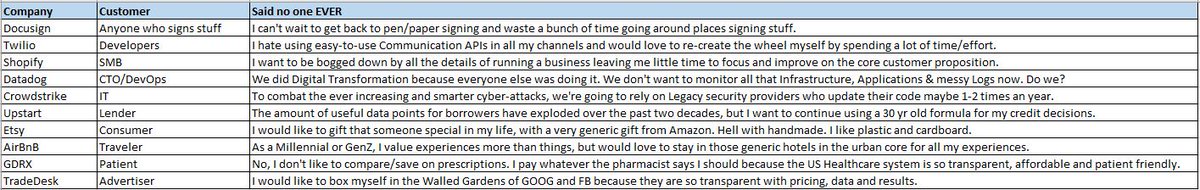

Thesis for🔟of my positions. The Fun version. Don't worry, I have a proper thesis too.

This is just a fun exercise, to zoom out from Stock prices, Quarterly Reports and look at the core customer value proposition.

$DOCU $TWLO $SHOP $DDOG $CRWD $UPST $ETSY $ABNB $GDRX $TTD

This is just a fun exercise, to zoom out from Stock prices, Quarterly Reports and look at the core customer value proposition.

$DOCU $TWLO $SHOP $DDOG $CRWD $UPST $ETSY $ABNB $GDRX $TTD

1⃣ $DOCU

Anyone who signs stuff - "I can't wait to get back to pen/paper signing and waste a bunch of time going around places signing stuff."

Anyone who signs stuff - "I can't wait to get back to pen/paper signing and waste a bunch of time going around places signing stuff."

2⃣ $TWLO

Developers : I hate using easy-to-use Communication APIs in all my channels and would love to re-create the wheel myself by spending a lot of time/effort.

Developers : I hate using easy-to-use Communication APIs in all my channels and would love to re-create the wheel myself by spending a lot of time/effort.

3⃣ $SHOP

SMB : I want to be bogged down by all the details of running an online business leaving me little time to focus and improve on the core customer proposition.

SMB : I want to be bogged down by all the details of running an online business leaving me little time to focus and improve on the core customer proposition.

4⃣ $DDOG

CTO/DevOps : We did Digital Transformation because everyone else was doing it. We don't want to monitor all that Infrastructure, Applications & messy Logs now. Do we?

CTO/DevOps : We did Digital Transformation because everyone else was doing it. We don't want to monitor all that Infrastructure, Applications & messy Logs now. Do we?

5⃣ $CRWD

IT : To combat the ever increasing and smarter cyber-attacks, we're going to rely on Legacy security providers who update their code maybe 1-2 times an year.

IT : To combat the ever increasing and smarter cyber-attacks, we're going to rely on Legacy security providers who update their code maybe 1-2 times an year.

6⃣ $UPST

Lender : The amount of useful data points for borrowers have exploded over the past two decades, but we want to continue using a 30 yr old formula for my credit decisions.

Lender : The amount of useful data points for borrowers have exploded over the past two decades, but we want to continue using a 30 yr old formula for my credit decisions.

7⃣ $ETSY

Consumer : I would like to gift that someone special in my life, a very generic gift from $AMZN. Hell with handmade. I like plastic and cardboard.

Consumer : I would like to gift that someone special in my life, a very generic gift from $AMZN. Hell with handmade. I like plastic and cardboard.

8⃣ $ABNB

Traveler : As a Millennial or GenZ, I value experiences more than things, but would love to stay in those generic hotels in the urban core for all my experiences.

Traveler : As a Millennial or GenZ, I value experiences more than things, but would love to stay in those generic hotels in the urban core for all my experiences.

9⃣ $GDRX

Patient : No, I don't like to compare/save on prescriptions. I pay whatever the pharmacist says I should because the US Healthcare system is so transparent, affordable and patient friendly.

Patient : No, I don't like to compare/save on prescriptions. I pay whatever the pharmacist says I should because the US Healthcare system is so transparent, affordable and patient friendly.

🔟 $TTD

Advertiser : I would like to box myself in the Walled Gardens of $GOOG and $FB because they are so transparent with pricing, data and results.

Advertiser : I would like to box myself in the Walled Gardens of $GOOG and $FB because they are so transparent with pricing, data and results.

The actual use cases in all these scenarios are to offer the customers a more efficient, cheaper, transparent solution or a better/differentiated experience compared to the Legacy offerings.

These are the Co.'s currently doing the best at those use cases leveraging Technology and keeping Customer needs at front/center of their offerings.

Doesn't mean that they always stay that far ahead or that the incumbents can't improve.

Doesn't mean that they always stay that far ahead or that the incumbents can't improve.

That's both the fun & challenging part of investing. Keeping up with who's winning & losing in the Competitive world, and if the current Market prices offer us an opportunity to go along for the long ride with the Winners.

These are my current horses in these races. Let's go. 🏇

These are my current horses in these races. Let's go. 🏇

• • •

Missing some Tweet in this thread? You can try to

force a refresh