Slack is down, so a quick 🧵 about pricing bets.

"What is fair value?"

It's the price at which I don't expect to make money if I'm long or short.

"Over what timescale?"

Depends on who I am and what I'm doing.

Trading 101 - Pricing the fair value of a bet. 👇👇👇

1/n

"What is fair value?"

It's the price at which I don't expect to make money if I'm long or short.

"Over what timescale?"

Depends on who I am and what I'm doing.

Trading 101 - Pricing the fair value of a bet. 👇👇👇

1/n

Pricing a financial instrument is similar to price any game with uncertain outcomes.

Let's play a game.

You toss a coin.

If it comes up heads I give you $10.

If it comes up tails I give you nothing.

How much would you pay to play the game?

2/n

Let's play a game.

You toss a coin.

If it comes up heads I give you $10.

If it comes up tails I give you nothing.

How much would you pay to play the game?

2/n

To work this out, write down:

1. All the potential outcomes.

2. The probability of each occurring

3. The payoff if it occurs.

The expected return for playing the game for free is the sum of:

[probability of outcome] * [payoff if it happens]

for all outcomes.

3/n

1. All the potential outcomes.

2. The probability of each occurring

3. The payoff if it occurs.

The expected return for playing the game for free is the sum of:

[probability of outcome] * [payoff if it happens]

for all outcomes.

3/n

If we could play this game lots of times for free, we'd expect to make $5 per game.

Which should make intuitive sense...

We expect to win half the time - and we win $10 each time we win.

4/n

Which should make intuitive sense...

We expect to win half the time - and we win $10 each time we win.

4/n

Now - what is the *fair value* of this game?

It's the price at which we expect neither to make money or lose money.

It's the price at which our expectation is zero.

Our expectation if we could play for free was $5 per game.

So the fair value of the game is $5.

5/n

It's the price at which we expect neither to make money or lose money.

It's the price at which our expectation is zero.

Our expectation if we could play for free was $5 per game.

So the fair value of the game is $5.

5/n

If I have to pay $5 to play I don't expect to lose money or make money over the long run.

I wouldn't play the game for more than $5 (unless I were a massive degen) cos I'd expect to lose money doing that.

6/n

I wouldn't play the game for more than $5 (unless I were a massive degen) cos I'd expect to lose money doing that.

6/n

I'd be keen to play the game for less than $5 because I'd expect to make money doing that.

And I'd be especially keen to do that if I could play the game lots of times.

Let's do a simple trading example.

7/n

And I'd be especially keen to do that if I could play the game lots of times.

Let's do a simple trading example.

7/n

I'm going to adapt an example I read in one of @KrisAbdelmessih 's email newsletters. Subscribe to it here: moontower.substack.com

It's ace and one of the few things that land in my inbox that I actually read.

8/n

It's ace and one of the few things that land in my inbox that I actually read.

8/n

Imagine you have a biotech stock and tomorrow there is an important ruling.

90% chance of bad news.

10% chance of good news.

What price should the stock be trading at?

The fair value is the price at which we expect neither to make money being long or short.

9/n

90% chance of bad news.

10% chance of good news.

What price should the stock be trading at?

The fair value is the price at which we expect neither to make money being long or short.

9/n

Remember, write down:

1. All the potential outcomes.

2. The probability of each occurring

3. The payoff if it occurs.

We have 1 and 2. What about 3?

We need to estimate what we think the stock will be worth in each scenario.

10/n

1. All the potential outcomes.

2. The probability of each occurring

3. The payoff if it occurs.

We have 1 and 2. What about 3?

We need to estimate what we think the stock will be worth in each scenario.

10/n

So we need some kind of model for that.

We talk to our analyst when he gets back from lunch.

If there is bad news, he says, the stock is probably worth nothing.

If there is good news, he says, he thinks it is worth about $100.

So we plug those numbers in.

11/n

We talk to our analyst when he gets back from lunch.

If there is bad news, he says, the stock is probably worth nothing.

If there is good news, he says, he thinks it is worth about $100.

So we plug those numbers in.

11/n

And assuming our outcome probabilities and estimates of value are "correct", the fair value of the stock is $10.

If it were trading at $10 then we'd don't expect to make long or short the stock.

12/n

If it were trading at $10 then we'd don't expect to make long or short the stock.

12/n

If we pay $10 to long the stock then...

90% of the time we'd lose $10

10% of the time we'd win $90.

We expect to lose the bet - but if we won, we'd expect to win big.

Overall, if we could reverse back time and keep taking this bet we'd make no money.

13/n

90% of the time we'd lose $10

10% of the time we'd win $90.

We expect to lose the bet - but if we won, we'd expect to win big.

Overall, if we could reverse back time and keep taking this bet we'd make no money.

13/n

If we short the stock at $10 (w no costs) then...

90% of the time we'd win $10

10% of the time we'd lose $90.

We expect to win the bet - but if we lose, we'd expect to lose big.

Overall, if we could reverse back time and keep taking this bet we'd make no money.

13/n

90% of the time we'd win $10

10% of the time we'd lose $90.

We expect to win the bet - but if we lose, we'd expect to lose big.

Overall, if we could reverse back time and keep taking this bet we'd make no money.

13/n

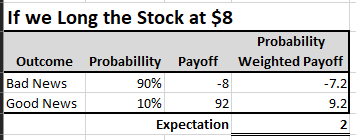

Now - what if the stock were trading at $8?

Then, if we could long at $8

90% of the time we'd lose $8

10% of the time we'd win $92

We expect to make $2 per share on the bet.

Cos we can buy below fair value.

14/n

Then, if we could long at $8

90% of the time we'd lose $8

10% of the time we'd win $92

We expect to make $2 per share on the bet.

Cos we can buy below fair value.

14/n

For completeness, what if we shorted at $8...

90% of the time we expect to win $8

10% of the time we expect to lose $92

We expect to lose $2 per share on the bet.

Cos we had to sell below fair value.

15/n

90% of the time we expect to win $8

10% of the time we expect to lose $92

We expect to lose $2 per share on the bet.

Cos we had to sell below fair value.

15/n

It is not enough to forecast the most likely outcome

You need to identify:

- the most possible outcomes

- their probability of occurring

- your likely payoff if they occur

And, if you can do that, you can price anything.

(We'll look at pricing options like this soon.)

16/n

You need to identify:

- the most possible outcomes

- their probability of occurring

- your likely payoff if they occur

And, if you can do that, you can price anything.

(We'll look at pricing options like this soon.)

16/n

In practice, this is hard. You don't know the probabilities or the payoffs.

You need models for that.

And you find that each of the numbers is massively sensitive to your input assumptions.

And it's hard to find enough similar bets to know if you have an edge.

17/n

You need models for that.

And you find that each of the numbers is massively sensitive to your input assumptions.

And it's hard to find enough similar bets to know if you have an edge.

17/n

So those of us with the freedom to trade any way we like, tend not to try to predict in this way.

Instead of predicting future outcomes and payoffs, we're more likely to ask:

"What should this thing be trading at given where similar things are trading right now?"

18/n

Instead of predicting future outcomes and payoffs, we're more likely to ask:

"What should this thing be trading at given where similar things are trading right now?"

18/n

And we're likely to try to assess fair value over timescales and in environments where we can get a lot of quick feedback on whether our fair value is correct.

But that's a conversation for another time...

19/n

But that's a conversation for another time...

https://twitter.com/therobotjames/status/1377025270729728000

19/n

tldr:

Fair value is the price at which you don't expect to make money long or short.

It's the sum of probability-weighted outcomes. (Which is often a hard thing to forecast.)

Getting an edge requires you to buy below fair value and sell above fair value, on average.

20/20

Fair value is the price at which you don't expect to make money long or short.

It's the sum of probability-weighted outcomes. (Which is often a hard thing to forecast.)

Getting an edge requires you to buy below fair value and sell above fair value, on average.

20/20

• • •

Missing some Tweet in this thread? You can try to

force a refresh