Fortnite made +$2.4B selling digital costumes…

Talk about a demand for alternative assets!

Do you have enough exposure?

Time for a thread 👇👇👇

Talk about a demand for alternative assets!

Do you have enough exposure?

Time for a thread 👇👇👇

60/40 is dead.

Smart money knows this but few talk about it.

That is: 60% of your portfolio in Equities and 40% in Bonds.

But what happens when the risk-reward profile changes?

It gets replaced with 60/20/20 with the introduction of Alternatives!

Smart money knows this but few talk about it.

That is: 60% of your portfolio in Equities and 40% in Bonds.

But what happens when the risk-reward profile changes?

It gets replaced with 60/20/20 with the introduction of Alternatives!

Today, in <5 minutes, we’ll cover:

Why “digital alternatives” came to exist 👉 change of the old guard, technological advancements

Crypto 👉 Market update and increased adoption

NFTs 👉 What the heck are these things?

Why “digital alternatives” came to exist 👉 change of the old guard, technological advancements

Crypto 👉 Market update and increased adoption

NFTs 👉 What the heck are these things?

1.1/ Why “digital alternatives” came to exist 👉 Change of the old guard, technological advancements

You’d have to be living in a cave to miss the whole trend of cryptocurrencies and NFTs (non-fungible tokens), but why did they come about and why does it matter?

You’d have to be living in a cave to miss the whole trend of cryptocurrencies and NFTs (non-fungible tokens), but why did they come about and why does it matter?

1.2/ 5 ASSET CLASSES

Depending on which business school textbook you crack open, you can traditionally find around 5 different asset classes:

Equities

Fixed Income/Bonds

Currencies

Commodities

Real Estate/ Real Assets (Infrastructure, Farm Land, etc)

Depending on which business school textbook you crack open, you can traditionally find around 5 different asset classes:

Equities

Fixed Income/Bonds

Currencies

Commodities

Real Estate/ Real Assets (Infrastructure, Farm Land, etc)

1.3/ 1-3

Equities are typically higher risk, higher return when compared to fixed income and bonds that provide stability (generally) and cash flow.

Currency as an asset class involves making macroeconomic calls surrounding relative interest rate policy and GDP growth rates.

Equities are typically higher risk, higher return when compared to fixed income and bonds that provide stability (generally) and cash flow.

Currency as an asset class involves making macroeconomic calls surrounding relative interest rate policy and GDP growth rates.

1.4/ 4&5

Commodities are cyclical in nature and tend to expand and contract with the overall economy.

Real estate and real assets are historically great protection against inflation (if prices go up, so does the value of real assets).

Commodities are cyclical in nature and tend to expand and contract with the overall economy.

Real estate and real assets are historically great protection against inflation (if prices go up, so does the value of real assets).

1.5/ THE GOOD NEWS

ALL these asset classes are now available to regular investors. There is no excuse not to be diversifying.

The idea is to have the right combination of these assets, and this is what the smart money do in order to generate uncorrelated returns.

ALL these asset classes are now available to regular investors. There is no excuse not to be diversifying.

The idea is to have the right combination of these assets, and this is what the smart money do in order to generate uncorrelated returns.

1.6/ WHY?

Why do we want uncorrelated returns? Because you want to capture returns through all parts of the economic cycle. Different asset classes shine at different times.

Conversely, different asset classes suck at different times.

Why do we want uncorrelated returns? Because you want to capture returns through all parts of the economic cycle. Different asset classes shine at different times.

Conversely, different asset classes suck at different times.

1.7/

These buckets served well as traditional means to allocate capital towards efficient means of (physical) production.

But what about now? When so much of that “production” has moved online.

These buckets served well as traditional means to allocate capital towards efficient means of (physical) production.

But what about now? When so much of that “production” has moved online.

1.8/ ENTER CRYPTO & NFTs

Cryptocurrencies are not like traditional currencies because they are not issued by a central bank that can control the monetary supply and interest rates.

It is at the center of the Decentralized Finance movement that is disintermediating banks.

Cryptocurrencies are not like traditional currencies because they are not issued by a central bank that can control the monetary supply and interest rates.

It is at the center of the Decentralized Finance movement that is disintermediating banks.

1.9/ NFTs

When you break them down, NFTs are like real assets, except they are not exactly “real.”

These two assets are different and are at the intersection of an asset class revolution and the shift to a digital-first economy. Every Investment Advisor NEEDS TO PAY ATTENTION.

When you break them down, NFTs are like real assets, except they are not exactly “real.”

These two assets are different and are at the intersection of an asset class revolution and the shift to a digital-first economy. Every Investment Advisor NEEDS TO PAY ATTENTION.

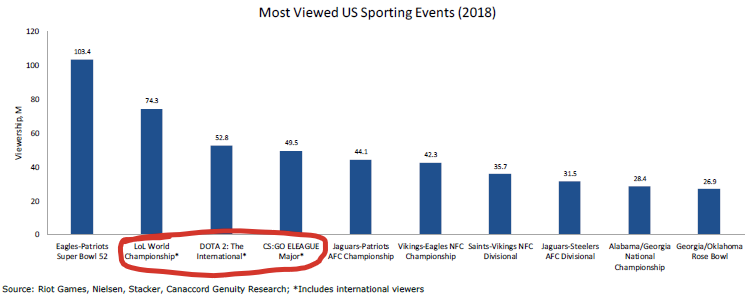

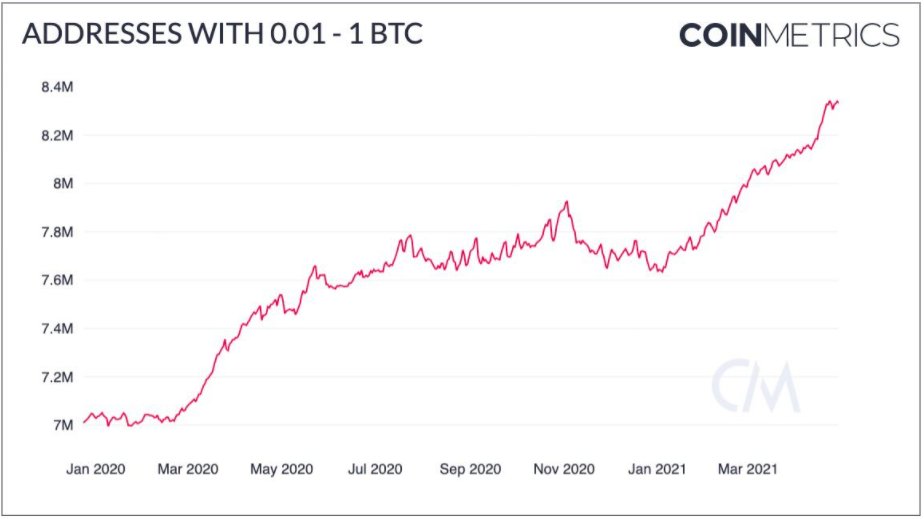

2.1/ Crypto 👉 Market update & increased adoption metrics

The market commentary surrounding BTC & ETH has been characterized as “broadening strength”. This is a terrific indicator. When the “breadth” of a market rally widens, it is indicating overall strength and staying power.

The market commentary surrounding BTC & ETH has been characterized as “broadening strength”. This is a terrific indicator. When the “breadth” of a market rally widens, it is indicating overall strength and staying power.

2.2/ MORE COMFORTABLE

This is due to institutions beginning to get more comfortable with the underlying technology.

In early adoption stages there are trailblazers, then when iteration of ideas occurs, the kinks start to get worked out. Shots on net!

This is due to institutions beginning to get more comfortable with the underlying technology.

In early adoption stages there are trailblazers, then when iteration of ideas occurs, the kinks start to get worked out. Shots on net!

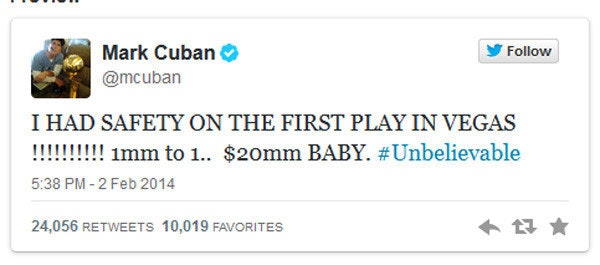

2.3/ BRRRRR....

People are now paying attention to this in terms of both institutionalized adoption and as a hedge against inflation, which we know is coming with a massive amount of money printing, as we talked about in my previous newsletters.

People are now paying attention to this in terms of both institutionalized adoption and as a hedge against inflation, which we know is coming with a massive amount of money printing, as we talked about in my previous newsletters.

2.4/ To me...

BTC & ETH are a store of value, a means of transaction, and building blocks to the new digital economy.

Ideas and constructs are allowed to be different things to different people.

What you can’t really debate is the widespread use and acceptance of this asset.

BTC & ETH are a store of value, a means of transaction, and building blocks to the new digital economy.

Ideas and constructs are allowed to be different things to different people.

What you can’t really debate is the widespread use and acceptance of this asset.

2.5/ FUNDS!

+$3B in assets from institutions in Canada have flown into Bitcoin closed-end funds and ETFs in order for Investment Advisors to gain exposure in an equity-like vehicle.

+$3B in assets from institutions in Canada have flown into Bitcoin closed-end funds and ETFs in order for Investment Advisors to gain exposure in an equity-like vehicle.

2.6/ ENERGY...

Bitcoin currently consumes 0.55% of electricity with +40% being carbon-neutral.

As one of my favourite Bitcoiners said on CNBC:

“Larry Fink better drop the dollar then, cause the dollar is way worse for the environment than bitcoin is.” -@APompliano

Bitcoin currently consumes 0.55% of electricity with +40% being carbon-neutral.

As one of my favourite Bitcoiners said on CNBC:

“Larry Fink better drop the dollar then, cause the dollar is way worse for the environment than bitcoin is.” -@APompliano

3.1/ NFTs 👉 What the heck are these things?

Mentions of NFTs by executives are skyrocketing in 2021.

When you try to google what is an NFT (Non-fungible token), you get some next-level mumbo jumbo.

So let’s just call it what it is:

Unique digital certificate. Much better.

Mentions of NFTs by executives are skyrocketing in 2021.

When you try to google what is an NFT (Non-fungible token), you get some next-level mumbo jumbo.

So let’s just call it what it is:

Unique digital certificate. Much better.

3.2/ AUTHENTIC

Just like when you buy shares in a stock, you get a unique certificate that verifies its authenticity.

NFTs however, exist only in the digital world - so you don’t have to worry about storing it for a price, or worry about the condition deteriorating over time.

Just like when you buy shares in a stock, you get a unique certificate that verifies its authenticity.

NFTs however, exist only in the digital world - so you don’t have to worry about storing it for a price, or worry about the condition deteriorating over time.

3.3/ DIGITAL GOODS!

But when it comes to desirability for differentiation or status signaling, think about how Fortnite made $2.4B in 2018 alone selling digital costumes. So the market for digital goods exists!

But when it comes to desirability for differentiation or status signaling, think about how Fortnite made $2.4B in 2018 alone selling digital costumes. So the market for digital goods exists!

3.4/ IMAGINE...

A world where you are provided base customizability in your house and avatar & you pay for upgrades.

In this world, you also own unique digital assets like skins. Unique digital assets can also have utility beyond just aesthetic. This sounds like the metaverse!

A world where you are provided base customizability in your house and avatar & you pay for upgrades.

In this world, you also own unique digital assets like skins. Unique digital assets can also have utility beyond just aesthetic. This sounds like the metaverse!

4/ GRIT NEWSLETTER

Want more?

Every week I write a newsletter to +28k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

Want more?

Every week I write a newsletter to +28k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh