Are you ready for a visual exercise?

Qualities we will be looking for:

1) A clean horizontal boundary

2) Min 3 tests of the pattern boundary

3) If a short trade = needs to be below 200-day

If a long trade = needs to be above 200-day

1) A clean horizontal boundary

2) Min 3 tests of the pattern boundary

3) If a short trade = needs to be below 200-day

If a long trade = needs to be above 200-day

Find 3 text-book trades / chart pattern setups

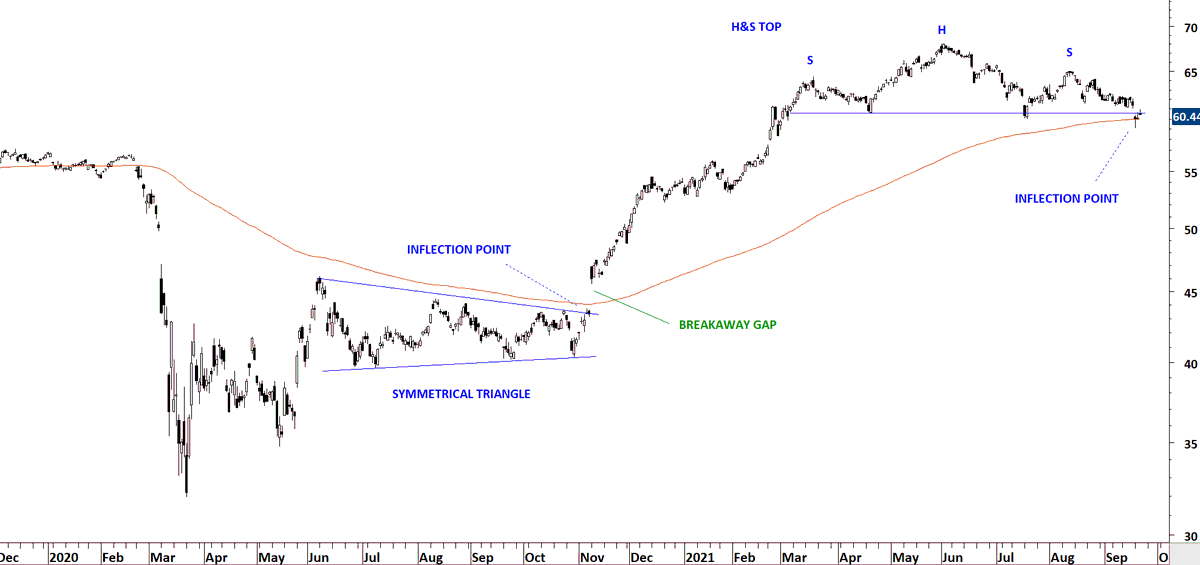

This is a weekly scale price chart and the moving average is 40 week period (200-day)

Answers format:

Pattern name/completed year

This is a weekly scale price chart and the moving average is 40 week period (200-day)

Answers format:

Pattern name/completed year

Great stuff. The third pattern is open for discussion but as you can see from the possibilities of ascending triangle, cup & handle or H&S continuation, all of them has similar price projections and bullish implications.

Here is my labelling.

Here is my labelling.

The criticism you will hear: well its always easier to tell things in hindsight.

You will never know if a trade will be successful even if you identify the pattern in a correct way.

We are trying to increase the probability of success slightly by picking right setups

You will never know if a trade will be successful even if you identify the pattern in a correct way.

We are trying to increase the probability of success slightly by picking right setups

So let's look at one recent setup.

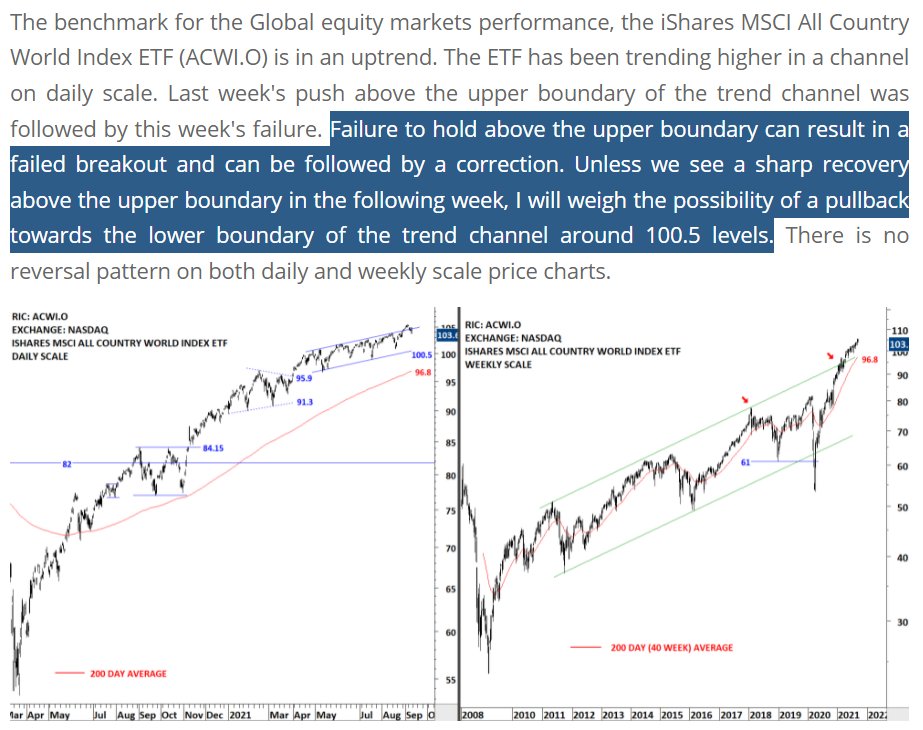

Weekly scale price charts I review them with 5 years of data.

The minute I open the chart my eye is fixated to the area right of the dashed line.

What pattern do you see?

Weekly scale price charts I review them with 5 years of data.

The minute I open the chart my eye is fixated to the area right of the dashed line.

What pattern do you see?

• • •

Missing some Tweet in this thread? You can try to

force a refresh