I'm briefly revisiting my DD on $PROG from 18 days ago because there was some call outs I made ahead of time that have played out, and will help give newcommers to this stock some much needed confidence and context for why the price is rising so rapidly and why it will continue.

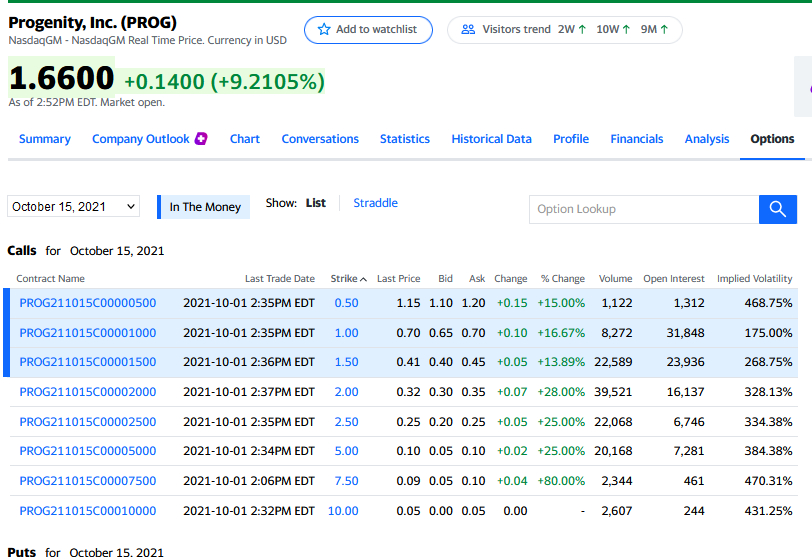

On Oct 1, I called out the options chain in this thread, but since then, there was major action in calls leading up to Oct 15.

Specifically, I said that if the price would stay above $1.50 that $3 would be inavitable.

Clearly we see that happened here.

Specifically, I said that if the price would stay above $1.50 that $3 would be inavitable.

Clearly we see that happened here.

https://twitter.com/TRUExDEMON/status/1444017794232713216?s=20

We can take comfort in the fact that, comparing the options chain from Oct 1 and 13 side by side shows that almost all of those options at $2 and below were held to expiration and expired ITM

The following Monday, $PROG ran to $3 like it was nothing.

The following Monday, $PROG ran to $3 like it was nothing.

https://twitter.com/TRUExDEMON/status/1448305802368802824?s=20

What I must say about $PROG is that it is the first stock I've played that has PERFECTLY followed Fibbonacci timelines, retracements and extensions on every timeline I have drawn.

Each time $PROG rips, it relaxes by a 20% retracement before it's next bound.

Each time $PROG rips, it relaxes by a 20% retracement before it's next bound.

Funny enough, we don't have to go far back in $PROG's chart history to see evidence of this action.

This chart action and fib extension comes just two days prior to today, and you can see the resistance and support levels are being respected each time.

This chart action and fib extension comes just two days prior to today, and you can see the resistance and support levels are being respected each time.

It might be naivete, but looking at this price action, I keep seeing shorts covering, more people FOMOing in, shorts re-shorting, but nobody is selling.

Ortex keeps showing massive return and re-borrows every day, and the price keeps bounding upward each time.

It's incredible.

Ortex keeps showing massive return and re-borrows every day, and the price keeps bounding upward each time.

It's incredible.

This is the first stock where we may actually be able to see a short squeeze play out in front of our eyes where the shorts actually cover, cuz the price keeps moving against them.

They've been underwater since $1.60, even after that big dilution and coordinated sellof on 10/1.

They've been underwater since $1.60, even after that big dilution and coordinated sellof on 10/1.

That cost-to-borrow is growing every day, shorts are paying more every day, and that bag is getting heavier every day.

Meanwhile, longs keep loading up on shares and calls, as the options chain continues growing more and more bullish.

Meanwhile, longs keep loading up on shares and calls, as the options chain continues growing more and more bullish.

$PROG keeps showing more and more gamma momentum as the call chain grows further and further, and the price keeps setting higher highs and higher lows.

Eventually, shorts will overleverage themselves to the edge of the cliff from which there is no return. All we gotta do is hold

Eventually, shorts will overleverage themselves to the edge of the cliff from which there is no return. All we gotta do is hold

The reason being? $PROG has more patents and bullish catalysts coming out every day, giving more and more reasons to increase faith in its future as a company, despite the short thesis against it that it would not survive it's first year.

Current cash on hand proves otherwise.

Current cash on hand proves otherwise.

This is not including the freshly obtained $20M that $PROG rose in it's recent equity raise via direct market offering which successfully completed as of October 9th.

investors.progenity.com/news-releases/…

investors.progenity.com/news-releases/…

And let's not forget that their 4 newly granted patents give them 4 new products to enter emerging markets as the first-comer to preclampsia screening, hereditary cancer screening, AND a new delivery mechanism for Humira, the world's most profitable drug

investors.progenity.com/news-releases/…

investors.progenity.com/news-releases/…

There's too many reasons to love $PROG, and they have enough cash on hand to survive long into their market emergence in a few years.

I know everyone is expecting a stupid-crazy squeeze RIGHT NOW, but these things take time.

Shenanigans will ensue as shorts attempt to escape.

I know everyone is expecting a stupid-crazy squeeze RIGHT NOW, but these things take time.

Shenanigans will ensue as shorts attempt to escape.

These wild swings in $PROG are something that experienced apes and day traders have come to accept and embrace as they continue to buy the dips, but this is more for the youngling stonk jedi among us who haven't been exposed to these kinds of emotionally targeted price swings.

$PROG is simply a low-float, micro-cap stock with a lot of retail attention and is being exacerbated by an extraordinary amount of short interest and options interest, particularly on the call side.

But $PROG also happens to have a huge long-term bull thesis worth researching

But $PROG also happens to have a huge long-term bull thesis worth researching

The reason is, $PROG has a promising future, and what you probably aren't aware of is that a very large firm "Athyrium" is trying to acquire them as cheaply as possible by scooping up more share every time they dilute.

Athyrium's CEO is on $PROG's board as majority shareholder.

Athyrium's CEO is on $PROG's board as majority shareholder.

Athyrium has a very sketchy track-record of shorting stocks they are long on in order to lower their price and acquire them cheaply to sell them to bigger fish for profit.

If that's happening here, and Athyrium is short, then they are VERY short, and very overleveraged.

If that's happening here, and Athyrium is short, then they are VERY short, and very overleveraged.

With that in mind, you should fully expect this stock to do some crazy stuff.

Just let it roll off your back, cuz those emotions you're feeling are what bears and big-money investment institutions WANT you to feel so you'll sell early and give up your stake. Not financial advice

Just let it roll off your back, cuz those emotions you're feeling are what bears and big-money investment institutions WANT you to feel so you'll sell early and give up your stake. Not financial advice

So for those newbies out here reading this, don't sweat it. Make sure you're not playing with more 💵 than you can stand to lose.

Just let your investment grow.

Set alerts, and walk away. This stock will do some crazy things, and the emotional toll shouldn't be understimated

Just let your investment grow.

Set alerts, and walk away. This stock will do some crazy things, and the emotional toll shouldn't be understimated

The fact is, wall street money knows this game better than any of us ever will. They prey on our ignorance and our emotions.

If we give up emotion and become TOTALLY ignorant to their shenanigans, and just buy and hold regardless of what the price does, it defeats their algos.

If we give up emotion and become TOTALLY ignorant to their shenanigans, and just buy and hold regardless of what the price does, it defeats their algos.

Think about it.

The stock market is human psychology playing out in real time. Every algo works by creating action, waiting for a reaction, and responding to it.

Don't give them data. Don't give them a response.

If we stop responding to price action, & the algos fail totally.

The stock market is human psychology playing out in real time. Every algo works by creating action, waiting for a reaction, and responding to it.

Don't give them data. Don't give them a response.

If we stop responding to price action, & the algos fail totally.

Others might disagree on the "why" but computerized/algorithmic trading is what is used against us every day, and most of us aren't capable or willing to try to outsmart it.

But the ultimate strategy of buy & hold continues to win time after time when it's a good truly company.

But the ultimate strategy of buy & hold continues to win time after time when it's a good truly company.

Simplify your life. Take the stress out of trading. Pick a stock you love and believe in, buy it, and don't sell it for anything short of what you believe it's worth.

A strategy so simple...

Even an ape can do it.

As always, not financial advice, but good luck to everyone. ✌

A strategy so simple...

Even an ape can do it.

As always, not financial advice, but good luck to everyone. ✌

• • •

Missing some Tweet in this thread? You can try to

force a refresh