Narrativa española:

"Obtener buenas rentabilidades con la renta fija es imposible", "La renta fija es fija", "clase de inversión para personas mayores", "Con los tipos actuales está garantizado perder dinero"

Realidad:

Nuestra inversión en renta fija +93% vs -9% la acción y +51%

"Obtener buenas rentabilidades con la renta fija es imposible", "La renta fija es fija", "clase de inversión para personas mayores", "Con los tipos actuales está garantizado perder dinero"

Realidad:

Nuestra inversión en renta fija +93% vs -9% la acción y +51%

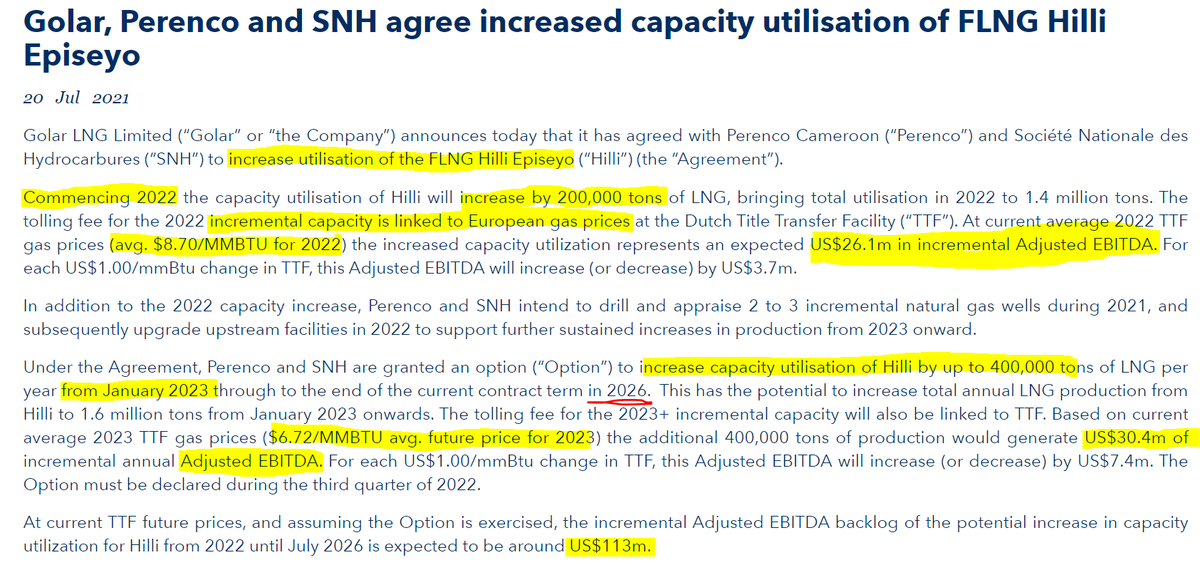

Mañana nos amortizan el bono que compramos el año pasado generando una rentabilidad total del 93% incluyendo cupones. Destacar la diferencia entre el comportamiento de la acción en el mismo periodo (-9%). Analizamos las compañías y decidimos en que estructura tomar la posición

+93% en año y poco superando el +51% del S&P 500. ¿Mucho riesgo? Incorrecto! El papel esta colateralizado con una serie de tankers cuya valoración minimizaba el riesgo. Si la compañía no pagaba, el administrador liquidaba los activos rápidamente y recuperábamos nuestra inversión

Es momento de ampliar el conocimiento del inversor español en este campo que es el pilar de la estrategia del fondo Gamma Global.

Imprescindible ver la charla de @dantelriv en @Rankia con papel y boli para iniciarse en este mundo. A tus pies Dani!

Imprescindible ver la charla de @dantelriv en @Rankia con papel y boli para iniciarse en este mundo. A tus pies Dani!

• • •

Missing some Tweet in this thread? You can try to

force a refresh