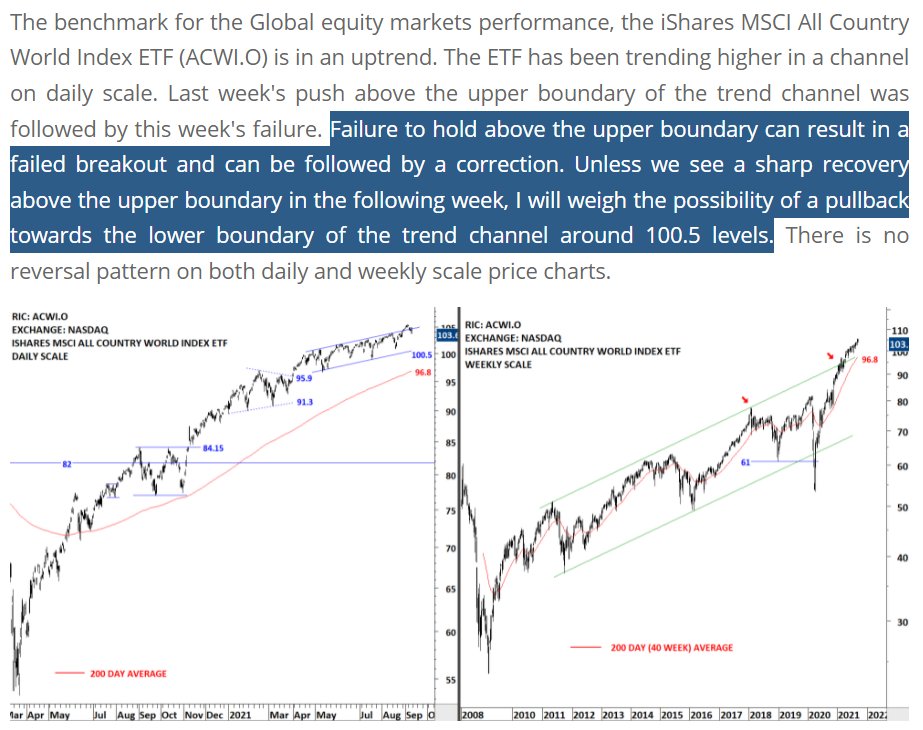

(1) Let's study this chart and discuss some of the concepts in classical charting & technical analysis. It is a great chart.

https://twitter.com/TechCharts/status/1440710610400919559

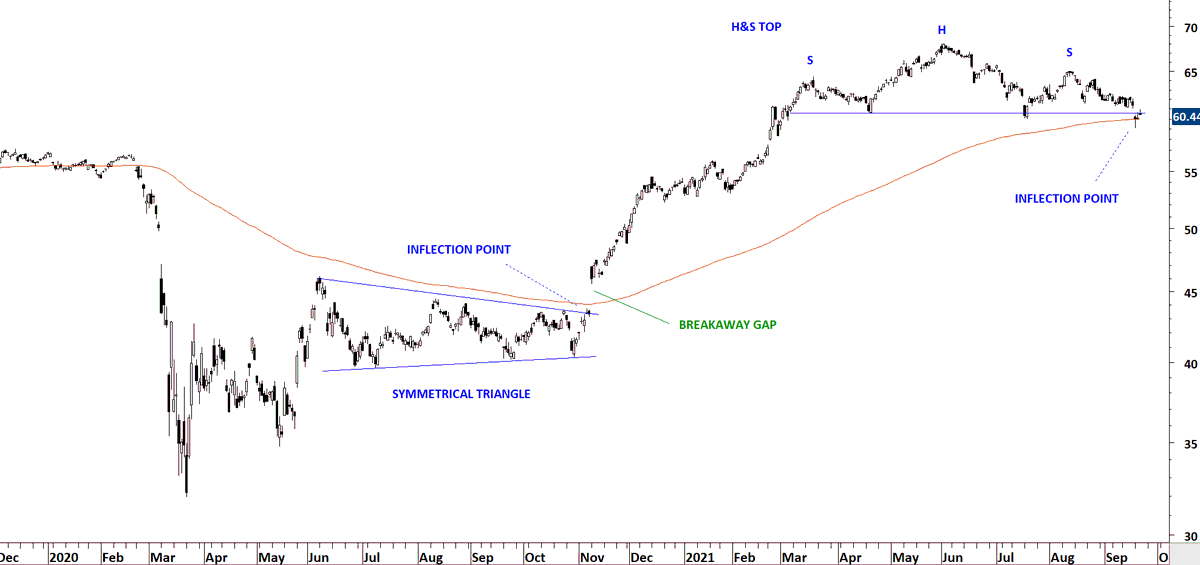

(2) Symmetrical triangle formed right below the 200-day average. Breakout took place at the same price level which I call inflection point. When such condition is met, it is a high conviction setup for me.

(3) Breakout took place with a gap opening. This was a clear breakaway gap as explained by Schabacker.

Breakout took place above the 200-day average and it was a change in trend as well. A significant technical development.

Breakout took place above the 200-day average and it was a change in trend as well. A significant technical development.

(4) Now, a clean H&S top has formed with price testing the 200-day average forming what I call an inflection point. Means: if a breakdown takes place it will be a high conviction signal. A possible change in trend.

• • •

Missing some Tweet in this thread? You can try to

force a refresh