1. Better headline: "Will Common Prosperity Make Japan Great Again?" MJGA!😂 We have deep expertise and top indexes on Japanese equity, particularly currency hedging. Below is the list of some under appreciated things of Japanese equity.

https://twitter.com/japantimes/status/1443763861996376065

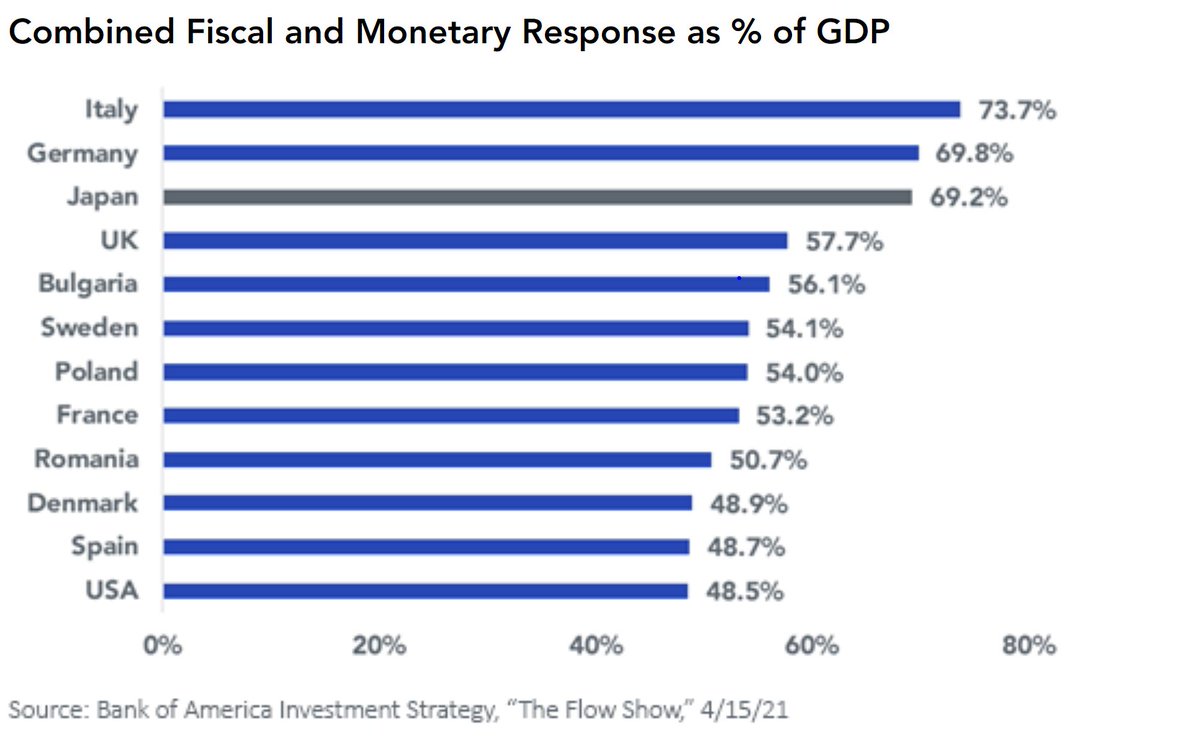

2. Underappreciated: If US fiscal/monetary response to the pandemic is large, Japan's is even a larger share of GDP. Lay person language: money money money for the economy.

3. Our colleague reviewed how Warren Buffet's Japanese investment last September has turned out. Following Mr. Buffet, global investors have been putting money there quietly for a while. wisdomtree.com/blog/2021-05-0…

4. There's impression that Japanese companies hoard cash and pay peanuts on dividend. Data actually showed they are increasing dividend as a faster rate than many other developed countries. @JeffWeniger

5. On Corporate Governance: a new requirement that the number of independent board directors must increase from two individuals to one-third of the mix. A new requirement to publish disclosure materials in English!!! wisdomtree.com/blog/2021-08-3…

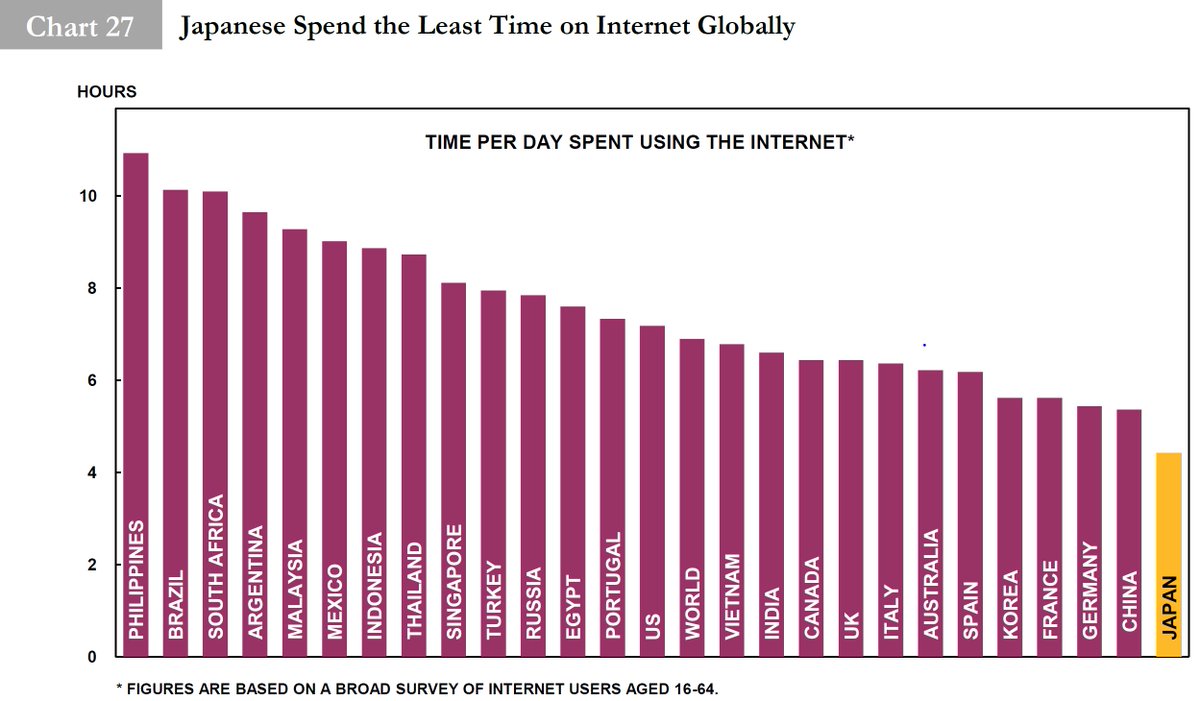

6. Digitalization will be a growth area for Japan because they are below average in spending time on the internet and spending money on digitalization by the government. h/t Clocktowers

8. Next 20 years, competition will be fierce in energy efficiency and hard tech industries. Japanese companies are in the best position to benefit on #China's push for self-reliance on hard tech and biotech.

@threadreaderapp unroll #Japan #Equity #dividend #China #CommonProsperity #Hedging #DigitalTransformation #manufacturing #semiconductor #hardtech

• • •

Missing some Tweet in this thread? You can try to

force a refresh