Stunning new estimates suggest that the 400 wealthiest American families paid an average Federal tax rate of only 8.2%. whitehouse.gov/cea/blog/2021/…

Here’s why:

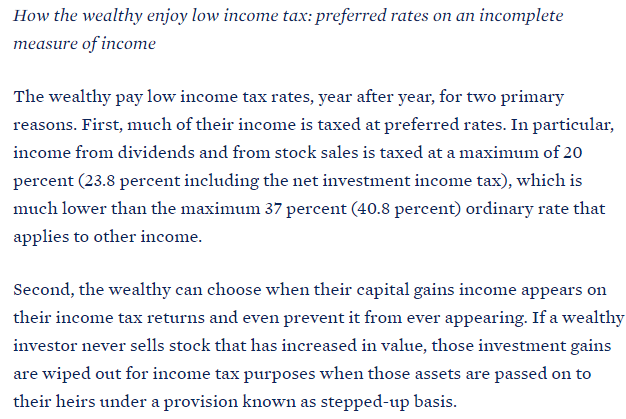

1. The rich rely on investment income, which is taxed at lower rates than labor income.

2. They pay no income tax on a big chunk of their investment income. (This is the “stepped up basis” loophole.)

1. The rich rely on investment income, which is taxed at lower rates than labor income.

2. They pay no income tax on a big chunk of their investment income. (This is the “stepped up basis” loophole.)

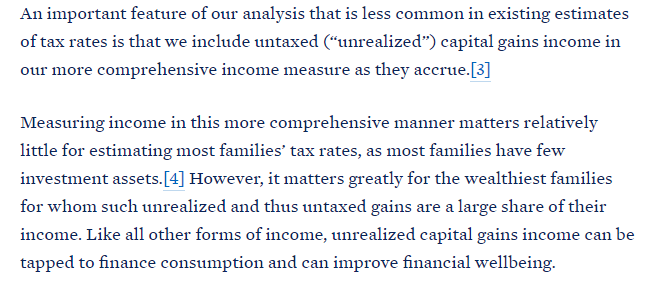

This new estimate does something quite important: It analyzes a measure of income that includes unrealized capital gains. The rich earn a lot of this income, but because it’s difficult to calculate, few estimates of tax rates include it.

Obvious implication: If past studies understated the income of the rich, they overstated the income tax *rates* the rich pay.

The analysis calculates average tax rates for the rich over the period 2010-18. This lower federal income tax rate is not a one-year anomaly, but a persistent result of the loopholes built into U.S. tax law.

While this analysis comes from the White House, it’s written by two of the leading tax scholars of their generation. It’s serious stuff. You might quibble with specific details, but it’s not going to change the big picture that the very rich face very low federal income tax rates

I see the old "but unrealized gains aren't income" crowd in my mentions. Let's follow that logic: If my employer pays my wage as stock rather than in $US, is it logical/fair/efficient to not count that as income? Or do we think it's a valuable asset, and hence counts as income?

• • •

Missing some Tweet in this thread? You can try to

force a refresh