Step by step analysis of price action around rising trend channels.

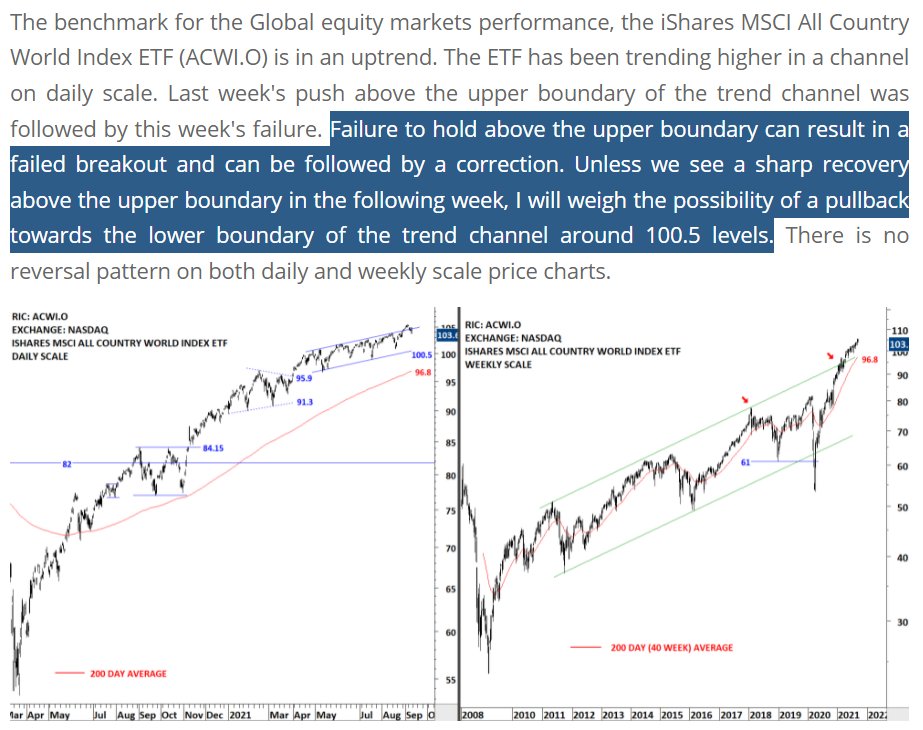

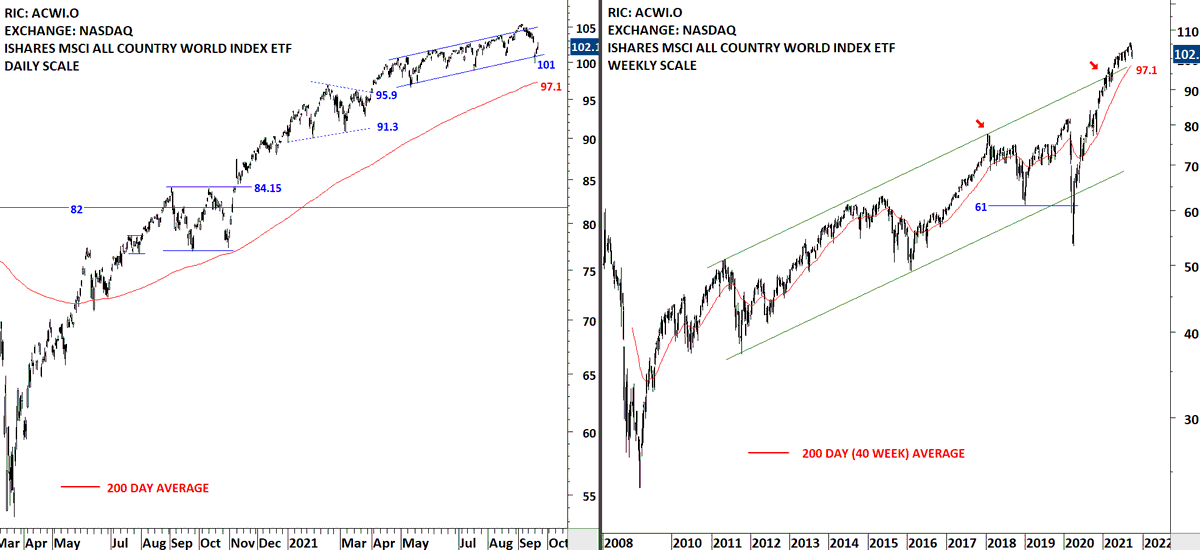

A breach above the upper boundary, if not followed by an acceleration on the upside, can result in a failed breakout.

Sept 4 Global Equity Markets report >> blog.techcharts.net/index.php/prem…

A breach above the upper boundary, if not followed by an acceleration on the upside, can result in a failed breakout.

Sept 4 Global Equity Markets report >> blog.techcharts.net/index.php/prem…

Sept 18 >> Targeting the lower boundary of the rising trend channel.

blog.techcharts.net/index.php/2021…

blog.techcharts.net/index.php/2021…

Update >> Reached the lower boundary of the rising trend channel and rebounded. Uptrend is still intact. $ACWI

• • •

Missing some Tweet in this thread? You can try to

force a refresh