1/ Private Equity Investment As A Divining Rod For Market Failure: Policy Responses To Harmful Physician Practice Acquisitions

This is an important, thoughtful piece.

HT @LorenAdler

This is an important, thoughtful piece.

HT @LorenAdler

2/ As the title implies, the best way to think about the problem is that Private Equity points the way towards every opportunity for outsized financial gains, especially where there is arbitrage, or market failures.

PE investors use the word "rents" in a positive way

PE investors use the word "rents" in a positive way

3/ As @brianwpowers @WillShrank have pointed out, if you create outsized opportunities in new payment models, private capital can accelerated that too

Though IMO they undersell the degree to which PE-backed groups in MA tend to focus on...risk adjustment

Though IMO they undersell the degree to which PE-backed groups in MA tend to focus on...risk adjustment

https://twitter.com/Farzad_MD/status/1426930067200950272?t=ucL8vOlnhAXJZiSjvXR1DA&s=19

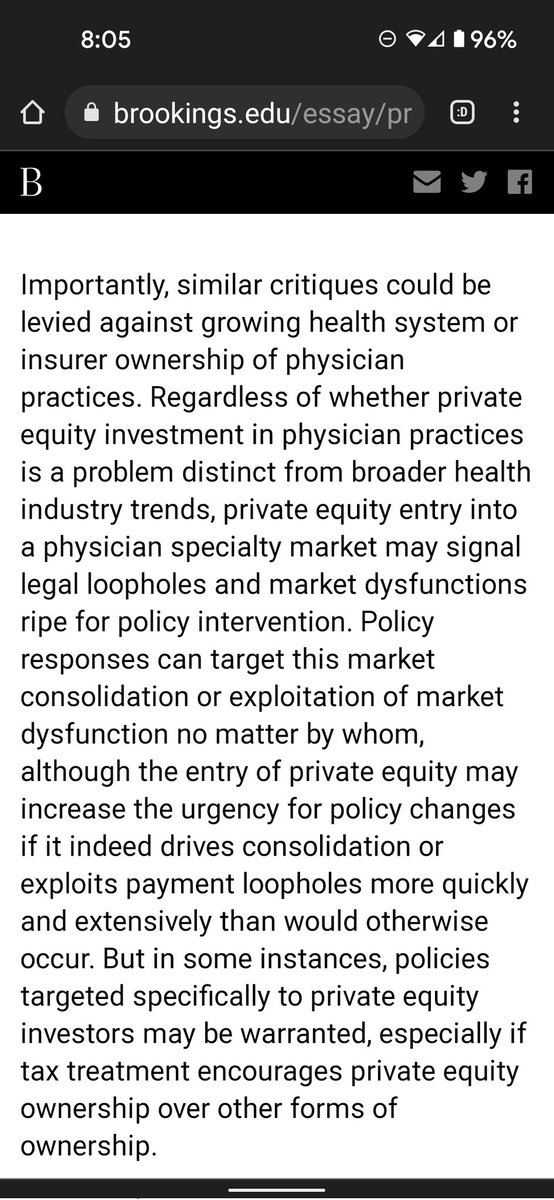

4/ The Brookings team acknowledges that PE is not necessarily worse than payers or hospitals when it comes to taking advantage of arbitrage.

We've seen plenty of that

(My favorite explanation for persistent belief in "Medicare cost shifting" -- "non profit hospitals are lazy")

We've seen plenty of that

(My favorite explanation for persistent belief in "Medicare cost shifting" -- "non profit hospitals are lazy")

5/ I know that for normal people, venture capital is private equity too, but in practice their incentives and strategies are completely different.

VCs fund startups, and you can't count on arbitrage/loopholes staying open for the time it takes to get to scale ("regulatory risk")

VCs fund startups, and you can't count on arbitrage/loopholes staying open for the time it takes to get to scale ("regulatory risk")

6/ my view is that attempts to target PE ownership specifically won't work, and could be distracting from the more important (and difficult) task of prying incumbents away from a status quo that bestows rent upon them.

Good policy = aligning private profit & public good

Good policy = aligning private profit & public good

7/ I haven't thought about this enough, but if the problem is PE firms exploiting loopholes for short term gains and flipping it to the next player within 3 year investment window, a logical solution would be to increase the duration needed for them to realize long term cap gains

• • •

Missing some Tweet in this thread? You can try to

force a refresh