Chartered Market Technician (CMT) and Classical chart trader. Ex- Fund manager.

Premium membership ➡️ https://t.co/Y3Q8Y9Flke

YouTube ➡️ https://t.co/GDPhOs0GwD

13 subscribers

How to get URL link on X (Twitter) App

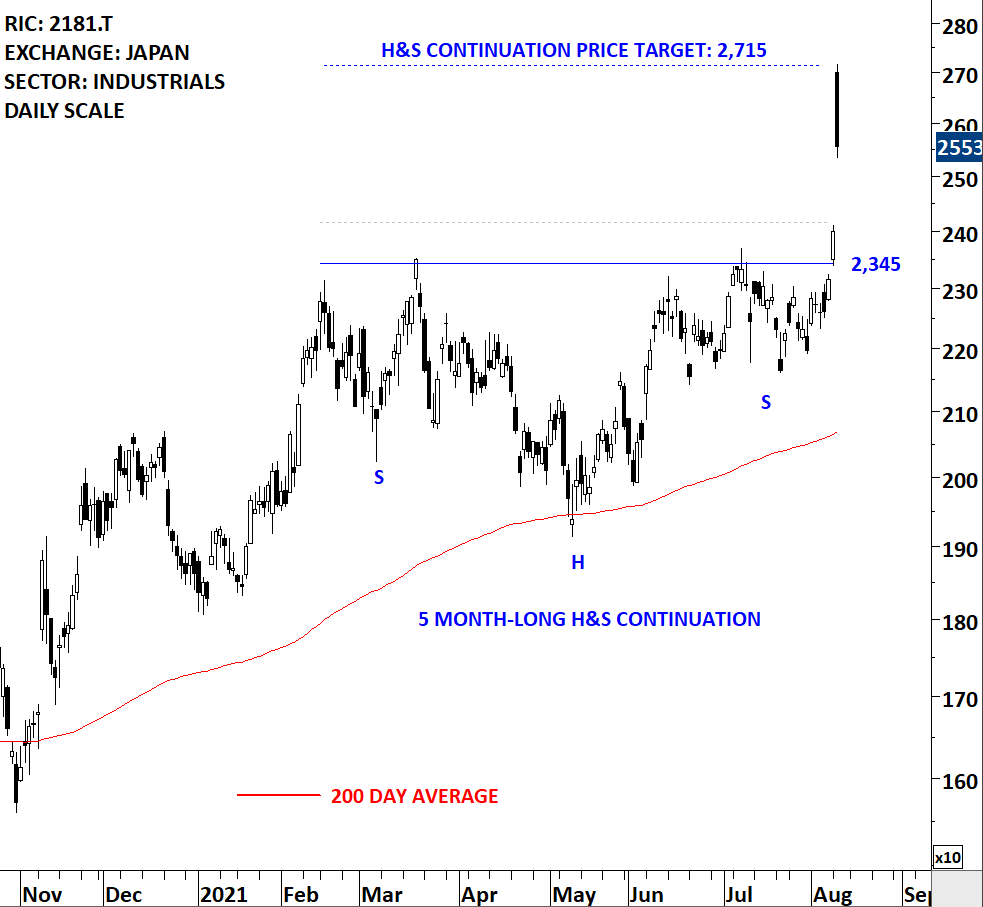

https://twitter.com/TechCharts/status/1322478580618715136Chart patterns are confirmed when they are mature. It is usually difficult to understand at what level the pattern is mature. For me this is with several tests of pattern boundary.

https://twitter.com/TechCharts/status/1383644781331378177

Question I'm trying to answer, what are those gaps at all-time highs???

Question I'm trying to answer, what are those gaps at all-time highs???

Piyasada birileri..., dis gucler, soros, vs. gibi inanclari olan arkadaslar icin Isvec borsasinda islem goren bir hissenin grafigini paylasiyorum.

Piyasada birileri..., dis gucler, soros, vs. gibi inanclari olan arkadaslar icin Isvec borsasinda islem goren bir hissenin grafigini paylasiyorum.

https://twitter.com/TechCharts/status/1440710610400919559

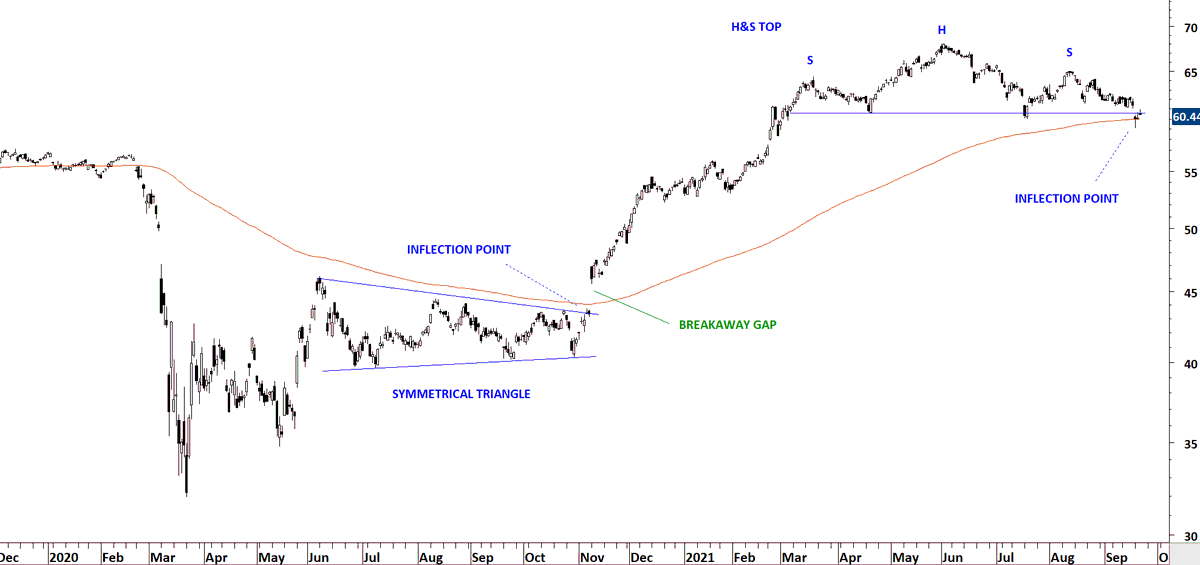

(2) Symmetrical triangle formed right below the 200-day average. Breakout took place at the same price level which I call inflection point. When such condition is met, it is a high conviction setup for me.

(2) Symmetrical triangle formed right below the 200-day average. Breakout took place at the same price level which I call inflection point. When such condition is met, it is a high conviction setup for me.

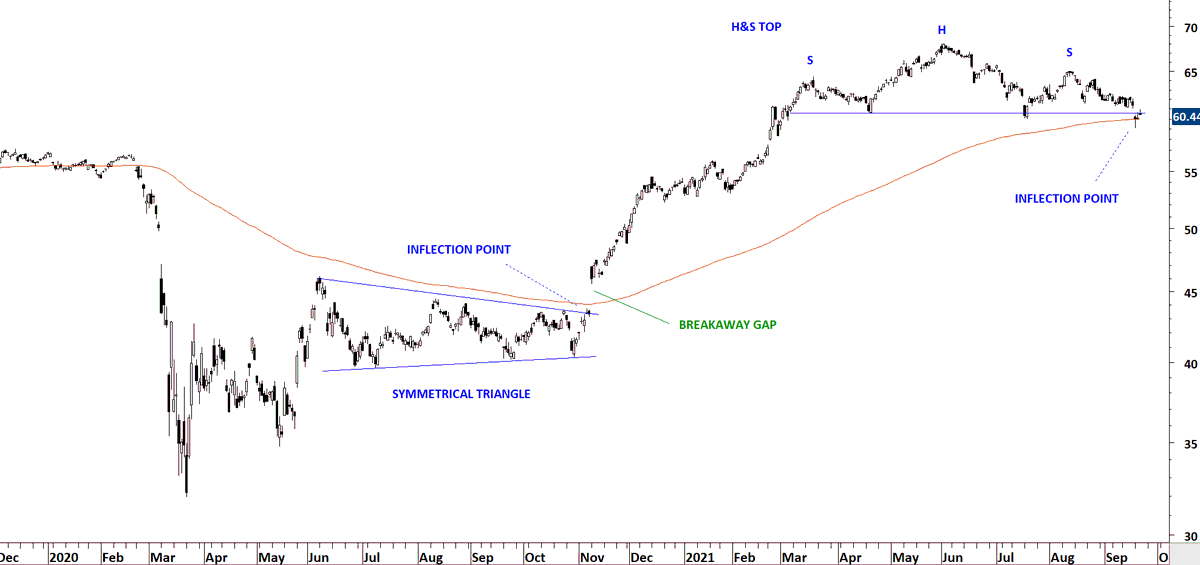

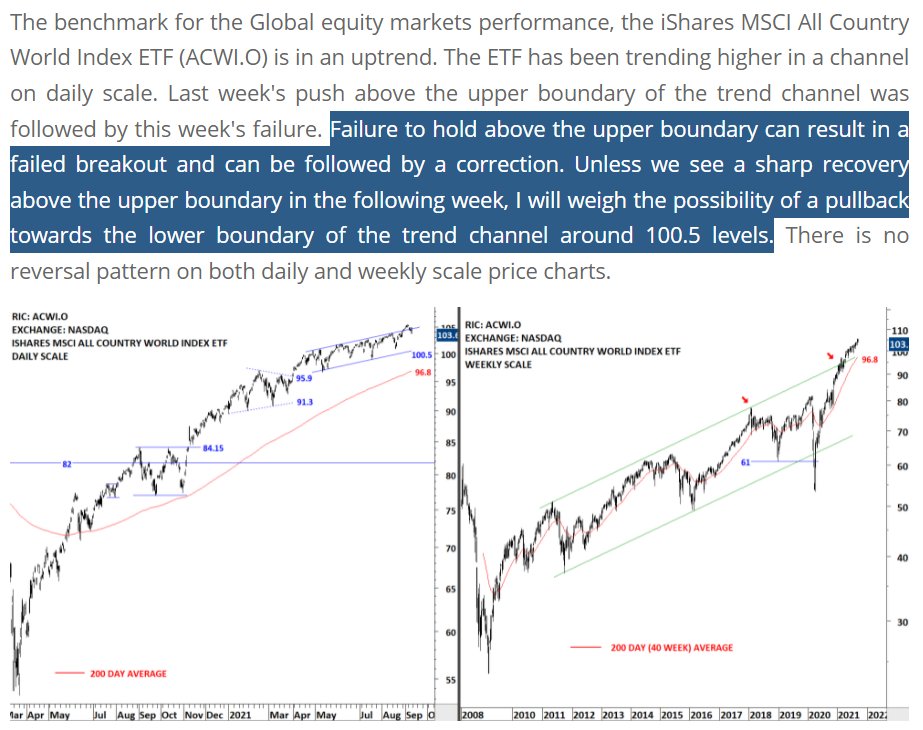

Sept 11 >> Price fails to hold above the upper boundary.

Sept 11 >> Price fails to hold above the upper boundary.

So what should you look for? What is the sweet spot?

So what should you look for? What is the sweet spot?