Ixigo DRHP Takeaways!

KYI - Know Your IPO ✅

Let's understand everything about this OTA (online travel aggregator) in the thread below

Do Retweet and help us educate more investors :)

KYI - Know Your IPO ✅

Let's understand everything about this OTA (online travel aggregator) in the thread below

Do Retweet and help us educate more investors :)

1/n

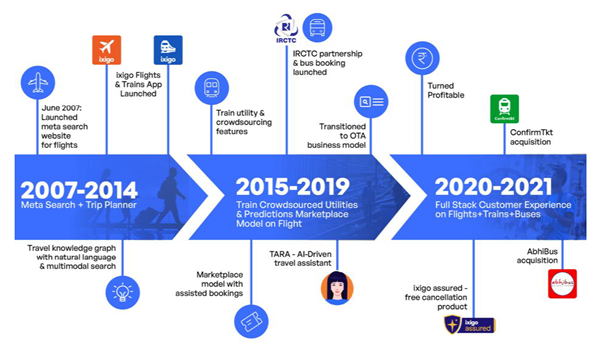

About Ixigo -

- History

- Largest Indian OTA in online train bookings

- ixigo trains + ConfirmTkt collectively are the leading B2C distribution platforms for IRCTC with a 42% market share

- AbhiBus, was the second-largest Indian bus-ticketing OTA with a 10% market share

About Ixigo -

- History

- Largest Indian OTA in online train bookings

- ixigo trains + ConfirmTkt collectively are the leading B2C distribution platforms for IRCTC with a 42% market share

- AbhiBus, was the second-largest Indian bus-ticketing OTA with a 10% market share

2/n

- Third largest flight OTA in India with a market share of 12% in online air bookings

- They say "we are the leading travel ecosystem for the ‘next billion users, with our focus on localized content and app features that aim at solving problems of travelers”

- Third largest flight OTA in India with a market share of 12% in online air bookings

- They say "we are the leading travel ecosystem for the ‘next billion users, with our focus on localized content and app features that aim at solving problems of travelers”

3/n

Some Key Metrics -

- Gross Transaction Value

- Transactions CAGR

- Monthly Screenviews

- Cumulative Downloads

- Total registered users

- Repeat transaction rate

- Organic Traffic

- Leadership positions

Some Key Metrics -

- Gross Transaction Value

- Transactions CAGR

- Monthly Screenviews

- Cumulative Downloads

- Total registered users

- Repeat transaction rate

- Organic Traffic

- Leadership positions

4/n

- Buildup (growth or run rates) of the above metrics over 3 years

- Cost of acquiring a customer has come down (A&P spends pullback)

- App Strategy (Img 3)

- Ecosystem (Img 4)

- Buildup (growth or run rates) of the above metrics over 3 years

- Cost of acquiring a customer has come down (A&P spends pullback)

- App Strategy (Img 3)

- Ecosystem (Img 4)

5/n

How does it earn money/Rokda Kaise kamate hain?

- Rail tickets - agent service charges, payment gateway charges & ixigo assured charges

- Flights - airline commissions, convenience charges, cancellation charges, rescheduling charges, ixigo assured charges

How does it earn money/Rokda Kaise kamate hain?

- Rail tickets - agent service charges, payment gateway charges & ixigo assured charges

- Flights - airline commissions, convenience charges, cancellation charges, rescheduling charges, ixigo assured charges

6/n

- Bus tickets - Commissions from bus operators and convenience charges, which is based on the value of the ticket

- Hotels - commissions based on the volume of hotel-room nights occupied

- Cabs - fixed commission from ANI Technologies (Ola)

- Bus tickets - Commissions from bus operators and convenience charges, which is based on the value of the ticket

- Hotels - commissions based on the volume of hotel-room nights occupied

- Cabs - fixed commission from ANI Technologies (Ola)

7/n

Partnerships -

- Their services are displayed on the Flipkart website. (Agreement expires Dec 31, 2021. The company says they don't expect such agreement to get renewed)

- Also partnered with PhonePe for flight and train bookings.

Partnerships -

- Their services are displayed on the Flipkart website. (Agreement expires Dec 31, 2021. The company says they don't expect such agreement to get renewed)

- Also partnered with PhonePe for flight and train bookings.

8/n

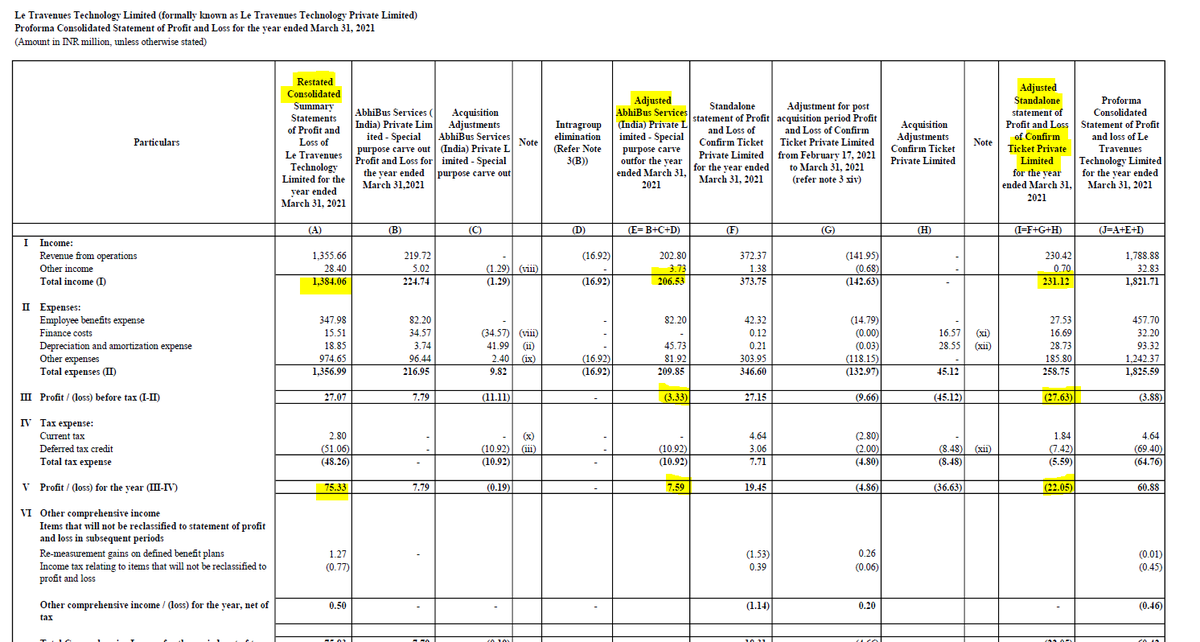

M&A -

- Confirm Ticket, a train-utility & ticketing company, w.e.f February 17, 2021

- Recently did an acquisition of AbhiBus, which is into bus ticketing (slump-sale) w.e.f Aug 1, 2021

Have given a breakup in the below image of these 2 👇

M&A -

- Confirm Ticket, a train-utility & ticketing company, w.e.f February 17, 2021

- Recently did an acquisition of AbhiBus, which is into bus ticketing (slump-sale) w.e.f Aug 1, 2021

Have given a breakup in the below image of these 2 👇

9/n

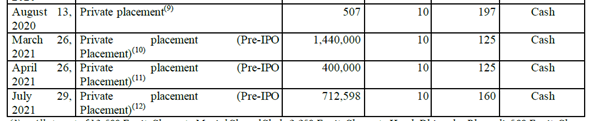

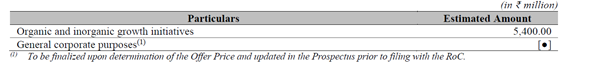

About the Offer -

- Issue Size – 1600 Cr (Fresh 750 Cr + OFS 850 CR)

- Selling Shareholders

- 540 Cr toward Organic or inorganic growth opportunities

Shareholding (as of DRHP date i.e. Aug 12, 2021)-

About the Offer -

- Issue Size – 1600 Cr (Fresh 750 Cr + OFS 850 CR)

- Selling Shareholders

- 540 Cr toward Organic or inorganic growth opportunities

Shareholding (as of DRHP date i.e. Aug 12, 2021)-

https://twitter.com/aditya_kondawar/status/1440550903556165632

10/n

Risks -

- train ticketing services depend on agreement with IRCTC (in past, the agreement has been renewed and extended several times. in recent times, renewed in 2020 awarded till April 30, 2023)

- The Indian OTA industry is highly competitive

Risks -

- train ticketing services depend on agreement with IRCTC (in past, the agreement has been renewed and extended several times. in recent times, renewed in 2020 awarded till April 30, 2023)

- The Indian OTA industry is highly competitive

11/n

Financials -

- This is the first year company made a profit (Great time to cash in given the bull run?)

- Margins are not great (would there be any operating leverage when the competition is never-ending?)

Financials -

- This is the first year company made a profit (Great time to cash in given the bull run?)

- Margins are not great (would there be any operating leverage when the competition is never-ending?)

12/n

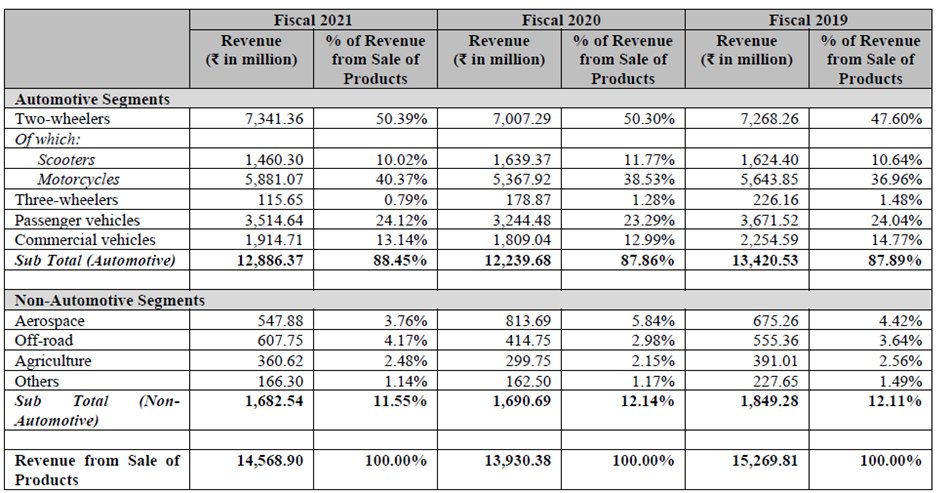

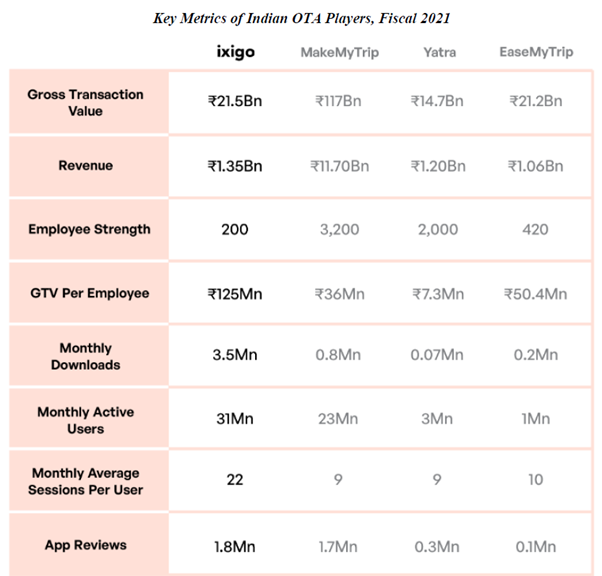

Peer Comparison with other OTAs-

- GTV

- Revenue

- Revenue to GTV Ratio (Highest for MMT, just below avg for Ixigo)

- App Downloads in App Store

- Monthly Downloads April 2021

Peer Comparison with other OTAs-

- GTV

- Revenue

- Revenue to GTV Ratio (Highest for MMT, just below avg for Ixigo)

- App Downloads in App Store

- Monthly Downloads April 2021

13/n

Now, of course, this thread won't be complete without talking about Ease my trip and its crazy rally since listing.

It has given 300% returns from its IPO Price of Rs 187 and now trades at Rs 600. (peak of Rs 720)

Now, of course, this thread won't be complete without talking about Ease my trip and its crazy rally since listing.

It has given 300% returns from its IPO Price of Rs 187 and now trades at Rs 600. (peak of Rs 720)

14/n

Valuations -

Easy trip is the only listed Indian OTA that trades at 60.3x Price to sales.

Ixigo is said to be looking at a 600-800mn $ valuation. at upper valuation, it will be demanding 43.5x Price to sales.

Valuations -

Easy trip is the only listed Indian OTA that trades at 60.3x Price to sales.

Ixigo is said to be looking at a 600-800mn $ valuation. at upper valuation, it will be demanding 43.5x Price to sales.

15/n

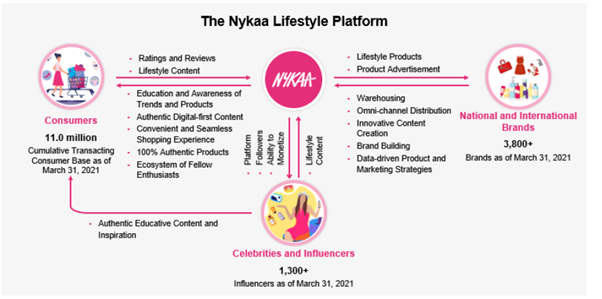

Industry -

Next billion internet users (NBUs) are a highly anticipated consumer class, that will determine the direction of consumption in many internet-based industries

ixigo says 70% of their traffic and 92.6% of transactions are driven by smaller towns and cities

Industry -

Next billion internet users (NBUs) are a highly anticipated consumer class, that will determine the direction of consumption in many internet-based industries

ixigo says 70% of their traffic and 92.6% of transactions are driven by smaller towns and cities

16/n

- B2C and B2B in Indian OTA Landscape

B2C -

- Consumers directly book tickets from OTAs on basis of cheap prices or better services

- B2C has been the traditional mainstay of the OTA industry since it first started and accounts for 60% of the OTA market, even in 2020

- B2C and B2B in Indian OTA Landscape

B2C -

- Consumers directly book tickets from OTAs on basis of cheap prices or better services

- B2C has been the traditional mainstay of the OTA industry since it first started and accounts for 60% of the OTA market, even in 2020

17/n

- It is also from the core B2C segment, that the OTAs can extract maximum value through cross selling of value-added products and services

- This is why the largest OTA in the market - MMT still focuses mostly on the B2C segment

- It is also from the core B2C segment, that the OTAs can extract maximum value through cross selling of value-added products and services

- This is why the largest OTA in the market - MMT still focuses mostly on the B2C segment

18/n

B2B -

- Here the corporate division of an OTA deals with corporate clients by helping generate company specific codes to be used by the employees to book tickets and rooms at lower prices

- The B2B segment accounted for 30% of the overall OTA revenue in 2021

B2B -

- Here the corporate division of an OTA deals with corporate clients by helping generate company specific codes to be used by the employees to book tickets and rooms at lower prices

- The B2B segment accounted for 30% of the overall OTA revenue in 2021

19/n

B2B2C -

- In Tier-II & III cities, where it is difficult for OTAs to grow their services due to lack of internet penetration or lack of trust amongst consumers, the B2B2C model is more prevalent, where traditional travel agencies route their traffic through OTA portals

B2B2C -

- In Tier-II & III cities, where it is difficult for OTAs to grow their services due to lack of internet penetration or lack of trust amongst consumers, the B2B2C model is more prevalent, where traditional travel agencies route their traffic through OTA portals

20/n

The company is demanding expensive valuations. They also have plans to grow the inorganic way, but the key monitorable of course is the operating leverage and competition!

End of thread! Thanks for reading :)

The company is demanding expensive valuations. They also have plans to grow the inorganic way, but the key monitorable of course is the operating leverage and competition!

End of thread! Thanks for reading :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh