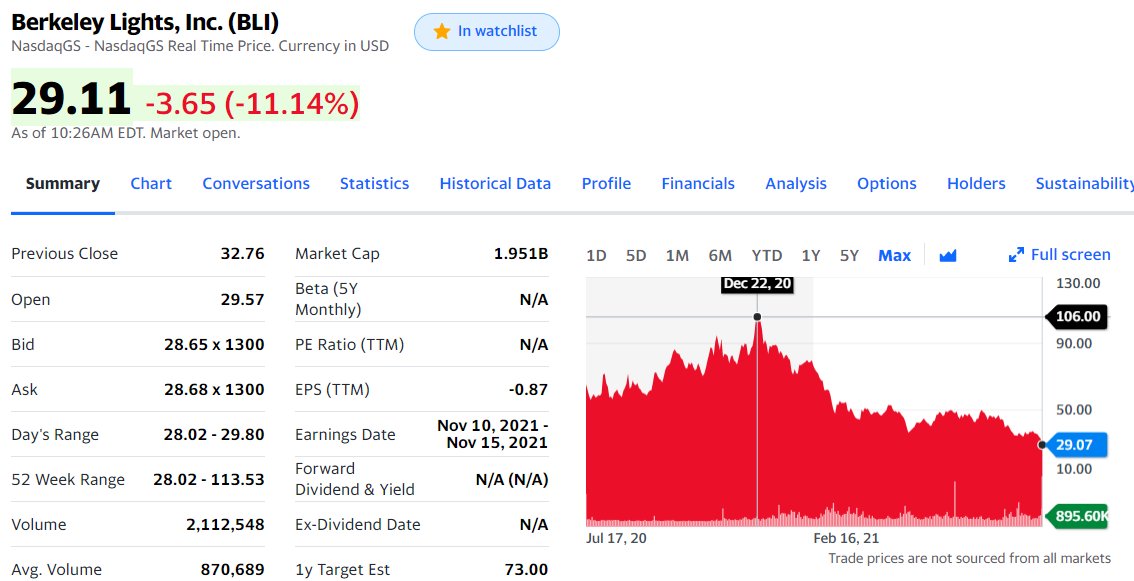

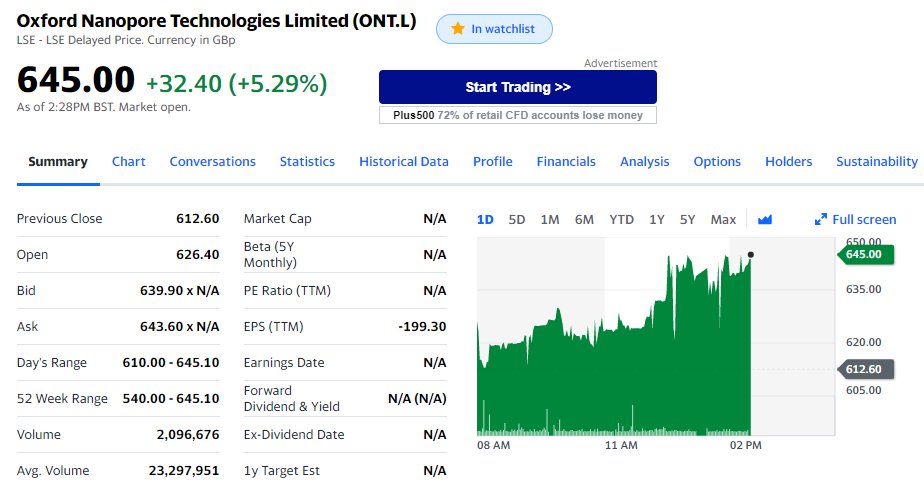

In #biotech #stocks, more market jitters at NASDAQ opening, all biotech stocks down except for $ONT.L Oxford @nanopore and $NEO NeoGenomics

$ONT.L Oxford @nanopore floated on Wednesday, today still on a steady uphill. Trades in London stock exchange, so off by 4-5 hours US East time.

$NEO NeoGenomics has been on a tear in the last few days. A company growing both organically and by acquisition, aggressively positioning itself in the #LiquidBiopsy #CancerScreening segment.

More at bit.ly/liqbiopsy

• • •

Missing some Tweet in this thread? You can try to

force a refresh