BOOM! Payrolls growth of +943k in July, and unemployment down from 5.9% to 5.4%, and that's what a robust jobs report looks like.

Pretty helpful revisions add another +119k to May/June.

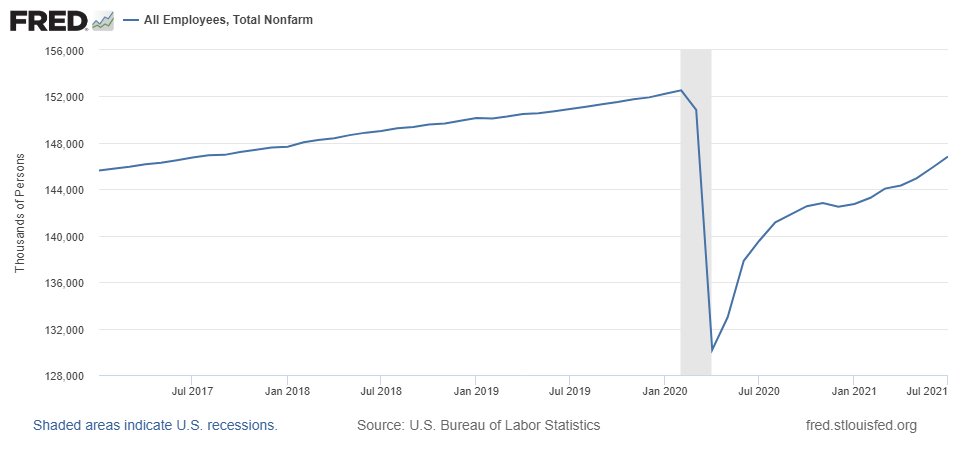

Volatility is a thing, so better to focus on the three month average of jobs gains running at +801k per month, which is pretty great, but also pretty necessary given the depth of the hole we're in.

Volatility is a thing, so better to focus on the three month average of jobs gains running at +801k per month, which is pretty great, but also pretty necessary given the depth of the hole we're in.

Household survey shows employment grew +1,043k in July, roughly confirming the payrolls numbers.

Unemployment fell a lot because more people got jobs. Participation actually rose a tick (though it has further to go).

Unemployment fell a lot because more people got jobs. Participation actually rose a tick (though it has further to go).

Some part of the story is changing seasonal patterns in hiring by schools -- related to their reopening -- and local government education jobs contributed +221k to July's payrolls growth.

Today's jobs data were collected in early July and reflect decisions made in June.

They're largely pre-Delta.

The most important economic variable is the spread of the virus (plus vaccines!) and these numbers say nothing about how Delta might cause the recovery to stall.

They're largely pre-Delta.

The most important economic variable is the spread of the virus (plus vaccines!) and these numbers say nothing about how Delta might cause the recovery to stall.

Another cold take: Taking one month's headline number to infer anything about the effects of UI benefits is a pretty dodgy proposition. Far better to dig into the state-by-state numbers, and thankfully we have this careful thread by @p_ganong:

https://twitter.com/p_ganong/status/1423483874911346695

As good as today's numbers are, the U.S. still has 6 million fewer jobs than it did pre-pandemic, and is about 8 million below the pre-pandemic trend. The labor market is still in a pretty deep hole, and we need a lot more numbers like today before we celebrate anything.

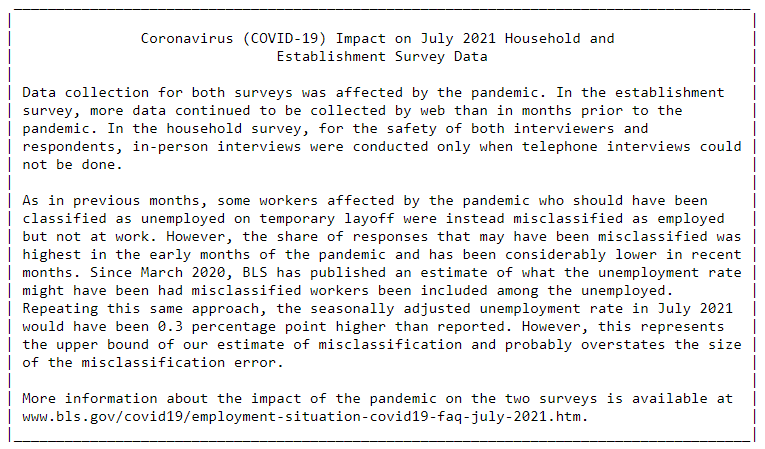

The misclassification issue (folks on temporary layoff being counted as employed) is still with us, so the "true" unemployment rate might be about 0.3%-points higher than reported.

Also none of our surveys are operating normally so there's greater uncertainty about everything.

Also none of our surveys are operating normally so there's greater uncertainty about everything.

Economic policy tip: Fiscal and monetary policy can't defeat sickness and fear, so the most important thing to keep this recovery rolling is continuing to get people vaccinated so that Delta can't derail it.

It turns out that there's robust agreement on this point within my household.

https://twitter.com/BetseyStevenson/status/1423629553617051648

• • •

Missing some Tweet in this thread? You can try to

force a refresh