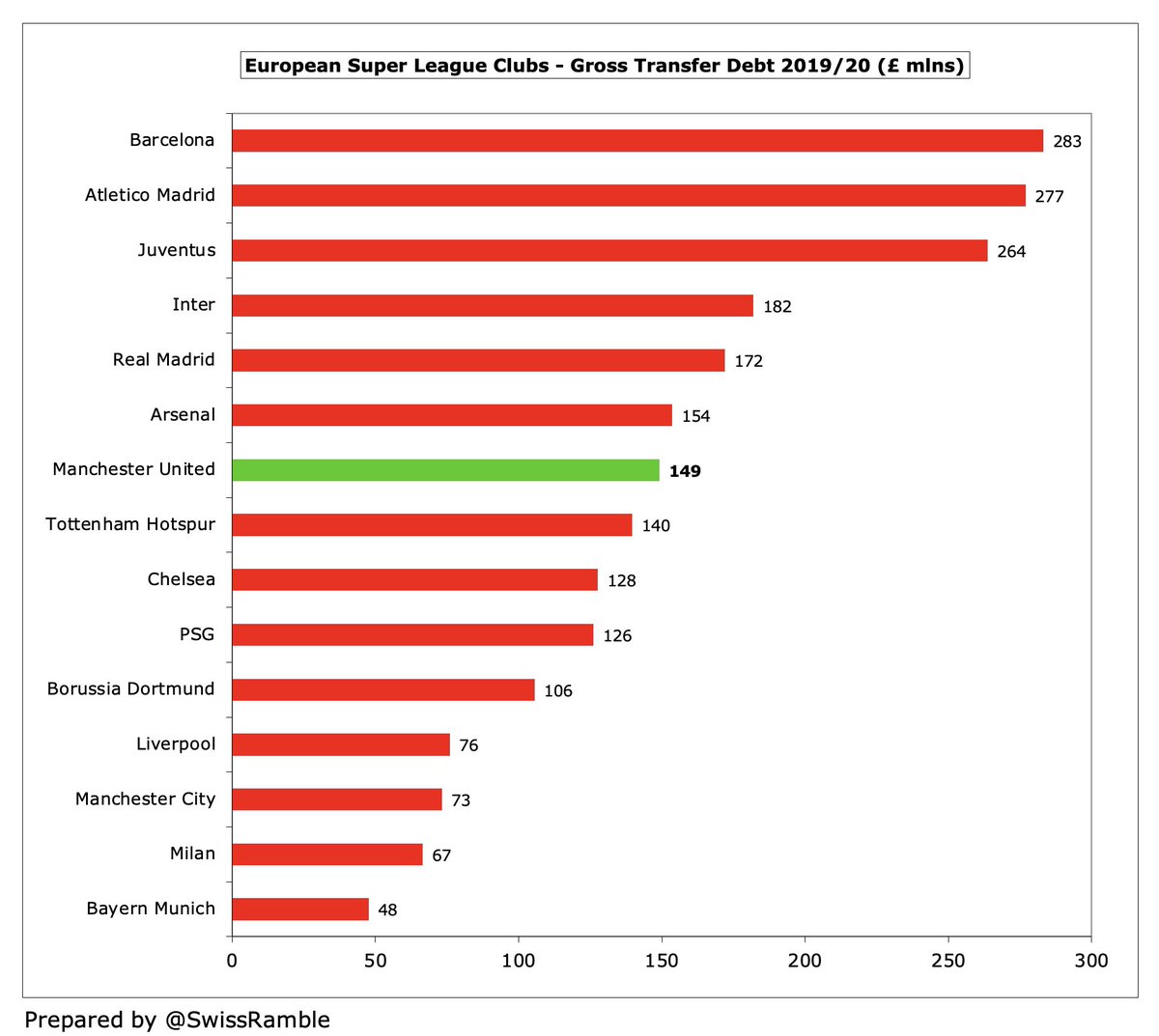

#MUFC transfer payables fell from £149m to £136m, having been as high as £258m 3 years ago, with net transfer debt flat at £93m. Third highest in the Premier League, only behind #AFC £154m and #THFC £140m. Prior season far below Barcelona £283m, Atleti £277m and Juventus £264m.

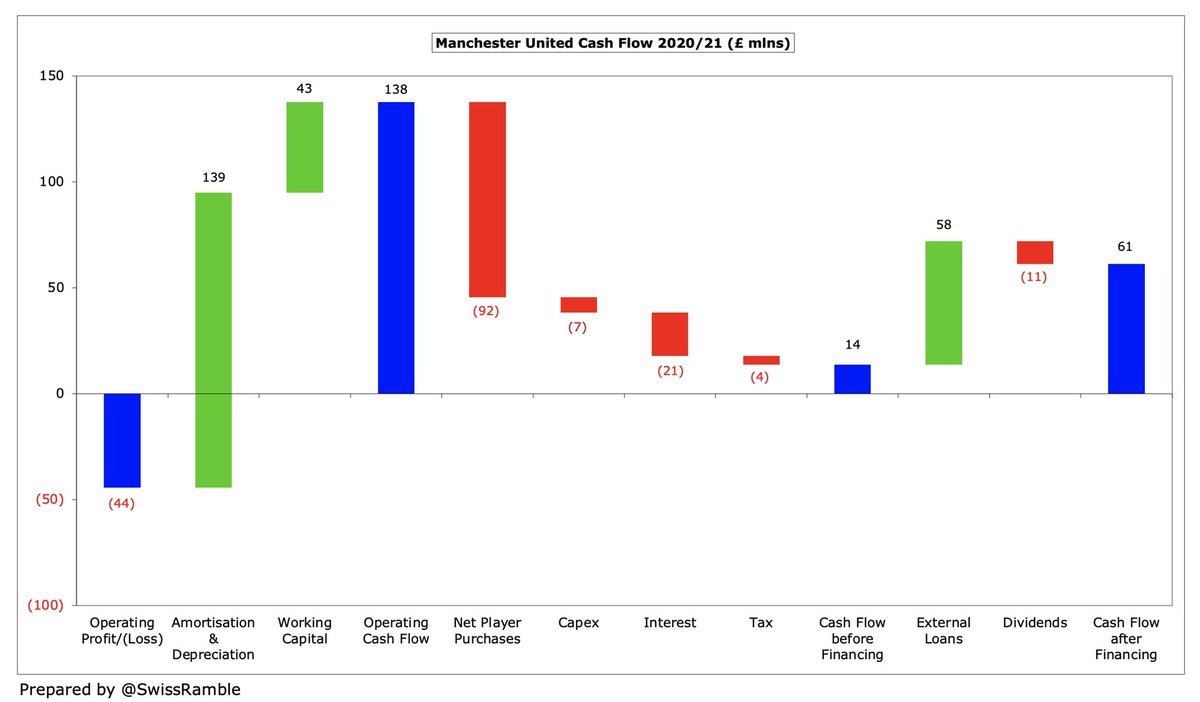

After adding back £139m non-cash items and £43m working capital movements, #MUFC had £138m operating cash flow in 2020/21, but then spent £92m on players (purchases £138m, sales £46m), interest £21m, dividends £11m, capex £7m and tax £4m. Funded by £58m external loans.

As a result, #MUFC cash balance increased by £59m (including £2m FX loss) from £52m to £111m, though around £200m less than £308m peak 2 years ago. Nevertheless, still one of the highest in the Premier League and you would expect #THFC and #LFC to be much lower in 2021 accounts.

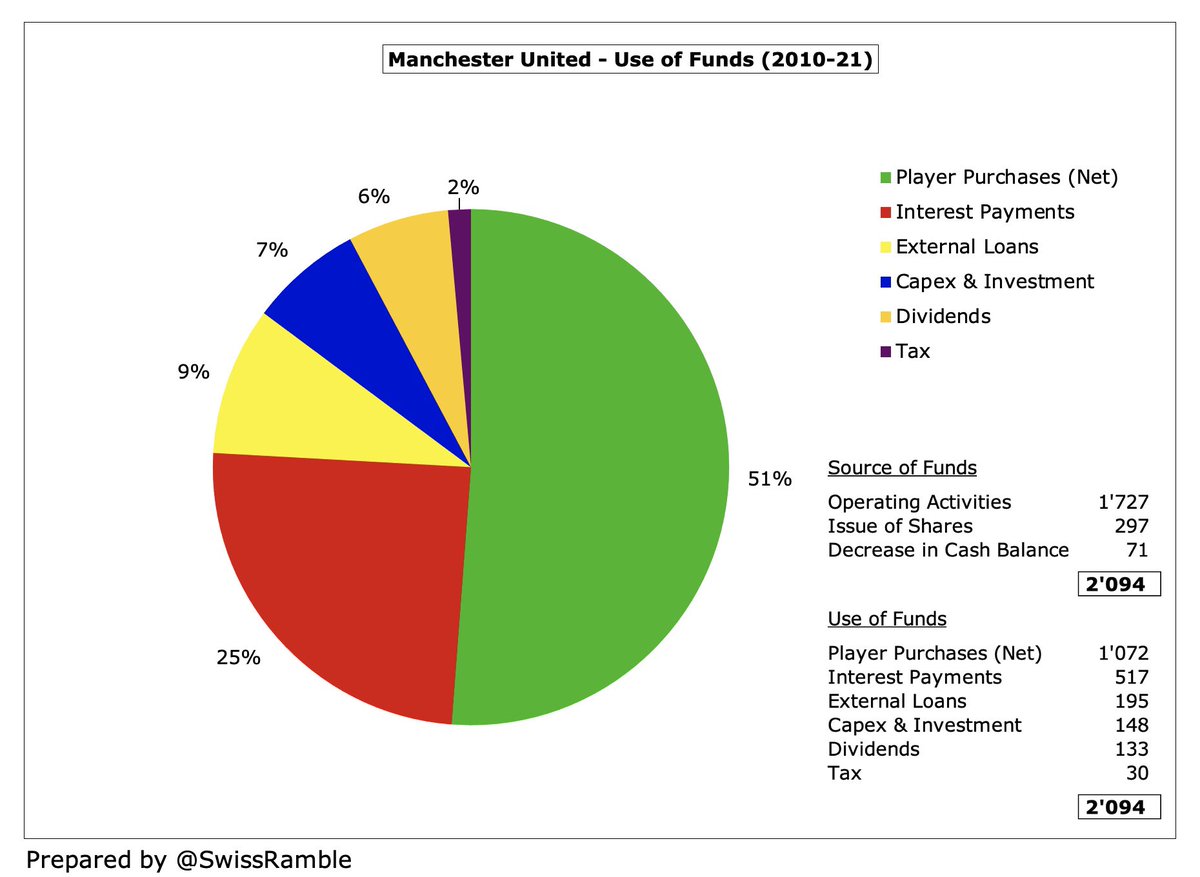

Since 2010 #MUFC have generated £2.1 bln of cash, mainly from operating activities. Around £1 bln has been spent on players, but almost the same (£844m) has gone on financing: interest £517m, loans £195m and dividends £133m. Another £148m on infrastructure and £30m on tax.

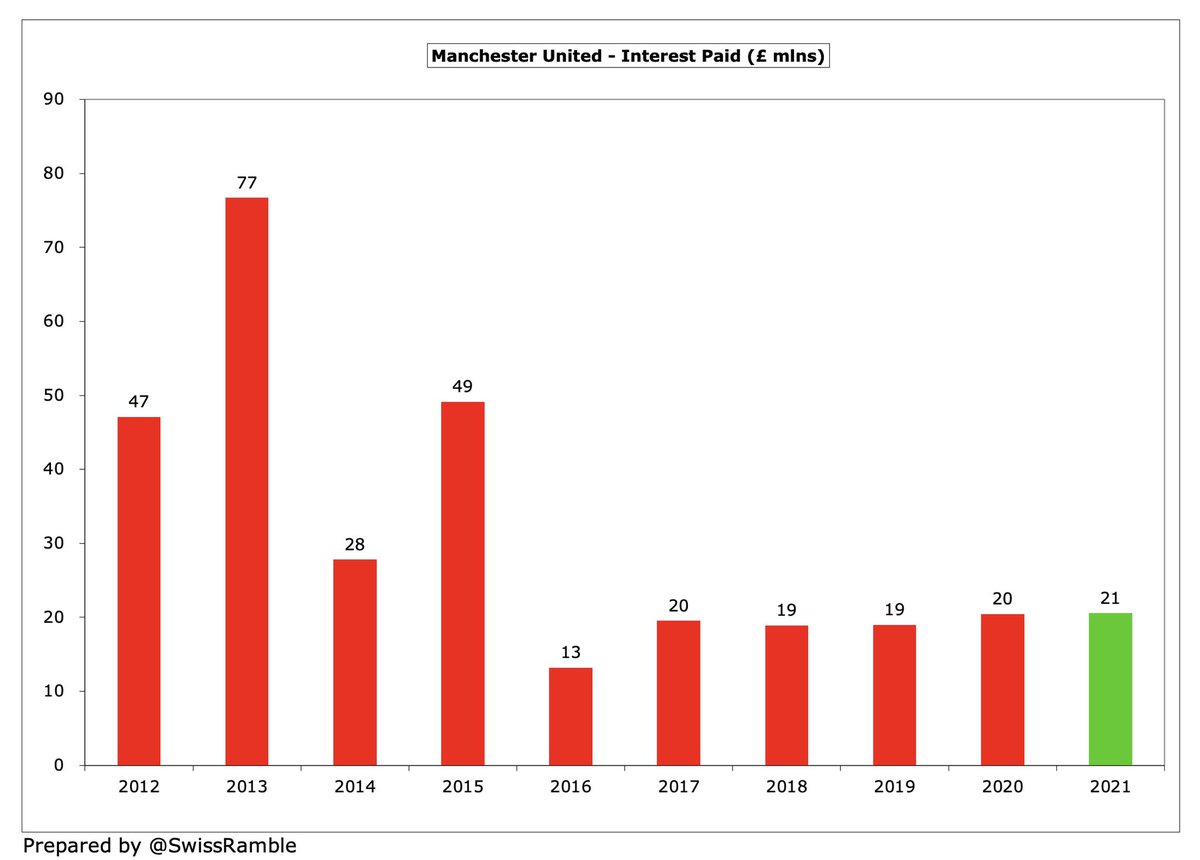

Although it has fallen from its (sizeable) peak, #MUFC annual interest payment of £21m is a lot more than every other Premier League club with the closest challengers being #THFC £14m and #AFC £11m. More relevantly, #LFC and #MCFC only paid £2m and £1m respectively.

Despite the financial challenges, #MUFC have still found enough cash to pay shareholders (mainly the Glazers) a full £22m dividend. First half (£11m) included in 2020/21 accounts, while the remainder was paid on 30 July (i.e. after the accounts closed).

Even though Joel Glazer has attempted to justify the dividends as “a modest proportion of our five to six hundred million pounds of revenue”, it is striking how much the club has paid here: around £133m in the last 6 years. Only one other club has paid dividends in this period.

#MUFC would have had even more money to spend if they did not have to bear the cost of the Glazers’ leveraged buy-out. Since 2006 they have spent over £1 bln on financing: £725m interest, £186m debt repayments and £136m dividends. Dividends/interest annual cost is around £44m.

Furthermore, in the 5 years up to 2020, no owners in the Premier League have taken out more money than #MUFC’s £133m (dividends £112m, share buyback £21m). In stark contrast, some owners have put in significant funds: #EFC £348m, #AVFC £337m and #CFC £255m.

That said, it is clear that #MUFC have coped with the pandemic better than most, as evidenced by the financial woes at many of their peers. As Woodward said, “It is not an accident that we have been able to invest this summer at a time when many clubs have been retrenching.”

Woodward added, “This was made possible by the strength of our operating model, with sustained investment in the team underpinned by robust commercial revenues.” Despite the huge revenue losses, #MUFC remain in a relatively strong position compared to other clubs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh