Evergrande is NOT 2008.

Time for a thread 👇

Time for a thread 👇

1. Not interconnected to the global financial system:

- Debts are mainly owed to Chinese companies.

- Didn't happen overnight, problems started last year when the pandemic slowed down sales.

- Anyone that still owns their debt may need to find another job.

- Debts are mainly owed to Chinese companies.

- Didn't happen overnight, problems started last year when the pandemic slowed down sales.

- Anyone that still owns their debt may need to find another job.

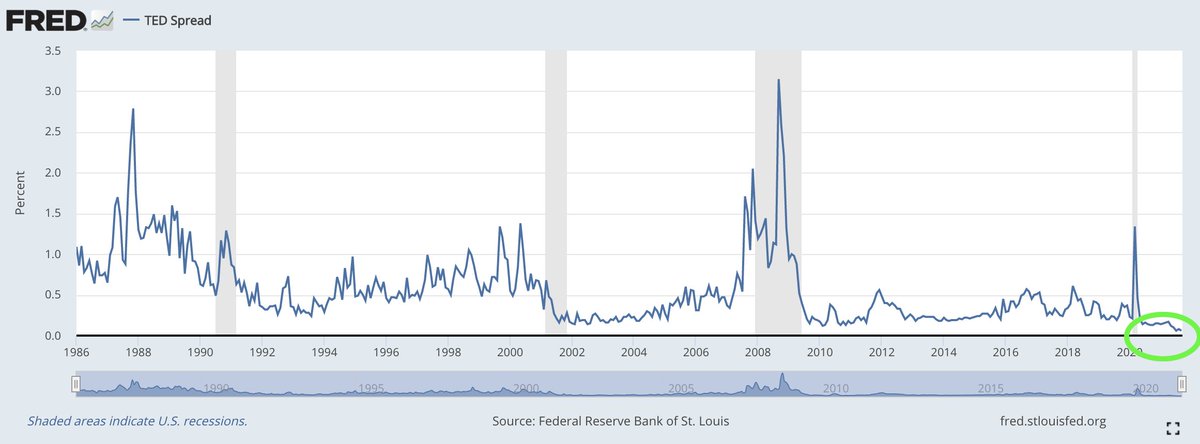

2. No blowout financial crunch:

- TED spread FINE

- TED spread is difference between the interest rate on short-term U.S. government debt & the interest rate on interbank loans.

- In 2008, the TED spread exceeded +300 bps, breaking previous record set after the crash of 1987.

- TED spread FINE

- TED spread is difference between the interest rate on short-term U.S. government debt & the interest rate on interbank loans.

- In 2008, the TED spread exceeded +300 bps, breaking previous record set after the crash of 1987.

3. Not too big to fail:

- Evergrande has $19B in international debt

- US Federal Reserve buys $120B in bonds EVERY MONTH

Credit: @bullandbaird

- Evergrande has $19B in international debt

- US Federal Reserve buys $120B in bonds EVERY MONTH

Credit: @bullandbaird

4. Not without a plan:

- Evergrande has hired financial advisors & is moving to debt restructuring

- Chinese government wants to stop home prices from surging

- Speculation is govt. will let it fail BUT find way to protect people who have paid for unfinished apartments

- Evergrande has hired financial advisors & is moving to debt restructuring

- Chinese government wants to stop home prices from surging

- Speculation is govt. will let it fail BUT find way to protect people who have paid for unfinished apartments

4. Not without a plan (cont):

- Evergrande is estimated to have presold +1.4MM apartments valued at $200 billion

- Chinese government would get other developers to take over the unfinished apartments

- Evergrande is estimated to have presold +1.4MM apartments valued at $200 billion

- Chinese government would get other developers to take over the unfinished apartments

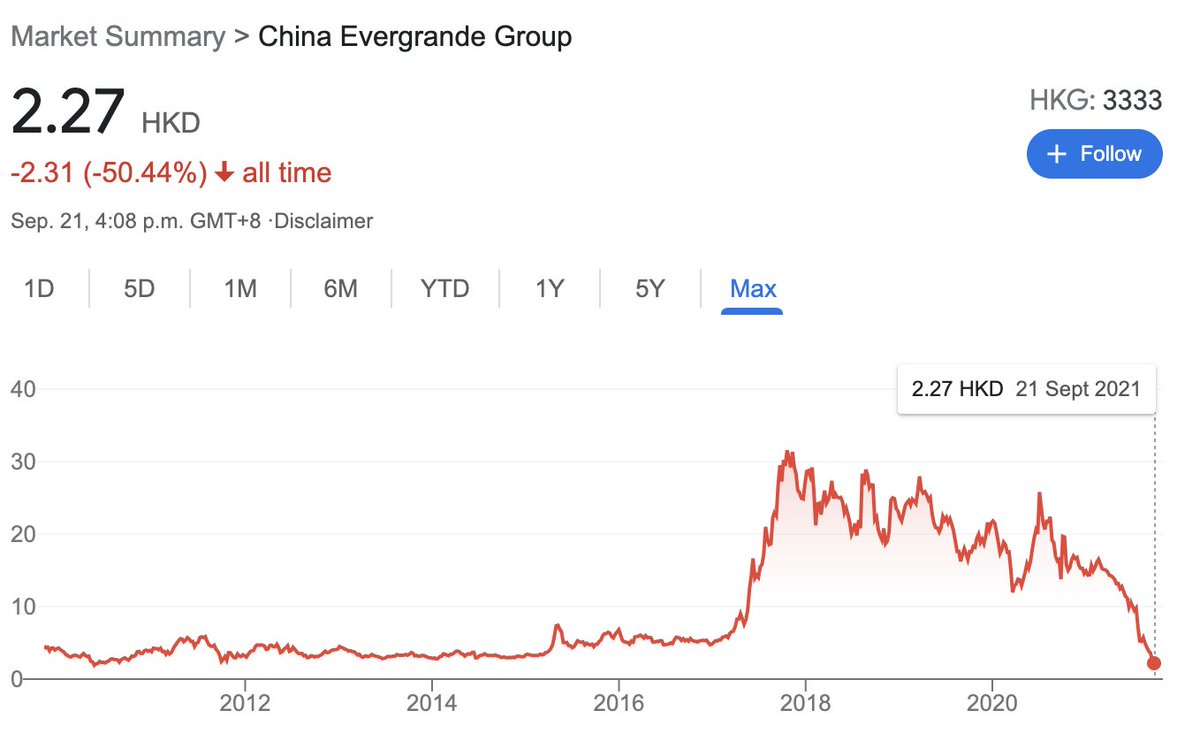

5. Having said that...

Lord give me the strength of investors buying Evergrande stock at $2 which looks like it’s going to zero.

Lord give me the strength of investors buying Evergrande stock at $2 which looks like it’s going to zero.

• • •

Missing some Tweet in this thread? You can try to

force a refresh