I don't know if everyone remembers when I drew those Fib retracement levels on $PROG, but one of the major levels of resistance at $2.40 were called out exactly on the exact fib timeline I used.

If these continue to play out, breakout will occur on or before fib marker 5 (10/22)

If these continue to play out, breakout will occur on or before fib marker 5 (10/22)

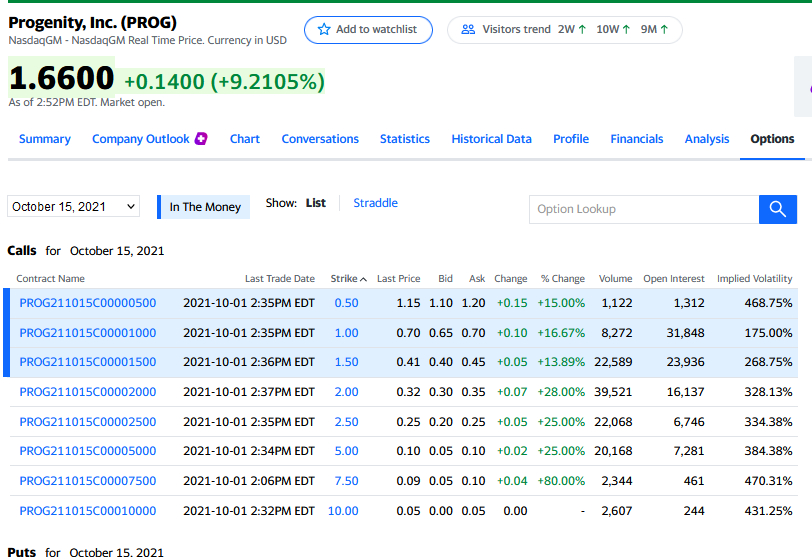

Options interest continues to be staggering, but it seems unlikely that the $5 strikes and above will expire ITM.

We are continuing to move up steadily toward $4 on this trend pattern, establishing higher highs and higher lows, but $5 before Friday is a tall order.

We are continuing to move up steadily toward $4 on this trend pattern, establishing higher highs and higher lows, but $5 before Friday is a tall order.

If we base above $2.50 before Thursday, gamma could carry the price well into $3-4. The 109k calls expiring this Friday above $3 would mean 10.9M shares, about 20% of those I suspect have not been hedged for.

The price is being pinned at $2.40 right now, major resistance.

The price is being pinned at $2.40 right now, major resistance.

We touched $2.50 8 times in the last two days and briefly broke through on 4 of those occurences.

The price WANTS to rise above $2.50 but shorts are using every available share to share to not let it happen.

The price WANTS to rise above $2.50 but shorts are using every available share to share to not let it happen.

Big fucking surprise, every share returned from Friday is already short again, just as I predicted they would. 🙄

Ortex shows that shorts returned a huge amount of shares yesterday as well (arrived today), and they are already being sold back against the stock.

Ortex shows that shorts returned a huge amount of shares yesterday as well (arrived today), and they are already being sold back against the stock.

The good news is that a ton of shorts entered their positions below $1.60 and are now firmly in a losing trade, as you can see from the security lending volume from last week.

Utilization remains maxed out. They have no ammo to work with. They're fucked.

Utilization remains maxed out. They have no ammo to work with. They're fucked.

Better yet, the average short's cost basis is all the way back at $0.95 according to the average short data, with over 202% average cost to borrow, putting continuous pressure on them to exit their trade.

Every short that entered had no idea that the patent news would hit today.

Every short that entered had no idea that the patent news would hit today.

And the final nail in the coffin, Short Exempts have been over 3% for more than 6 out of the last 10 trading days while the price has risen more than 120% since 9/28.

I'm calling it. $PROG is a firm squeeze candidate, and it's gonna print. Not financial advice...

I'm calling it. $PROG is a firm squeeze candidate, and it's gonna print. Not financial advice...

My thesis will remain bullish for $PROG. I will be attempting to buy every share I can afford in order to cash in on this play. Regardless of who may be shorting them or why, if it's some bizarre duality greed play by their shareholders or whatever... it's gonna backfire on them.

Further, @ORTEX and Fintel both agree that $PROG is meeting their squeeze criteria as well, with Ortex showing $PROG as all three squeeze types.

The latest dilution against $PROG , I suspect, only served to briefly delay it, but now no further dilutions can be made until Nov.

The latest dilution against $PROG , I suspect, only served to briefly delay it, but now no further dilutions can be made until Nov.

EPS has diverged massively from the stock price, and now that $PROG has 4 patents on life-changing products, one of which will compete with Humira, the world's most profitable drug, it's inevitable that $PROG will become a profitable biotech company.

Long term, they are a win.

Long term, they are a win.

My DD is done here. Make your own decisions and take control of your financial future. None of this is financial advice, and I'm not a financial advisor. Whatever trades you make are your decision, and this is not a solicitation to buy $PROG or any stock.

Good luck

Good luck

• • •

Missing some Tweet in this thread? You can try to

force a refresh