1/ Altair $AIR - Bridges real-world assets (RWA's) into DeFi, providing liquidity for asset owners and stable yield for investors 🔥

This is a fantastic project with potential beyond belief.

I hope you find value 💪

@centrifuge $KSM $DOT $CFG #Polkadot #Kusama #RWA

This is a fantastic project with potential beyond belief.

I hope you find value 💪

@centrifuge $KSM $DOT $CFG #Polkadot #Kusama #RWA

2/ Thread Menu

✅ $CFG & $AIR

✅ What Is It

✅ Asset Originators

✅ Lenders / Investors

✅ Problems with Traditional Banking

✅ Value Prop

✅ $KSM parachain

✅ How Does to Altair Operate

✅ Tokenized Assets

✅ NFT's & P2P Protocol/Node

✅ Tinlake

✅ Revolving Pools

$KSM $DOT

✅ $CFG & $AIR

✅ What Is It

✅ Asset Originators

✅ Lenders / Investors

✅ Problems with Traditional Banking

✅ Value Prop

✅ $KSM parachain

✅ How Does to Altair Operate

✅ Tokenized Assets

✅ NFT's & P2P Protocol/Node

✅ Tinlake

✅ Revolving Pools

$KSM $DOT

3/ (cont.) Thread Menu

✅ ChainSafe Bridge

✅ Token Utility

✅ Incentives

✅ Tokenomics

✅ Roadmap

✅ Team

✅ Partnerships

✅ Investors

✅ Verdict

$KSM $DOT $CFG $AIR

✅ ChainSafe Bridge

✅ Token Utility

✅ Incentives

✅ Tokenomics

✅ Roadmap

✅ Team

✅ Partnerships

✅ Investors

✅ Verdict

$KSM $DOT $CFG $AIR

4/ $CFG owns $AIR

As per Polkadot/Kusama's design, tokenization of the most experimental assets & financing will happen on Altair before deployment on Centrifuge

$CFG & $AIR are close in design, but $AIR has special experimental features incorporated into its design

$MOVR

As per Polkadot/Kusama's design, tokenization of the most experimental assets & financing will happen on Altair before deployment on Centrifuge

$CFG & $AIR are close in design, but $AIR has special experimental features incorporated into its design

$MOVR

5/ So What Is $AIR

$AIR, built on Parity's Substrate & bridged to Ethereum, is a connection, a bridge, that allows for the transfer of real-world assets (RWA's) into DeFi

RWA's include: assets such as invoices, mortgages, royalties, etc. (more on RWA types later)

$AIR, built on Parity's Substrate & bridged to Ethereum, is a connection, a bridge, that allows for the transfer of real-world assets (RWA's) into DeFi

RWA's include: assets such as invoices, mortgages, royalties, etc. (more on RWA types later)

6/ $AIR Asset Originators (AO's)

Two categories of users can benefit from Altair

A) ASSET ORIGINATORS - such as small and medium-sized enterprises (SME's) can tokenize their RWA's and use them as collateral for financing.

$KSM $DOT $CFG $AIR #Polkadot #Kusama

Two categories of users can benefit from Altair

A) ASSET ORIGINATORS - such as small and medium-sized enterprises (SME's) can tokenize their RWA's and use them as collateral for financing.

$KSM $DOT $CFG $AIR #Polkadot #Kusama

7/ $AIR Lenders / Investors

B) LENDERS / INVESTORS

Altair enables Defi users (investors) to earn stable yields by investing in real-world companies.

In addition, the money (stable coin) invested generates bankless liquidity for AO's

B) LENDERS / INVESTORS

Altair enables Defi users (investors) to earn stable yields by investing in real-world companies.

In addition, the money (stable coin) invested generates bankless liquidity for AO's

8/ $AIR - Problems with Traditional Banking

➤ Only large businesses get direct access to liquid capital markets

➤ The value locked in traditional RWA's is not accessible

➤ SME's lack competitive interest rates

➤ Saving accounts offer extremely poor interest rates

➤ Only large businesses get direct access to liquid capital markets

➤ The value locked in traditional RWA's is not accessible

➤ SME's lack competitive interest rates

➤ Saving accounts offer extremely poor interest rates

9/ $AIR - Value Prop

➤ No need for conventional banking system's

➤ Lowers the barrier of entry for originating and investing in assets

➤ Creates a bridge between the real world and DeFi

➤ Scales asset financing

➤ Secured KSM parachain

#blockchain #parachain

➤ No need for conventional banking system's

➤ Lowers the barrier of entry for originating and investing in assets

➤ Creates a bridge between the real world and DeFi

➤ Scales asset financing

➤ Secured KSM parachain

#blockchain #parachain

10/ $AIR Kusama Parachain

Altair can benefit from a $KSM parachain in ways such as added security, cross-chain interoperability, on-chain governance decision making & implementation, also with extremely fast & cheap transactions!

A massive milestone for $AIR 🔥

$DOT $KSM $MOVR

Altair can benefit from a $KSM parachain in ways such as added security, cross-chain interoperability, on-chain governance decision making & implementation, also with extremely fast & cheap transactions!

A massive milestone for $AIR 🔥

$DOT $KSM $MOVR

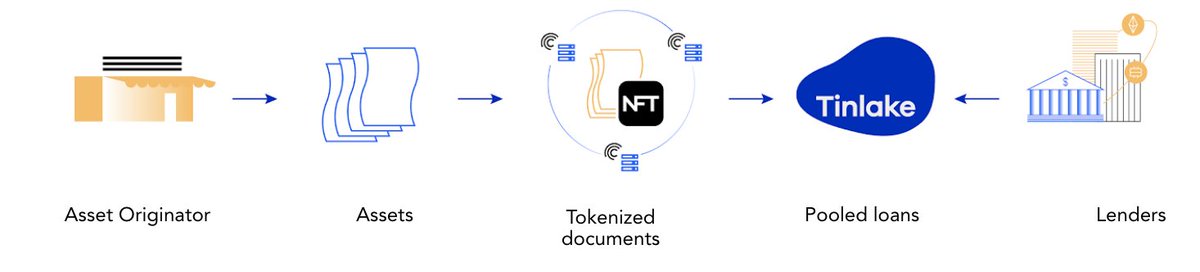

11/ $AIR - AO's - Working Operation

From Bob's lumber business, his docs show he is owed $10k from Alice, but she cannot settle for another 30 days

Bob cannot wait; he has bills. So what can he do?

Bob can tokenize his invoice into an NFT & use it as collateral for a loan

From Bob's lumber business, his docs show he is owed $10k from Alice, but she cannot settle for another 30 days

Bob cannot wait; he has bills. So what can he do?

Bob can tokenize his invoice into an NFT & use it as collateral for a loan

12/ $AIR - AO's - Working Operation

The loan, issued in stable coin, is performed through the Tinlake DAPP

When Alice pays Bob back, he can pay back the loan in full, partially, or whenever he desires as long as it complies with the terms and conditions of the loan agreements

The loan, issued in stable coin, is performed through the Tinlake DAPP

When Alice pays Bob back, he can pay back the loan in full, partially, or whenever he desires as long as it complies with the terms and conditions of the loan agreements

13/ $AIR - Investors / Lenders - Working Operation

Lenders provide liquidity for Bob's assets. In exchange, lenders earn a stable yield (AIR rewards) on their investment.

On the Tinlake #DAPP, several companies are open for investment, all of which have various APRs.

Lenders provide liquidity for Bob's assets. In exchange, lenders earn a stable yield (AIR rewards) on their investment.

On the Tinlake #DAPP, several companies are open for investment, all of which have various APRs.

14/ Altair - Tokenized Assets

The list of potential tokenized assets solely depends on how big your imagination is!

Common assets such as invoices, mortgages, and royalties can be tokenized

The list of potential tokenized assets solely depends on how big your imagination is!

Common assets such as invoices, mortgages, and royalties can be tokenized

15/ Altair -(cont.) Tokenized Assets

Rare or high-value NFT's such as @MoonsamaNFT could be used as collateral!

Real Estate, collectibles, entire businesses, vintage cars, helicopters, private jets, etc., are high potential asset classes that may be eligible for tokenization 🤯

Rare or high-value NFT's such as @MoonsamaNFT could be used as collateral!

Real Estate, collectibles, entire businesses, vintage cars, helicopters, private jets, etc., are high potential asset classes that may be eligible for tokenization 🤯

16/ $AIR - NFT’s & P2P Protocol/Node

To keep Asset Originators loan details private, Altair uses privacy-enabled NFT's, executed on a private P2P trusted (peer-to-peer) network 🔥

Tracking public asset ownership is carried out on a decentralized public ledger as normal

$CFG

To keep Asset Originators loan details private, Altair uses privacy-enabled NFT's, executed on a private P2P trusted (peer-to-peer) network 🔥

Tracking public asset ownership is carried out on a decentralized public ledger as normal

$CFG

17/ $AIR - NFT’s & P2P Protocol/Node

This combination of private and public ledgers is essential to Altair's operation

Segments of the process will remain centralized for the time being. The tokenization of assets needs to be approved/disapproved as part of the onboard process

This combination of private and public ledgers is essential to Altair's operation

Segments of the process will remain centralized for the time being. The tokenization of assets needs to be approved/disapproved as part of the onboard process

18/ $AIR - Tinlake

Tinlake is Altair's smart contract DAPP Marketplace.

It unites both asset originators & Investors for the ultimate Defi experience.

Tinlake is currently built on ETH. However, it plans to migrate to Altair Chain & a secure p2p protocol

Tinlake is Altair's smart contract DAPP Marketplace.

It unites both asset originators & Investors for the ultimate Defi experience.

Tinlake is currently built on ETH. However, it plans to migrate to Altair Chain & a secure p2p protocol

19/ Tinlake

Two different tokens the investor can invest with, TIN & DROP

➤ TIN (risk token) – high risk / high reward (Risk token takes the risks of defaults)

➤ DROP (yield token) – low risk / low stable rewards (Yield token is protected against defaults by Risk token)

Two different tokens the investor can invest with, TIN & DROP

➤ TIN (risk token) – high risk / high reward (Risk token takes the risks of defaults)

➤ DROP (yield token) – low risk / low stable rewards (Yield token is protected against defaults by Risk token)

20/ $AIR - Revolving Pools

Revolving pools allow users to investors or withdraw their funds at any time

This is achieved by a decentralized mechanism that ensures Asset Originators have a constant source of liquidity while investors can flexibly invest and redeem

$CFG $MOVR

Revolving pools allow users to investors or withdraw their funds at any time

This is achieved by a decentralized mechanism that ensures Asset Originators have a constant source of liquidity while investors can flexibly invest and redeem

$CFG $MOVR

21/ $AIR - ChainSafe Bridge

This ChainSafe bridge (a substrate pallet implementation) allows the safe transfer of assets between Altair Chain and Ethereum

#Polkadot #Kusama $CFG

This ChainSafe bridge (a substrate pallet implementation) allows the safe transfer of assets between Altair Chain and Ethereum

#Polkadot #Kusama $CFG

22/ $AIR - Token Utility

AIR - native token that powers Altair

With basic functionality delegated to Kusama, the AIR token has no limits — it can become more than a traditional network token

➤ Om-chain governance

➤ Transaction fees

➤ Staking / Security

➤ Reward adoption

AIR - native token that powers Altair

With basic functionality delegated to Kusama, the AIR token has no limits — it can become more than a traditional network token

➤ Om-chain governance

➤ Transaction fees

➤ Staking / Security

➤ Reward adoption

23/ $AIR - Incentives

➤ Staking rewards

➤ Validator rewards

➤ On-chain governance

➤ Adoption Rewards

$CFG $DOT $KSM $MOVR #Polkadot #Kusama

➤ Staking rewards

➤ Validator rewards

➤ On-chain governance

➤ Adoption Rewards

$CFG $DOT $KSM $MOVR #Polkadot #Kusama

24/ $AIR - Tokenomics

I have reached out to the team for more details on full tokenomics including, T. Supply, Inflationary/Deflationary models, vesting for crowdloan participants, initial MC, etc.

I will update this thread as I receive

For now, see below

I have reached out to the team for more details on full tokenomics including, T. Supply, Inflationary/Deflationary models, vesting for crowdloan participants, initial MC, etc.

I will update this thread as I receive

For now, see below

25/ $AIR - Roadmap

I have reached out to the team for more information regarding Altair Roadmap - I will keep you updated as I receive

I have reached out to the team for more information regarding Altair Roadmap - I will keep you updated as I receive

26/ $AIR has a solid team with lots of experience from companies such as

Consensys, Electric Coin Company, Parity, Goldman Sachs, Credit Suisse, SAP, Microsoft, Deloitte, United Nations, Federal Reserve

➤ Lucas Vogelsang (CEO & Co-Founder)

➤ Martin Quensel (Co-Founder)

Consensys, Electric Coin Company, Parity, Goldman Sachs, Credit Suisse, SAP, Microsoft, Deloitte, United Nations, Federal Reserve

➤ Lucas Vogelsang (CEO & Co-Founder)

➤ Martin Quensel (Co-Founder)

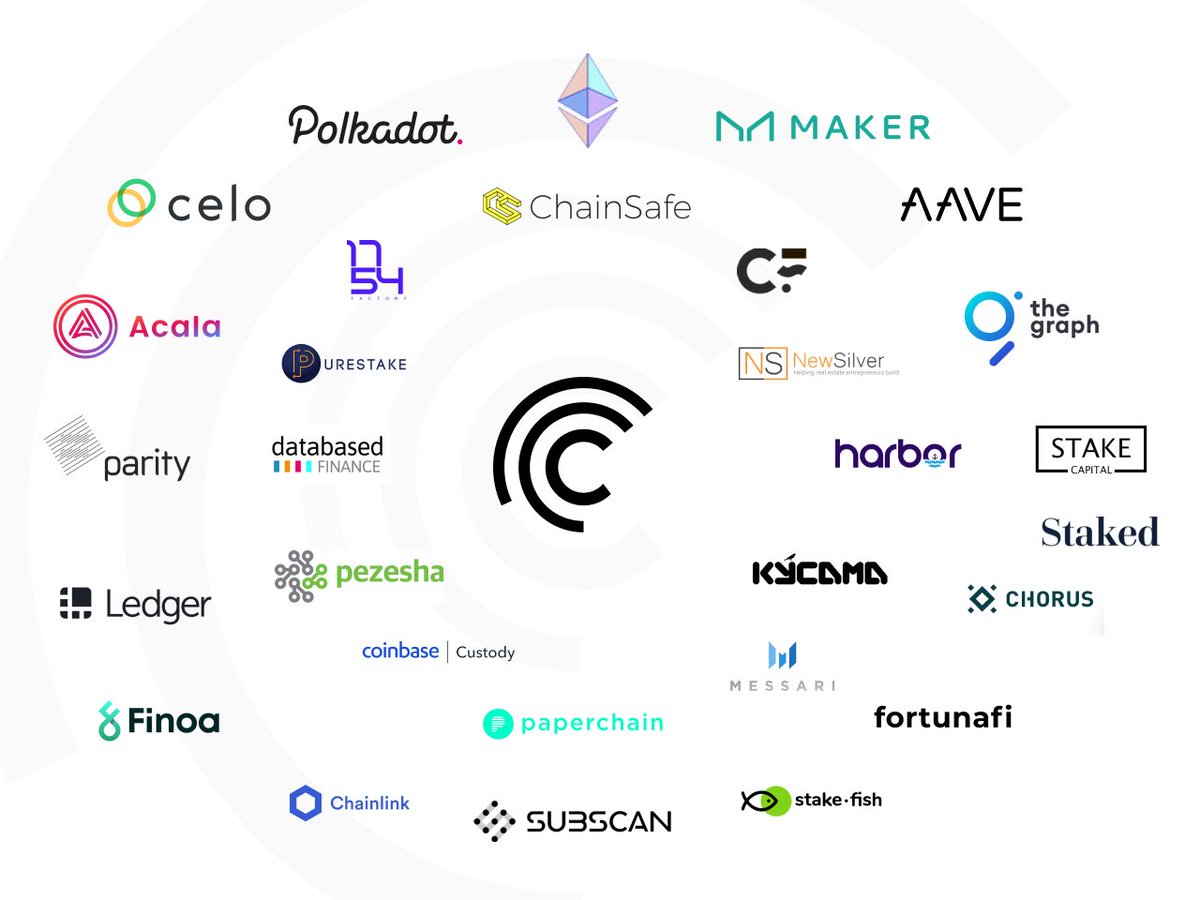

27/ $AIR Partnerships

Altair has a large number of partnerships, including, MakerDAO, Aave, & Paperchain

All partnerships add value to Altair in their own unique way. Please see the image below for further detail

Altair has a large number of partnerships, including, MakerDAO, Aave, & Paperchain

All partnerships add value to Altair in their own unique way. Please see the image below for further detail

28/ $AIR Investors

Mosaic, BlueYard, & Fintech Collective were the main contributors to the seed round, with a total contribution of $8m

The 2nd round of investments was made by investors such as Fenbushi, Galaxy Digital, IOSG, and Moonwhale

Mosaic, BlueYard, & Fintech Collective were the main contributors to the seed round, with a total contribution of $8m

The 2nd round of investments was made by investors such as Fenbushi, Galaxy Digital, IOSG, and Moonwhale

29/ $AIR Verdict

Altair's unique use case will provide so much value to SME's and individuals that require bankless liquidity of their assets with ease of use

It incorporates Defi, NFT's, RWA's, and a Kusama Parachain. An all-in-one crypto mind-blowing package

$DOT $KSM $CFG

Altair's unique use case will provide so much value to SME's and individuals that require bankless liquidity of their assets with ease of use

It incorporates Defi, NFT's, RWA's, and a Kusama Parachain. An all-in-one crypto mind-blowing package

$DOT $KSM $CFG

30/ (cont.) $AIR Verdict

Altair's DAPP Tinlake is very easy to use with good UI/UX. RWA's are not correlated with the cryptocurrency markets, so high volatility is less likely

The $KSM parachain slot also adds significant value to $AIR, opens up a world of features & benefits

Altair's DAPP Tinlake is very easy to use with good UI/UX. RWA's are not correlated with the cryptocurrency markets, so high volatility is less likely

The $KSM parachain slot also adds significant value to $AIR, opens up a world of features & benefits

31/ $AIR Verdict

The benefits associated with borrowing against RWA's on-chain in a bankless way will escalate the world of DeFi to all-time highs

Potential to bring trillions of dollars into Defi. I can't even begin to imagine where $AIR will be in two years from now 🔥

The benefits associated with borrowing against RWA's on-chain in a bankless way will escalate the world of DeFi to all-time highs

Potential to bring trillions of dollars into Defi. I can't even begin to imagine where $AIR will be in two years from now 🔥

32/ $AIR Review Rating

I am still waiting on more information from the team concerning Tokenomics and Roadmap, so I can not give this a rating yet.

When I receive more information, I will provide a rating

I hope the thread has shown you the value $AIR brings to the table

I am still waiting on more information from the team concerning Tokenomics and Roadmap, so I can not give this a rating yet.

When I receive more information, I will provide a rating

I hope the thread has shown you the value $AIR brings to the table

• • •

Missing some Tweet in this thread? You can try to

force a refresh