Policy Bazaar DRHP Takeaways!

KYI - Know Your IPO ✅

Let's understand everything about this online insurance broking company in the thread below 👇

Do Retweet and help us educate more investors :)

KYI - Know Your IPO ✅

Let's understand everything about this online insurance broking company in the thread below 👇

Do Retweet and help us educate more investors :)

1/n

- The story goes - Yashish Dahiya’s father was cheated by a few insurance brokers. So Dahiya junior went on a crusade and co-founded PB for consumers to compare insurance policies & purchase a policy that makes sense for them. (Src – @MorningContext )

- The story goes - Yashish Dahiya’s father was cheated by a few insurance brokers. So Dahiya junior went on a crusade and co-founded PB for consumers to compare insurance policies & purchase a policy that makes sense for them. (Src – @MorningContext )

2/n

About Policybazaar (PB) or PB Fintech –

- Incorporated as “ETECHACES Marketing and Consulting Private Limited” at New Delhi on June 4, 2008.

- Professionally managed company with no identifiable promoter

About Policybazaar (PB) or PB Fintech –

- Incorporated as “ETECHACES Marketing and Consulting Private Limited” at New Delhi on June 4, 2008.

- Professionally managed company with no identifiable promoter

3/n

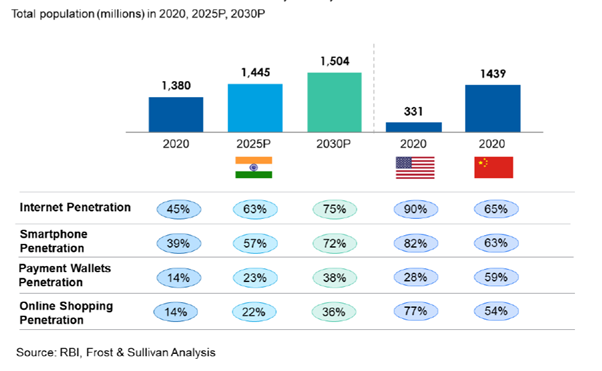

- According to Frost & Sullivan (FY20) -

- PB was India’s largest digital insurance marketplace with a 93.4% market share based on no. of policies sold

- In FY20, 65.3% of all digital insurance sales in India by volume was transacted through PB

- According to Frost & Sullivan (FY20) -

- PB was India’s largest digital insurance marketplace with a 93.4% market share based on no. of policies sold

- In FY20, 65.3% of all digital insurance sales in India by volume was transacted through PB

4/n

- Paisabazaar was India’s largest digital consumer credit marketplace with a 51.4% market share, based on disbursals in FY20. It is widely used to access credit scores, with ~21.5 mn Consumers in total having accessed their credit score through the platform

- Paisabazaar was India’s largest digital consumer credit marketplace with a 51.4% market share, based on disbursals in FY20. It is widely used to access credit scores, with ~21.5 mn Consumers in total having accessed their credit score through the platform

5/n

- They also innovate with Insurers and Lending Partners with the help of their extensive data insights

- Policybazaar and Paisabazaar platforms make personalised recommendations of insurance and credit products respectively based on consumer needs

- They also innovate with Insurers and Lending Partners with the help of their extensive data insights

- Policybazaar and Paisabazaar platforms make personalised recommendations of insurance and credit products respectively based on consumer needs

6/n

- FY21 - 7,310 full-time employees. 462 in tech & product. As per the morning context, their call centres employ more than 5000 employees!

- They have operations in Dubai. They plan to scale up in Gulf Cooperation Council (“GCC”) region as well as South-East Asian countries

- FY21 - 7,310 full-time employees. 462 in tech & product. As per the morning context, their call centres employ more than 5000 employees!

- They have operations in Dubai. They plan to scale up in Gulf Cooperation Council (“GCC”) region as well as South-East Asian countries

7/n

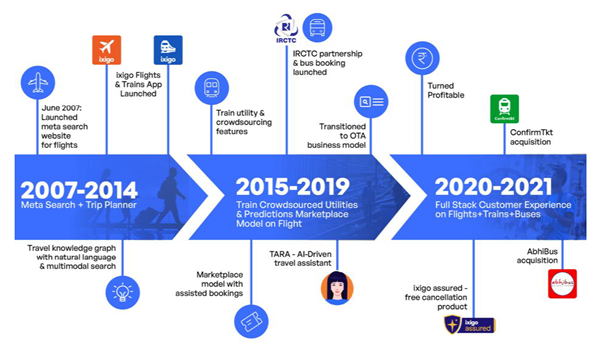

Policy Bazaar - From a Web aggregator to Insurance broker –

- PB became a direct insurance broker on June 10, 2021, from a web aggregator

- The web aggregator licence had limitations on commissions and offline sales ability.

More details in image, do read completely

Policy Bazaar - From a Web aggregator to Insurance broker –

- PB became a direct insurance broker on June 10, 2021, from a web aggregator

- The web aggregator licence had limitations on commissions and offline sales ability.

More details in image, do read completely

8/n

Let's talk about 2 of their main platforms -

Starting with of course PolicyBazaar -

- As of FY21 - 51 Insurer Partners offered 340 term, health, motor, home, and travel insurance products.

- In FY21 it sold over 7.2 million policies worth over Rs 4,700 crore

Let's talk about 2 of their main platforms -

Starting with of course PolicyBazaar -

- As of FY21 - 51 Insurer Partners offered 340 term, health, motor, home, and travel insurance products.

- In FY21 it sold over 7.2 million policies worth over Rs 4,700 crore

9/n

Now moving to Paisa Bazaar -

- 54 partnerships with large banks, NBFCs, and fintech lenders

- Offerings - personal loans, business loans, credit cards, home loans & Loan Against Property

- scaling this up as a digital personal credit platform for varied consumer segments

Now moving to Paisa Bazaar -

- 54 partnerships with large banks, NBFCs, and fintech lenders

- Offerings - personal loans, business loans, credit cards, home loans & Loan Against Property

- scaling this up as a digital personal credit platform for varied consumer segments

10/n

PaisaBazaar Disbursals -

- However, disbursals are down for Paisa Bazaar majorly which makes sense as the economy was shut down and of course the company must have treaded carefully here before starting to lend again

PaisaBazaar Disbursals -

- However, disbursals are down for Paisa Bazaar majorly which makes sense as the economy was shut down and of course the company must have treaded carefully here before starting to lend again

11/n

Key operating and financial metrics

- Good growth seen in business premiums and total sum assured

- Total disbursals came down but notice that disbursals to existing users went up (so our previous statement of management's carefulness is confirmed)

Key operating and financial metrics

- Good growth seen in business premiums and total sum assured

- Total disbursals came down but notice that disbursals to existing users went up (so our previous statement of management's carefulness is confirmed)

12/n

Covid-19 Impact on India Insurance Industry -

- The World became conscious during the COVID period when hospitalization and negativity was seen all around us

- Insurance growth was seen as more people wanted to safeguard themselves

Covid-19 Impact on India Insurance Industry -

- The World became conscious during the COVID period when hospitalization and negativity was seen all around us

- Insurance growth was seen as more people wanted to safeguard themselves

13/n

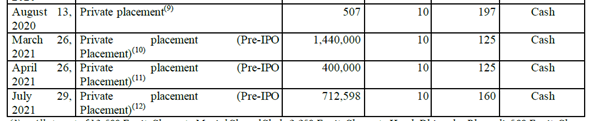

Issue size -

- Total Size – 6017.5 Cr

- Fresh issue – 3750 Cr

- OFS – 2267.5 Cr

- Pre IPO Placement - Rs 750 Cr can be raised

Fresh issue Objectives - (Img 1)

Shareholding Pattern - (Img 2)

Issue size -

- Total Size – 6017.5 Cr

- Fresh issue – 3750 Cr

- OFS – 2267.5 Cr

- Pre IPO Placement - Rs 750 Cr can be raised

Fresh issue Objectives - (Img 1)

Shareholding Pattern - (Img 2)

14/n

Capital Structure –

- 41.12 Cr Shares of FV ₹ 2 each + fresh shares of 3750 cr i.e 1.875 cr new shares (assuming 2000 rs per share, taken from unlisted market deal prices)

- So mcap = 85990 Cr = 11.47 Bn $

Capital Structure –

- 41.12 Cr Shares of FV ₹ 2 each + fresh shares of 3750 cr i.e 1.875 cr new shares (assuming 2000 rs per share, taken from unlisted market deal prices)

- So mcap = 85990 Cr = 11.47 Bn $

15/n

Risks –

- 4 largest partners accounted for 33% of total revenue for FY21

- A lot of competition! From independent online players, offline players to fintech companies!

- HDFC Ergo delisted its products from online insurance aggregators, including Policybazaar.

Risks –

- 4 largest partners accounted for 33% of total revenue for FY21

- A lot of competition! From independent online players, offline players to fintech companies!

- HDFC Ergo delisted its products from online insurance aggregators, including Policybazaar.

16/n

- Insurance companies are looking to gain more autonomy in the increasingly digital world of retail insurance

- HDFC Ergo joined the largest private sector general insurer ICICI Lombard and public sector behemoth LIC of India in such a move

- Insurance companies are looking to gain more autonomy in the increasingly digital world of retail insurance

- HDFC Ergo joined the largest private sector general insurer ICICI Lombard and public sector behemoth LIC of India in such a move

17/n

Insurance Regulator on Web Aggregators – (2019-20 Annual Report) -

- In a nutshell, online web aggregators haven’t moved a needle when it comes to the insurance space.

Insurance Regulator on Web Aggregators – (2019-20 Annual Report) -

- In a nutshell, online web aggregators haven’t moved a needle when it comes to the insurance space.

18/n

- In Life insurance – web aggregators share of individual new business was 0.27% compared to 60% by agents

- In health Insurance - web aggregators share of individual new business was 0.99% compared to 34% by agents

- In Life insurance – web aggregators share of individual new business was 0.27% compared to 60% by agents

- In health Insurance - web aggregators share of individual new business was 0.99% compared to 34% by agents

19/n

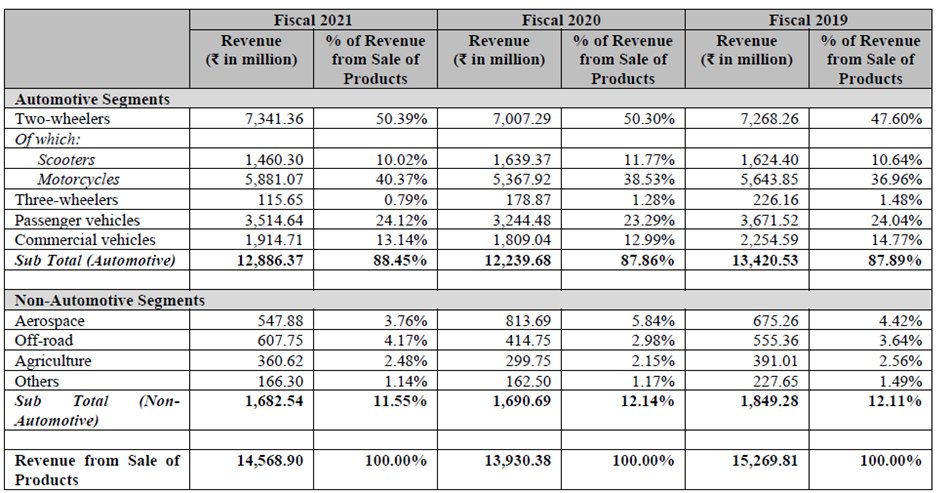

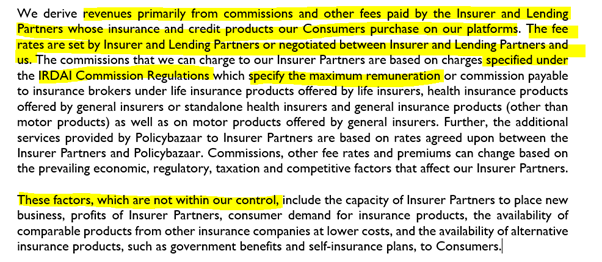

Revenue Model -

- Before we look at financials, let’s take a look at their revenue model and how it is fixed

Revenue Breakup -

Revenue Model -

- Before we look at financials, let’s take a look at their revenue model and how it is fixed

Revenue Breakup -

20/n

Financials -

- Good topline Growth

- High A&P costs + 5000+ employees in call centre shows characteristics of a push product (Insurance is such. Takes many calls to convert a sale)

- EBITDA & net loss narrowed down due to A&P expenses pullback

- Cash flows +ve in FY21

Financials -

- Good topline Growth

- High A&P costs + 5000+ employees in call centre shows characteristics of a push product (Insurance is such. Takes many calls to convert a sale)

- EBITDA & net loss narrowed down due to A&P expenses pullback

- Cash flows +ve in FY21

21/n

Valuations & Conclusion -

FY21 EPS (4.11)

Roe (7.54%)

NAV 54.5

- 2000 Rs heard in unlisted, So mcap = 85990 Cr = 11.47 Bn $

In comparison -

- HDFC Life mcap = 145,119 Cr

- SBI Life mcap = 120,636 Cr

- ICICI Lombard - 75,375 cr

Valuations & Conclusion -

FY21 EPS (4.11)

Roe (7.54%)

NAV 54.5

- 2000 Rs heard in unlisted, So mcap = 85990 Cr = 11.47 Bn $

In comparison -

- HDFC Life mcap = 145,119 Cr

- SBI Life mcap = 120,636 Cr

- ICICI Lombard - 75,375 cr

22/n

PB in unlisted is at valuations that are near insurance companies (more than ICICI Lombard)

What’s more surprising is that the company is expected to get IPO near 1000 Rs and unlisted markets are ready to pay more than 2x the price!

At Rs 1200 = 53094 Cr = 7.1 bn $

PB in unlisted is at valuations that are near insurance companies (more than ICICI Lombard)

What’s more surprising is that the company is expected to get IPO near 1000 Rs and unlisted markets are ready to pay more than 2x the price!

At Rs 1200 = 53094 Cr = 7.1 bn $

23/n

- To conclude, yes, the insurance penetration is low in India, online is even very less and the scope for such aggregators/online brokers is HUGE!

- But many are entering the space and creating their own ecosystem of financial services.

- To conclude, yes, the insurance penetration is low in India, online is even very less and the scope for such aggregators/online brokers is HUGE!

- But many are entering the space and creating their own ecosystem of financial services.

24/n

- Brokerages are creating platform companies with all services inside, fintech too are entering and insurance creators i.e life and general insurance companies are taking the tech route themselves and they are no rush as agents are accounting for a good share of business

- Brokerages are creating platform companies with all services inside, fintech too are entering and insurance creators i.e life and general insurance companies are taking the tech route themselves and they are no rush as agents are accounting for a good share of business

25/n

- Definitely, the company valuations seem to be pricing in a lot of future events and the unlisted markets seem to be pricing in the same to an even greater extent.

- Definitely, the company valuations seem to be pricing in a lot of future events and the unlisted markets seem to be pricing in the same to an even greater extent.

27/n

Insurance Opportunity -

The market for insurance products in India is estimated to be ₹7.6 trillion (US$102 billion) in total premium in FY20across life and non-life insurance and is expected to grow to ₹39.0 trillion (US$520 billion) by Fiscal 2030 at a CAGR of 17.8%.

Insurance Opportunity -

The market for insurance products in India is estimated to be ₹7.6 trillion (US$102 billion) in total premium in FY20across life and non-life insurance and is expected to grow to ₹39.0 trillion (US$520 billion) by Fiscal 2030 at a CAGR of 17.8%.

28/n

More points that point towards the huge scope of growth ahead -

- Sum Assured as % of GDP

- Mortality protection Gap

- India’s healthcare expenditure is the lowest globally

More points that point towards the huge scope of growth ahead -

- Sum Assured as % of GDP

- Mortality protection Gap

- India’s healthcare expenditure is the lowest globally

End of thread! Thanks for patiently reading.

Stay tuned for more IPO threads, hit the follow button, and make sure you don't miss out on any future threads!

Stay tuned for more IPO threads, hit the follow button, and make sure you don't miss out on any future threads!

• • •

Missing some Tweet in this thread? You can try to

force a refresh