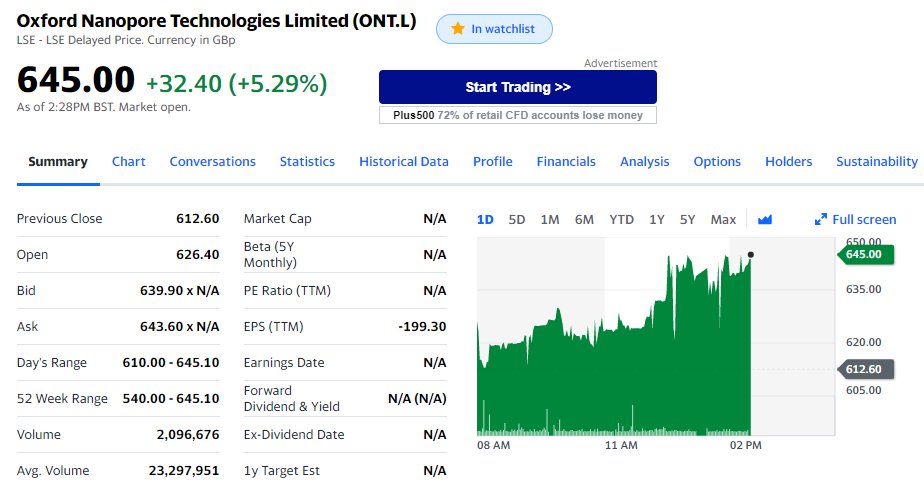

More highlights of the prospectus for $ONT.L Oxford @nanopore, now concentrating on more technical aspects.

Aiming for a 4-5x step change in throughput between the different product lines: 126/512 ~ 4x and 512/2675 ~ 5x between Flongle / MinION / PromethION

There are a lots of other details that matter here, but it gives us a rough estimate of multiples between product throughput and how the company thinks about them. Compared to Illumina, their MiSeq/NextSeq/NovaSeq ratios are:

15/360 ~ 24x and 360/6000 ~ 16x, but with ...

15/360 ~ 24x and 360/6000 ~ 16x, but with ...

... smaller flowcells in each machine to smothen the steps in between. In the case of Oxford Nanopore, the flowcell is the instrument, except for GridION, but there are indications of more flexibility all along with the PromethION P2 and P2 Solo instruments.

While Illumina has a very granular cadence of price per Gb via their multitude of flowcells/cycles/instrument combinations (see green value in image bit.ly/ilmnkits), $ONT.L Oxford @nanopore has 3 basic flowcell sizes, but provides pricing flexibility via volume.

Flowcells have a 2x range in price according to volume for MinION, up to 3x range for PromethION. The largest 144 Pack is essentially priced at the famous $600/genome mark, but that could easily be $300 with 200Gb runs, which have been reported by customers recently.

Considering ssDNA Q20+ and Duplex circa Q30, then a $600 PromethION run would put $ONT.L on par with market leader Illumina, and the $200-300 range would put it on par with MGI Tech DNBSEQ10x4RS NGS factory (only available in China). PacBio is still around $2000 ATM.

• • •

Missing some Tweet in this thread? You can try to

force a refresh