In December the U.S. economy lost -140,000 jobs, and THE RECOVERY HAS STALLED JUST LIKE I WARNED.

We lost 22 million jobs in Feb & March, then regained half of them, and now we've stalled, with the economy in a deeper jobs hole than the darkest days after the financial crisis.

We lost 22 million jobs in Feb & March, then regained half of them, and now we've stalled, with the economy in a deeper jobs hole than the darkest days after the financial crisis.

The glimmer of good news here (and it's only a glimmer) is that October and November were stronger than we thought, and revisions added +135k to those months.

But there's no way around the depressing fact that the economy is in a hole as deep or deeper than anything following the financial crisis, the mechanical bounceback is behind us, and further progress has stalled.

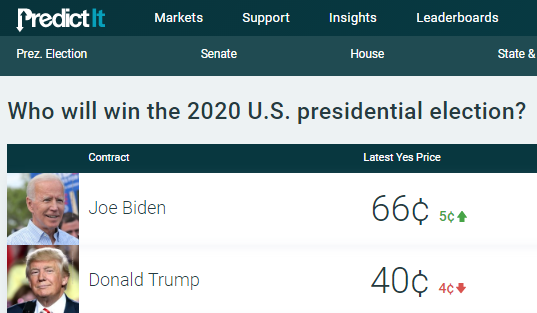

We're in the midst of a political crisis, during a public health crisis, and an economic crisis.

Millions are jobless, thousands are dying, and it's because dozens in DC are dithering.

The household survey doesn't really have any better news. It shows employment growth of a meager +21k, and so unemployment is only as low as it is (a still elevated 6.7%) because of an extraordinary exodus from the labor force.

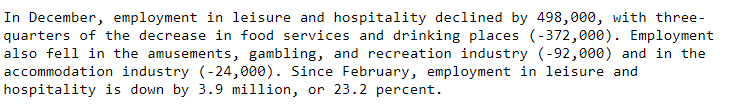

And this is an economic crisis that's disproportionately hurting the poor.

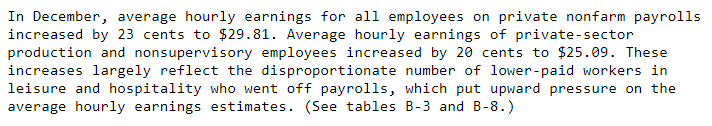

You can see this is a rather extraordinary statistic: Average wages are rising, but that's because low-wage workers are losing their jobs, leaving only high-wage workers in the average.

You can see this is a rather extraordinary statistic: Average wages are rising, but that's because low-wage workers are losing their jobs, leaving only high-wage workers in the average.

There's obviously no doubt that the third wave of covid is the cause of our current economic ills, and as a result, we lost nearly half a million jobs in leisure and hospitality.

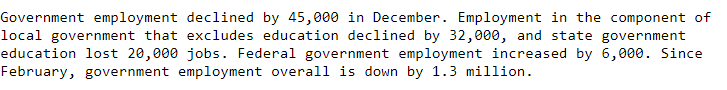

But there's a big unforced error that'll extend this economic crisis: The failure to provide aid to state and local governments means that they're cutting back, firing teachers and the like. It's totally unnecessary, but obviously follows from the logic of balanced budget rules.

The economic diagnosis here is simple: There's no economic health without public health. The surest way to restart the economy is to beat the bug.

To those who doubted this, we've tried your experiment, and it led to a third wave of covid, and an economic reversal.

To those who doubted this, we've tried your experiment, and it led to a third wave of covid, and an economic reversal.

Part of our economic crisis stems from our political crisis. Charlatans like @StephenMoore argued the problem was restrictions on business rather than a deadly virus.

Public health measures were relaxed, the virus spread, the economy stalled.

Public health measures were relaxed, the virus spread, the economy stalled.

https://twitter.com/Acyn/status/1294356556251684864

A technical side note. A recession is defined as a period of declining economic activity. By this logic the initial covid recession which started in February ended a few months later when the rebound started.

Today's numbers may signal that a second recession began in late 2020.

Today's numbers may signal that a second recession began in late 2020.

A Covid recession affects some more than others

https://twitter.com/mikemadowitz/status/1347542555483922434

• • •

Missing some Tweet in this thread? You can try to

force a refresh