Manyavar DRHP Takeaways!

KYI - Know Your IPO ✅

It is not just a clothing company!

It is a SaaS company (Stitching or Sherwani as a service) 😝😝

Do Retweet as it will help us educate more investors!

KYI - Know Your IPO ✅

It is not just a clothing company!

It is a SaaS company (Stitching or Sherwani as a service) 😝😝

Do Retweet as it will help us educate more investors!

1/n

About Manyavar -

- The largest company in India in the men’s Indian wedding and celebration wear segment

- Crisil – “‘Manyavar’ brand is a category leader in the branded Indian wedding and celebration wear market with a pan-India presence through its multi-channel network”

About Manyavar -

- The largest company in India in the men’s Indian wedding and celebration wear segment

- Crisil – “‘Manyavar’ brand is a category leader in the branded Indian wedding and celebration wear market with a pan-India presence through its multi-channel network”

2/n

- For a large portion of attires and accessories, third-party manufacturers (“jobbers”) are used

- Jobbers perform different stages of the manufacturing process, including cutting, embroidery, stitching, and finishing

- For a large portion of attires and accessories, third-party manufacturers (“jobbers”) are used

- Jobbers perform different stages of the manufacturing process, including cutting, embroidery, stitching, and finishing

3/n

- Their warehouse, factory, and a majority of their jobbers are based in and around Kolkata, India, and they depend on jobbers for a significant portion of the manufacturing processes of their products

- Their warehouse, factory, and a majority of their jobbers are based in and around Kolkata, India, and they depend on jobbers for a significant portion of the manufacturing processes of their products

4/n

Brands -

- Manyavar, Mohey, Mebaz, Manthan and Twamev

- A Major revenue chunk (84.2% in FY21) comes from the sale of products under the Manyavar brand.

Brands -

- Manyavar, Mohey, Mebaz, Manthan and Twamev

- A Major revenue chunk (84.2% in FY21) comes from the sale of products under the Manyavar brand.

5/n

Distribution –

- Exclusive brand outlets (EBOs)

- Multi brand Outlets (MBS) and Large Format Stores (LFS)

- E-Commerce

- They intend to expand the footprint of their franchisee-owned EBOs, MBOs, and LFS and use targeted marketing initiatives such as digital and offline

Distribution –

- Exclusive brand outlets (EBOs)

- Multi brand Outlets (MBS) and Large Format Stores (LFS)

- E-Commerce

- They intend to expand the footprint of their franchisee-owned EBOs, MBOs, and LFS and use targeted marketing initiatives such as digital and offline

6/n

EBOs and Franchisees: The good ‘fit’ -

- 90% revenue came from EBOs in FY21

- As of Jun 30, 2021, they have 300+ franchisees and 537 EBOs (includes 55 shop-in-shops & 12 international stores) spread over 1.1 m.sq.ft in 207 cities/towns in India & 8 cities internationally

EBOs and Franchisees: The good ‘fit’ -

- 90% revenue came from EBOs in FY21

- As of Jun 30, 2021, they have 300+ franchisees and 537 EBOs (includes 55 shop-in-shops & 12 international stores) spread over 1.1 m.sq.ft in 207 cities/towns in India & 8 cities internationally

7/n

- As of June 30, 2021, 70% of their franchisees have been with them for 3+ years

- For franchisee-owned EBOs – the top 5 franchises accounted for 28% of total sales as of June 30, 2021. It was 36% in FY19.

- As of June 30, 2021, 70% of their franchisees have been with them for 3+ years

- For franchisee-owned EBOs – the top 5 franchises accounted for 28% of total sales as of June 30, 2021. It was 36% in FY19.

8/n

- In FY21, 44.22% of sales were generated by franchisee-owned EBOs from Tier I cities, 42.05% from Tier-II cities, and 12.31% from Tier III towns. The remaining 1.42% were generated from international markets

- In FY21, 44.22% of sales were generated by franchisee-owned EBOs from Tier I cities, 42.05% from Tier-II cities, and 12.31% from Tier III towns. The remaining 1.42% were generated from international markets

9/n

- Highly concentrated on a single discretionary product – Indian wedding and celebration wear.

- Extends credit to franchisee-owned EBOs, MBOs, and LFSs in respect of products sales, and thus faces the risk of uncertainty in receiving outstanding amounts.

- Highly concentrated on a single discretionary product – Indian wedding and celebration wear.

- Extends credit to franchisee-owned EBOs, MBOs, and LFSs in respect of products sales, and thus faces the risk of uncertainty in receiving outstanding amounts.

10/n

Financials -

- No Debt

- Company pulled back on A&P

- CFO and FCF good (IPO anyways is a pure OFS)

- Lucrative margin business (brand magic, many more trying to get here like AB group, etc)

Financials -

- No Debt

- Company pulled back on A&P

- CFO and FCF good (IPO anyways is a pure OFS)

- Lucrative margin business (brand magic, many more trying to get here like AB group, etc)

11/n

Manyavar Valuations -

- Buyback of shares @ Rs 990 on 14/07/21 (FV 2)

- Split to FV Rs 1 (so Rs 495)

- If IPO at Rs 600, Mcap= 14520 Cr

- At Rs 700, Mcap = 16940 Cr

- Sales of 950 Cr in FY20, 625 Cr in FY21

- Taking 1000 cr sales - 14.5x to 17x Price to sales!

Expensive!

Manyavar Valuations -

- Buyback of shares @ Rs 990 on 14/07/21 (FV 2)

- Split to FV Rs 1 (so Rs 495)

- If IPO at Rs 600, Mcap= 14520 Cr

- At Rs 700, Mcap = 16940 Cr

- Sales of 950 Cr in FY20, 625 Cr in FY21

- Taking 1000 cr sales - 14.5x to 17x Price to sales!

Expensive!

12/n

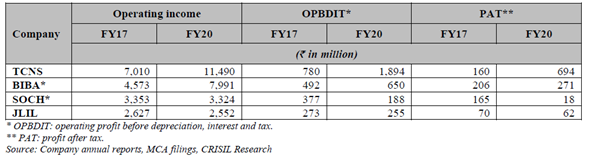

- Peers and a closer look at them -

- Key financial parameters of players operating in the Indian wedding and celebration market

- Key financial parameters of ethnic-wear market players in casual wear but having Indian wedding and celebration wear brands as well

- Peers and a closer look at them -

- Key financial parameters of players operating in the Indian wedding and celebration market

- Key financial parameters of ethnic-wear market players in casual wear but having Indian wedding and celebration wear brands as well

13/n

- Key Brands in the space

- Factors contributing to the growth in the domestic apparel market

- Competitive Landscape Men's Segment (in celebration wear we see that Manyavar's brands are having a good hold)

- Competitive Landscape Women's Segment (quite a few brands here)

- Key Brands in the space

- Factors contributing to the growth in the domestic apparel market

- Competitive Landscape Men's Segment (in celebration wear we see that Manyavar's brands are having a good hold)

- Competitive Landscape Women's Segment (quite a few brands here)

15/n

According to CRISIL, the Indian wedding/celebration wear apparel market was estimated at Rs 1.02 lakh Cr in FY20!

Just the apparel 🤯

Expected to reach Rs 1.37 lakh Cr by FY25 thanks to higher spending per consumer, and increasing trend of multi-day wedding functions!

According to CRISIL, the Indian wedding/celebration wear apparel market was estimated at Rs 1.02 lakh Cr in FY20!

Just the apparel 🤯

Expected to reach Rs 1.37 lakh Cr by FY25 thanks to higher spending per consumer, and increasing trend of multi-day wedding functions!

16/n

About 9.5 million to 10 million weddings happen in India every year!

Imagine the total outlay on these 10 million weddings 🤯

And of course, goes without saying that the top 5-10% of weddings (Big Fat Indian weddings) would account for 90% of the expenses

About 9.5 million to 10 million weddings happen in India every year!

Imagine the total outlay on these 10 million weddings 🤯

And of course, goes without saying that the top 5-10% of weddings (Big Fat Indian weddings) would account for 90% of the expenses

17/n

This was definitely a good DRHP to read!

End of thread! Thanks for reading :)

Hit the follow button and never miss out on more such threads!

This was definitely a good DRHP to read!

End of thread! Thanks for reading :)

Hit the follow button and never miss out on more such threads!

• • •

Missing some Tweet in this thread? You can try to

force a refresh