Excellent compilation of Quarterly Fund Letters to Investors. h/t @Vintage_Value 👏

From this list, I always look forward to the updates from @IntrinsicInv @SagaPartners @AltaFoxCapital @BaillieGifford @HaydenCapital @OctahedronCap and few others.

vintagevalueinvesting.com/the-complete-l…

From this list, I always look forward to the updates from @IntrinsicInv @SagaPartners @AltaFoxCapital @BaillieGifford @HaydenCapital @OctahedronCap and few others.

vintagevalueinvesting.com/the-complete-l…

I love this new format even more as it lists the stocks mentioned (if any in detail) in the letters.

Always good to read well researched/written long or short commentary from some smart investors on our Portfolio/Watchlist companies.

Always good to read well researched/written long or short commentary from some smart investors on our Portfolio/Watchlist companies.

My fav pts from some new ones I read recently in the thread below.

✔️Guardian Funds on investing in

-Thriving Digitally native businesses

-Founders that focus on culture, innovation, long-term thinking

-having an owner mindset as an investor

$SHOP, $SPOT, $RBLX and $PLTR

✔️Guardian Funds on investing in

-Thriving Digitally native businesses

-Founders that focus on culture, innovation, long-term thinking

-having an owner mindset as an investor

$SHOP, $SPOT, $RBLX and $PLTR

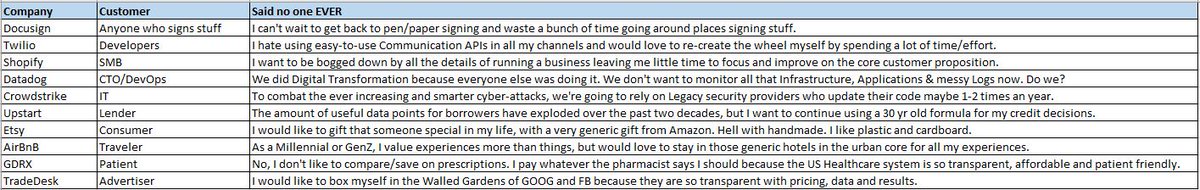

✔️Worm Capital on

-Few key attributes to determine the long-term value of a business

$ABNB, $SHOP, $TSLA

-Few key attributes to determine the long-term value of a business

$ABNB, $SHOP, $TSLA

✔️RiverPark/Wedgewood Fund on

Copart $CPRT one of the businesses that managed to achieve network effects in both the physical and digital world.

Copart $CPRT one of the businesses that managed to achieve network effects in both the physical and digital world.

• • •

Missing some Tweet in this thread? You can try to

force a refresh