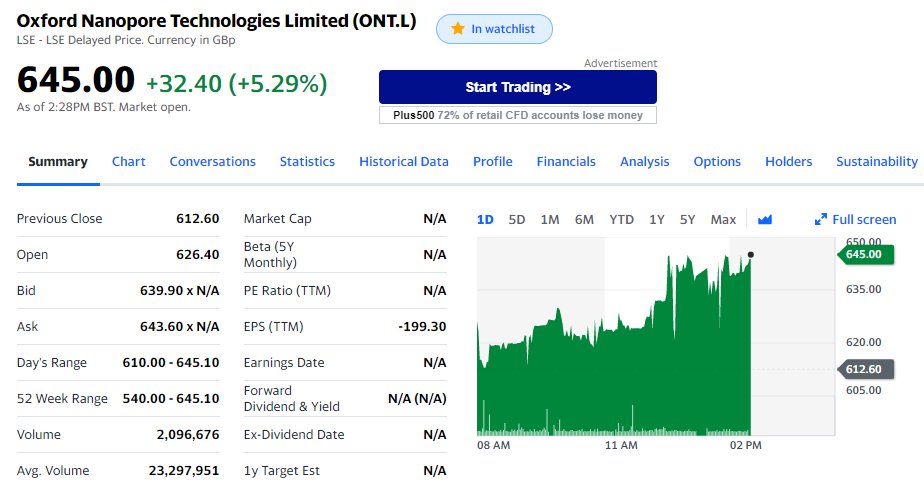

A few notes (in no particular order) on the Oxford @nanopore 30-Sep-2021 document timed for their IPO (data.fca.org.uk/artefacts/NSM/…)

(1) The importance of GPUs and SSDs as part of the computational equipment perceived to be needed now and in the near/mid term future

(1) The importance of GPUs and SSDs as part of the computational equipment perceived to be needed now and in the near/mid term future

They only mention competitors by name in stating the difference between synthesis-based sequencing and the nanopore approach. They mention Illumina and PacBio later on in patent litigation risks but not too interesting.

Their TAM and potential TAM slide is probably the most insightful: reiterating what the company always said about long-reads, ubiquitous and fast TAT products and the markets they can disrupt with these

They only mention #LiquidBiopsy once in the Figure legend of the TAM/PTAM chart. They mention cfDNA (cell-free fragmented DNA) once, nothing stating it directly as a weakness, which could mean they are anticipating a concatenation method could help (but not mentioned).

Some indications on instrument pull-through and reagents/flowcells revenue, although this can vary widely as the use is a moving target matching their improvements with throughput and Q-scores (example in second screenshot).

• • •

Missing some Tweet in this thread? You can try to

force a refresh