AMC has been one of the most spectacular shows I have witnessed in my 15 years in finance…

Momentum investing on steroids!

How did we go from reading quotes in newspapers to hedge funds bleeding billions while retail investors make millions overnight?

Time for a thread 👇

Momentum investing on steroids!

How did we go from reading quotes in newspapers to hedge funds bleeding billions while retail investors make millions overnight?

Time for a thread 👇

PLUS...

I’m extremely excited to announce that MY PAID NEWSLETTER HAS LAUNCHED.

FIRST ISSUE DROPPED MONDAY.

I talked about 4 private deals I am putting money into. Don't miss out!

Sign up here 👇 before June 30th and get 15% off!

gritcapital.substack.com/subscribe?coup…

I’m extremely excited to announce that MY PAID NEWSLETTER HAS LAUNCHED.

FIRST ISSUE DROPPED MONDAY.

I talked about 4 private deals I am putting money into. Don't miss out!

Sign up here 👇 before June 30th and get 15% off!

gritcapital.substack.com/subscribe?coup…

This week, in <5 minutes, we’ll cover The Retail Revolution:

A Brief History of Market Access 👉 Exclusivity & Old ‘Boys’ Clubs

The Information Age 👉 Electronic Trading

Entry of ETFs 👉 Jack Bogle, Passive Investing

Let’s get started!

A Brief History of Market Access 👉 Exclusivity & Old ‘Boys’ Clubs

The Information Age 👉 Electronic Trading

Entry of ETFs 👉 Jack Bogle, Passive Investing

Let’s get started!

1.1/ A Brief History of Market Access 👉 Exclusivity

In a not-too-long ago world, investing in a single stock as an individual was hard.

This is what’s is portrayed in old movies when you see a gaggle of “stock brokers” huddled around a newspaper checking the quotes.

In a not-too-long ago world, investing in a single stock as an individual was hard.

This is what’s is portrayed in old movies when you see a gaggle of “stock brokers” huddled around a newspaper checking the quotes.

1.2/ THE OLD WAY

People with the right resources were the only ones that could access a wealth of information in order to buy or sell.

Once you knew which company you wanted to invest in, you called your broker and asked to buy the stock, indicating the quantity and price.

People with the right resources were the only ones that could access a wealth of information in order to buy or sell.

Once you knew which company you wanted to invest in, you called your broker and asked to buy the stock, indicating the quantity and price.

1.3/ MIDDLEMEN

This allowed the middlemen in the system to extract value, which took returns away from the individual investor.

Or worse still, everyday people would get targeted by snake oil salesmen after hearing about their friends getting rich through the Stock Market.

This allowed the middlemen in the system to extract value, which took returns away from the individual investor.

Or worse still, everyday people would get targeted by snake oil salesmen after hearing about their friends getting rich through the Stock Market.

2.1/ The Information Age 👉 Electronic Trading

I remember back when I got my first gig in the business as a summer intern, the traders on the floor (and in our office) used an actual physical piece of paper to write down buy and sell orders. I couldn’t believe it.

I remember back when I got my first gig in the business as a summer intern, the traders on the floor (and in our office) used an actual physical piece of paper to write down buy and sell orders. I couldn’t believe it.

2.2/ THE OLD SCHOOL MENTALITY...

Refused to change. They used these sheets and made their assistants log the trades into the computer.

There were two revolutions taking place.

The access of information made possible by the internet.

And executing a trade was becoming easier.

Refused to change. They used these sheets and made their assistants log the trades into the computer.

There were two revolutions taking place.

The access of information made possible by the internet.

And executing a trade was becoming easier.

2.3/ INTERNET

It’s no secret the internet gave everyone access to unlimited instantaneous information. You could now check through financials and market news all right at your fingertips from a terminal.

This is how Mike Bloomberg got so rich. As a merchant of information.

It’s no secret the internet gave everyone access to unlimited instantaneous information. You could now check through financials and market news all right at your fingertips from a terminal.

This is how Mike Bloomberg got so rich. As a merchant of information.

2.4/ EXECUTION

The next to get disrupted was execution.

The NASDAQ didn’t begin as an electronic trading system. It was just an automated quotation system that allowed broker-dealers to see the prices that other firms were offering, while trades were handled over the phone.

The next to get disrupted was execution.

The NASDAQ didn’t begin as an electronic trading system. It was just an automated quotation system that allowed broker-dealers to see the prices that other firms were offering, while trades were handled over the phone.

2.5/ BLACK MONDAY

The 1987 stock market crash '“Black Monday” changed this.

As major US markets crashed 20-30% in one day, some market makers straight up refused to pick up their phone.

This caused contagion in the system and ultimately made the panic sell even worse.

The 1987 stock market crash '“Black Monday” changed this.

As major US markets crashed 20-30% in one day, some market makers straight up refused to pick up their phone.

This caused contagion in the system and ultimately made the panic sell even worse.

2.6/

After this, the Small Orders Execution System was launched, allowing electronic order delivery. Other exchanges soon followed, like CME’s Globex in 1992.

In Canada, it’s tough to believe that we didn’t have an electronic exchange for the Toronto Stock Exchange until 1997.

After this, the Small Orders Execution System was launched, allowing electronic order delivery. Other exchanges soon followed, like CME’s Globex in 1992.

In Canada, it’s tough to believe that we didn’t have an electronic exchange for the Toronto Stock Exchange until 1997.

2.7/ HUGE COMMISSION

What electronic trading did is lower information asymmetry when it comes to executing trades and accessing prices.

This was the beginning of the end of the “middleman tax” AKA Huge Trading Commission.

What electronic trading did is lower information asymmetry when it comes to executing trades and accessing prices.

This was the beginning of the end of the “middleman tax” AKA Huge Trading Commission.

3.1/ Entry of ETFs 👉 Jack Bogle & Passive Investing

With execution and access to information simplified, the retail investor was now more empowered to buy individual stocks.

With execution and access to information simplified, the retail investor was now more empowered to buy individual stocks.

3.2/ THE PROBLEM

But individual stocks are risky and most people don’t want to remain tapped in 24/7 to monitor their positions, and the only pooled options at the time that were mainstream were mutual funds.

Mutual funds have been around for a long time - dating back to 1929.

But individual stocks are risky and most people don’t want to remain tapped in 24/7 to monitor their positions, and the only pooled options at the time that were mainstream were mutual funds.

Mutual funds have been around for a long time - dating back to 1929.

3.3/ MUTUAL FUNDS

They had a common fee of around 2% per year based on what you put into the fund AKA assets under management (AUM).

The idea here is you get someone who can beat the market consistently by more than 2% that thus can manage your money to make you rich.

They had a common fee of around 2% per year based on what you put into the fund AKA assets under management (AUM).

The idea here is you get someone who can beat the market consistently by more than 2% that thus can manage your money to make you rich.

3.4/ BUT...

Is that always the case? Let’s break down the math.

Hedge funds push the envelope on fees further and charge “2 and 20”, AKA 2% management fee per year on AUM, then 20% of the fund’s performance above a certain benchmark.

Is that always the case? Let’s break down the math.

Hedge funds push the envelope on fees further and charge “2 and 20”, AKA 2% management fee per year on AUM, then 20% of the fund’s performance above a certain benchmark.

3.5/ FEES

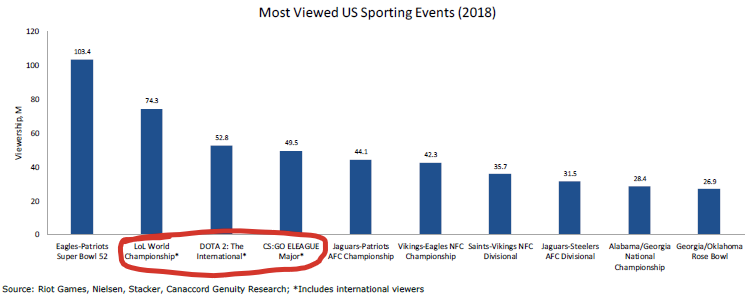

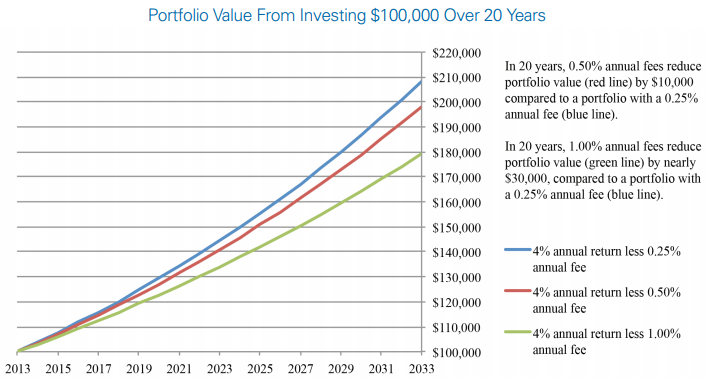

All this is to say that not only PERFORMANCE but also FEES are very important components of your return.

This is why Exchange Traded Funds (ETFs) came into existence. To lower the fees.

All this is to say that not only PERFORMANCE but also FEES are very important components of your return.

This is why Exchange Traded Funds (ETFs) came into existence. To lower the fees.

3.6/ ETFs

ETFs are a basket of stocks that track an index, sector, or other types of asset that can be bought and sold just like a stock on an exchange.

Instead of buying one stock, you’re buying hundreds or thousands of them, and betting on the overall composite basket.

ETFs are a basket of stocks that track an index, sector, or other types of asset that can be bought and sold just like a stock on an exchange.

Instead of buying one stock, you’re buying hundreds or thousands of them, and betting on the overall composite basket.

3.7/ ETFs

What this allows an investor to do is make a bet on an overall industry or market in an extremely diversified way. When someone says “just buy the market,” they’re talking about ETFs.

They make the “benchmark” referenced above investible. And at a low cost!

What this allows an investor to do is make a bet on an overall industry or market in an extremely diversified way. When someone says “just buy the market,” they’re talking about ETFs.

They make the “benchmark” referenced above investible. And at a low cost!

3.8/

Compound interest is a wonderful force; high fees are equally powerful but in a destructive way. An ETF solves this!

A magnificent tool to use in your portfolio in order to enhance your returns. And as technology has evolved some newer tools have entered the market…

Compound interest is a wonderful force; high fees are equally powerful but in a destructive way. An ETF solves this!

A magnificent tool to use in your portfolio in order to enhance your returns. And as technology has evolved some newer tools have entered the market…

3.9/ ROBINHOOD

Like Robinhood, where you pay ZERO trading commissions.

In 2019, when Robinhood got so large the big firms couldn’t ignore them anymore they capitulated, copied and removed fees for stock and ETF trading.

This changed the entire industry.

Like Robinhood, where you pay ZERO trading commissions.

In 2019, when Robinhood got so large the big firms couldn’t ignore them anymore they capitulated, copied and removed fees for stock and ETF trading.

This changed the entire industry.

3.10/ ROBINHOOD

But Robinhood has to make money somehow… and the fee isn’t actually zero. Its’ much darker than that… DUN DUN DUN ….

Next week we’ll dive into this PLUS some mind-blowing innovations in the retail space!

But Robinhood has to make money somehow… and the fee isn’t actually zero. Its’ much darker than that… DUN DUN DUN ….

Next week we’ll dive into this PLUS some mind-blowing innovations in the retail space!

4/ GRIT NEWSLETTER

Want more?

Every week I write a newsletter to +29k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

Want more?

Every week I write a newsletter to +29k investors, including hedge funds, billionaires, institutions & retail investors.

SUBSCRIBE (it's Free!) 👇👇👇

gritcapital.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh