Here's a thread with more stats/tables from my gold vs #Bitcoin note. This is my 3rd time doing a piece like this since 2018 and I find that each time gold bugs and bitcoiners both disagree with me on multiple points while favoring their respective side far far more heavily. 1/5

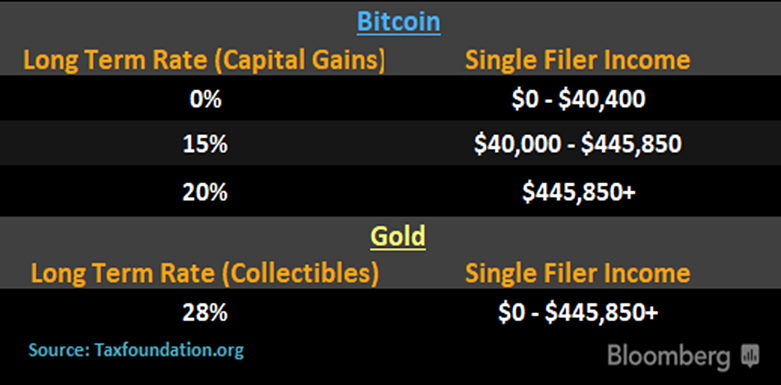

An undisputed victory for U.S. Bitcoin investors on the Bitcoin vs Gold debate is the tax rate situation. 4/5

5/5 There's a lot more to my note than these images and there are nuances to pretty much every stat but if you want to read the entire piece it can be found on the terminal as a part of my $GBTC primer at {GBTC US Equity BICO<Go>} and at the link below:

blinks.bloomberg.com/news/stories/Q…

blinks.bloomberg.com/news/stories/Q…

• • •

Missing some Tweet in this thread? You can try to

force a refresh