1/n

The discussion about "transitory" versus "permanent" higher inflation is silly.

The point that the Federal Reserve has created a massive excess liquidity - broad money supply growths continue to strongly outpace the trend in money demand.

That is inflationary.

The discussion about "transitory" versus "permanent" higher inflation is silly.

The point that the Federal Reserve has created a massive excess liquidity - broad money supply growths continue to strongly outpace the trend in money demand.

That is inflationary.

2/n

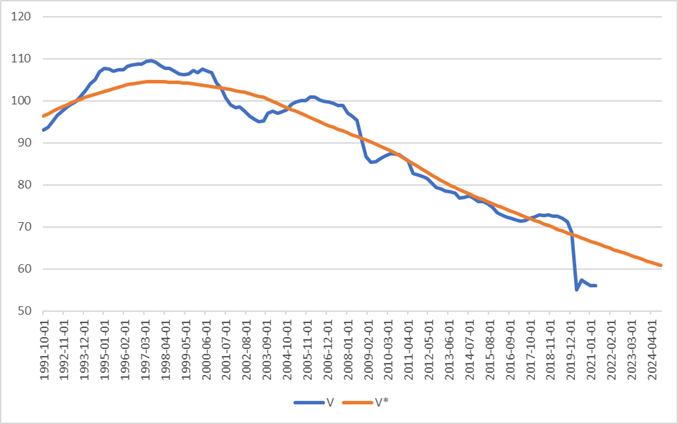

Have a look at the M3 of compared to a very long-term trend.

All that extra money will have to increase nominal spending in the US economy.

Have a look at the M3 of compared to a very long-term trend.

All that extra money will have to increase nominal spending in the US economy.

3/n

Higher nominal spending will cause the price LEVEL to increase as the output gap already has been closed in the US (Y likely is above Y*).

Higher nominal spending will cause the price LEVEL to increase as the output gap already has been closed in the US (Y likely is above Y*).

4/n

This will cause a PERMANENT increase in the US price LEVEL.

This will cause a PERMANENT increase in the US price LEVEL.

5/n

That doesn't necessarily mean permanently higher inflation in the US. But the money already printed by the Fed will cause a hop in price level. Whether INFLATION will be permanently higher dependent on FUTURE Fed policy.

That doesn't necessarily mean permanently higher inflation in the US. But the money already printed by the Fed will cause a hop in price level. Whether INFLATION will be permanently higher dependent on FUTURE Fed policy.

6/n

A way of looking at the monetary "overhang" created by the Fed is to look at the so-called P-star model.

A way of looking at the monetary "overhang" created by the Fed is to look at the so-called P-star model.

7/n

P-star is given by the actually level of broad money in the economy relative to the trend in money demand (real GDP and velocity)

P-star is given by the actually level of broad money in the economy relative to the trend in money demand (real GDP and velocity)

8/n

I have calculated P-star using the CBO's measure of Y* and used the trend in velocity as a measure of V*.

So I do assume a continued downward trend in V.

I have calculated P-star using the CBO's measure of Y* and used the trend in velocity as a measure of V*.

So I do assume a continued downward trend in V.

9/n

I also assume that the monetary expansion is over and M3 from now on will grow at the same rate a in the 2010-2019 period.

I also assume that the monetary expansion is over and M3 from now on will grow at the same rate a in the 2010-2019 period.

10/n

Under this assumptions we can calculate the present and future P-star level. That's the blue line below. The orange line is the actual US price level.

Under this assumptions we can calculate the present and future P-star level. That's the blue line below. The orange line is the actual US price level.

11/n

Over time this gap (P-gap) has to close. I have here assume a fairly slow closing of the P-gap over +5 years.

Over time this gap (P-gap) has to close. I have here assume a fairly slow closing of the P-gap over +5 years.

12/n

If we make this assumption we will see inflation - here measured as the GDP deflator spike to nearly 10% by the end of this year.

And then gradually come down.

If we make this assumption we will see inflation - here measured as the GDP deflator spike to nearly 10% by the end of this year.

And then gradually come down.

13/n

We could call this a "temporary" increase in inflation, but in this scenario inflation will remain well above Fed's 2% target for the next 5-6 years. That is hardly "temporary" in the normal sense of the world.

We could call this a "temporary" increase in inflation, but in this scenario inflation will remain well above Fed's 2% target for the next 5-6 years. That is hardly "temporary" in the normal sense of the world.

14/n

Alternatively if we assume that the monetary overhang will 'disappear' in two years time then the spike in inflation will have to be much bigger.

I have simulated that below.

In such scenario we are back at 2% in 2024, but inflation will be spike to above 18%.

Alternatively if we assume that the monetary overhang will 'disappear' in two years time then the spike in inflation will have to be much bigger.

I have simulated that below.

In such scenario we are back at 2% in 2024, but inflation will be spike to above 18%.

15/n

I think this quite well illustrates that the discussion about "temporary" versus "permanent" is silly.

The case is that the Fed already have done the damage. The question is how fast it will play out. We will have no way of knowing.

I think this quite well illustrates that the discussion about "temporary" versus "permanent" is silly.

The case is that the Fed already have done the damage. The question is how fast it will play out. We will have no way of knowing.

16/n

But what we know is that the Fed consistently has down played the inflationary risks and that is worrying and I personally have a very hard time seeing the US economy just settling down in a nice 'steady state' with 2% inflation and stable real GDP growth in the near future

But what we know is that the Fed consistently has down played the inflationary risks and that is worrying and I personally have a very hard time seeing the US economy just settling down in a nice 'steady state' with 2% inflation and stable real GDP growth in the near future

17/n

The monetary overhang simply is too large and we haven't in any way seen the impact of that on the US price level yet. We have seen it in stock prices and property prices, but a lot of prices haven't adjusted fully yet. That will happen over the coming years.

The monetary overhang simply is too large and we haven't in any way seen the impact of that on the US price level yet. We have seen it in stock prices and property prices, but a lot of prices haven't adjusted fully yet. That will happen over the coming years.

18/18

The question is what happens to the Fed's credibility in the process.

Fingers crossed the Fed (and the Biden administration) doesn't (continue to) repeat the mistakes of the 1970s.

/The End.

The question is what happens to the Fed's credibility in the process.

Fingers crossed the Fed (and the Biden administration) doesn't (continue to) repeat the mistakes of the 1970s.

/The End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh