🧵Oberoi Realty Vs Sunteck Realty

‼️Since real estate is d talk of d town, so let’s compare d 2 nearest competitors in d MMR market.

Both have

-minimum debt

-no CG issue

-clean and reputed promoters

@pd_log @nid_rockz @SwarnashishC @AnishA_Moonka @mmvRavindra

‼️Since real estate is d talk of d town, so let’s compare d 2 nearest competitors in d MMR market.

Both have

-minimum debt

-no CG issue

-clean and reputed promoters

@pd_log @nid_rockz @SwarnashishC @AnishA_Moonka @mmvRavindra

👉So, Oberoi Realty is already a reputed brand name in MMR market.

It is into mid & luxury segment along with a commercial portfolio which provides it consistent rental rev.

It is into mid & luxury segment along with a commercial portfolio which provides it consistent rental rev.

👉Sunteck too was into mid and Luxury resi segment but in 2018 they forayed into affordable housing.

They do not have any active commercial portfolio, but they do had plans to create assets ,which were delayed due to covid.

They do not have any active commercial portfolio, but they do had plans to create assets ,which were delayed due to covid.

𝘽𝙍𝘼𝙉𝘿 𝙉𝘼𝙈𝙀

💪No doubts OBEROI is a much bigger brand as compared to SUNTECK

Which can be seen in their margin profile,upwards of 50%, although they are also boosted by their Rental portfolio which enjoys 𝙀𝙗𝙞𝙩𝙙𝙖 𝙢𝙖𝙧𝙜𝙞𝙣𝙨 ~98%.

💪No doubts OBEROI is a much bigger brand as compared to SUNTECK

Which can be seen in their margin profile,upwards of 50%, although they are also boosted by their Rental portfolio which enjoys 𝙀𝙗𝙞𝙩𝙙𝙖 𝙢𝙖𝙧𝙜𝙞𝙣𝙨 ~98%.

👉SUNTECK - On the other hand also had Ebitda margins upwards of 45% in the past.

But after their foray into affordable segment their margins reduced.

But in their upcoming projects, EBITDA margins are expected to go back to 35-40%.

But after their foray into affordable segment their margins reduced.

But in their upcoming projects, EBITDA margins are expected to go back to 35-40%.

𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 𝗤𝘂𝗮𝗹𝗶𝘁𝘆

👉Since both the co’s r run by 1st gen entrepreneurs ,both the promoters are highly professional & do not believe in debt funded expansion.

Promoter Pledge - NONE

👉Since both the co’s r run by 1st gen entrepreneurs ,both the promoters are highly professional & do not believe in debt funded expansion.

Promoter Pledge - NONE

👉Both co’s are one man show Mr.Vikas Oberoi (MD,Oberoi Realty) and Mr.Kamal Khetan(MD, Sunteck realty)

👉Sunteck Promoters had twice waived off their right to dividend in the absence of Substantial Profits in 2015 and 2021.

Promoter Salary - Within Prescribed Limits

👉Sunteck Promoters had twice waived off their right to dividend in the absence of Substantial Profits in 2015 and 2021.

Promoter Salary - Within Prescribed Limits

𝗔𝗿𝗲𝗮 𝗨𝗻𝗱𝗲𝗿 𝗱𝗲𝘃𝗲𝗹𝗼𝗽𝗺𝗲𝗻𝘁

👉Oberoi Realty – ~45msf of developable/Usold area in the pipeline.

Out of which around 8.25mnsqft is Commercial+Retail

👉Oberoi Realty – ~45msf of developable/Usold area in the pipeline.

Out of which around 8.25mnsqft is Commercial+Retail

👉Sunteck Realty-

~32.8mnsqft of Developable/unsold area.

Out of which 2.8mnsqft is for Commercial Projects.

~32.8mnsqft of Developable/unsold area.

Out of which 2.8mnsqft is for Commercial Projects.

𝗥𝗲𝗮𝗹𝗶𝘇𝗮𝘁𝗶𝗼𝗻𝘀

As far as realizations are concerned then OBEROI 💪definitely gets an advantage

Cz its not present in affordable seg. in which Realizations are lower.

👉Oberoi Realty enjoys overall realizations around 17-18k/sqft in the residential segment.

As far as realizations are concerned then OBEROI 💪definitely gets an advantage

Cz its not present in affordable seg. in which Realizations are lower.

👉Oberoi Realty enjoys overall realizations around 17-18k/sqft in the residential segment.

𝗦𝗔𝗟𝗘𝗦 𝗗𝗨𝗥𝗜𝗡𝗚 𝗟𝗔𝗨𝗡𝗖𝗛 𝗬𝗘𝗔𝗥

👉As far as sales velocity is concerned Sunteck💪 has clear advantage over Oberoi.

As they r able to sell majority of their Inventory during the launch itself.

👉As far as sales velocity is concerned Sunteck💪 has clear advantage over Oberoi.

As they r able to sell majority of their Inventory during the launch itself.

Sunteck – Since majority of their products fall into LMIG category, they are able to clear their inventory more efficiently.

E.g. They sold around 80% of d Westworld Naigaon Inventory during the launch month and repeated the same success in Sunteck Maxxworld, Naigaon.

E.g. They sold around 80% of d Westworld Naigaon Inventory during the launch month and repeated the same success in Sunteck Maxxworld, Naigaon.

Recently they have launched Phase 1 of Vasai and as per various reports the project has got good traction.

The Table shows units sold at the end of Q1FY21

The Table shows units sold at the end of Q1FY21

👉Oberoi Realty – Present in Mid and Luxury category makes it a lil difficult to clear the inventory during the launch.

As we can see in the below table that barring 3 projects (Eternia,Enigma& skycity) sales during the launch year are below 50% threshold.

As we can see in the below table that barring 3 projects (Eternia,Enigma& skycity) sales during the launch year are below 50% threshold.

𝗦𝗧𝗥𝗔𝗧𝗘𝗚𝗬

Strategy wise both the co’s are different.

One believes in getting more projects under JDA route which lowers the initial capital requirement.

Whereas other believes in buying land parcel directly and developing it over a period of time

Strategy wise both the co’s are different.

One believes in getting more projects under JDA route which lowers the initial capital requirement.

Whereas other believes in buying land parcel directly and developing it over a period of time

👉Sunteck – After 2018 mgt has started focusing more on the JDA route with the landlords on revenue sharing basis model.

Every single project acq./entered by Sunteck after 2018 has been a JDA.

Every single project acq./entered by Sunteck after 2018 has been a JDA.

Landlord is responsible for all the approvals and clearances from authorities whereas Sunteck is responsible for construction,marketing and sales of the project.

👉 Oberoi on the other side prefers to own d land parcels.

👉 Oberoi on the other side prefers to own d land parcels.

𝗖𝗼𝗺𝗺𝗲𝗿𝗰𝗶𝗮𝗹 𝗣𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼

Now this is where things get very interesting.

👉Oberoi Realty – They hv a target to approximately treble their Commercial portfolio from 1.7msf to 6msf,

Which will help in trebling their rental revenue from 320crs to 990crs by FY24.

Now this is where things get very interesting.

👉Oberoi Realty – They hv a target to approximately treble their Commercial portfolio from 1.7msf to 6msf,

Which will help in trebling their rental revenue from 320crs to 990crs by FY24.

Their Commerz III project is 2.5x of their existing Commerz I & Commerz II.

‼️Out of total 2.8msf of commerz III 1.1msf has already been pre-leased to 𝗠𝗼𝗿𝗴𝗮𝗻 𝗦𝘁𝗮𝗻𝗹𝗲𝘆 𝗳𝗼𝗿 9.5𝘆𝗲𝗮𝗿𝘀.💥

‼️Out of total 2.8msf of commerz III 1.1msf has already been pre-leased to 𝗠𝗼𝗿𝗴𝗮𝗻 𝗦𝘁𝗮𝗻𝗹𝗲𝘆 𝗳𝗼𝗿 9.5𝘆𝗲𝗮𝗿𝘀.💥

👉Sunteck - On the other hand do not own any significant Rental Portfolio.

But they had plans which were postponed due to Covid.

They have around 2.8msf of developable Commercial portfolio in Sunteck City ,ODC ,which will generate around 💥~425crs of Annual Revenue.💥

But they had plans which were postponed due to Covid.

They have around 2.8msf of developable Commercial portfolio in Sunteck City ,ODC ,which will generate around 💥~425crs of Annual Revenue.💥

They have recently given green signal to the project and they are going to launch 1st Phase- Sunteck Pinnacle on 30th sept.

In addition to ODC they have 3 commercial projects in BKC, which are On-going but most probably they will be sold out directly.

In addition to ODC they have 3 commercial projects in BKC, which are On-going but most probably they will be sold out directly.

𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗣𝗿𝗼𝗳𝗶𝗹𝗲

Oberoi Realty

Net Debt/Equity – 0.12x (one of the best in the industry)

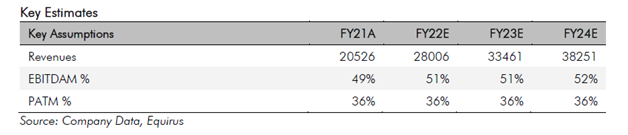

As per analyst Oberoi is expected to report

👉Rev/Ebitda/Pat CAGR of 23%/26%/23% resp. over FY21-FY24

Their Ebitda margins are expected to improve further to 52%💥

Oberoi Realty

Net Debt/Equity – 0.12x (one of the best in the industry)

As per analyst Oberoi is expected to report

👉Rev/Ebitda/Pat CAGR of 23%/26%/23% resp. over FY21-FY24

Their Ebitda margins are expected to improve further to 52%💥

Sunteck Realty –

Net Debt/Equity – 0.18x ( among the best in the industry )

👉 Analyst Expectations - Revenue/Ebitda/Pat CAGR is expected to be 31%/58%/84% (on a low base of FY21)

Ebitda margins are expected to scale back their previous levels of around 45% 👍

Net Debt/Equity – 0.18x ( among the best in the industry )

👉 Analyst Expectations - Revenue/Ebitda/Pat CAGR is expected to be 31%/58%/84% (on a low base of FY21)

Ebitda margins are expected to scale back their previous levels of around 45% 👍

Margins and Revenue no's of Sunteck r more sustainable now as they have a good pipeline of Projects.

𝗩𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻𝘀:

Since real estate co’s can never be valued on d basis of P.E. as their revenue recognition method is totally different.

As per IND-AS standards they can only recognize Revenue in the P&L after the project has been completed & handed over to the customer.

Since real estate co’s can never be valued on d basis of P.E. as their revenue recognition method is totally different.

As per IND-AS standards they can only recognize Revenue in the P&L after the project has been completed & handed over to the customer.

Till that time sales are shown in the PRE-SALES no. which is shared every quarter.

Cz of this, they are usually valued on the basis of NAV, by discounting the future cash flows from the projects.

Cz of this, they are usually valued on the basis of NAV, by discounting the future cash flows from the projects.

👉Now if we compare d presales no.s of both the co’s ,it seems that Sunteck is following the path of Oberoi Realty

Sunteck hv targets to 2x their pre-sales no. by every two years.

-Pre-sales no.s r expected to cross all time high of ~ 1200crs in FY22 & shud rch 3600crs by FY24.

Sunteck hv targets to 2x their pre-sales no. by every two years.

-Pre-sales no.s r expected to cross all time high of ~ 1200crs in FY22 & shud rch 3600crs by FY24.

💥Which will help them to generate post-tax operating cash flows of 700-1000crs/year

👉They also have few projects lined up for the distant future which will also give them Project Operating Surplus to the tune of Rs.3000

👉They also have few projects lined up for the distant future which will also give them Project Operating Surplus to the tune of Rs.3000

Comparing the valuations

Oberoi realty has a Mcap of around 32kcrs whereas Sunteck is valued around 7kcrs.

Once during the concall, Vikas Oberoi mentioned that the stock mrkts r not realizing full potential of the Co.

Oberoi realty has a Mcap of around 32kcrs whereas Sunteck is valued around 7kcrs.

Once during the concall, Vikas Oberoi mentioned that the stock mrkts r not realizing full potential of the Co.

👉The way markets are valuing it ,they are either valuing residential segment or Commercial segment for free. At that time M.cap of Oberoi Realty was around 22k crs.

So, effectively Oberoi shud get far higher value in a REIT or in a Pvt Equity deal.

So, effectively Oberoi shud get far higher value in a REIT or in a Pvt Equity deal.

👉In FY24 Sunteck will do profits equivalent to what Oberoi used to do till FY17 (550crs) & whats different this time will be that the profits will be sustainable.

& these profits estimates do not include any Rental Income, which they will start generating in few years.

& these profits estimates do not include any Rental Income, which they will start generating in few years.

𝗦𝗲𝗰𝘁𝗼𝗿 𝗩𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻𝘀:

👉The whole listed Real Estate pack represents only 2-3% of the Total M.cap of India. Whereas in terms of GDP it contributes 10-15% and also creates demand for various industries linked with it like Paints, Cement, Plyboard , Steel etc.

👉The whole listed Real Estate pack represents only 2-3% of the Total M.cap of India. Whereas in terms of GDP it contributes 10-15% and also creates demand for various industries linked with it like Paints, Cement, Plyboard , Steel etc.

👉So, when the sector itself is valued cheaply, then the co’s are surely bound to outperform as and when the cycle turns up.

*END*

*END*

• • •

Missing some Tweet in this thread? You can try to

force a refresh