Did you know Tesla’s biggest profit center is CARBON CREDITS?

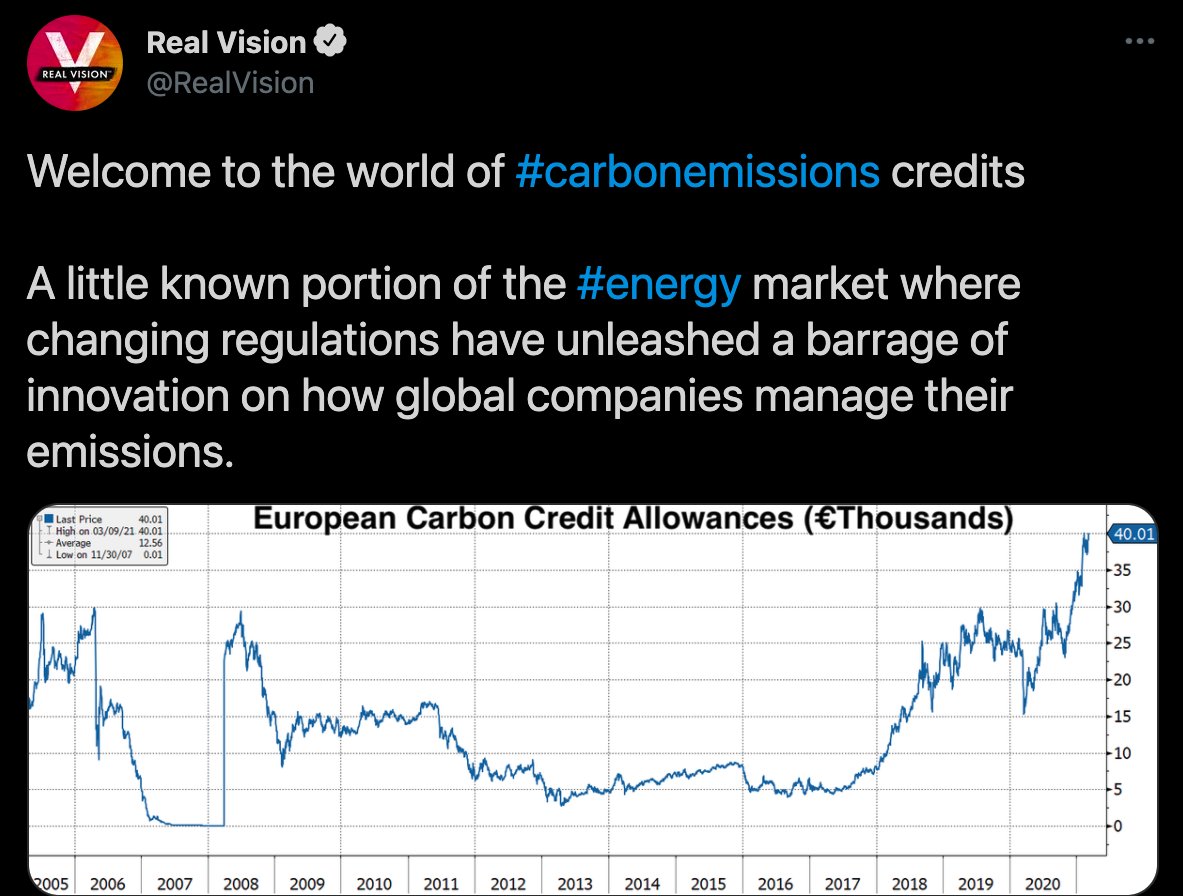

Did you also know carbon credits are hitting all-time highs in Europe, up 135% over the last 12 months.

The Wall Street Journal even called them a HOT commodity – maybe the next OIL ;)

Time for a thread 👇👇👇

Did you also know carbon credits are hitting all-time highs in Europe, up 135% over the last 12 months.

The Wall Street Journal even called them a HOT commodity – maybe the next OIL ;)

Time for a thread 👇👇👇

This week, in <5 minutes, we’ll cover carbon credits:

GHGs 👉 Carbon dioxide production

Carbon Credits 👉 Tradable certificates

Assigning responsibility 👉 Track carbon on a micro level (blockchain!)

Examples in the market today 👉 Corporations driving change

Let’s get started!

GHGs 👉 Carbon dioxide production

Carbon Credits 👉 Tradable certificates

Assigning responsibility 👉 Track carbon on a micro level (blockchain!)

Examples in the market today 👉 Corporations driving change

Let’s get started!

1.1/ Greenhouse gases (GHGs) 👉 CO2 production

Carbon dioxide being released into the atmosphere is the primary cause of global warming. This is done in two ways: natural and human.

Natural: forest fires occur, volcanoes erupt, etc.

Human: wood, coal, natural gas burning.

Carbon dioxide being released into the atmosphere is the primary cause of global warming. This is done in two ways: natural and human.

Natural: forest fires occur, volcanoes erupt, etc.

Human: wood, coal, natural gas burning.

1.2/ GHG

Carbon dioxide is a greenhouse gas (GHG): a gas that absorbs and radiates heat.

Unlike oxygen or nitrogen (which make up most of our atmosphere), greenhouse gases absorb that heat and release it gradually over time, like bricks in a fireplace after the fire goes out.

Carbon dioxide is a greenhouse gas (GHG): a gas that absorbs and radiates heat.

Unlike oxygen or nitrogen (which make up most of our atmosphere), greenhouse gases absorb that heat and release it gradually over time, like bricks in a fireplace after the fire goes out.

1.3/ GHG

Without this greenhouse effect, Earth’s average annual temperature would be below freezing instead of close to 60°F.

But increases in greenhouse gases have tipped the Earth's energy budget out of balance, trapping additional heat and raising Earth's temperature.

Without this greenhouse effect, Earth’s average annual temperature would be below freezing instead of close to 60°F.

But increases in greenhouse gases have tipped the Earth's energy budget out of balance, trapping additional heat and raising Earth's temperature.

1.4/ GLOBAL WARMING

Global warming stresses ecosystems through temperature rises, water shortages, increased fire threats, drought, weed and pest invasions, intense storm damage and salt invasion, just to name a few.

This is a very expensive problem!

Global warming stresses ecosystems through temperature rises, water shortages, increased fire threats, drought, weed and pest invasions, intense storm damage and salt invasion, just to name a few.

This is a very expensive problem!

2.1/ Carbon Credits 👉 Tradable certificates, cap-and-trade programs

The ultimate goal of carbon credits is to reduce the emission of GHGs into the atmosphere.

A carbon credit is any tradable certificate or permit representing the right to emit one tonne of a GHG.

The ultimate goal of carbon credits is to reduce the emission of GHGs into the atmosphere.

A carbon credit is any tradable certificate or permit representing the right to emit one tonne of a GHG.

2.2/ CAP & TRADE

An idea came about to facilitate carbon credits: cap-and-trade.

Cap: set limits on GHG emissions, which will lower over time.

Trade: companies can buy and sell allowances that let them emit only a certain amount, while supply and demand set the price.

An idea came about to facilitate carbon credits: cap-and-trade.

Cap: set limits on GHG emissions, which will lower over time.

Trade: companies can buy and sell allowances that let them emit only a certain amount, while supply and demand set the price.

2.3/

What this does is put a hard cap on pollution-producing businesses like electric power plants, large industrial plants, and fuel distributors.

Once a cap is set, the government sells “allowances” to exceed these limits, essentially taxing pollution. These are then traded.

What this does is put a hard cap on pollution-producing businesses like electric power plants, large industrial plants, and fuel distributors.

Once a cap is set, the government sells “allowances” to exceed these limits, essentially taxing pollution. These are then traded.

2.4/

By creating a free market, investors are welcomed into the market on top of actual companies that need to purchase these in order to be compliant.

When you have more actors in a market, this creates a more liquid market, therefore making price discovery more effective!

By creating a free market, investors are welcomed into the market on top of actual companies that need to purchase these in order to be compliant.

When you have more actors in a market, this creates a more liquid market, therefore making price discovery more effective!

2.5/ CARBON CAPTURE

One risk is that superior carbon capture technology may come out that will eliminate the need for cap and trade programs altogether.

The technology isn't there yet, but the acceleration of carbon capture could essentially wipe out the need for this market.

One risk is that superior carbon capture technology may come out that will eliminate the need for cap and trade programs altogether.

The technology isn't there yet, but the acceleration of carbon capture could essentially wipe out the need for this market.

3.1/ Tracking carbon on a micro level 👉 The Blockchain!

I came across an absolutely fascinating podcast by the always-interesting Robert Friedland.

Mr. Friedland is a billionaire mining legend.

I came across an absolutely fascinating podcast by the always-interesting Robert Friedland.

Mr. Friedland is a billionaire mining legend.

3.2/

A particular section I found interesting was when Mr. Friedland went into granular assignment of a carbon footprint through blockchain-like technology that could foster electronic markets where there are 30 grades of copper, nickel, and lithium from individual mines.

A particular section I found interesting was when Mr. Friedland went into granular assignment of a carbon footprint through blockchain-like technology that could foster electronic markets where there are 30 grades of copper, nickel, and lithium from individual mines.

3.3/

To me, this sounds like an epic technological undertaking that could surpass the efficacy of a carbon credit cap-and-trade incentive network.

Cool stuff.

To me, this sounds like an epic technological undertaking that could surpass the efficacy of a carbon credit cap-and-trade incentive network.

Cool stuff.

4.1/ Examples in the market today 👉 Corporations driving change

Companies always seem to be 'thinking about the climate problem.'

While Carbon credits attempt to shift incentives, root-cause initiatives on a company level are also extremely important.

Companies always seem to be 'thinking about the climate problem.'

While Carbon credits attempt to shift incentives, root-cause initiatives on a company level are also extremely important.

4.2/ Examples (of companies I own):

Apple (NASDAQ:AAPL) - The company recently shared details about its $4.7B spend in green bonds to support environmental projects around the world. While running on 100% renewable energy for nearly 3 years.

Apple (NASDAQ:AAPL) - The company recently shared details about its $4.7B spend in green bonds to support environmental projects around the world. While running on 100% renewable energy for nearly 3 years.

4.3/

Microsoft (NASDAQ:MSFT) - Signed a power purchase agreement (PPA) to cover 100% of Microsoft’s energy consumption in Sweden

Microsoft (NASDAQ:MSFT) - Signed a power purchase agreement (PPA) to cover 100% of Microsoft’s energy consumption in Sweden

4.4/ Other Examples:

General Motors (NSYE:GM) - They plan to source 100% renewable energy to meet GM’s global electricity needs by 2035.

Starbucks (NYSE:SBUX) - Source 100% renewable energy for its more than 9,000 US, Canada, and EMEA company-operated stores since 2015.

General Motors (NSYE:GM) - They plan to source 100% renewable energy to meet GM’s global electricity needs by 2035.

Starbucks (NYSE:SBUX) - Source 100% renewable energy for its more than 9,000 US, Canada, and EMEA company-operated stores since 2015.

Deal Alert!

Six months ago, through my deal flow connections, I was able to get in on a hot new carbon deal. I invested on 2 private rounds at $0.25/share and $0.75/share BOTH had full warrants. They may be going public at $1/share, raising +$100MM and looking to list on NASDAQ!

Six months ago, through my deal flow connections, I was able to get in on a hot new carbon deal. I invested on 2 private rounds at $0.25/share and $0.75/share BOTH had full warrants. They may be going public at $1/share, raising +$100MM and looking to list on NASDAQ!

Safe to say, I’m a happy camper.

Do you want to see private deals like these?

You can NOW on my paid newsletter 👇

gritcapital.substack.com/subscribe?coup…

Do you want to see private deals like these?

You can NOW on my paid newsletter 👇

gritcapital.substack.com/subscribe?coup…

5/ GRIT NEWSLETTER

Every week I write a newsletter to +32k investors, including hedge funds, billionaires, institutions & retail investors.

#3 TOP finance newsletter on Substack!

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

Every week I write a newsletter to +32k investors, including hedge funds, billionaires, institutions & retail investors.

#3 TOP finance newsletter on Substack!

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh